Paperwork

Open Small Business Paperwork Requirements

Introduction to Small Business Paperwork Requirements

Starting a small business can be an exciting venture, but it often comes with a multitude of paperwork requirements that must be navigated. From licenses and permits to tax registrations and employee contracts, the sheer volume of documents needed to legally operate a business can be overwhelming. In this article, we will delve into the world of small business paperwork, exploring the various requirements and providing guidance on how to efficiently manage these essential documents.

Business Structure and Registration

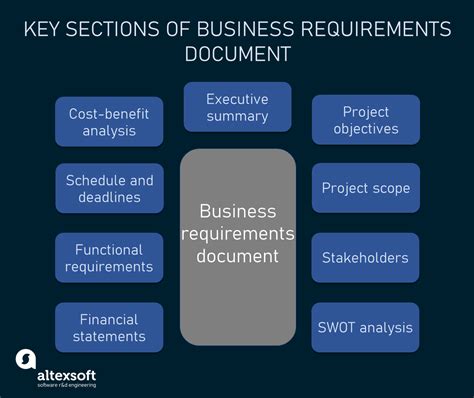

The first step in fulfilling small business paperwork requirements is to determine the business structure. This could be a sole proprietorship, partnership, limited liability company (LLC), or corporation. Each structure has its own set of paperwork and legal implications. For instance, an LLC requires articles of organization to be filed with the state, while a corporation needs articles of incorporation. Understanding the differences and choosing the right structure is crucial for compliance and tax purposes.

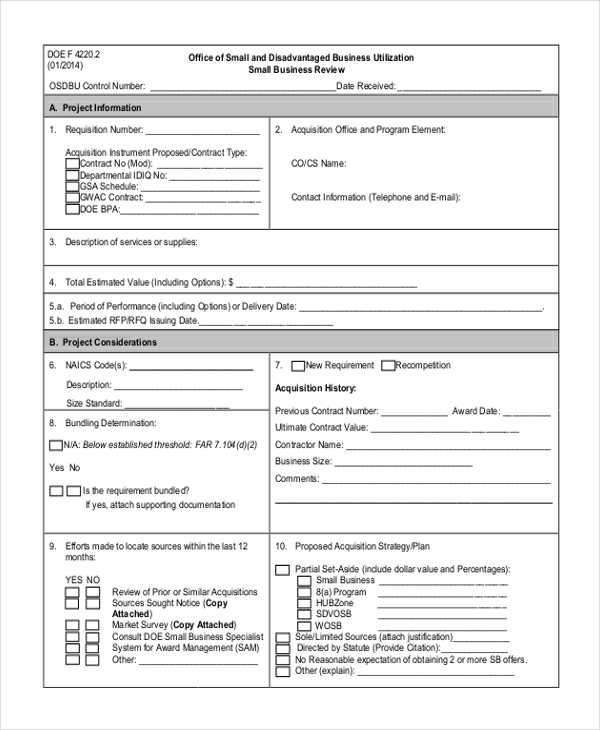

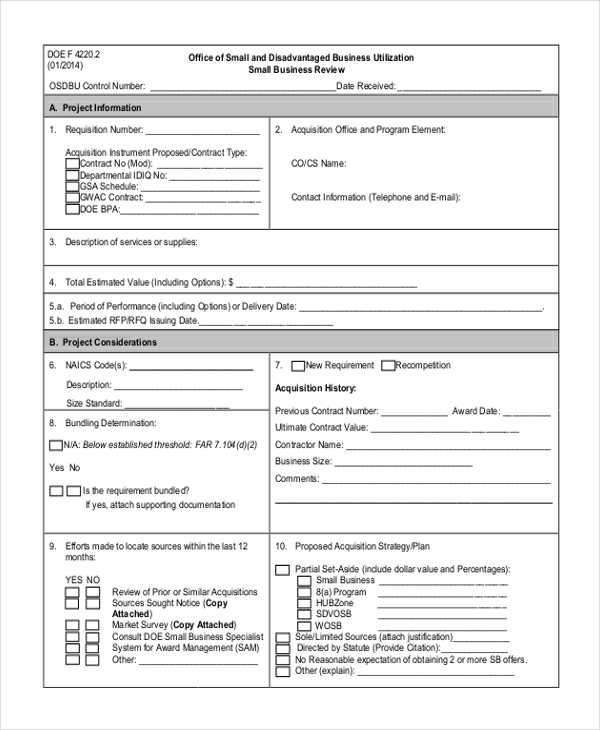

Licenses and Permits

Depending on the nature of the business and its location, various licenses and permits may be required. These can include: - Business license: Required by most states to operate a business. - Professional licenses: Needed for businesses in specialized fields, such as law, medicine, or engineering. - Sales tax permit: Necessary for businesses that sell taxable goods or services. - Zoning permits: Ensure that the business is operated in an area zoned for commercial use.

📝 Note: The specific licenses and permits required vary significantly by state and local jurisdiction, so it's essential to check with local authorities.

Tax Registrations

Tax registrations are a critical component of small business paperwork. This includes: - Employer Identification Number (EIN): Obtained from the IRS, it’s used to identify the business for tax purposes. - State tax registration: Required for state income tax and possibly sales tax. - Local tax registration: Depending on the location, additional local tax registrations might be necessary.

Employment Paperwork

For businesses that hire employees, there’s a whole other set of paperwork requirements, including: - Employee contracts: Outline the terms of employment. - W-4 forms: Completed by employees to determine tax withholdings. - I-9 forms: Verify the identity and employment eligibility of employees. - Workers’ compensation insurance: Mandatory in most states to cover employees in case of work-related injuries.

Contractual Agreements

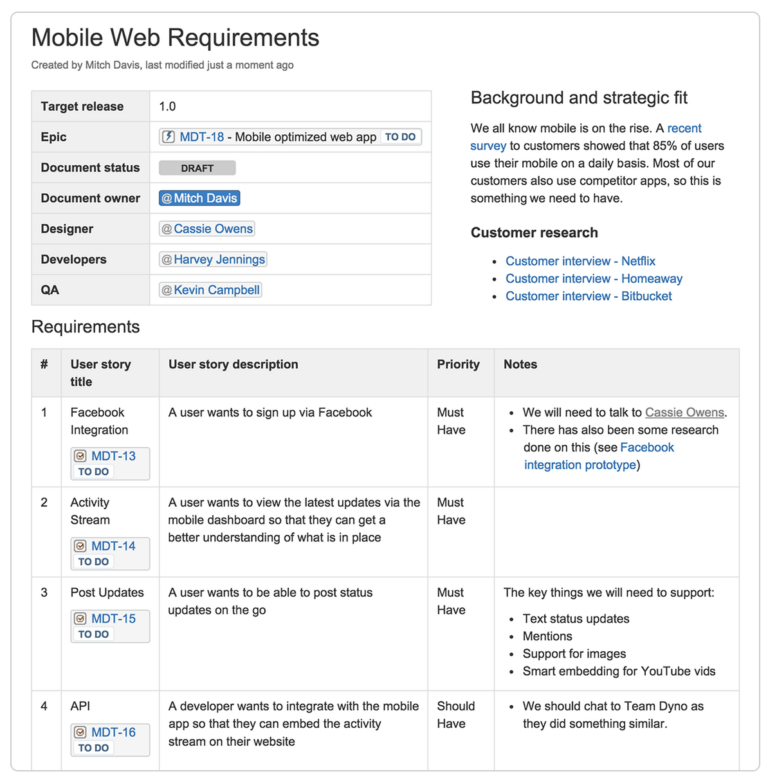

Contractual agreements are vital for protecting the interests of the business. These can include: - Client contracts: Detail the scope of work, payment terms, and confidentiality agreements. - Supplier contracts: Outline the terms of goods or services purchased. - Partnership agreements: If the business is a partnership, a partnership agreement should be in place to define the roles, responsibilities, and profit-sharing arrangements of partners.

Insurance and Benefits

While not strictly paperwork, insurance and benefits are crucial for the sustainability and attractiveness of the business. This includes: - Liability insurance: Protects the business from legal claims. - Property insurance: Covers business assets against damage or loss. - Health insurance: Offers medical benefits to employees. - Retirement plans: Such as 401(k) plans, to attract and retain talent.

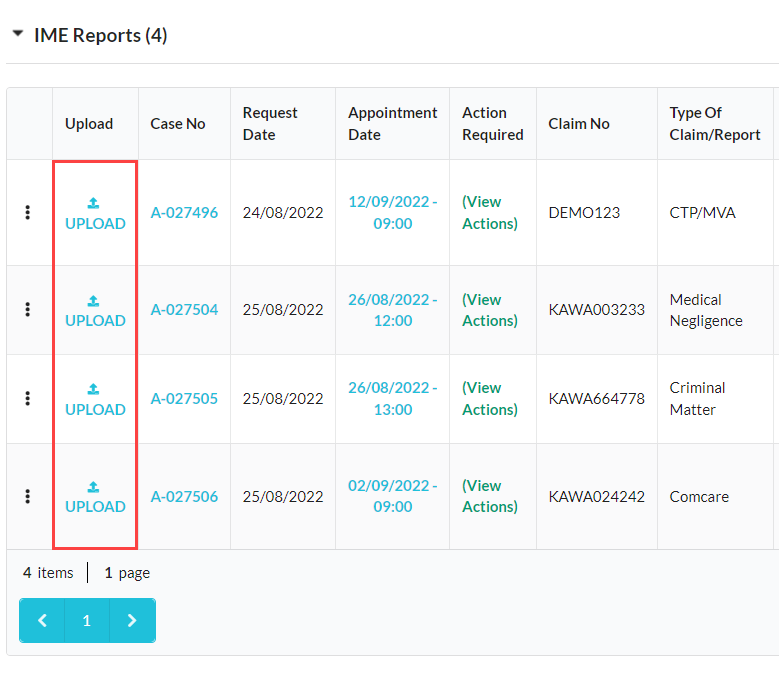

Record Keeping and Compliance

Effective record keeping is essential for compliance with legal requirements and for the smooth operation of the business. This involves maintaining accurate and detailed records of: - Financial transactions: Invoices, receipts, bank statements, etc. - Employment records: Employee information, contracts, and performance reviews. - Tax filings: Annual tax returns, quarterly estimated tax payments, etc.

| Type of Record | Retention Period |

|---|---|

| Employment records | At least 3 years |

| Tax records | At least 3 years, but often longer |

| Financial records | Varying periods, but at least 3 years for most |

Conclusion and Final Thoughts

Navigating the complex world of small business paperwork requirements can seem daunting, but understanding and fulfilling these obligations is crucial for the legal operation and success of the business. By choosing the right business structure, obtaining necessary licenses and permits, registering for taxes, managing employment paperwork, drafting contractual agreements, and maintaining thorough records, small businesses can ensure compliance and focus on growth and development.

What is the most important paperwork requirement for starting a small business?

+

Choosing the right business structure and registering the business with the state is among the most critical initial steps, as it impacts taxes, liability, and compliance with laws and regulations.

How do I determine which licenses and permits my business needs?

+

Check with your state’s business registration office and local government to determine the specific licenses and permits required for your business type and location.

What records should a small business keep, and for how long?

+

Small businesses should keep detailed records of financial transactions, employment, and tax filings. The retention period varies but is typically at least 3 years for employment and tax records.