203k Loan Paperwork Requirements

Introduction to 203k Loan Paperwork Requirements

The 203k loan is a type of mortgage insurance provided by the Federal Housing Administration (FHA) that allows borrowers to finance the purchase of a home and the cost of renovations or repairs with a single loan. The loan is ideal for borrowers who want to purchase a fixer-upper or a home that needs significant repairs. However, the 203k loan requires a significant amount of paperwork, which can be overwhelming for borrowers. In this article, we will discuss the paperwork requirements for a 203k loan and provide tips on how to navigate the process.

Understanding the 203k Loan Program

The 203k loan program is a government-backed loan program that provides financing for borrowers who want to purchase a home and renovate it. The loan program has two types: the Standard 203k and the Streamlined 203k. The Standard 203k loan is used for homes that require significant repairs or renovations, while the Streamlined 203k loan is used for homes that require minor repairs or renovations. The FHA has specific guidelines and requirements for the 203k loan program, including credit score requirements, debt-to-income ratios, and loan limits.

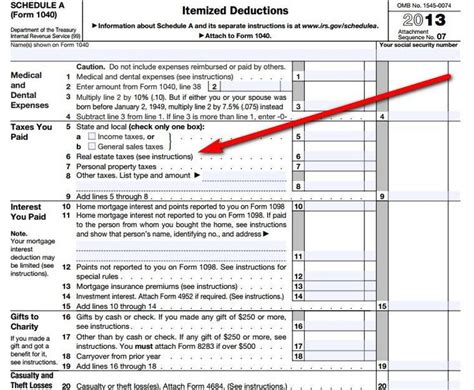

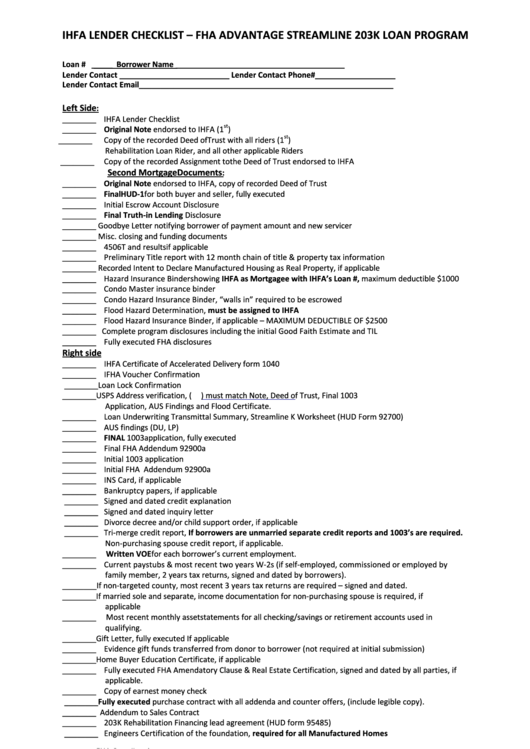

Required Documents for a 203k Loan

To apply for a 203k loan, borrowers must provide a significant amount of documentation, including: * Identification documents: Borrowers must provide a valid government-issued ID, such as a driver’s license or passport. * Income documents: Borrowers must provide proof of income, including pay stubs, W-2 forms, and tax returns. * Credit reports: Borrowers must provide their credit reports, which will be used to determine their creditworthiness. * Appraisal report: An appraisal report is required to determine the value of the property. * Inspection report: An inspection report is required to identify any defects or needed repairs in the property. * Renovation plans: Borrowers must provide a detailed plan of the renovations, including a scope of work and a budget. * Contractor bids: Borrowers must provide bids from licensed contractors to perform the renovations. * Permits: Borrowers must obtain any necessary permits for the renovations.

Renovation Plans and Specifications

The renovation plans and specifications are a critical part of the 203k loan paperwork requirements. Borrowers must provide a detailed plan of the renovations, including: * Scope of work: A description of the work to be performed, including the materials and labor required. * Budget: A detailed budget of the costs associated with the renovations. * Timeline: A timeline of the renovations, including the start and completion dates. * Permits: A list of any necessary permits required for the renovations.

| Renovation Plans and Specifications | Description |

|---|---|

| Scope of work | A description of the work to be performed |

| Budget | A detailed budget of the costs associated with the renovations |

| Timeline | A timeline of the renovations, including the start and completion dates |

| Permits | A list of any necessary permits required for the renovations |

Tips for Navigating the 203k Loan Paperwork Requirements

Navigating the 203k loan paperwork requirements can be overwhelming, but there are several tips that can help: * Work with an experienced lender: An experienced lender can help guide borrowers through the process and ensure that all necessary documentation is provided. * Provide detailed renovation plans: Borrowers should provide detailed renovation plans, including a scope of work, budget, and timeline. * Get multiple bids from contractors: Borrowers should get multiple bids from licensed contractors to ensure that they are getting the best price for the renovations. * Stay organized: Borrowers should stay organized and keep all documentation in a single file, including receipts, invoices, and inspection reports.

📝 Note: Borrowers should carefully review the 203k loan paperwork requirements and ensure that they understand all the terms and conditions of the loan before signing any documents.

Benefits of the 203k Loan Program

The 203k loan program offers several benefits to borrowers, including: * Financing for renovations: The 203k loan program allows borrowers to finance the purchase of a home and the cost of renovations or repairs with a single loan. * Low down payment: The 203k loan program requires a low down payment, which can be as low as 3.5%. * Flexible credit requirements: The 203k loan program has flexible credit requirements, which can make it easier for borrowers to qualify for the loan. * Energy-efficient improvements: The 203k loan program allows borrowers to finance energy-efficient improvements, such as solar panels and energy-efficient windows.

Common Mistakes to Avoid

There are several common mistakes that borrowers can avoid when applying for a 203k loan, including: * Not providing detailed renovation plans: Borrowers should provide detailed renovation plans, including a scope of work, budget, and timeline. * Not getting multiple bids from contractors: Borrowers should get multiple bids from licensed contractors to ensure that they are getting the best price for the renovations. * Not staying organized: Borrowers should stay organized and keep all documentation in a single file, including receipts, invoices, and inspection reports. * Not carefully reviewing the loan documents: Borrowers should carefully review the loan documents and ensure that they understand all the terms and conditions of the loan before signing any documents.

In summary, the 203k loan paperwork requirements can be overwhelming, but by understanding the requirements and following the tips outlined in this article, borrowers can navigate the process with ease. The 203k loan program offers several benefits to borrowers, including financing for renovations, low down payment, flexible credit requirements, and energy-efficient improvements. By avoiding common mistakes and carefully reviewing the loan documents, borrowers can ensure that they are getting the best deal possible on their 203k loan.

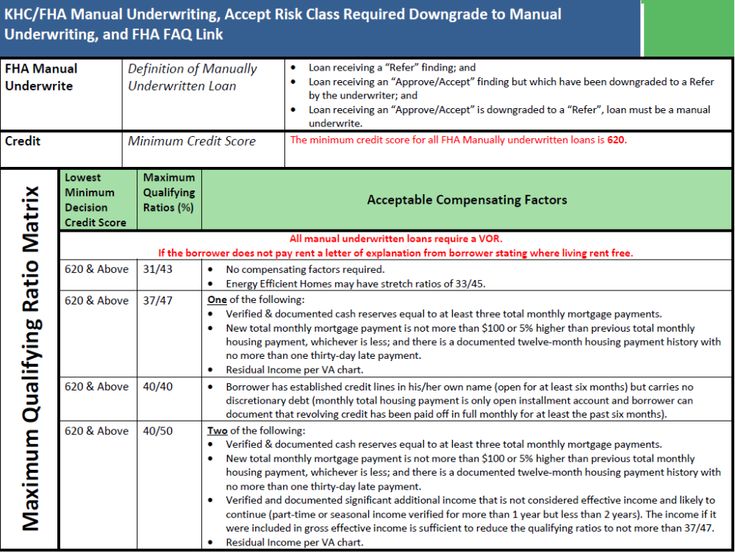

What is the minimum credit score required for a 203k loan?

+

The minimum credit score required for a 203k loan is 620, but some lenders may require a higher credit score.

Can I use a 203k loan to finance energy-efficient improvements?

+

How long does it take to process a 203k loan?

+

The processing time for a 203k loan can vary depending on the lender and the complexity of the loan, but it typically takes 60 to 90 days to process.