Paperwork

Prove 501c8 Status Paperwork

Introduction to 501c8 Status

When it comes to understanding the nuances of non-profit organizations in the United States, the 501c8 status is a designation that offers unique benefits and requirements. This status is bestowed upon fraternal beneficiary societies, organizations, and associations by the Internal Revenue Service (IRS). The primary purpose of these societies is to provide for the payment of life, sick, accident, or other benefits to their members. In this blog post, we will delve into the specifics of the 501c8 status, including the paperwork required to achieve and maintain it.

Eligibility for 501c8 Status

To be eligible for the 501c8 status, an organization must meet specific criteria set forth by the IRS. These criteria include: - The organization must be a fraternal beneficiary society, order, or association. - The organization must have a lodge system, with members and lodges that carry out the purposes of the organization. - The organization must provide for the payment of life, sick, accident, or other benefits to its members. - The organization must operate under the lodge system, with at least one lodge that has a representative form of government. - No part of the net earnings of the organization may inure to the benefit of any private shareholder or individual.

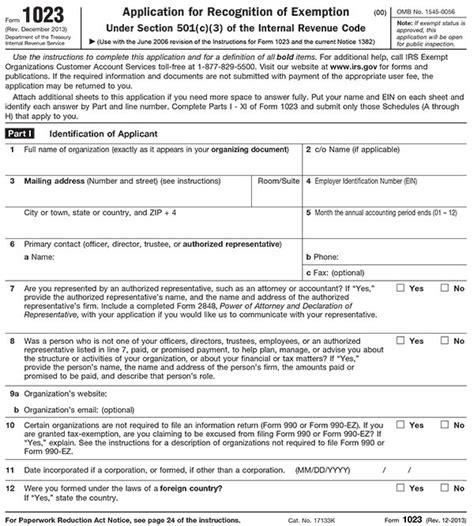

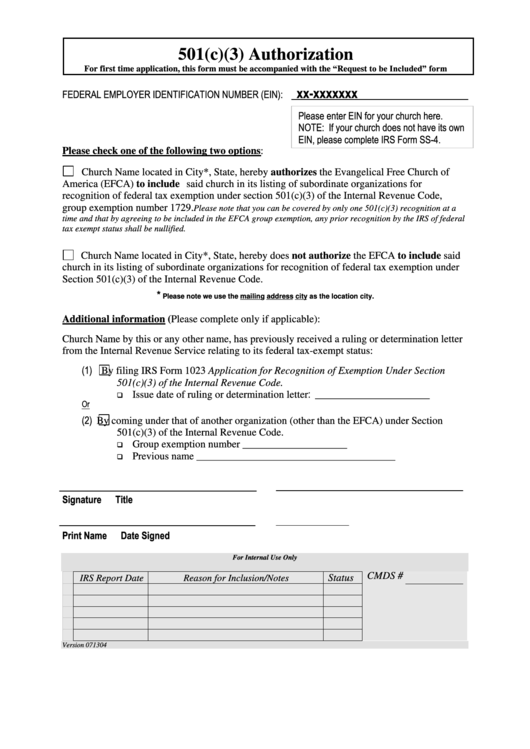

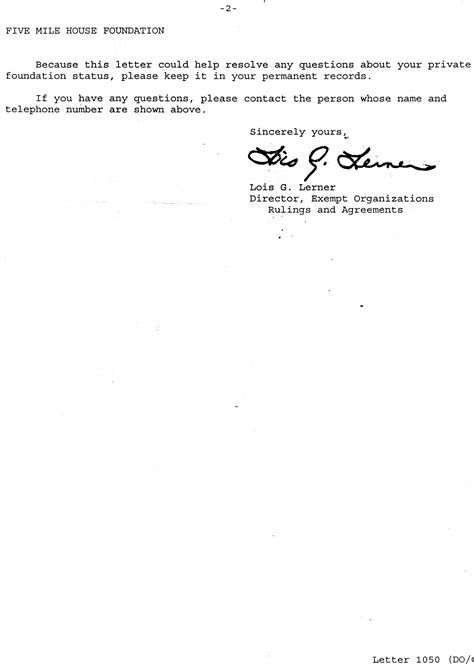

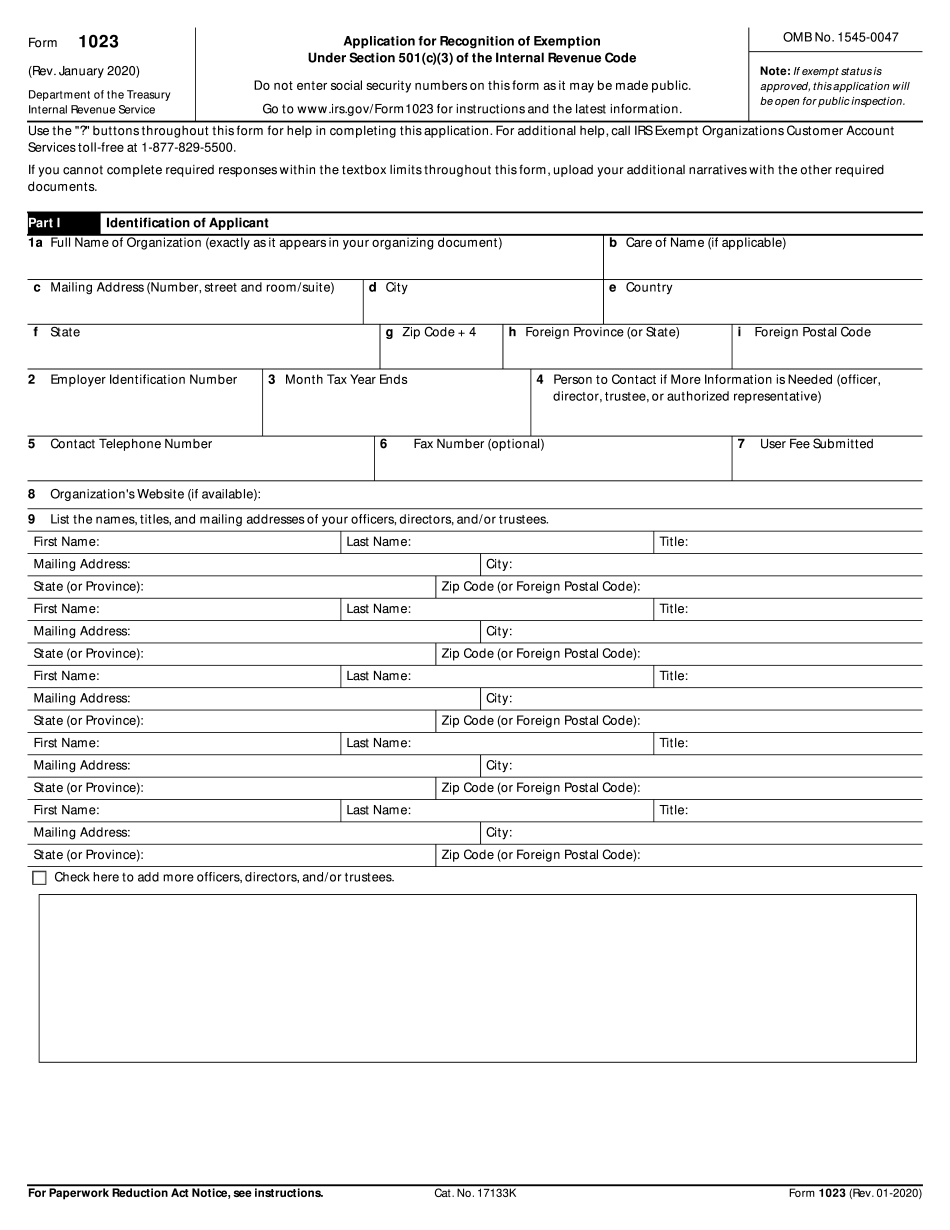

Application Process for 501c8 Status

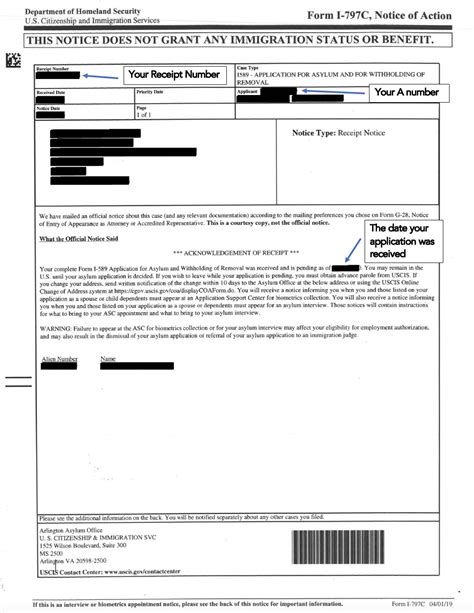

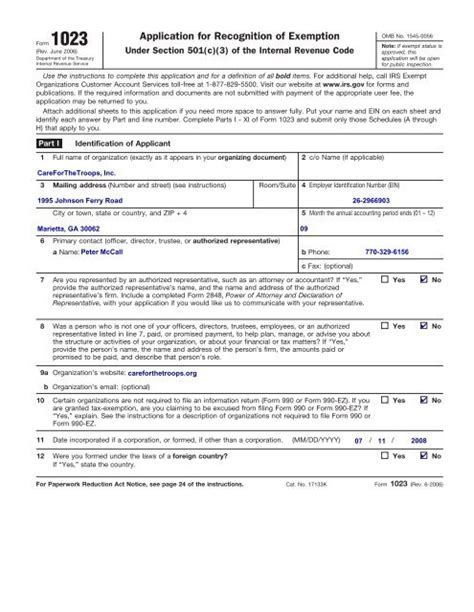

The application process for 501c8 status involves several steps, including: - Filing Form 1024: The organization must submit Form 1024, Application for Recognition of Exemption, to the IRS. This form requires detailed information about the organization, including its purpose, structure, and financial data. - Providing Required Documentation: Along with Form 1024, the organization must provide various documents, such as its articles of incorporation, bylaws, and financial statements. - Paying the User Fee: The organization must pay a user fee, which varies depending on the type of application and the complexity of the case.

Maintenance of 501c8 Status

Once an organization has been granted 501c8 status, it must comply with ongoing requirements to maintain its tax-exempt status. These requirements include: - Filing Annual Information Returns: The organization must file Form 990, Return of Organization Exempt from Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt from Income Tax, annually. - Maintaining Records: The organization must maintain accurate and detailed records, including financial statements, meeting minutes, and membership records. - Complying with IRS Regulations: The organization must comply with all applicable IRS regulations, including those related to governance, financial reporting, and lobbying activities.

Benefits of 501c8 Status

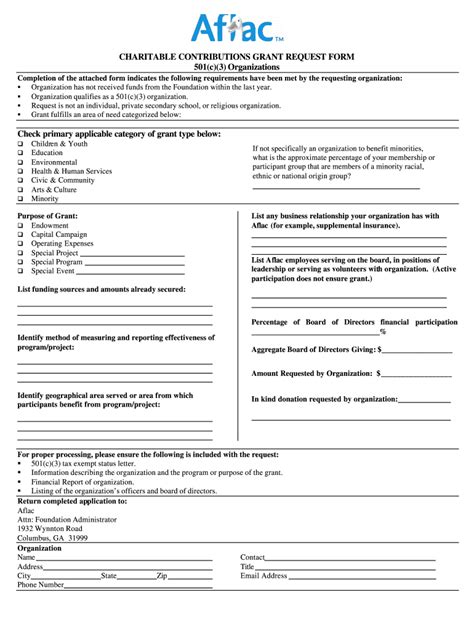

The 501c8 status offers several benefits to eligible organizations, including: - Tax Exemption: Organizations with 501c8 status are exempt from federal income tax on their exempt income. - Deductibility of Contributions: Contributions to 501c8 organizations may be deductible as charitable contributions, subject to certain limitations. - Access to Grants and Funding: Many foundations and government agencies provide grants and funding to 501c8 organizations, which can help support their programs and activities.

Challenges of Maintaining 501c8 Status

While the 501c8 status offers many benefits, maintaining it can be challenging. Some of the common challenges faced by 501c8 organizations include: - Complexity of IRS Regulations: The IRS regulations governing 501c8 organizations can be complex and difficult to navigate. - Ongoing Compliance Requirements: The ongoing compliance requirements, including annual filing and record-keeping, can be time-consuming and resource-intensive. - Limited Flexibility: The 501c8 status has specific requirements and limitations, which can limit the organization’s flexibility in terms of its activities and operations.

📝 Note: It is essential for organizations to seek professional advice from a qualified tax professional or attorney to ensure compliance with all applicable IRS regulations and to navigate the complexities of the 501c8 status.

Conclusion and Future Outlook

In conclusion, the 501c8 status is a unique designation that offers benefits and requirements for fraternal beneficiary societies, organizations, and associations. To achieve and maintain this status, organizations must navigate a complex application process and comply with ongoing requirements. While there are challenges associated with maintaining 501c8 status, the benefits can be significant, including tax exemption, deductibility of contributions, and access to grants and funding. As the non-profit landscape continues to evolve, it is essential for 501c8 organizations to stay informed and adapt to changes in IRS regulations and industry trends.

What is the primary purpose of a 501c8 organization?

+

The primary purpose of a 501c8 organization is to provide for the payment of life, sick, accident, or other benefits to its members.

What is the application process for 501c8 status?

+

The application process for 501c8 status involves filing Form 1024, providing required documentation, and paying a user fee.

What are the ongoing requirements for maintaining 501c8 status?

+

The ongoing requirements for maintaining 501c8 status include filing annual information returns, maintaining records, and complying with IRS regulations.