5 Ways Prove Embezzlement

Introduction to Embezzlement

Embezzlement is a form of white-collar crime that involves the misuse or misappropriation of funds or assets entrusted to an individual, often in a position of authority or trust. It can occur in various settings, including businesses, non-profit organizations, and government agencies. Proving embezzlement can be challenging, as it requires gathering evidence of the perpetrator’s intent to defraud and the subsequent misappropriation of funds. In this article, we will discuss five ways to prove embezzlement, highlighting the importance of thorough investigation and documentation.

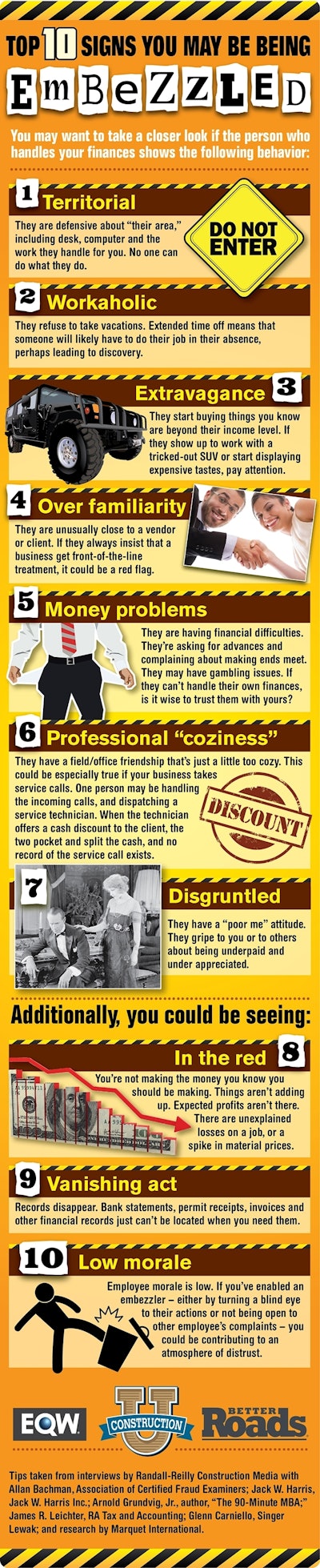

Understanding Embezzlement

Before we dive into the methods of proving embezzlement, it is essential to understand the concept of embezzlement and its various forms. Embezzlement can take many forms, including: * Cash embezzlement: The theft of cash or other liquid assets. * Asset embezzlement: The misappropriation of assets, such as inventory, equipment, or property. * Accounts payable embezzlement: The manipulation of accounts payable to divert funds for personal gain. * Accounts receivable embezzlement: The theft of funds intended for the organization.

5 Ways to Prove Embezzlement

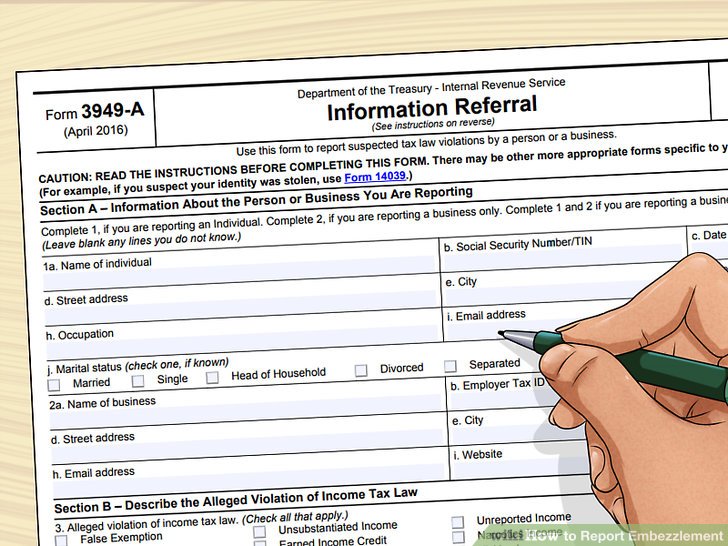

Proving embezzlement requires a thorough investigation and the collection of evidence. Here are five ways to prove embezzlement: * 1. Analyzing Financial Records: A thorough analysis of financial records, including bank statements, invoices, and ledgers, can help identify discrepancies and suspicious transactions. This analysis can be performed using various techniques, such as: + Reviewing financial statements for inconsistencies or irregularities. + Identifying unusual or unexplained transactions. + Analyzing trends and patterns in financial data. * 2. Conducting Interviews and Interrogations: Conducting interviews and interrogations with employees, management, and other relevant individuals can help gather information and identify potential suspects. This can include: + Asking questions about financial transactions and procedures. + Identifying potential motives and opportunities for embezzlement. + Gathering information about internal controls and procedures. * 3. Reviewing Internal Controls and Procedures: Reviewing internal controls and procedures can help identify weaknesses and vulnerabilities that may have contributed to the embezzlement. This can include: + Evaluating the effectiveness of internal controls, such as separation of duties and authorization procedures. + Identifying potential gaps or weaknesses in internal controls. + Reviewing policies and procedures related to financial transactions and asset management. * 4. Using Forensic Accounting Techniques: Forensic accounting techniques, such as data analysis and digital forensics, can help identify and track suspicious transactions. This can include: + Using data analysis software to identify patterns and anomalies in financial data. + Conducting digital forensics to recover deleted or hidden files and data. + Analyzing email and other communication records to identify potential evidence. * 5. Gathering Physical Evidence: Gathering physical evidence, such as receipts, invoices, and other documents, can help support the case against the perpetrator. This can include: + Collecting and analyzing physical documents, such as receipts and invoices. + Reviewing security footage and other surveillance evidence. + Gathering evidence from other sources, such as bank statements and credit card records.

Importance of Documentation

Documentation is critical in proving embezzlement. It is essential to maintain accurate and detailed records of all financial transactions, including:

| Transaction Type | Transaction Date | Transaction Amount |

|---|---|---|

| Cash Receipt | 2022-01-01 | 1,000</td> </tr> <tr> <td>Bank Transfer</td> <td>2022-01-05</td> <td>5,000 |

| Invoice Payment | 2022-01-10 | $2,000 |

Maintaining accurate records can help identify discrepancies and suspicious transactions, making it easier to prove embezzlement.

📝 Note: It is essential to maintain confidentiality and protect sensitive information during the investigation to avoid compromising the case.

Preventing Embezzlement

Preventing embezzlement requires a combination of strong internal controls, regular audits, and a culture of transparency and accountability. Some measures to prevent embezzlement include: * Implementing strong internal controls, such as separation of duties and authorization procedures. * Conducting regular audits and reviews of financial transactions and procedures. * Establishing a culture of transparency and accountability, including whistleblower policies and procedures. * Providing training and education on embezzlement prevention and detection.

In summary, proving embezzlement requires a thorough investigation, documentation, and analysis of financial records and internal controls. By understanding the forms of embezzlement, analyzing financial records, conducting interviews and interrogations, reviewing internal controls and procedures, using forensic accounting techniques, and gathering physical evidence, organizations can identify and prevent embezzlement.

The key points to take away from this discussion are the importance of documentation, internal controls, and a culture of transparency and accountability in preventing and detecting embezzlement. By implementing these measures, organizations can reduce the risk of embezzlement and protect their assets.

What is embezzlement?

+

Embezzlement is the misuse or misappropriation of funds or assets entrusted to an individual, often in a position of authority or trust.

How can embezzlement be prevented?

+

Embezzlement can be prevented by implementing strong internal controls, conducting regular audits, and establishing a culture of transparency and accountability.

What are the consequences of embezzlement?

+

The consequences of embezzlement can include financial losses, damage to reputation, and legal action, including criminal charges and civil lawsuits.