Home Purchase Paperwork Requirements

Introduction to Home Purchase Paperwork

When it comes to buying a home, the process can be overwhelming, especially when dealing with the paperwork requirements. The sheer volume of documents and the complexity of the information they contain can be daunting for many buyers. However, understanding what is required and being prepared can significantly simplify the process. In this article, we will delve into the key paperwork requirements for purchasing a home, highlighting the essential documents, their purposes, and the steps involved in navigating this critical aspect of home buying.

Pre-Approval and Pre-Qualification Documents

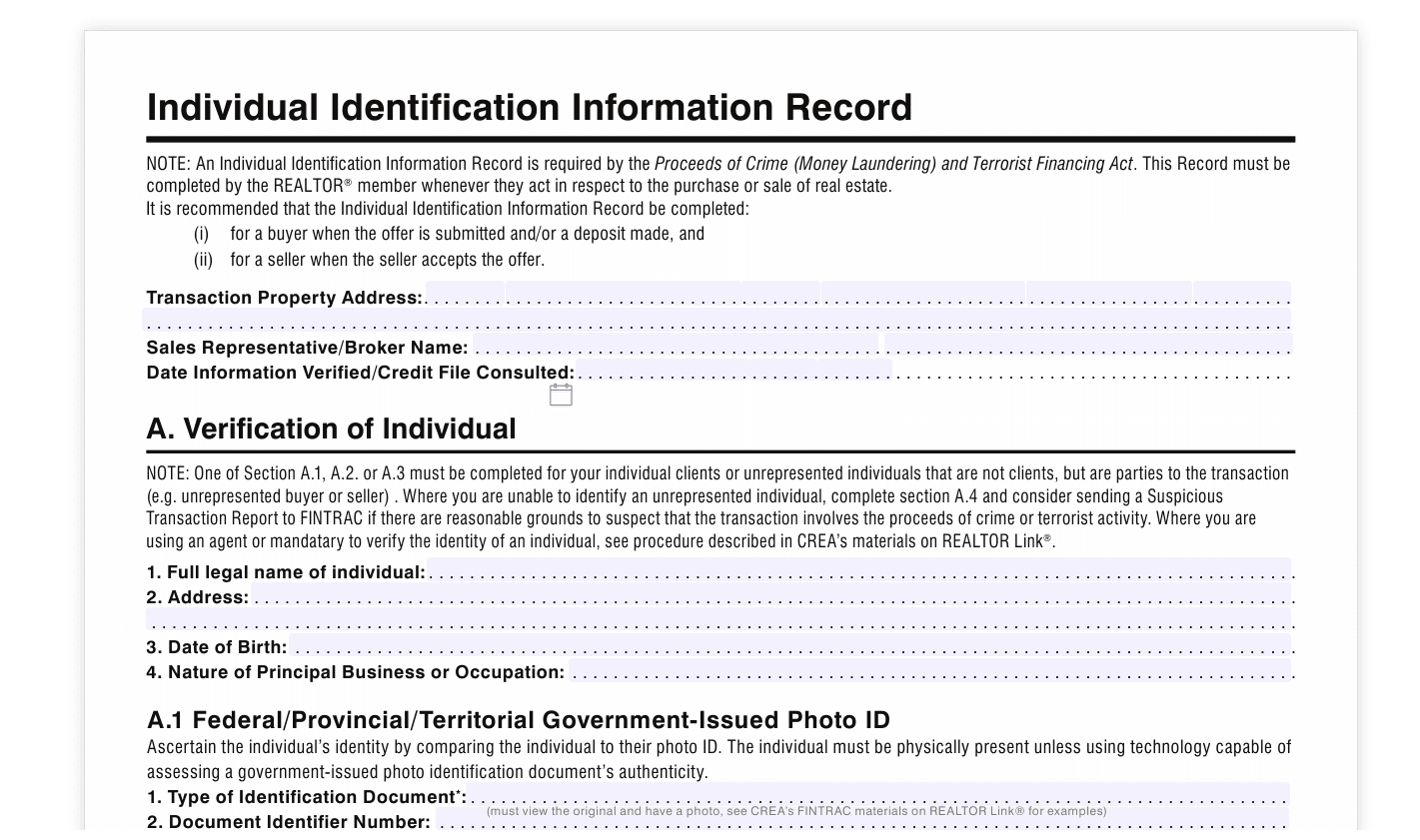

The journey to homeownership often begins with pre-qualification and pre-approval for a mortgage. These steps involve providing financial information to a lender, who then assesses the buyer’s creditworthiness and determines how much they can borrow. The primary documents needed for pre-qualification and pre-approval include: - Identification: A valid government-issued ID. - Income Proof: Pay stubs, W-2 forms, and tax returns. - Bank Statements: To verify savings and assets. - Credit Reports: A good credit score can significantly improve the chances of getting a favorable mortgage rate.

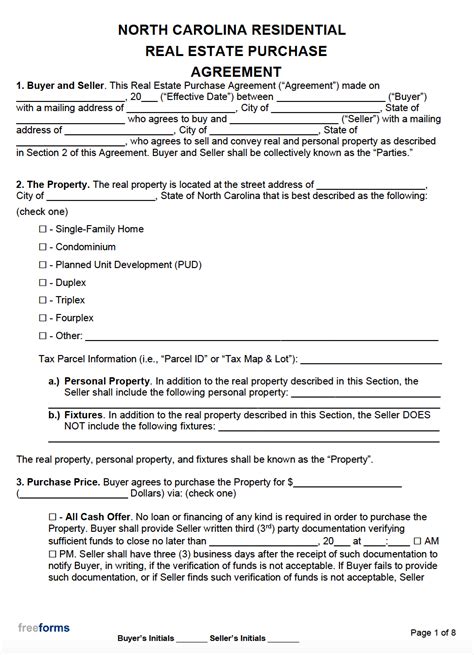

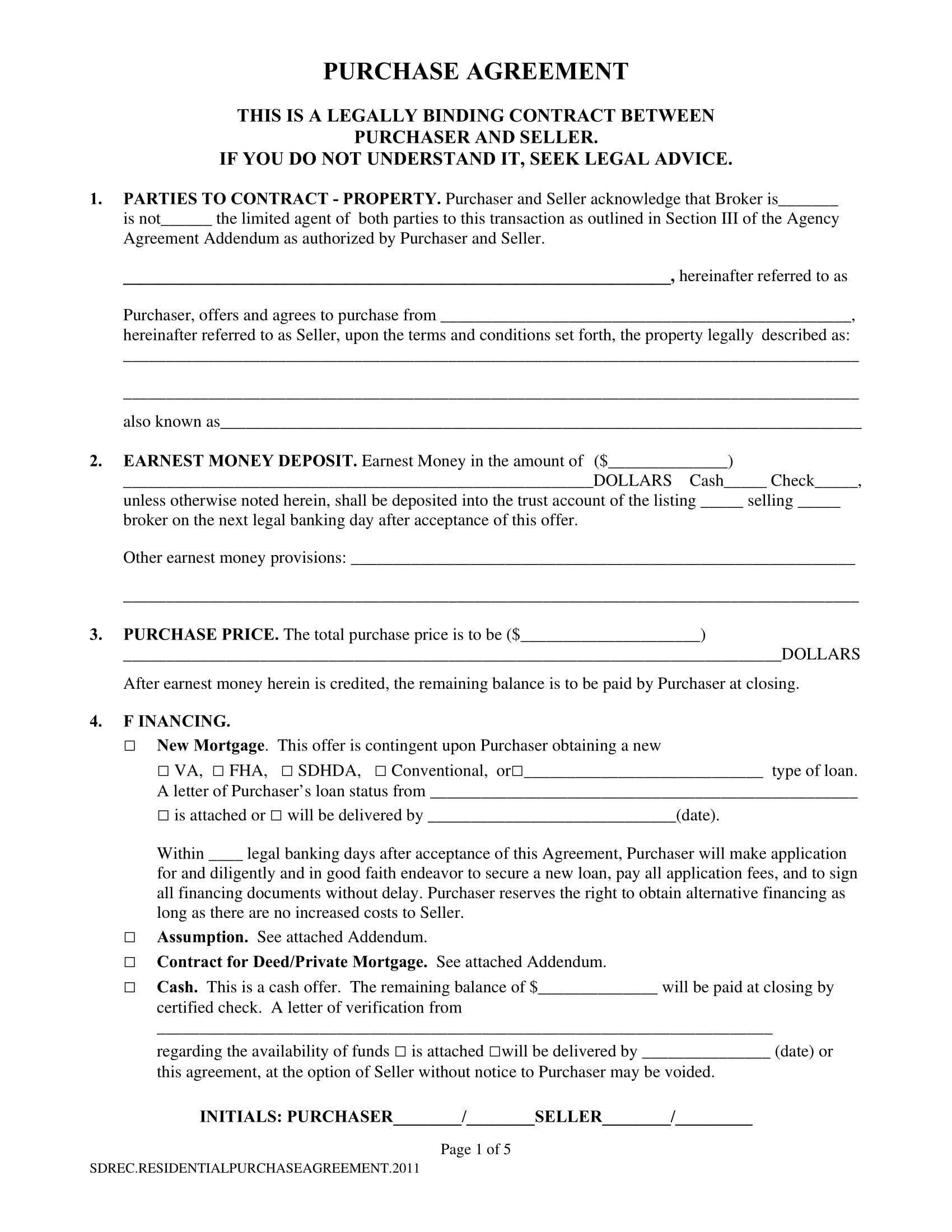

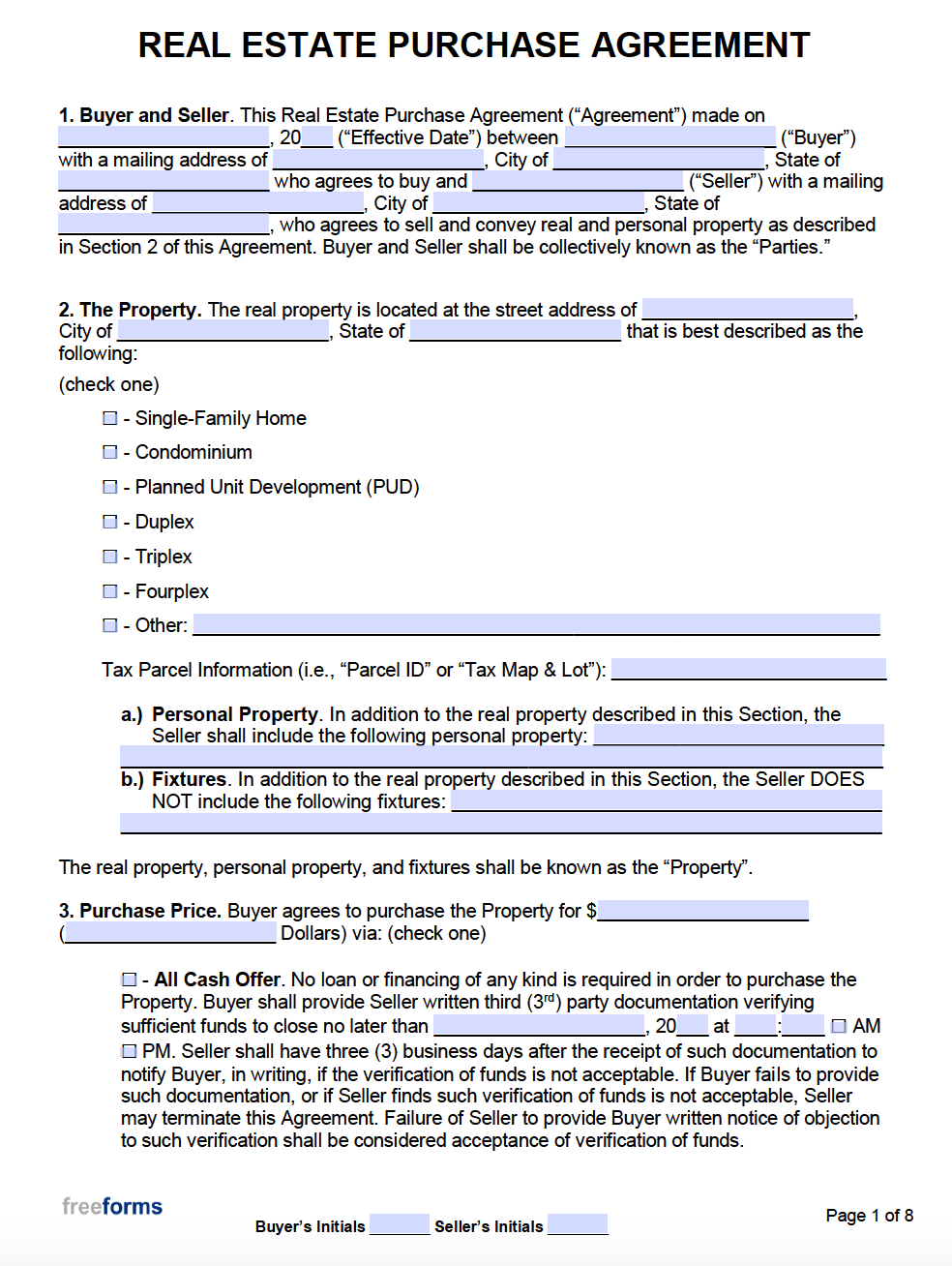

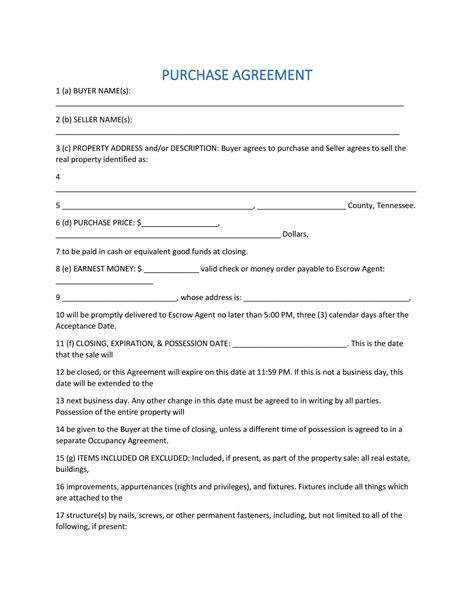

Purchase Agreement and Contract

Once a buyer finds a home they wish to purchase, the next step involves creating a Purchase Agreement, also known as a sales contract. This legally binding document outlines the terms of the sale, including: - The purchase price of the home. - Contingencies, such as financing, inspection, and appraisal contingencies. - Closing date and other essential dates. - Personal property included in the sale, such as appliances.

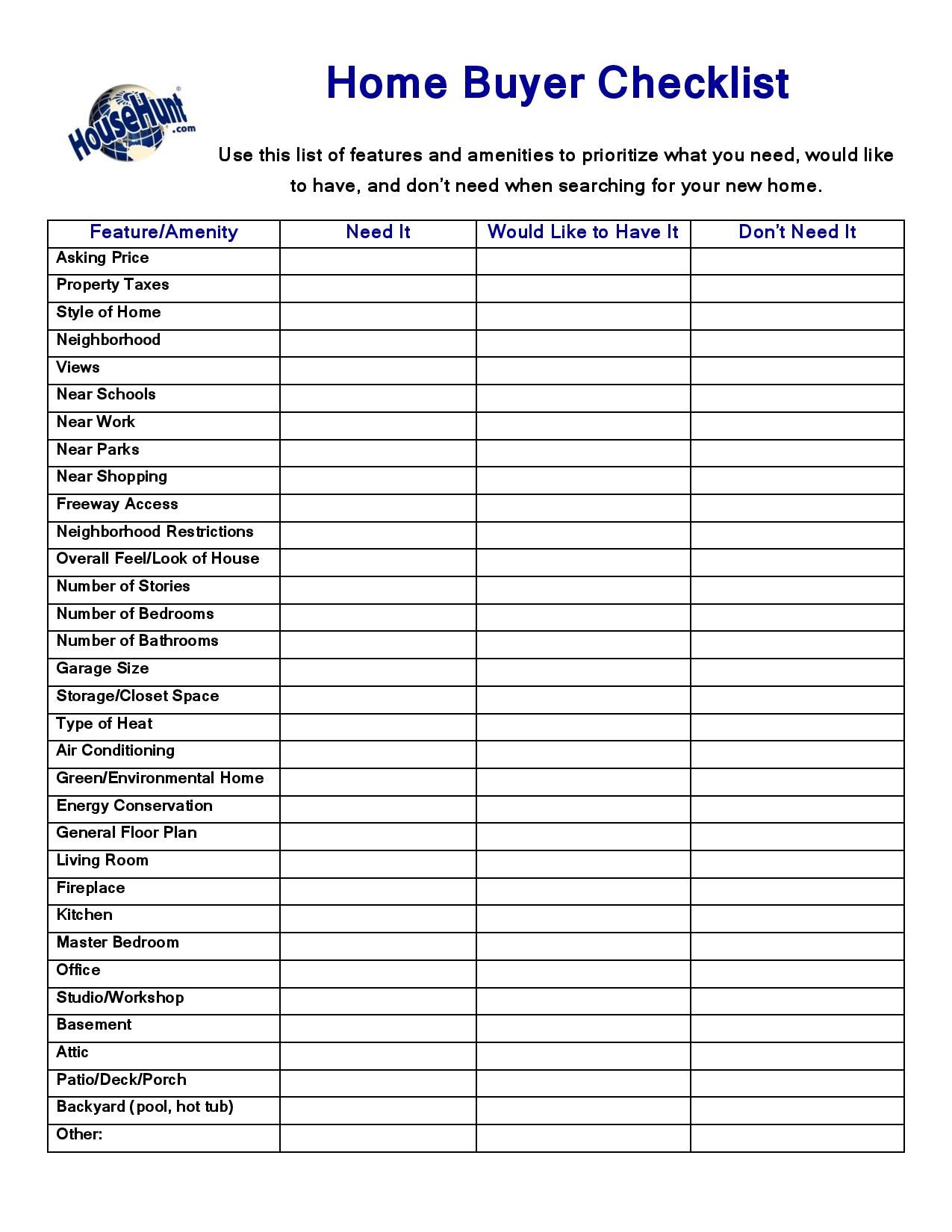

Inspection and Due Diligence

Before finalizing the purchase, buyers typically conduct home inspections and due diligence to ensure they are aware of the property’s condition and any potential issues. This may involve: - Home Inspection Reports: To identify any structural or mechanical issues with the property. - Termite Inspection Reports: To check for termite damage or infestation. - Review of Property Records: To understand the property’s history, including any liens or easements.

Appraisal and Financing Documents

An appraisal is conducted to determine the value of the property, ensuring it matches the purchase price. For financing, the buyer must finalize their mortgage application, which involves submitting: - Loan Application: A comprehensive application that includes detailed financial information. - Appraisal Report: Confirming the property’s value. - Title Report: Showing the property’s ownership history and any liens.

Closing Process

The closing process is the final step in purchasing a home, where the buyer and seller sign the necessary documents to transfer ownership. Key documents involved in closing include: - Deed: Transfers the ownership of the property from the seller to the buyer. - Mortgage Note: The buyer’s promise to repay the loan. - Mortgage Deed (or Trust Deed): Puts the property up as collateral for the loan. - Closing Disclosure: Outlines the terms of the loan, including the interest rate, monthly payments, and closing costs.

📝 Note: It's crucial for buyers to carefully review all documents before signing to ensure everything is in order and as agreed upon.

Post-Closing Responsibilities

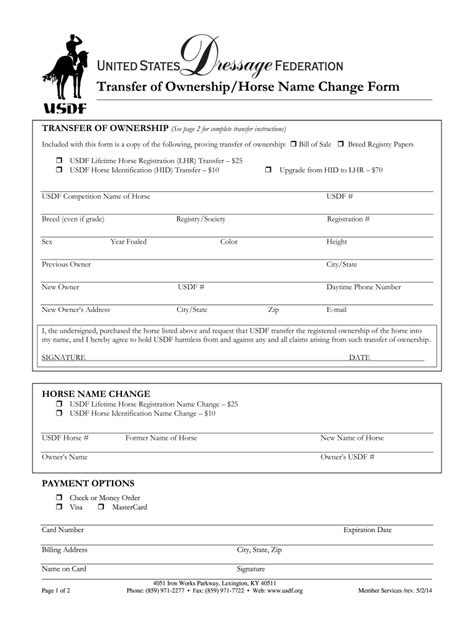

After closing, buyers have several responsibilities, including: - Updating Property Records: Ensuring the buyer’s name is on all property records. - Obtaining Homeowners Insurance: Mandatory for most mortgage loans. - Setting Up Utility Accounts: In the buyer’s name.

| Document | Purpose |

|---|---|

| Pre-approval Letter | Confirms buyer's loan eligibility |

| Purchase Agreement | Outlines terms of the sale |

| Home Inspection Report | Identifies property conditions and issues |

| Appraisal Report | Confirms property value |

| Deed | Transfers property ownership |

In the end, navigating the paperwork requirements for purchasing a home can seem like a daunting task, but with the right guidance and preparation, it can be managed efficiently. By understanding the role of each document and the steps involved in the process, buyers can ensure a smoother transition to homeownership. The key is to stay informed, be patient, and seek professional advice when needed, ultimately leading to a successful and satisfying home buying experience.

What are the primary documents needed for mortgage pre-approval?

+

The primary documents needed for mortgage pre-approval include identification, income proof (such as pay stubs, W-2 forms, and tax returns), bank statements to verify savings and assets, and credit reports to assess creditworthiness.

What is the purpose of a home inspection in the home buying process?

+

The purpose of a home inspection is to identify any potential issues or defects in the property, providing buyers with a comprehensive understanding of the property’s condition before finalizing the purchase.

What documents are typically signed during the closing process?

+

During the closing process, buyers typically sign documents such as the deed, which transfers ownership of the property; the mortgage note, promising to repay the loan; and the mortgage deed (or trust deed), which puts the property up as collateral for the loan.