Reaffirm Debt Paperwork Requirements

Understanding Reaffirmation Agreements in Debt Paperwork

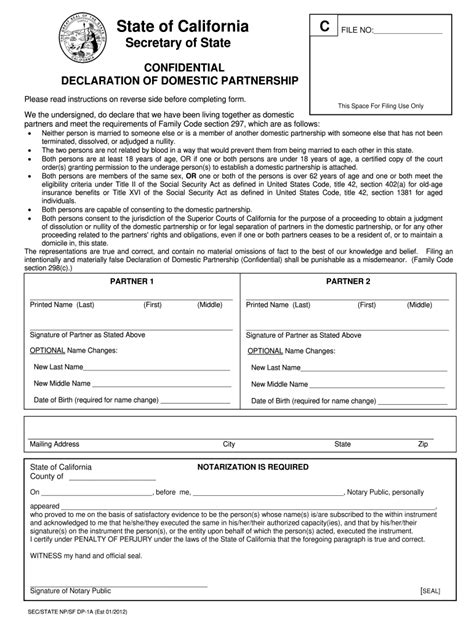

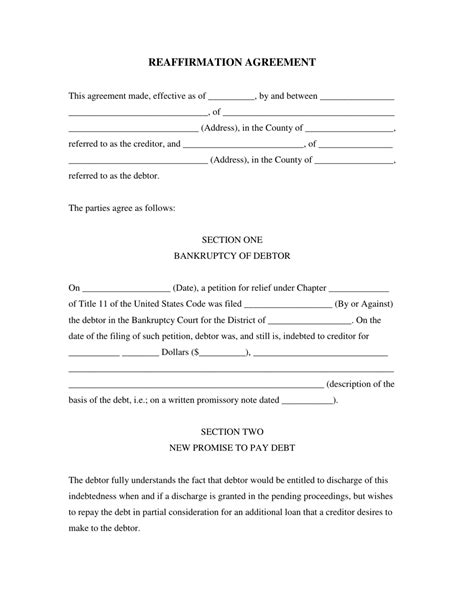

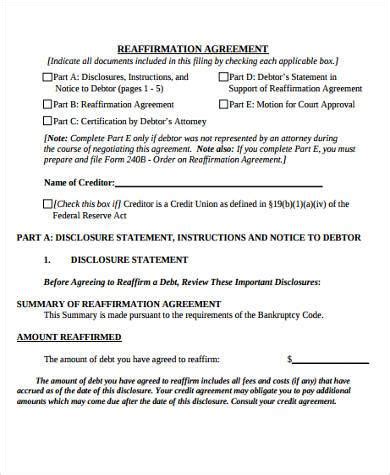

When dealing with debt, particularly in the context of bankruptcy, understanding the legal and financial implications of reaffirmation agreements is crucial. A reaffirmation agreement is a contract between a debtor and a creditor that the debtor will pay all or part of the debt owed, despite the bankruptcy filing. This agreement must be in writing, signed by the debtor, and filed with the bankruptcy court. The purpose of reaffirmation is to allow debtors to keep their property, such as a car or a house, by continuing to make payments on the debt associated with that property.

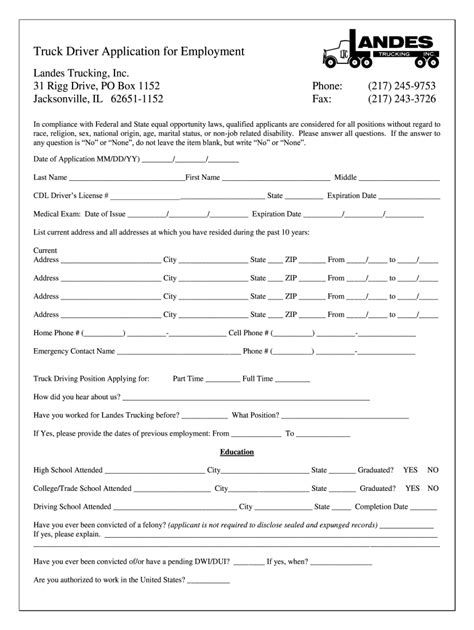

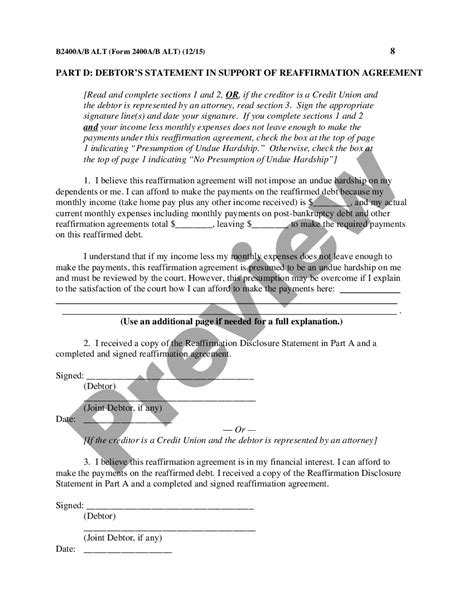

Requirements for Reaffirmation Debt Paperwork

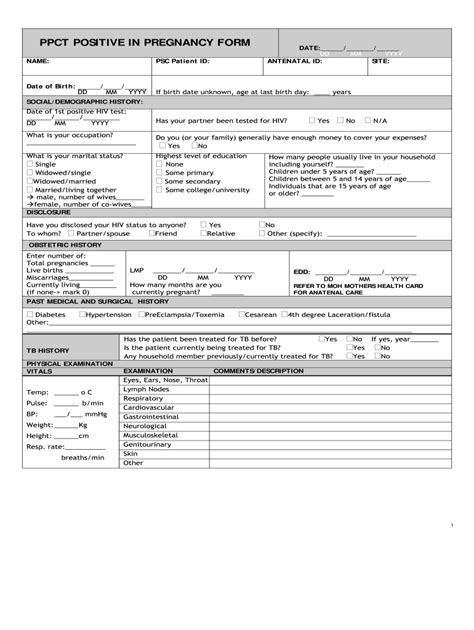

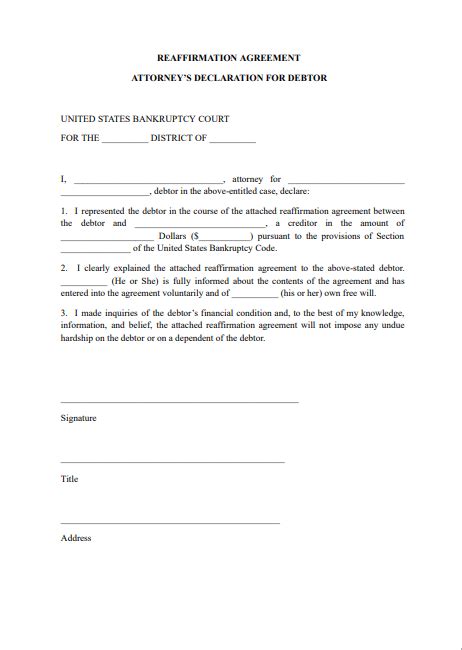

The process of reaffirming debt involves several key steps and requirements: - Written Agreement: The agreement must be in writing and clearly state the terms, including the amount of debt to be reaffirmed, the interest rate, and the payment schedule. - Debtor’s Signature: The debtor must sign the agreement, indicating their voluntary acceptance of the terms. - Filing with the Court: The signed agreement must be filed with the bankruptcy court. - Disclosure Statement: The creditor must provide a disclosure statement that includes information about the debt, such as the total amount to be paid, the annual percentage rate, and any late payment charges. - Statement of Income and Expenses: The debtor must provide a statement showing their income and expenses to demonstrate their ability to make the payments as agreed.

Key Considerations for Debtors

Before signing a reaffirmation agreement, debtors should carefully consider the following: - Financial Ability: Debtors should assess whether they can afford the payments. Signing an agreement they cannot fulfill can lead to further financial troubles. - Alternative Options: Understand if there are alternative options, such as redeeming the property (buying it back from the creditor at its current value) or surrendering the property and having the debt discharged. - Legal Advice: It is highly recommended that debtors seek the advice of an attorney. The attorney can help explain the agreement, ensure it is in the debtor’s best interest, and represent them in court if necessary.

Consequences of Default

If a debtor defaults on a reaffirmed debt, the creditor can repossess the property, and the debtor may still be liable for any deficiency balance (the difference between what is owed and what the property is sold for). This highlights the importance of carefully considering one’s financial situation before entering into a reaffirmation agreement.

Table of Comparison: Reaffirmation vs. Redemption vs. Surrender

| Option | Description | Financial Implication |

|---|---|---|

| Reaffirmation | Agree to pay the debt as per the original or modified terms. | Continued payments, potential for default and repossession. |

| Redemption | Pay the creditor the current value of the property in a lump sum. | One-time payment, keeps the property, and discharges the debt. |

| Surrender | Give the property back to the creditor. | No further payments, but may owe a deficiency balance. |

📝 Note: Debtors should carefully evaluate their financial situation and the terms of any agreement before making a decision, and it is advisable to consult with a legal professional.

In summary, reaffirmation agreements are a complex aspect of debt management, especially in the context of bankruptcy. Understanding the requirements, implications, and alternatives is crucial for making informed decisions. Debtors must approach these agreements with caution, ensuring they can meet the financial obligations and are fully aware of the potential consequences of default. By doing so, individuals can navigate their debt more effectively and work towards a more stable financial future.

What is the main purpose of a reaffirmation agreement in debt paperwork?

+

The main purpose of a reaffirmation agreement is to allow debtors to keep their property by continuing to make payments on the associated debt, despite filing for bankruptcy.

What are the key requirements for a reaffirmation agreement to be valid?

+

A reaffirmation agreement must be in writing, signed by the debtor, and filed with the bankruptcy court. It should also include a disclosure statement and a statement of the debtor’s income and expenses.

What happens if a debtor defaults on a reaffirmed debt?

+

If a debtor defaults on a reaffirmed debt, the creditor can repossess the property. The debtor may also be liable for any deficiency balance, which is the difference between what is owed and what the property is sold for.