Refinance Home Paperwork Needed

Introduction to Refinancing Your Home

Refinancing your home can be a great way to save money on your mortgage, lower your monthly payments, or tap into your home’s equity. However, the process can be complex and requires a significant amount of paperwork. In this article, we will guide you through the necessary paperwork needed to refinance your home.

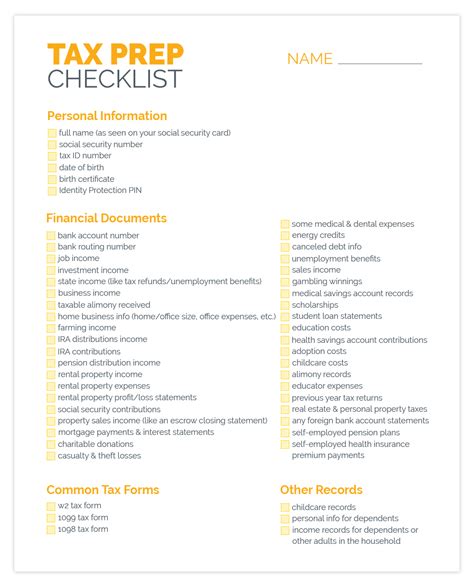

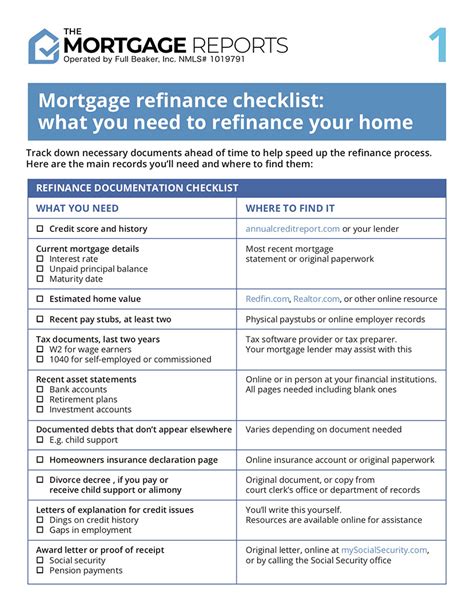

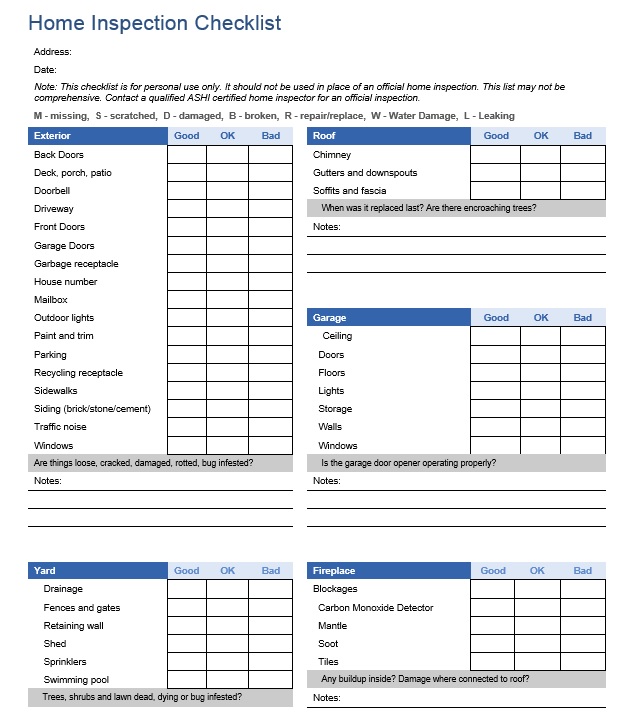

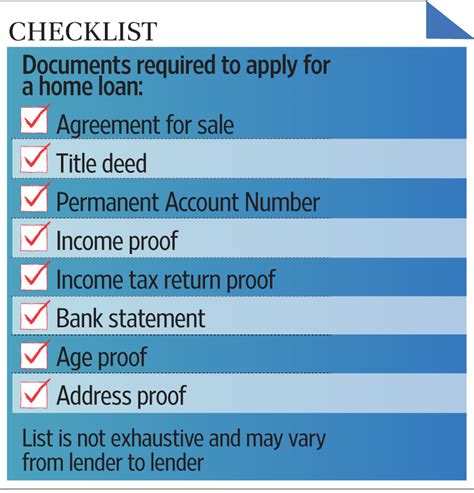

Pre-Refinance Checklist

Before you start the refinance process, it’s essential to gather all the necessary documents. Here’s a list of paperwork you’ll need: * Identification documents: Driver’s license, passport, or state ID * Income documents: Pay stubs, W-2 forms, and tax returns * Employment verification: Letter from your employer or proof of self-employment * Credit reports: Your credit score and history will be reviewed * Property documents: Deed, title report, and appraisal * Current mortgage documents: Loan statements, payment history, and loan terms * Bank statements: Proof of income, assets, and savings

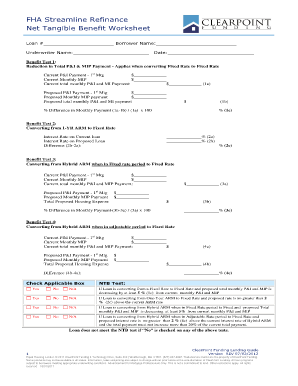

Refinance Application Process

Once you have gathered all the necessary documents, you can start the refinance application process. This typically involves: * Submitting your application and supporting documents to the lender * Reviewing and signing the loan estimate and disclosure forms * Locking in your interest rate * Undergoing a home appraisal (if required) * Reviewing and signing the final loan documents

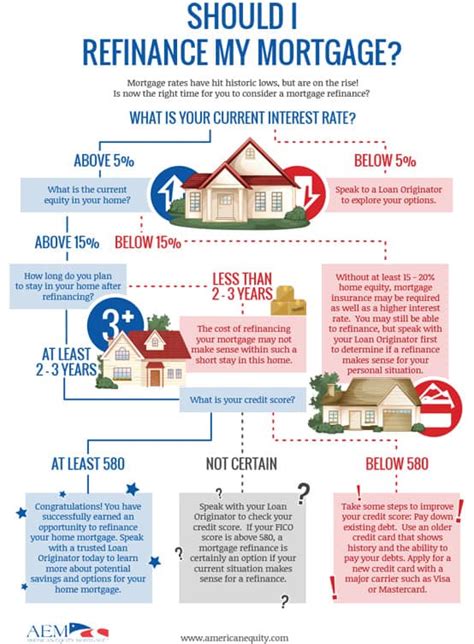

Loan Options and Terms

When refinancing your home, you’ll need to consider the loan options and terms. This includes: * Interest rate: Fixed or adjustable, and the corresponding rate * Loan term: 15-year, 30-year, or other terms * Loan type: Conventional, FHA, VA, or USDA * Repayment terms: Monthly payment amount, payment schedule, and prepayment penalties

Appraisal and Inspection

In some cases, a home appraisal or inspection may be required. This involves: * Hiring a licensed appraiser to assess the value of your home * Reviewing the appraisal report and any recommendations * Addressing any issues or concerns raised during the appraisal

Closing and Funding

The final step in the refinance process is closing and funding. This involves: * Reviewing and signing the final loan documents * Transferring the loan funds to your existing lender * Updating the property records and title report * Receiving the refinanced loan proceeds (if applicable)

📝 Note: It's essential to carefully review all the loan documents and terms before signing. Make sure you understand the repayment terms, interest rate, and any prepayment penalties.

Post-Refinance Considerations

After refinancing your home, you’ll need to consider the following: * Updated loan payments: New monthly payment amount and schedule * Changed loan terms: New interest rate, loan term, and repayment terms * Tax implications: Potential changes to your tax deductions and benefits * Credit score impact: The refinance process may affect your credit score

| Document | Description |

|---|---|

| Identification documents | Driver's license, passport, or state ID |

| Income documents | Pay stubs, W-2 forms, and tax returns |

| Employment verification | Letter from your employer or proof of self-employment |

| Credit reports | Credit score and history |

| Property documents | Deed, title report, and appraisal |

In summary, refinancing your home requires a significant amount of paperwork and documentation. By understanding the necessary paperwork and following the refinance process, you can navigate the complex process and achieve your financial goals.

What is the first step in the refinance process?

+

The first step in the refinance process is to gather all the necessary documents, including identification, income, employment, credit, property, and current mortgage documents.

What is the difference between a fixed-rate and adjustable-rate loan?

+

A fixed-rate loan has a fixed interest rate for the entire loan term, while an adjustable-rate loan has an interest rate that may change over time based on market conditions.

Do I need to get a home appraisal for a refinance?

+

Not always, but it depends on the lender and the loan program. Some lenders may require an appraisal to determine the value of your home, while others may use alternative methods.