LLC Sale Paperwork Requirements

Introduction to LLC Sale Paperwork Requirements

When selling an LLC, also known as a Limited Liability Company, there are several paperwork requirements that must be met to ensure a smooth and legally binding transaction. The sale of an LLC can be a complex process, involving various documents and agreements that protect the interests of both the buyer and the seller. In this article, we will delve into the necessary paperwork requirements for selling an LLC, highlighting the key documents and steps involved in the process.

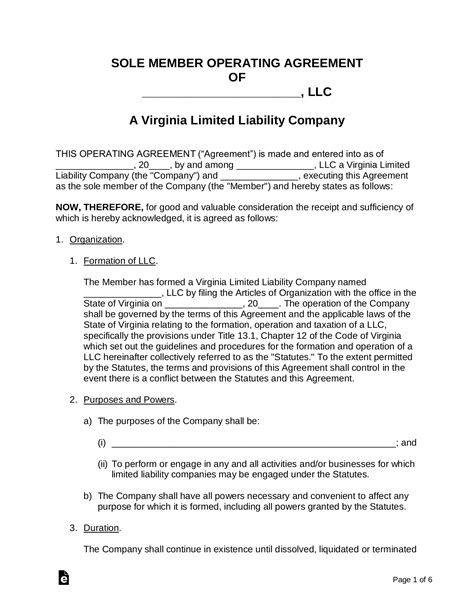

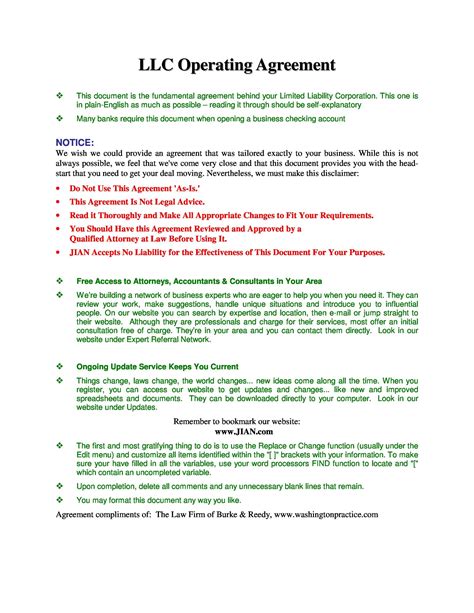

Pre-Sale Preparation

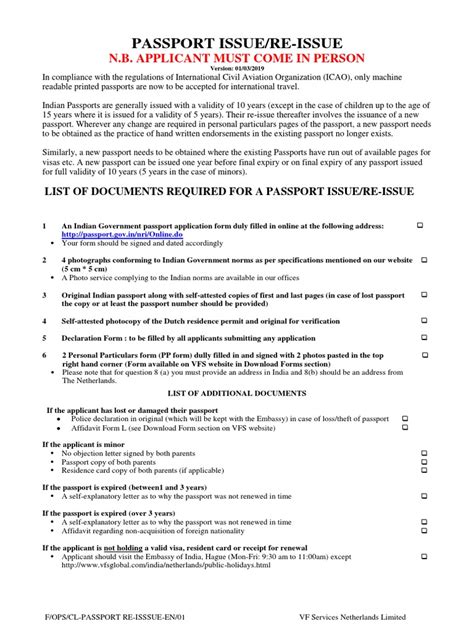

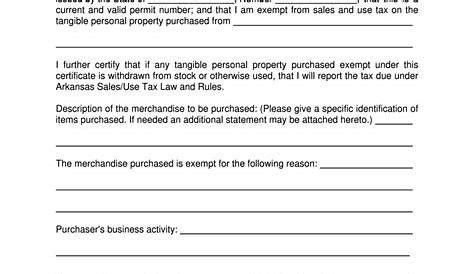

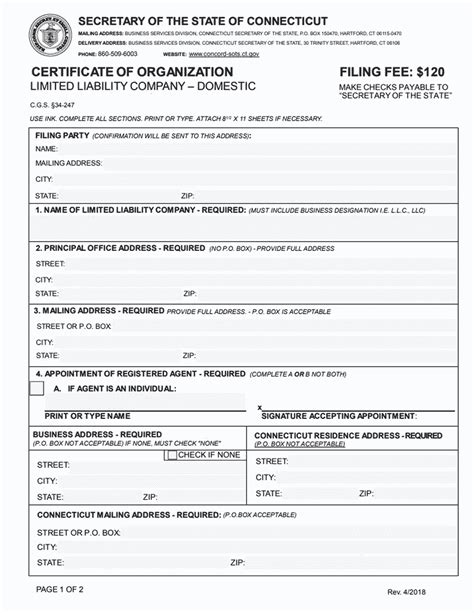

Before initiating the sale of an LLC, it is essential to prepare the necessary documents and ensure that the company is in good standing. This includes: * Articles of Organization: The original articles of organization should be reviewed and updated if necessary to reflect any changes in the company’s structure or ownership. * Operating Agreement: The operating agreement should be reviewed and updated to reflect any changes in the company’s management or ownership structure. * Financial Statements: The company’s financial statements, including balance sheets and income statements, should be prepared and made available to potential buyers. * Tax Returns: The company’s tax returns should be up to date and available for review by potential buyers.

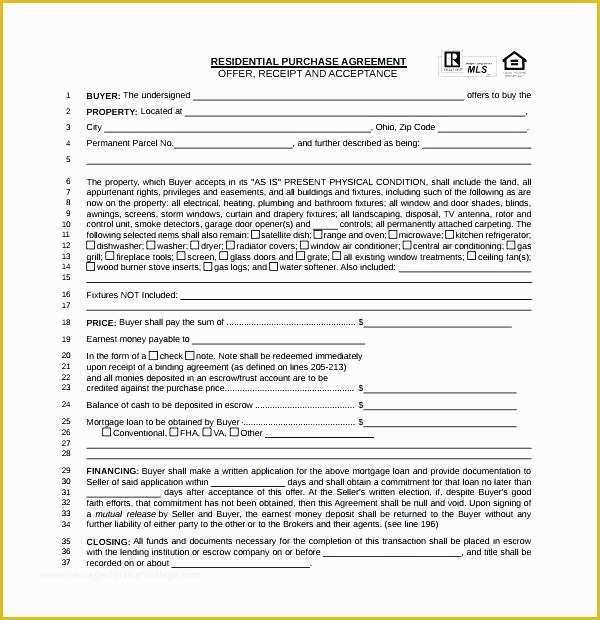

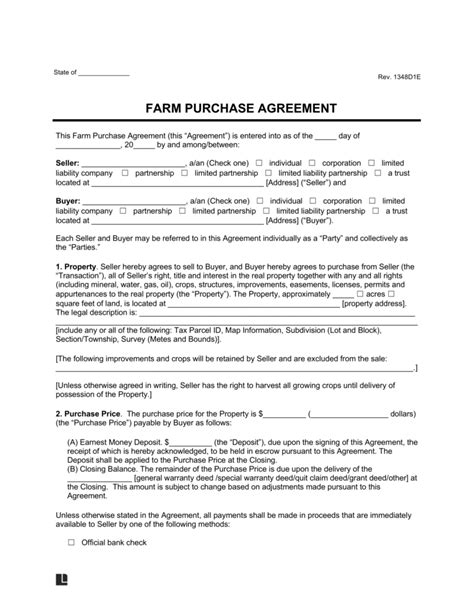

Purchase Agreement

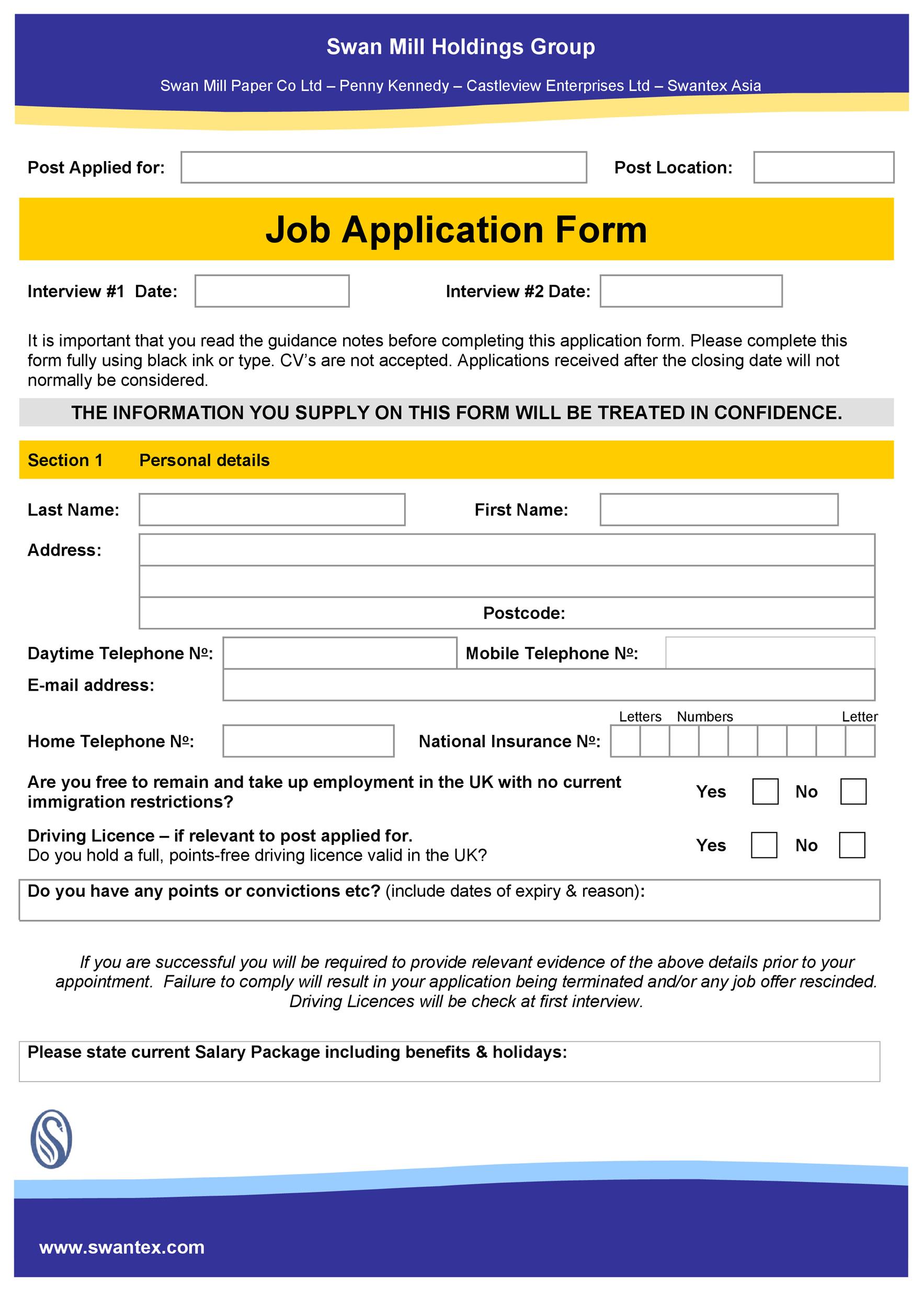

The purchase agreement is a critical document in the sale of an LLC, outlining the terms and conditions of the sale. The agreement should include: * Purchase Price: The purchase price of the LLC, including any adjustments or credits. * Payment Terms: The payment terms, including the method of payment and any financing arrangements. * Representations and Warranties: The representations and warranties made by the seller regarding the company’s assets, liabilities, and financial condition. * Closing Conditions: The conditions that must be met before the sale can be completed, including any regulatory approvals or third-party consents.

Asset Purchase Agreement

If the sale of the LLC involves the transfer of specific assets, an asset purchase agreement may be necessary. This agreement should include: * Asset Description: A detailed description of the assets being transferred, including any intellectual property or equipment. * Purchase Price: The purchase price of the assets, including any adjustments or credits. * Assumption of Liabilities: The assumption of liabilities by the buyer, including any debts or obligations associated with the assets.

Membership Interest Purchase Agreement

If the sale of the LLC involves the transfer of membership interests, a membership interest purchase agreement may be necessary. This agreement should include: * Membership Interest Description: A detailed description of the membership interests being transferred, including any voting rights or ownership percentages. * Purchase Price: The purchase price of the membership interests, including any adjustments or credits. * Representations and Warranties: The representations and warranties made by the seller regarding the company’s assets, liabilities, and financial condition.

Due Diligence

Due diligence is an essential step in the sale of an LLC, allowing the buyer to review the company’s financial and operational condition. The due diligence process should include: * Financial Review: A review of the company’s financial statements, including balance sheets and income statements. * Operational Review: A review of the company’s operational condition, including any contracts or agreements with suppliers or customers. * Legal Review: A review of the company’s legal condition, including any pending lawsuits or regulatory issues.

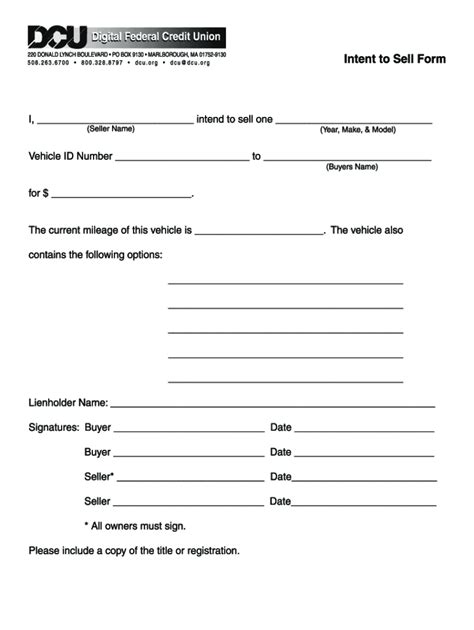

Closing Process

The closing process involves the finalization of the sale, including the transfer of ownership and the payment of the purchase price. The closing process should include: * Signing of Documents: The signing of the purchase agreement and any other necessary documents. * Transfer of Ownership: The transfer of ownership of the LLC, including any updates to the company’s records. * Payment of Purchase Price: The payment of the purchase price, including any financing arrangements.

📝 Note: The closing process should be carefully managed to ensure a smooth and efficient transfer of ownership.

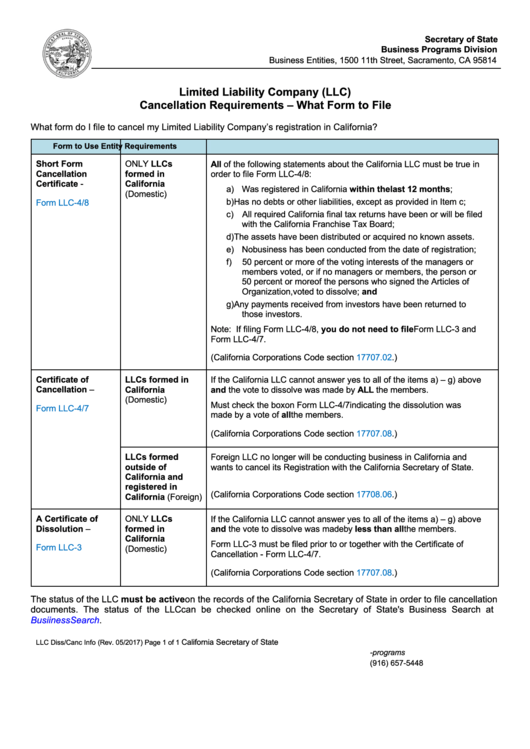

Post-Closing Obligations

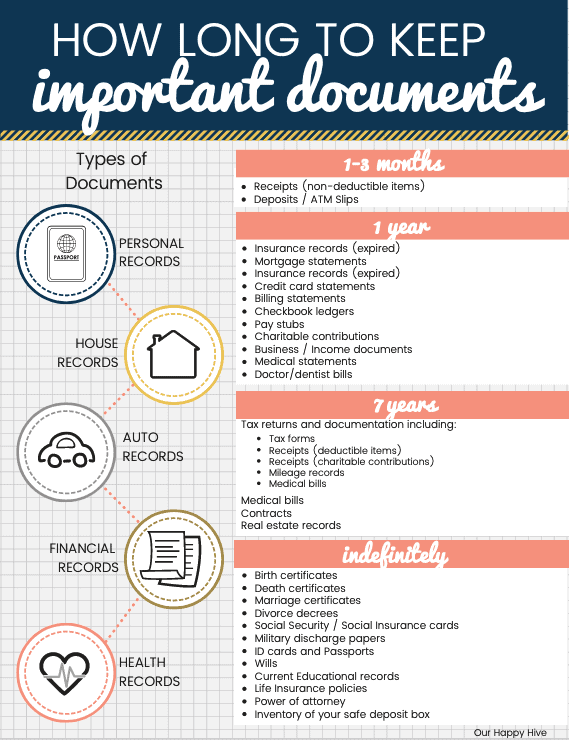

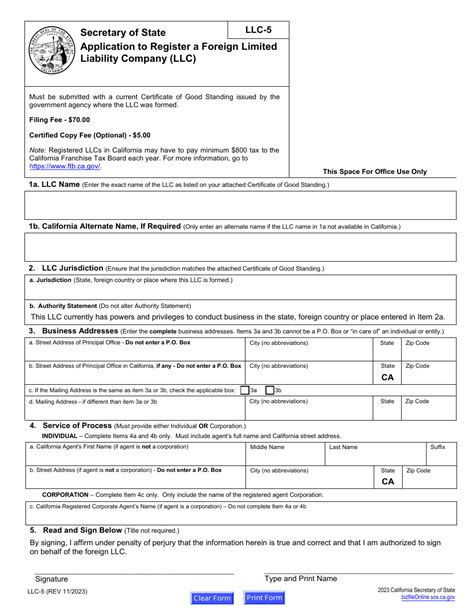

After the sale of the LLC, there may be post-closing obligations that must be met, including: * Notification of Regulatory Authorities: Notification of regulatory authorities, including the Secretary of State and the IRS. * Update of Company Records: Update of the company’s records, including any changes to the company’s name or ownership structure. * Compliance with Regulatory Requirements: Compliance with regulatory requirements, including any necessary licenses or permits.

| Document | Description |

|---|---|

| Purchase Agreement | Outlines the terms and conditions of the sale |

| Asset Purchase Agreement | Transfers specific assets from the seller to the buyer |

| Membership Interest Purchase Agreement | Transfers membership interests from the seller to the buyer |

In summary, the sale of an LLC requires careful planning and execution, involving various documents and agreements that protect the interests of both the buyer and the seller. By understanding the necessary paperwork requirements and following the steps outlined in this article, parties can ensure a smooth and efficient transfer of ownership.

What is the purpose of a purchase agreement in the sale of an LLC?

+

The purpose of a purchase agreement is to outline the terms and conditions of the sale, including the purchase price, payment terms, and any representations and warranties made by the seller.

What is due diligence in the context of an LLC sale?

+

Due diligence is the process of reviewing the company’s financial and operational condition, including any contracts or agreements with suppliers or customers, to ensure that the buyer is making an informed decision.

What are the post-closing obligations in the sale of an LLC?

+

The post-closing obligations may include notification of regulatory authorities, update of company records, and compliance with regulatory requirements, including any necessary licenses or permits.