5 Must Have Papers

Introduction to Essential Documents

When it comes to organizing our lives, whether personally or professionally, having the right documents in place is crucial. These documents not only provide a sense of security but also ensure that our wishes are respected and our affairs are in order, even in unforeseen circumstances. Among the myriad of papers we accumulate over a lifetime, there are a few that stand out as particularly important. Here, we’ll delve into the 5 must-have papers that everyone should consider having.

1. Will or Last Testament

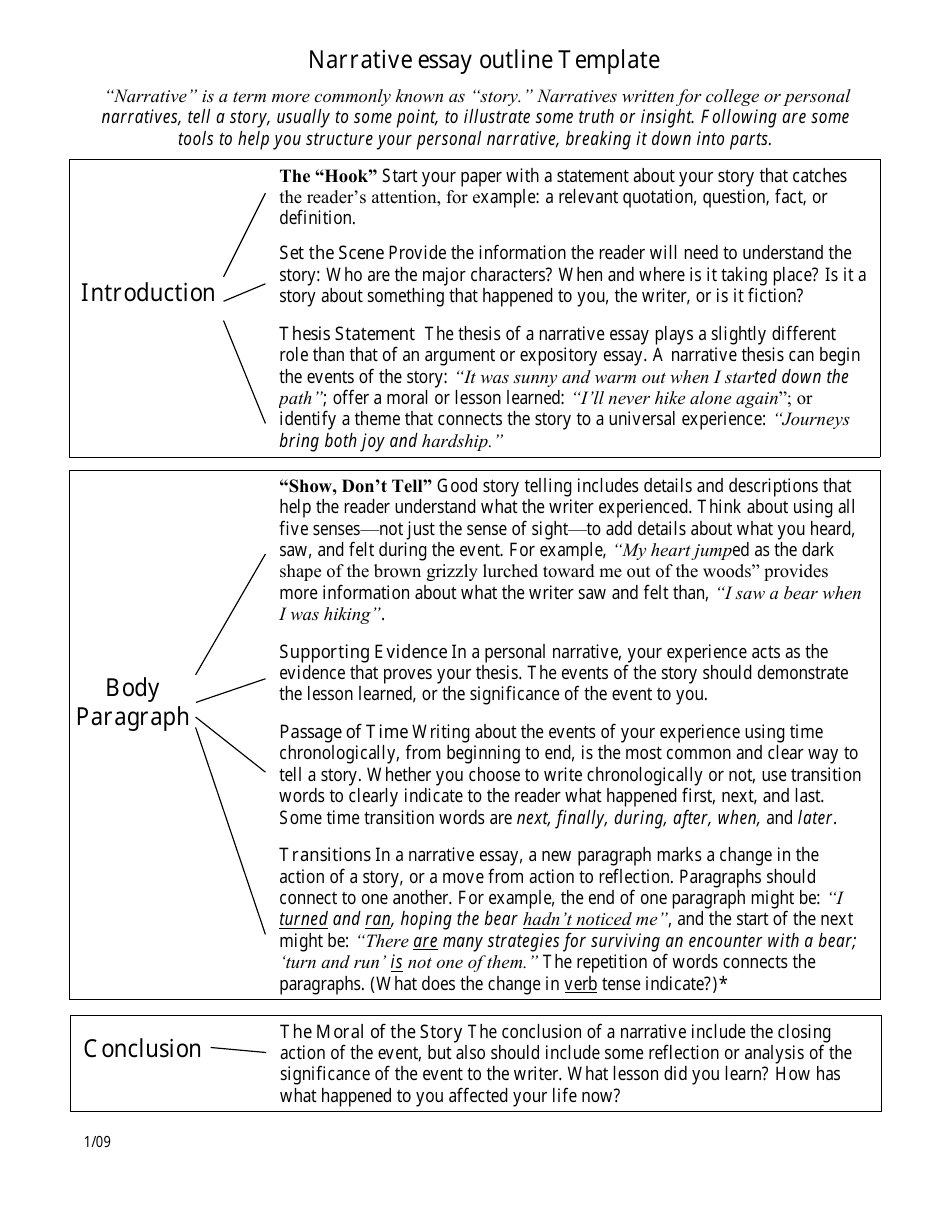

A Will, also known as a Last Testament, is a legal document that outlines how you want your assets to be distributed after your death. It’s a way to ensure that your property, money, and other belongings are given to the people you care about. Without a Will, the distribution of your assets will be decided by the laws of your state, which may not align with your wishes. A Will can also be used to appoint a guardian for minor children and to specify any funeral arrangements.

2. Power of Attorney (POA)

A Power of Attorney (POA) is a document that gives someone you trust the authority to act on your behalf in legal, financial, or health matters. This can be particularly useful if you become incapacitated or are unable to make decisions for yourself. There are different types of POA, including general POA, which covers a broad range of powers, and special or limited POA, which grants powers for specific purposes or periods.

3. Advance Directive or Living Will

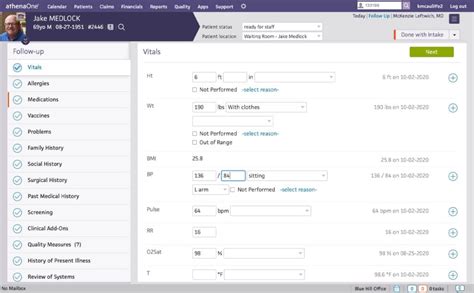

An Advance Directive, often referred to as a Living Will, is a document that specifies the medical treatment you want to receive if you become unable to make decisions for yourself. This includes decisions about life-sustaining treatments, such as feeding tubes or ventilators. An Advance Directive ensures that your healthcare providers know your preferences and can make decisions accordingly, respecting your autonomy even when you cannot communicate.

4. Insurance Policies

Insurance policies, whether they are life insurance, health insurance, disability insurance, or long-term care insurance, provide financial protection against unforeseen events. These policies can help ensure that you and your loved ones are not burdened with significant expenses in the event of illness, injury, or death. Reviewing and updating your insurance policies regularly is essential to make sure they continue to meet your needs.

5. Identity and Financial Documents

Lastly, having organized and accessible identity and financial documents is vital. This includes documents such as your passport, driver’s license, birth certificate, marriage certificate (if applicable), bank account information, investment accounts, and retirement accounts. Keeping these documents in a safe but accessible place, such as a fireproof safe or a secure online storage service, can make a significant difference in times of need.

💡 Note: It's essential to review and update these documents periodically to reflect any changes in your life, such as moving to a new state, getting married, having children, or experiencing significant changes in your financial situation.

In summary, these five types of documents are foundational to securing your legacy, protecting your loved ones, and ensuring that your wishes are carried out. They provide a framework for managing your affairs, both during your lifetime and after your passing, and offer peace of mind knowing that you have taken proactive steps to prepare for the future.

What is the primary purpose of having a Will?

+

The primary purpose of having a Will is to ensure that your assets are distributed according to your wishes after your death, and to appoint guardians for minor children and specify funeral arrangements if desired.

How often should I review my insurance policies?

+

You should review your insurance policies annually or whenever you experience a significant life change, such as marriage, the birth of a child, or a move to a new state, to ensure they continue to meet your needs.

What is the difference between a Power of Attorney and an Advance Directive?

+

A Power of Attorney grants someone the authority to make decisions on your behalf in financial, legal, or health matters, while an Advance Directive specifies the medical treatment you want to receive if you become unable to make decisions for yourself.