Paperwork

1099 Paperwork Requirements

Understanding 1099 Paperwork Requirements

As a business owner or independent contractor, it’s essential to understand the 1099 paperwork requirements to ensure compliance with the Internal Revenue Service (IRS) regulations. The 1099 form is used to report various types of income, such as freelance work, rents, and royalties, to the IRS. In this article, we’ll delve into the details of 1099 paperwork requirements, including who needs to file, what forms are required, and the deadlines for submission.

Who Needs to File 1099 Forms?

Businesses and individuals who make payments to independent contractors, freelancers, or other non-employees must file 1099 forms with the IRS. This includes:

- Businesses that pay more than 600 to an independent contractor or freelancer in a calendar year</li> <li>Renters who pay more than 600 in rent to a landlord or property manager

- Companies that pay royalties, prizes, or awards to individuals or businesses

Types of 1099 Forms

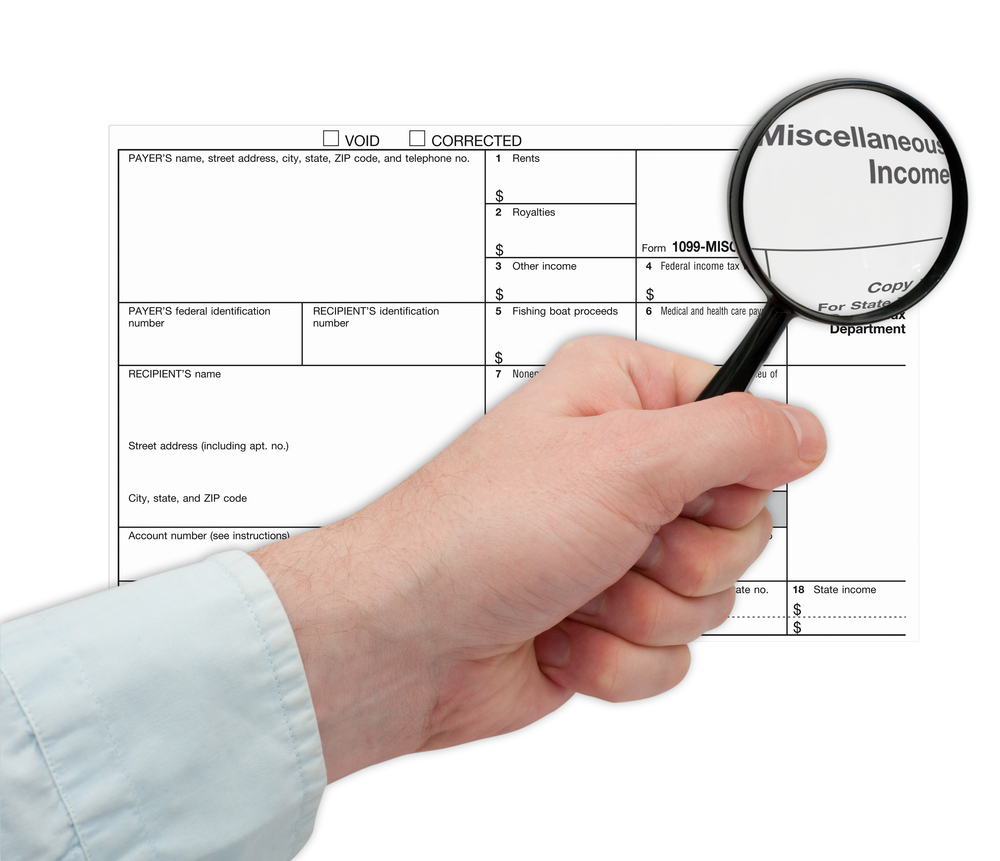

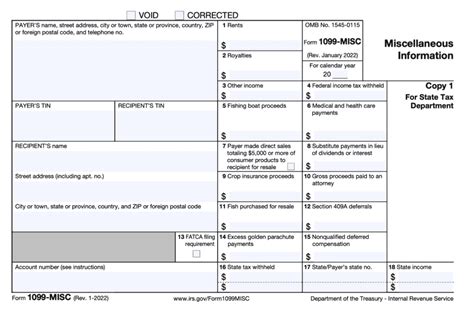

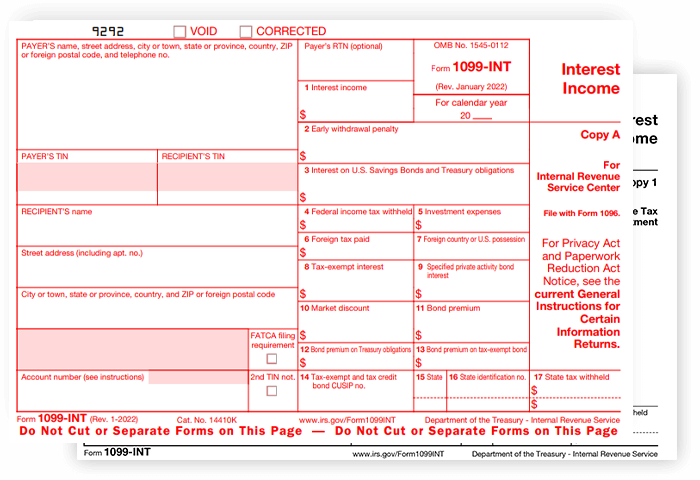

There are several types of 1099 forms, each designed for specific purposes:

| Form Type | Description |

|---|---|

| 1099-MISC | Used to report miscellaneous income, such as freelance work, rents, and royalties |

| 1099-INT | Used to report interest income, such as interest earned from savings accounts or investments |

| 1099-DIV | Used to report dividend income, such as income earned from stock ownership |

| 1099-B | Used to report proceeds from broker and barter exchange transactions |

Each form has its unique requirements and deadlines, so it’s essential to understand which form applies to your specific situation.

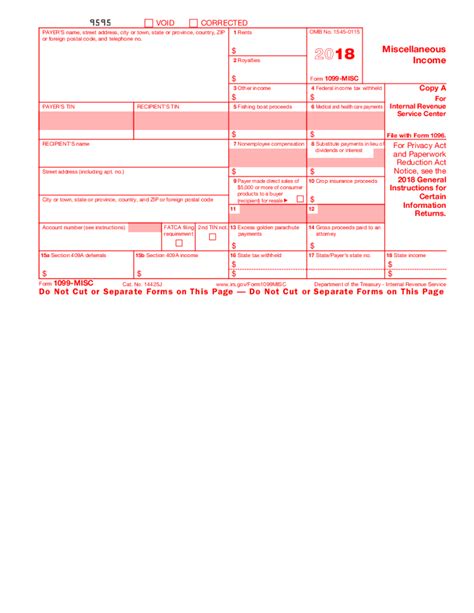

1099 Paperwork Requirements

To ensure compliance with the IRS, businesses and individuals must follow these 1099 paperwork requirements:

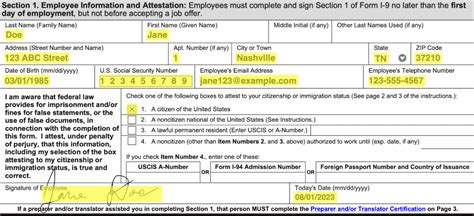

- Obtain the recipient’s tax identification number (TIN) or social security number (SSN)

- Complete the 1099 form accurately and legibly

- Provide a copy of the 1099 form to the recipient by January 31st of each year

- File the 1099 form with the IRS by February 28th (or March 31st if filing electronically)

- Keep a copy of the 1099 form for your records, in case of an audit or discrepancy

💡 Note: Failure to comply with 1099 paperwork requirements can result in penalties and fines, so it's essential to understand and follow the regulations carefully.

Deadlines and Penalties

The deadlines for filing 1099 forms are as follows:

- January 31st: Provide a copy of the 1099 form to the recipient

- February 28th: File the 1099 form with the IRS (or March 31st if filing electronically)

Conclusion and Next Steps

In conclusion, understanding 1099 paperwork requirements is essential for businesses and individuals who need to report various types of income to the IRS. By following the guidelines outlined in this article, you can ensure compliance with the IRS regulations and avoid penalties. Remember to prioritize accuracy and timeliness when filing 1099 forms, and don’t hesitate to seek professional help if you’re unsure about any aspect of the process.

What is the purpose of a 1099 form?

+

The purpose of a 1099 form is to report various types of income, such as freelance work, rents, and royalties, to the IRS.

Who needs to file a 1099 form?

+

Businesses and individuals who make payments to independent contractors, freelancers, or other non-employees must file a 1099 form with the IRS.

What are the deadlines for filing 1099 forms?

+

The deadlines for filing 1099 forms are January 31st for providing a copy to the recipient and February 28th (or March 31st if filing electronically) for filing with the IRS.