Guarantor Paperwork Requirements

Understanding Guarantor Paperwork Requirements

When an individual applies for a loan, credit card, or rental agreement, they may be required to provide a guarantor. A guarantor is a person who agrees to take on the responsibility of paying the debt if the borrower defaults. The guarantor paperwork requirements vary depending on the type of loan, credit agreement, or rental contract. In this article, we will explore the typical guarantor paperwork requirements and the process of becoming a guarantor.

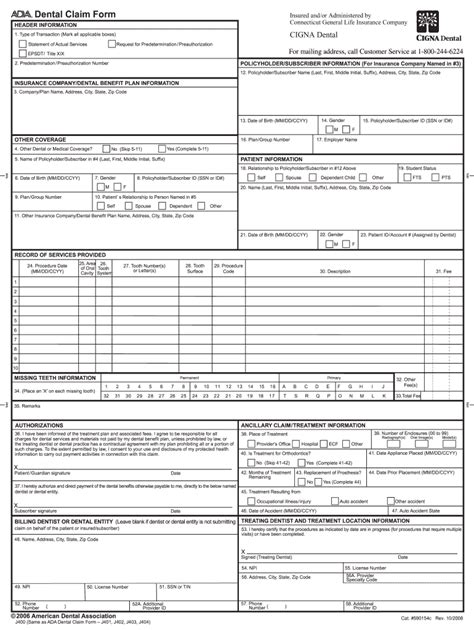

Types of Guarantor Paperwork

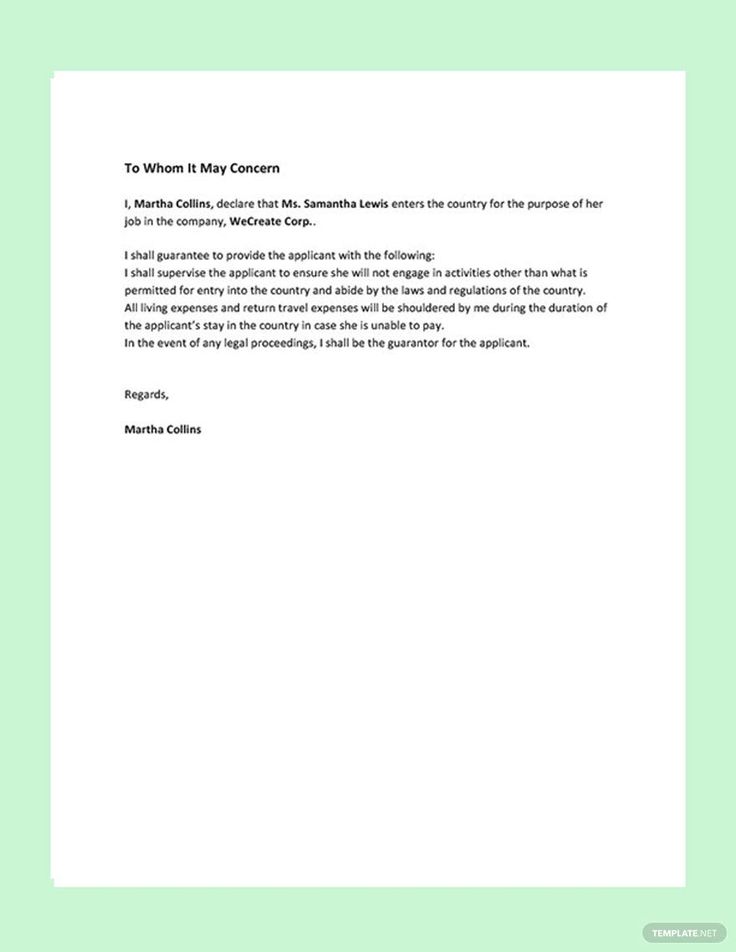

There are different types of guarantor paperwork, including: * Personal guarantee: This type of guarantee is used for business loans, where the business owner or director guarantees the loan using their personal assets. * Co-signer agreement: This type of agreement is used for personal loans, credit cards, or rental agreements, where a co-signer agrees to take on the responsibility of paying the debt if the borrower defaults. * Indemnity agreement: This type of agreement is used to protect the lender or creditor from losses incurred due to the borrower’s default.

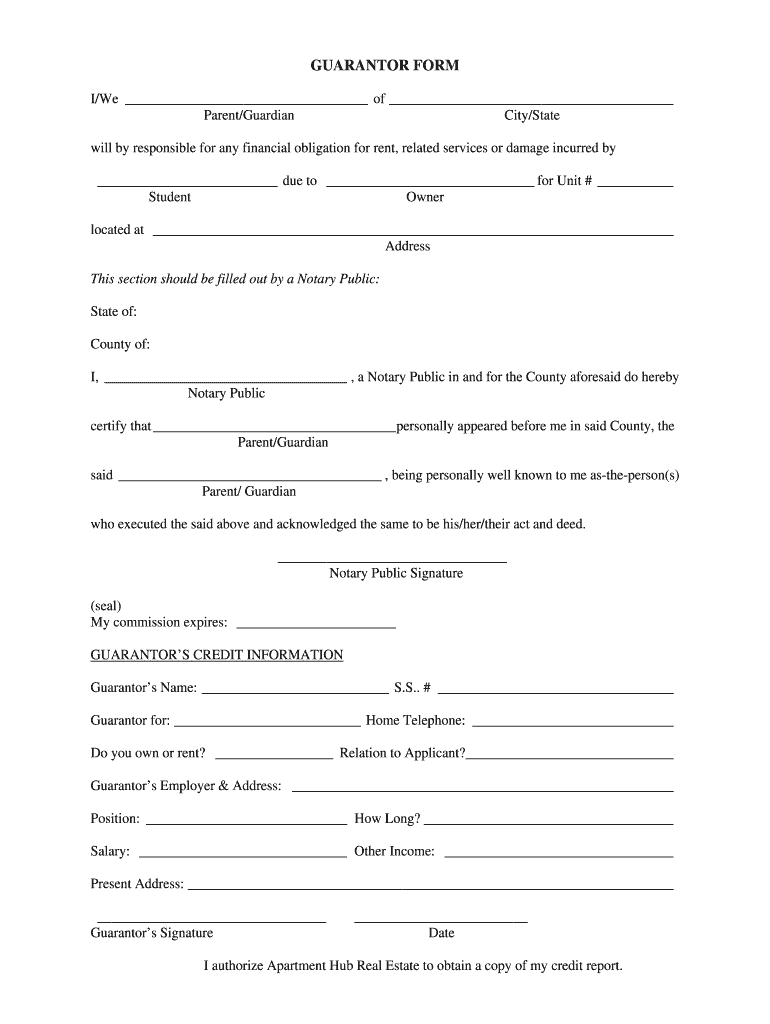

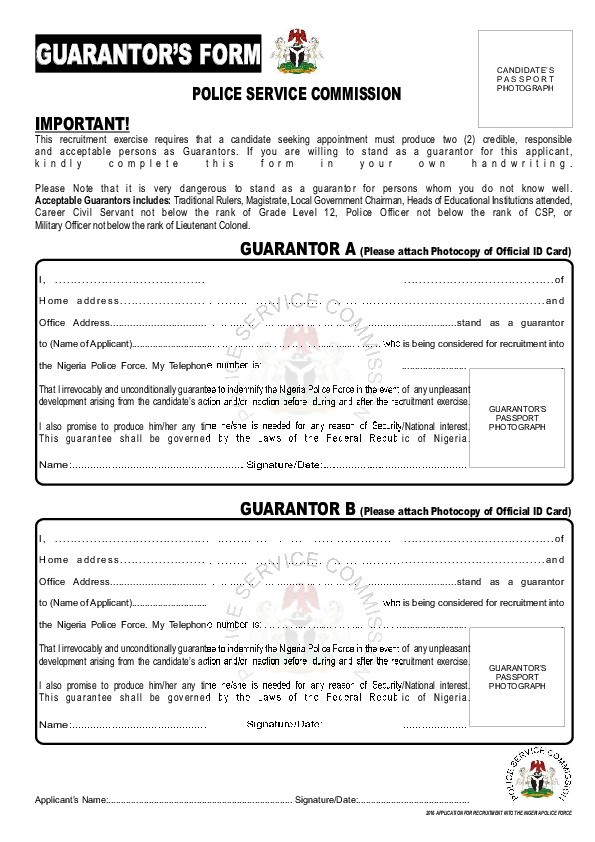

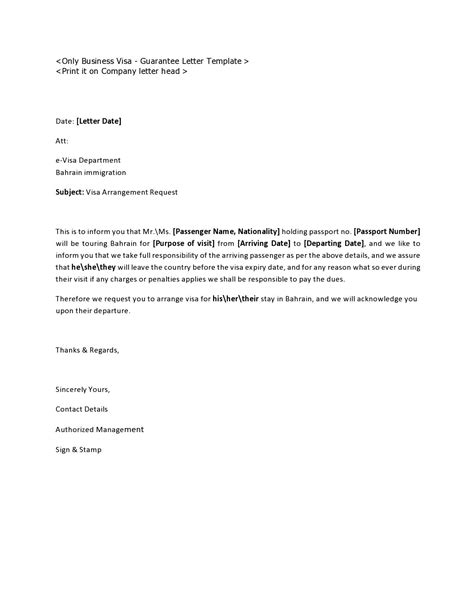

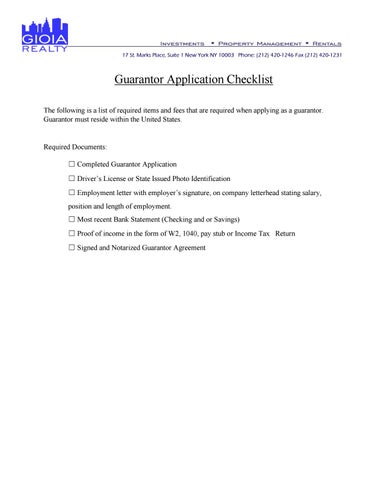

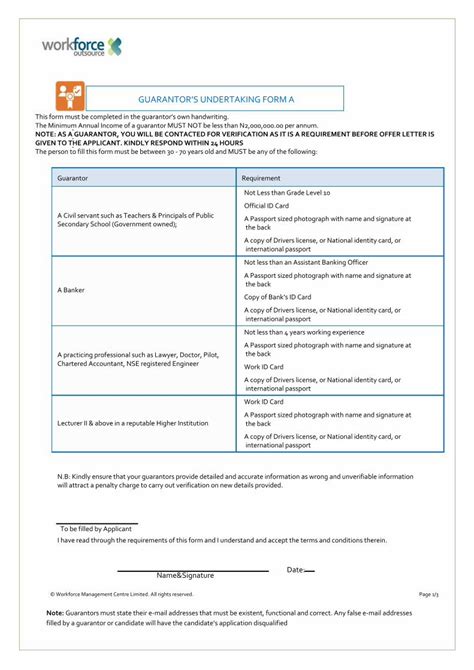

Guarantor Paperwork Requirements

The guarantor paperwork requirements typically include: * Identification documents: The guarantor must provide identification documents, such as a passport, driver’s license, or national ID card. * Income proof: The guarantor must provide income proof, such as payslips, tax returns, or bank statements, to demonstrate their ability to pay the debt. * Asset valuation: The guarantor may be required to provide asset valuation, such as property valuations or vehicle valuations, to demonstrate their net worth. * Credit report: The guarantor may be required to provide a credit report to demonstrate their creditworthiness.

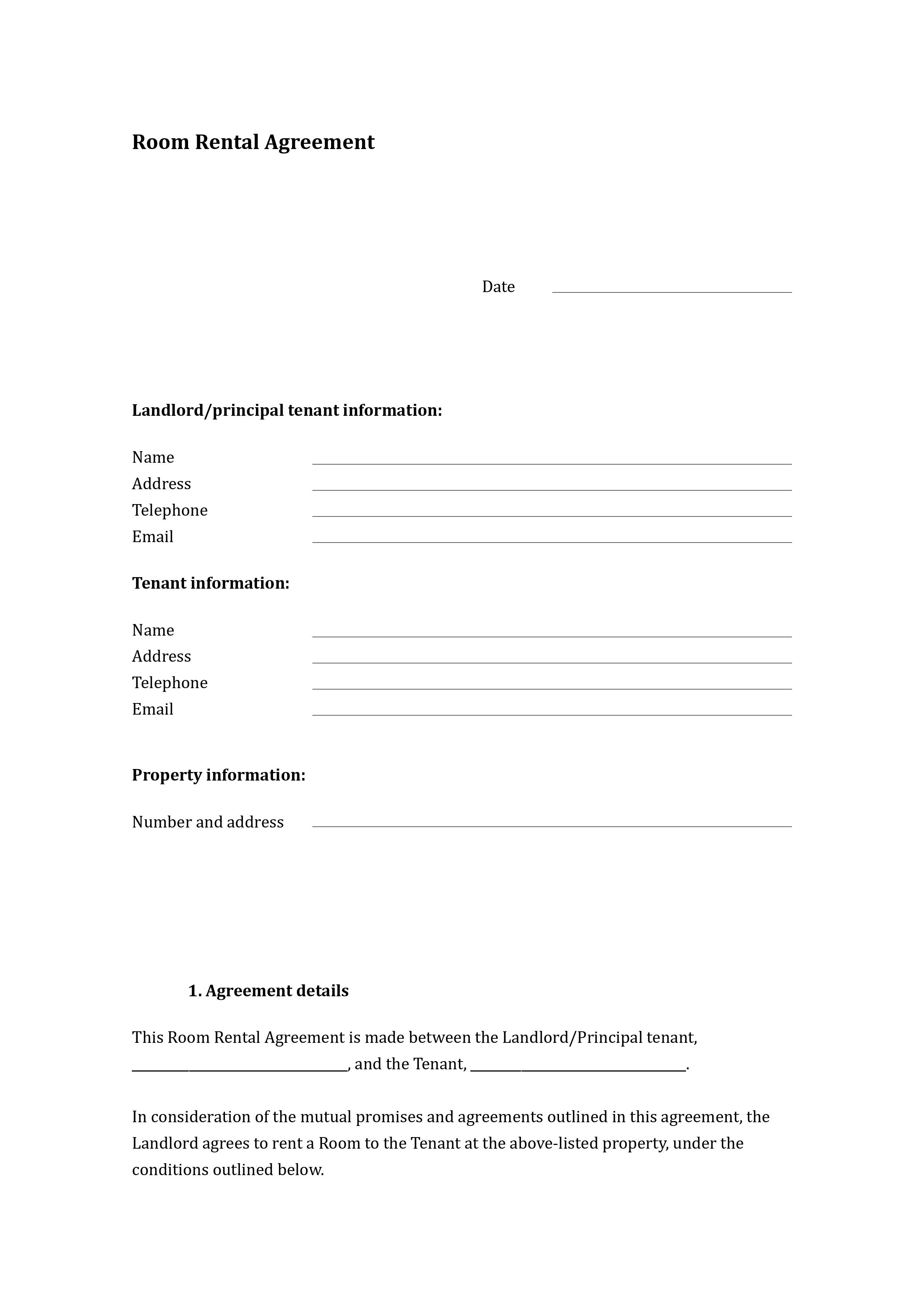

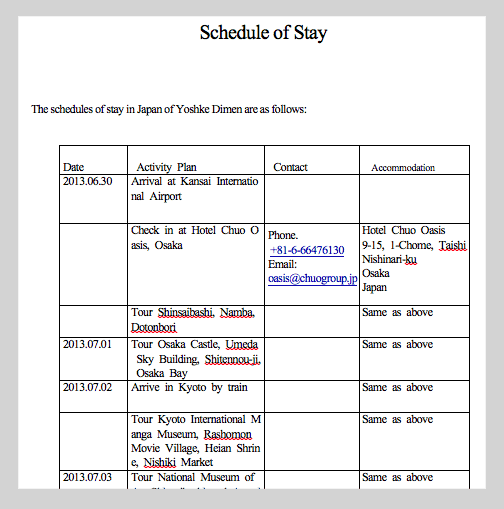

Process of Becoming a Guarantor

The process of becoming a guarantor typically involves the following steps: * Reviewing the loan agreement: The guarantor must review the loan agreement or credit contract to understand the terms and conditions. * Providing personal and financial information: The guarantor must provide personal and financial information, such as identification documents, income proof, and asset valuation. * Signing the guarantee agreement: The guarantor must sign the guarantee agreement, which outlines the terms and conditions of the guarantee. * Undergoing a credit check: The guarantor may be required to undergo a credit check to demonstrate their creditworthiness.

📝 Note: It is essential for the guarantor to carefully review the guarantee agreement and understand the terms and conditions before signing.

Responsibilities of a Guarantor

As a guarantor, you have the following responsibilities: * Paying the debt: If the borrower defaults, the guarantor is responsible for paying the debt. * Providing financial information: The guarantor may be required to provide financial information, such as income proof and asset valuation, to demonstrate their ability to pay the debt. * Notifying the lender: The guarantor must notify the lender of any changes to their financial situation or contact information.

Risks of Being a Guarantor

Being a guarantor carries the following risks: * Financial risk: If the borrower defaults, the guarantor may be required to pay the debt, which can lead to financial difficulties. * Credit risk: If the guarantor is required to pay the debt, it can negatively impact their credit score. * Relationship risk: Being a guarantor can strain relationships with the borrower, especially if the borrower defaults.

Table: Guarantor Paperwork Requirements

| Type of Guarantor Paperwork | Requirements |

|---|---|

| Personal Guarantee | Identification documents, income proof, asset valuation, credit report |

| Co-signer Agreement | Identification documents, income proof, credit report |

| Indemnity Agreement | Identification documents, income proof, asset valuation, credit report |

In summary, becoming a guarantor requires careful consideration and a thorough understanding of the guarantee agreement and the responsibilities involved. It is essential to review the loan agreement, provide personal and financial information, and sign the guarantee agreement. As a guarantor, you have the responsibility of paying the debt if the borrower defaults and providing financial information to demonstrate your ability to pay the debt.

The key points to remember are to carefully review the guarantee agreement, understand the terms and conditions, and be aware of the risks involved. It is also essential to notify the lender of any changes to your financial situation or contact information. By following these steps and understanding the guarantor paperwork requirements, you can make an informed decision about becoming a guarantor.

What is a guarantor?

+

A guarantor is a person who agrees to take on the responsibility of paying the debt if the borrower defaults.

What are the guarantor paperwork requirements?

+

The guarantor paperwork requirements typically include identification documents, income proof, asset valuation, and credit report.

What are the risks of being a guarantor?

+

The risks of being a guarantor include financial risk, credit risk, and relationship risk.