5 S-Corp Paperwork Requirements

Understanding the 5 S-Corp Paperwork Requirements

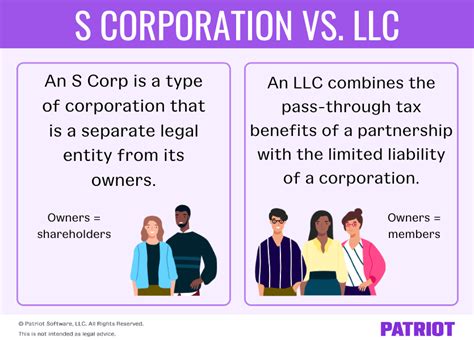

To form an S corporation, also known as an S-Corp, there are several essential paperwork requirements that must be fulfilled. These requirements are crucial for the formation and operation of an S-Corp, ensuring compliance with state and federal regulations. In this article, we will delve into the five primary S-Corp paperwork requirements, exploring their significance and the steps involved in completing them.

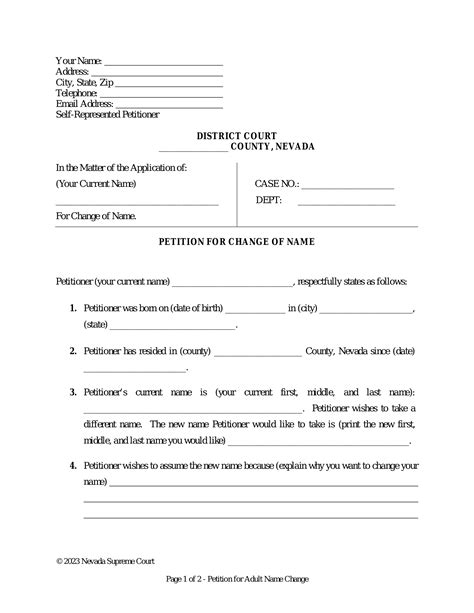

1. Articles of Incorporation

The first and most critical paperwork requirement for forming an S-Corp is filing the Articles of Incorporation with the state. This document, also known as a Certificate of Incorporation, provides fundamental information about the corporation, including its name, purpose, address, and the number of shares it is authorized to issue. The Articles of Incorporation must include a statement indicating the intention to elect S-Corp status. This document is typically filed with the Secretary of State’s office in the state where the S-Corp is located.

2. EIN Application

An Employer Identification Number (EIN) is a unique identifier assigned to a business by the Internal Revenue Service (IRS) for tax purposes. Applying for an EIN is the second crucial paperwork requirement for an S-Corp. The EIN application, also known as Form SS-4, is submitted to the IRS. An EIN is necessary for opening a business bank account, filing tax returns, and hiring employees. The application process can be completed online, by phone, or by mail, and it typically requires providing the business name, address, and the name and address of the principal officer.

3. S-Corp Election Form (Form 2553)

To officially elect S-Corp status, the business must file Form 2553 with the IRS. This form is used to make the S corporation election and must be signed by all shareholders. The deadline for filing Form 2553 is within 75 days of the corporation’s formation or during the first 75 days of the tax year for existing corporations. The form requires detailed information about the corporation, its shareholders, and the election itself. It is essential to ensure that all shareholders agree to the S-Corp election, as it affects how the corporation’s income is taxed.

4. Business Licenses and Permits

Depending on the nature of the business and its location, various licenses and permits may be required. These can include general business licenses, professional licenses, sales tax permits, and zoning permits. Compliance with local, state, and federal regulations is vital to avoid fines and penalties. The specific licenses and permits needed can vary significantly, so it is crucial to research the requirements for the particular industry and location of the S-Corp.

5. Annual Reports and Tax Filings

Lastly, S-Corps are required to file annual reports with the state and submit tax returns to the IRS. The annual report typically includes information about the corporation’s address, officers, and directors, and it may need to be filed with the Secretary of State’s office. The IRS requires S-Corps to file Form 1120S, the U.S. Income Tax Return for an S Corporation, which reports the corporation’s income, deductions, and credits. Additionally, Schedule K-1 is used to report each shareholder’s share of income, deductions, and credits. These tax filings are due on the 15th day of the third month following the close of the tax year.

💡 Note: It is essential to consult with a tax professional or attorney to ensure all paperwork requirements are met correctly and on time, as failure to comply can result in significant penalties and even the loss of S-Corp status.

In summary, forming and maintaining an S-Corp involves several critical paperwork requirements. These include filing the Articles of Incorporation, applying for an EIN, electing S-Corp status with Form 2553, obtaining necessary business licenses and permits, and filing annual reports and tax returns. Each of these steps is vital for ensuring the S-Corp’s compliance with legal and regulatory requirements, thereby protecting its status and facilitating its operation.

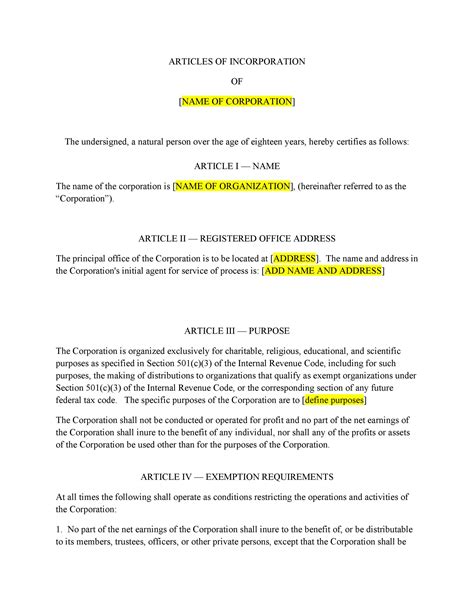

To further illustrate the importance and process of these requirements, consider the following table outlining the key paperwork needs for S-Corps:

| Document | Purpose | Filing Location |

|---|---|---|

| Articles of Incorporation | Forming the corporation | Secretary of State's office |

| EIN Application (Form SS-4) | Obtaining an Employer Identification Number | Internal Revenue Service (IRS) |

| S-Corp Election Form (Form 2553) | Election of S-Corp status | Internal Revenue Service (IRS) |

| Business Licenses and Permits | Compliance with local, state, and federal regulations | Varying authorities depending on the license |

| Annual Reports and Tax Filings (Form 1120S and Schedule K-1) | Reporting corporate information and tax obligations | Secretary of State's office and Internal Revenue Service (IRS) |

Ultimately, navigating the paperwork requirements for an S-Corp can be complex, but understanding and fulfilling these obligations is crucial for the successful formation and operation of the business. By prioritizing compliance and seeking professional advice when needed, S-Corp owners can ensure their business remains in good standing and reaps the benefits of this corporate structure.

What is the primary purpose of filing Form 2553 for an S-Corp?

+

The primary purpose of filing Form 2553 is to make the S corporation election, which allows the corporation to be taxed as a pass-through entity, avoiding double taxation.

How often must an S-Corp file annual reports with the state?

+

The frequency of filing annual reports can vary by state, but most states require S-Corps to file annual reports once a year, typically on the anniversary of the corporation’s formation or at the end of the calendar year.

What happens if an S-Corp fails to file its tax return (Form 1120S) on time?

+

If an S-Corp fails to file its tax return on time, it may be subject to penalties and interest on the unpaid tax. Additionally, the IRS may terminate the S-Corp’s election if the failure to file is deemed to be a significant error.