5 VA Loan Forms

Understanding VA Loan Forms

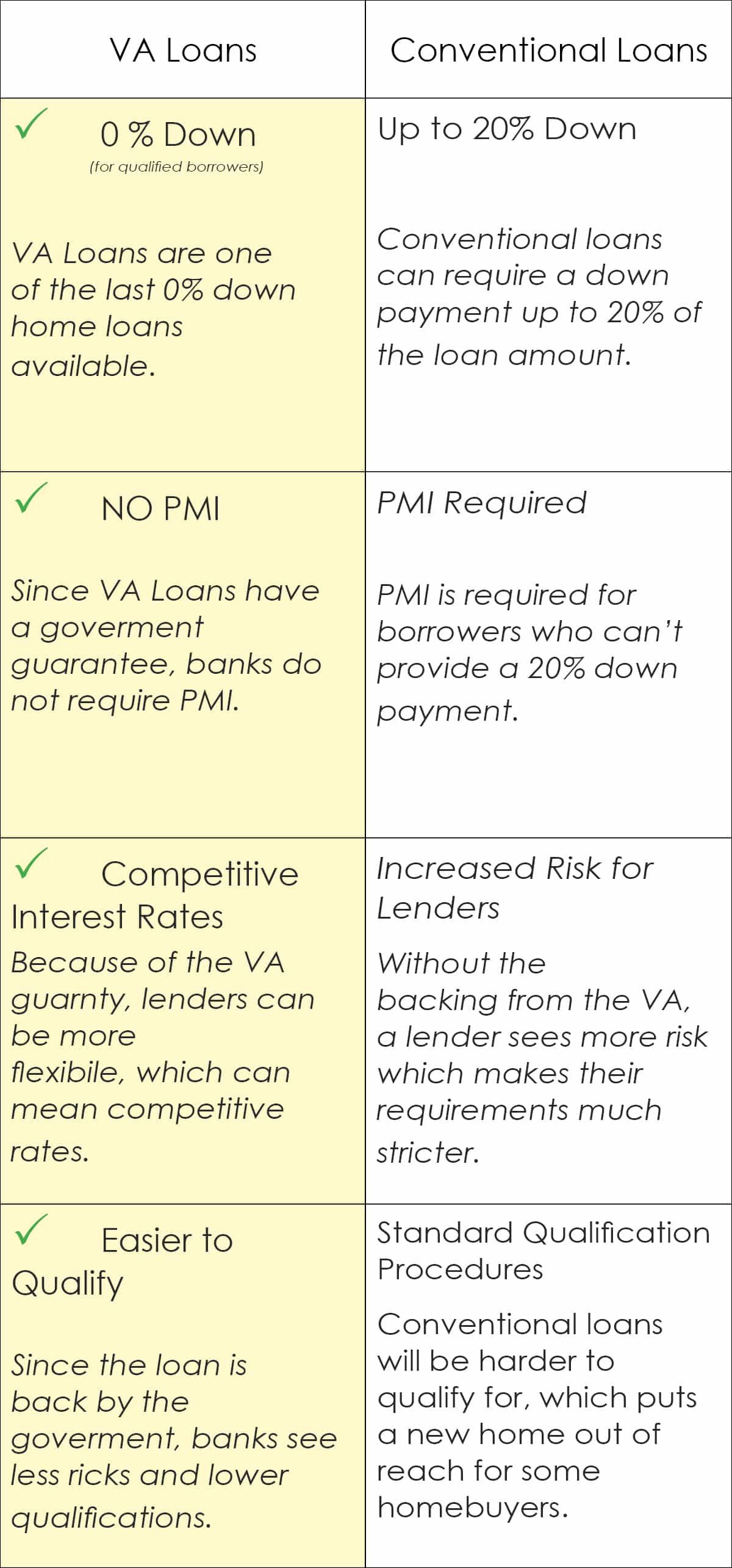

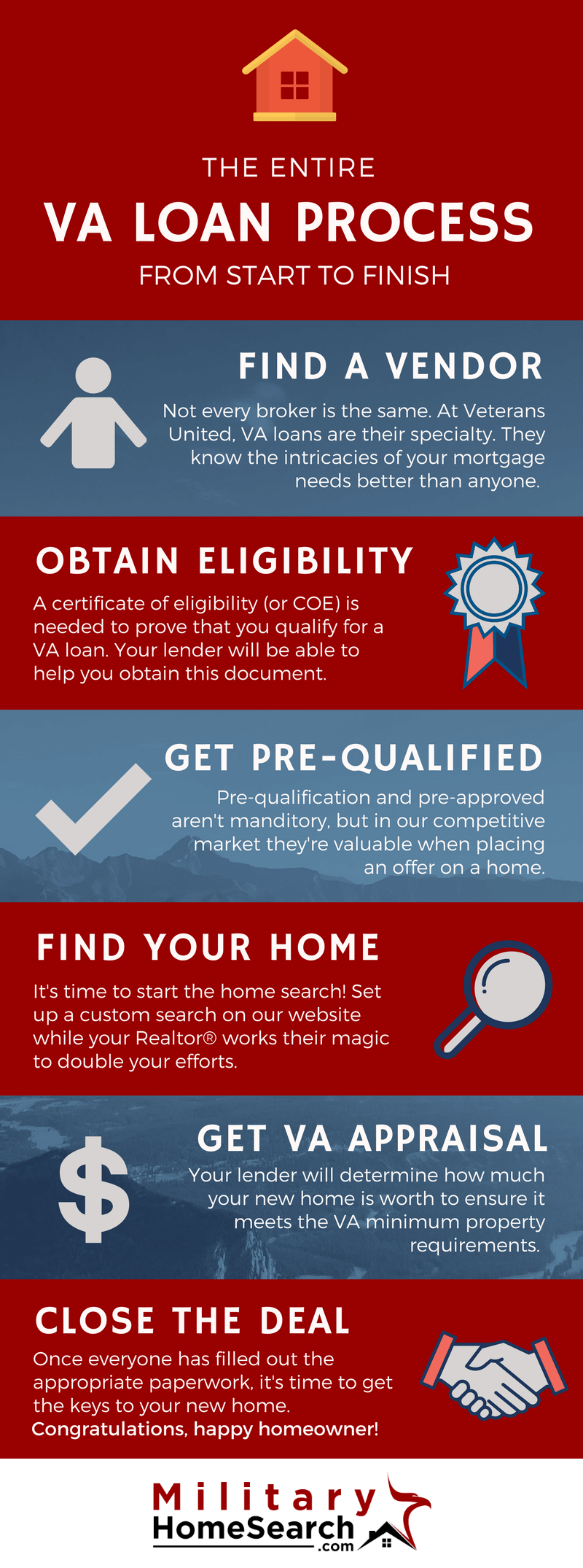

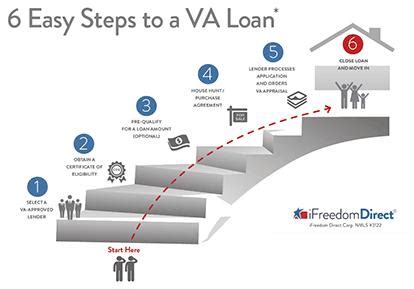

The process of obtaining a VA loan can be complex and involves various forms and documentation. For veterans, active-duty personnel, and eligible surviving spouses, understanding these forms is crucial for a successful loan application. In this article, we will delve into the details of 5 key VA loan forms that play a significant role in the loan process.

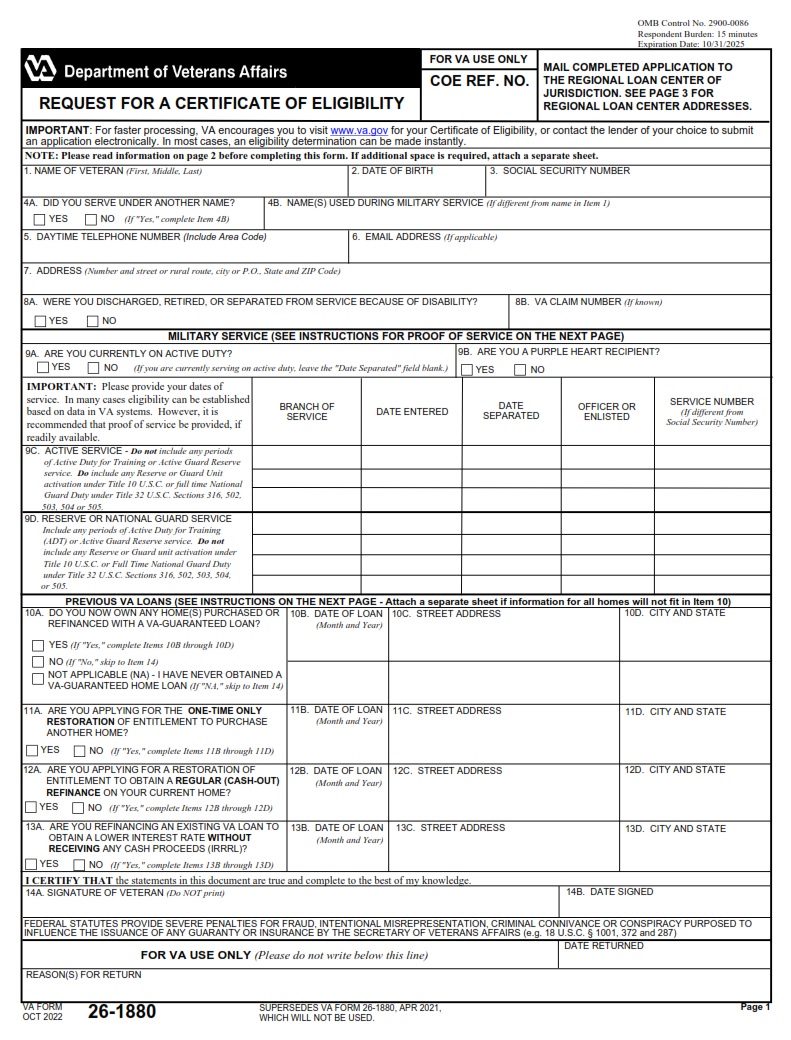

VA Form 26-1880: Request for Certificate of Eligibility

The VA Form 26-1880 is used to request a Certificate of Eligibility, which is a critical document that verifies the borrower’s eligibility for a VA loan. This form is typically submitted to the VA by the lender on behalf of the borrower. The Certificate of Eligibility provides information about the borrower’s entitlement, which determines the amount of guaranty available for the loan.

VA Form 26-1820: Report and Certification of Loan Disbursement

The VA Form 26-1820 is used to report the disbursement of loan funds to the VA. This form is completed by the lender and provides detailed information about the loan, including the loan amount, interest rate, and repayment terms. The form also certifies that the loan was disbursed in accordance with VA regulations.

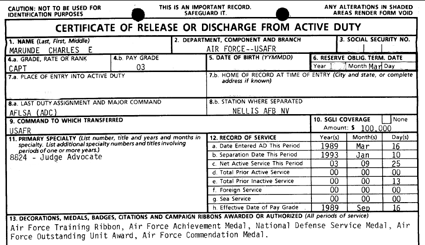

VA Form 26-8937: Verification of VA Benefit-Related Documents

The VA Form 26-8937 is used to verify the authenticity of benefit-related documents, such as the DD Form 214, which is the discharge paperwork for military personnel. This form is typically used when there are discrepancies or issues with the borrower’s documentation. The lender may request this form to verify the borrower’s eligibility for a VA loan.

VA Form 26-6393: Loan Guaranty Certificate

The VA Form 26-6393 is a certificate that guarantees the loan, up to a certain amount, in the event of default. This form is issued by the VA and provides the lender with assurance that the loan is guaranteed. The Loan Guaranty Certificate is typically issued after the loan has been approved and before it is disbursed.

VA Form 26-6705: VA Acquisition or Refinance Analysis

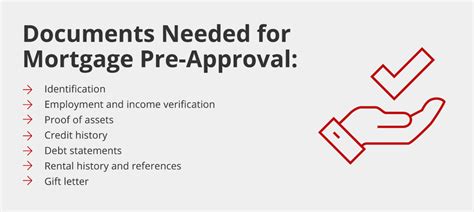

The VA Form 26-6705 is used to analyze the borrower’s financial situation and determine whether the loan is affordable. This form is completed by the lender and provides detailed information about the borrower’s income, expenses, and credit history. The form also evaluates the borrower’s debt-to-income ratio and ensures that the loan meets VA guidelines.

📝 Note: It's essential to carefully review and complete all VA loan forms accurately to avoid delays or rejection of the loan application.

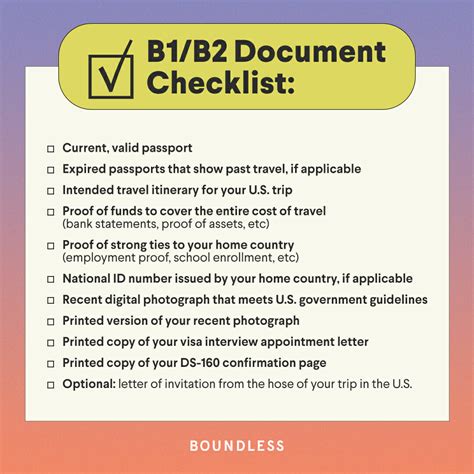

Additional Forms and Documentation

In addition to the forms mentioned above, borrowers may need to provide other documentation, such as: * DD Form 214: Discharge paperwork for military personnel * Pay stubs and W-2 forms: Income verification * Bank statements: Asset verification * Credit reports: Credit history evaluation * Identification documents: Proof of identity

| Form Number | Form Name | Purpose |

|---|---|---|

| VA Form 26-1880 | Request for Certificate of Eligibility | Verifies eligibility for a VA loan |

| VA Form 26-1820 | Report and Certification of Loan Disbursement | Reports loan disbursement to the VA |

| VA Form 26-8937 | Verification of VA Benefit-Related Documents | Verifies authenticity of benefit-related documents |

| VA Form 26-6393 | Loan Guaranty Certificate | Guarantees the loan in the event of default |

| VA Form 26-6705 | VA Acquisition or Refinance Analysis | Analyzes borrower's financial situation |

In summary, understanding the various VA loan forms is crucial for a successful loan application. Borrowers should carefully review and complete all forms accurately, and provide additional documentation as required. By doing so, they can ensure a smooth loan process and take advantage of the benefits offered by VA loans.

What is the purpose of the VA Form 26-1880?

+

The VA Form 26-1880 is used to request a Certificate of Eligibility, which verifies the borrower’s eligibility for a VA loan.

What documentation is required for a VA loan application?

+

In addition to the VA loan forms, borrowers may need to provide documentation such as DD Form 214, pay stubs, bank statements, credit reports, and identification documents.

How long does it take to process a VA loan application?

+

The processing time for a VA loan application can vary, but it typically takes 30-60 days from application to closing.