5 VA Loan Paperwork

Understanding the 5 VA Loan Paperwork You’ll Need

When navigating the process of obtaining a VA loan, it’s essential to understand the paperwork involved. The VA loan process can seem daunting, but being prepared with the necessary documents can make a significant difference. In this article, we’ll delve into the 5 key pieces of VA loan paperwork you’ll need, ensuring you’re well-prepared for your loan application.

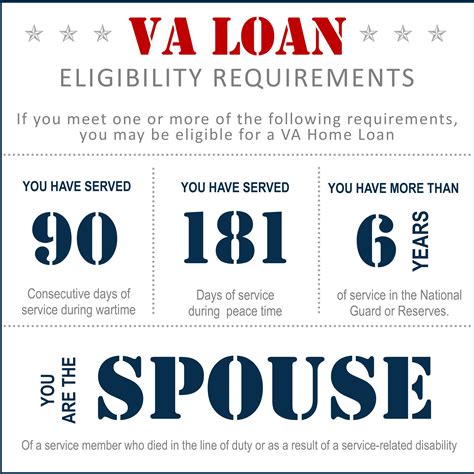

1. Certificate of Eligibility

The Certificate of Eligibility (COE) is a crucial document that verifies your eligibility for a VA loan. This certificate is issued by the Department of Veterans Affairs and confirms your military service status, which is a prerequisite for VA loan eligibility. To obtain a COE, you can apply online through the VA’s eBenefits portal, by mail, or through a lender. The COE is typically required at the pre-approval stage and will be necessary for your lender to determine the guaranty amount and your entitlement.

2. DD Form 214

The DD Form 214, also known as the Certificate of Release or Discharge from Active Duty, is a critical document for veterans and their families. This form contains essential information about your military service, including your dates of service, rank, and the nature of your discharge. You’ll need to provide a copy of your DD Form 214 as part of the VA loan application process. If you don’t have a copy, you can request one from the National Archives or your local VA office.

3. VA Loan Application

The VA loan application is the formal request for a VA loan. This application will require detailed personal and financial information, including your income, credit history, and employment status. Your lender will guide you through the application process, which typically involves submitting documentation to support the information provided in the application. This step is crucial as it sets the stage for the lender to assess your creditworthiness and your ability to repay the loan.

4. Appraisal Report

Once your loan application is pre-approved, an appraisal of the property you’re interested in purchasing will be necessary. The appraisal report is conducted by a VA-approved appraiser who assesses the property’s value and ensures it meets the VA’s Minimum Property Requirements (MPRs). The MPRs are guidelines that protect veterans from purchasing properties that could pose health or safety hazards. The appraisal report is a critical piece of paperwork as it confirms the property’s value and its suitability for a VA loan.

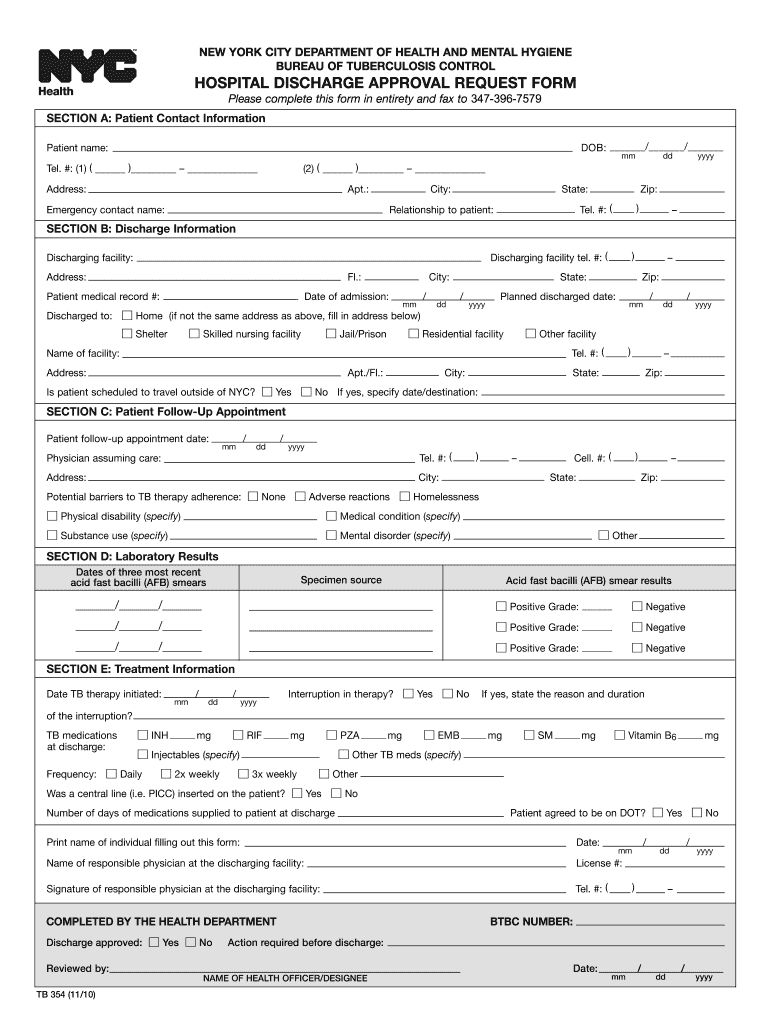

5. Closing Documents

The final step in the VA loan process involves signing the closing documents. These documents include the loan note, the mortgage or deed of trust, and other legal documents that finalize the loan and transfer of property ownership. The closing process typically takes place at a title company or attorney’s office and involves reviewing and signing numerous documents. It’s essential to carefully review each document to ensure you understand your obligations and the terms of your VA loan.

📝 Note: Keeping track of these documents and ensuring they are accurately completed is crucial for a smooth VA loan process. Maintaining open communication with your lender and being prepared to provide additional documentation as needed can also help avoid delays.

To further illustrate the importance of these documents, let’s consider the benefits of being prepared: - Streamlined Process: Having all necessary documents ready can expedite the loan application process. - Reduced Stress: Understanding what’s required upfront can reduce the stress associated with applying for a VA loan. - Improved Approval Rates: Complete and accurate paperwork can improve your chances of loan approval.

| Document | Description | Purpose |

|---|---|---|

| Certificate of Eligibility | Confirms VA loan eligibility | Verifies military service status |

| DD Form 214 | Contains military service information | Supports loan application and eligibility verification |

| VA Loan Application | Formal request for a VA loan | Initiates the loan approval process |

| Appraisal Report | Evaluates property value and condition | Ensures property meets VA's Minimum Property Requirements |

| Closing Documents | Finalizes the loan and property transfer | Completes the loan process and establishes loan terms |

In summary, the VA loan process involves several critical pieces of paperwork, each serving a unique purpose in verifying eligibility, assessing creditworthiness, and finalizing the loan. By understanding these documents and their roles, veterans and their families can better navigate the VA loan process, ensuring a smoother and more successful experience. The key to a successful VA loan application is preparation, awareness of the required documents, and maintaining open communication with your lender throughout the process.