5 NJ Medical Deductions

Understanding Medical Deductions in New Jersey

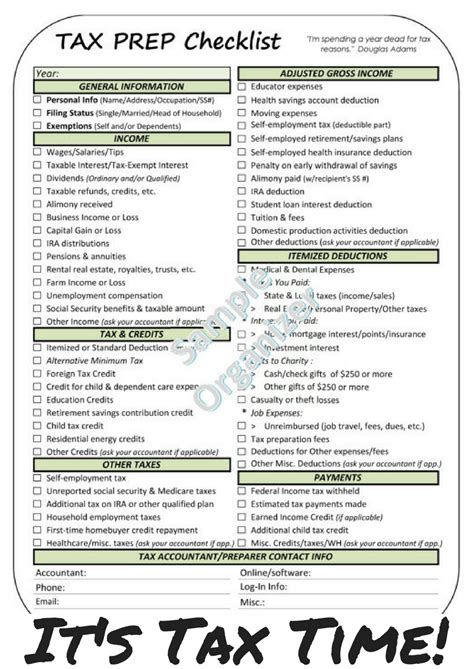

When it comes to taxes, medical expenses can be a significant factor in reducing your taxable income. In New Jersey, there are specific rules and regulations regarding medical deductions that can help you save on your taxes. In this article, we will delve into the world of medical deductions in New Jersey, exploring what qualifies as a medical expense, how to claim these deductions, and the benefits they can bring to your tax bill.

Qualifying Medical Expenses

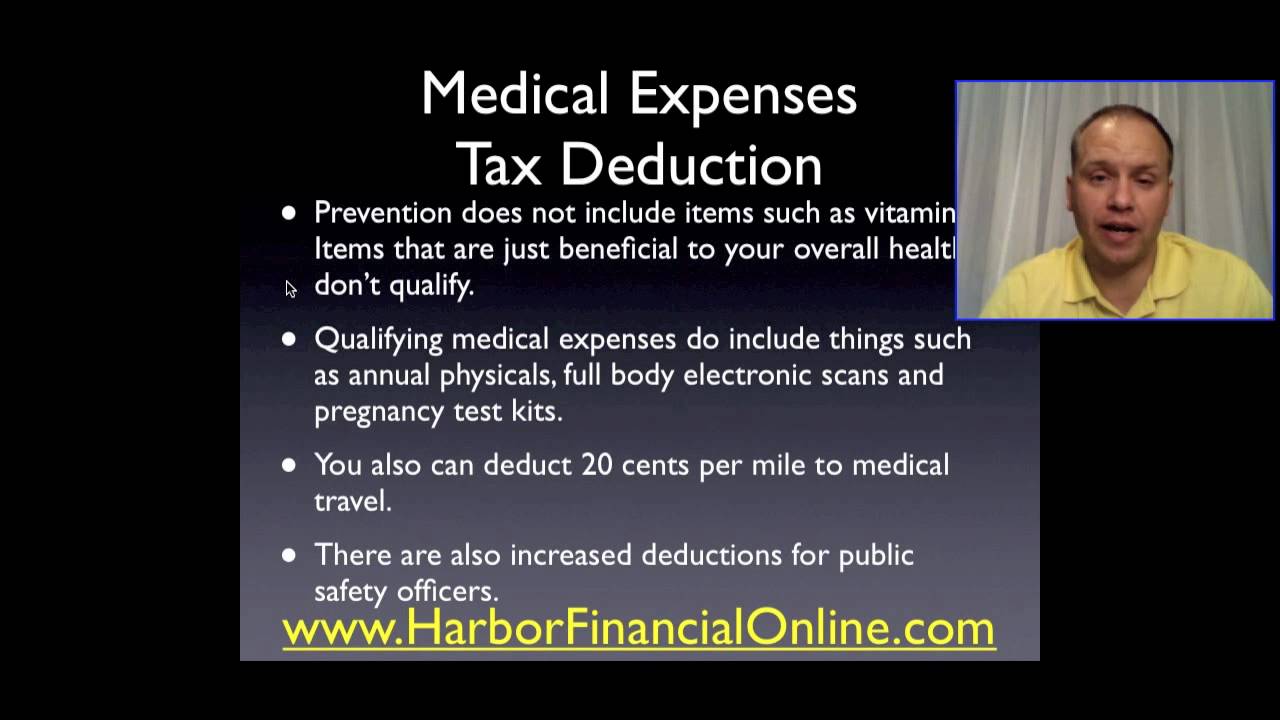

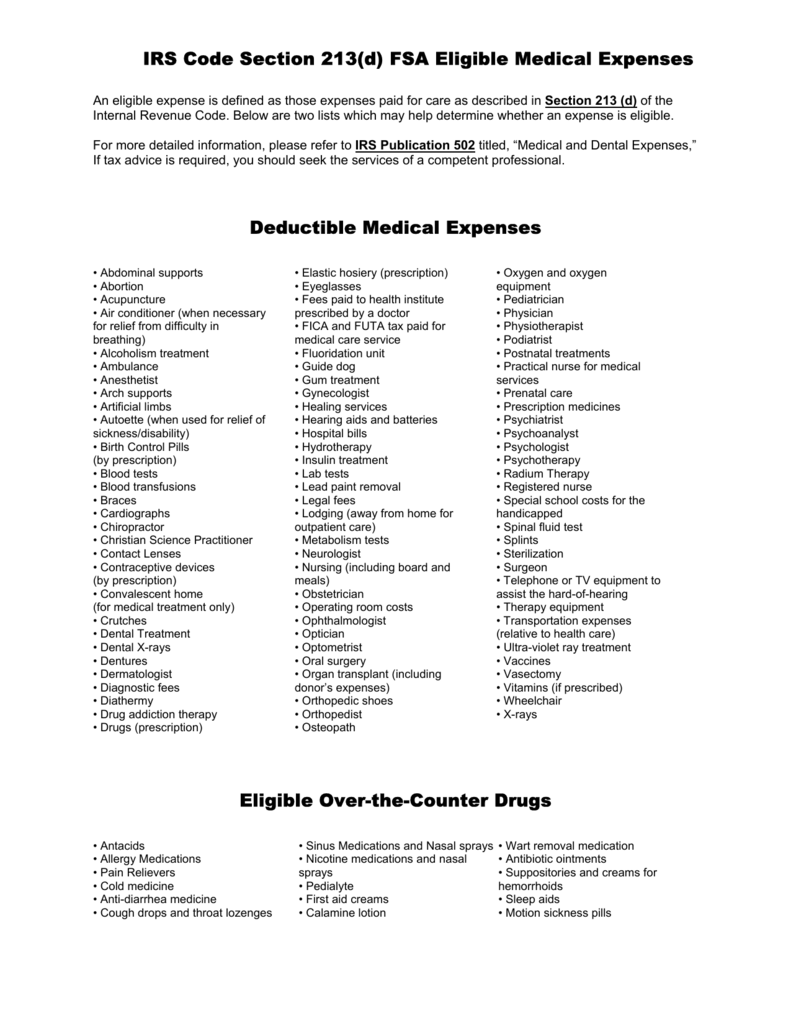

To qualify for medical deductions in New Jersey, your expenses must meet certain criteria. Generally, medical care expenses include the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and the costs for treatments affecting any part or function of the body. These can include: - Doctor visits and hospital stays - Prescription medications - Dental care and orthodontic work - Vision care, including glasses and contacts - Travel expenses to and from medical appointments - Home improvements for medical purposes, such as installing a wheelchair ramp

It’s essential to keep detailed records of your medical expenses throughout the year, as these will be necessary when filing your taxes.

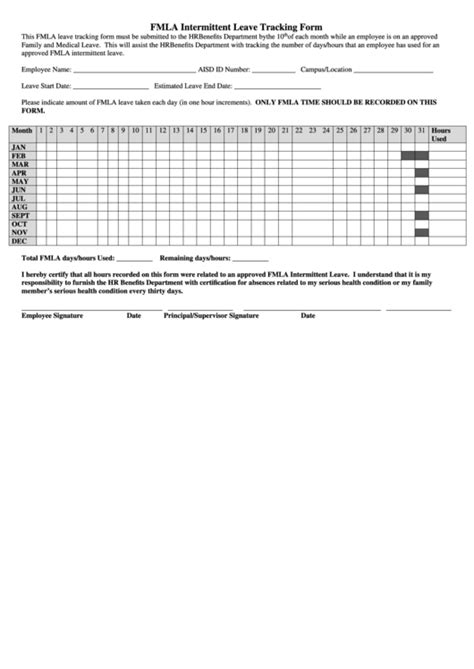

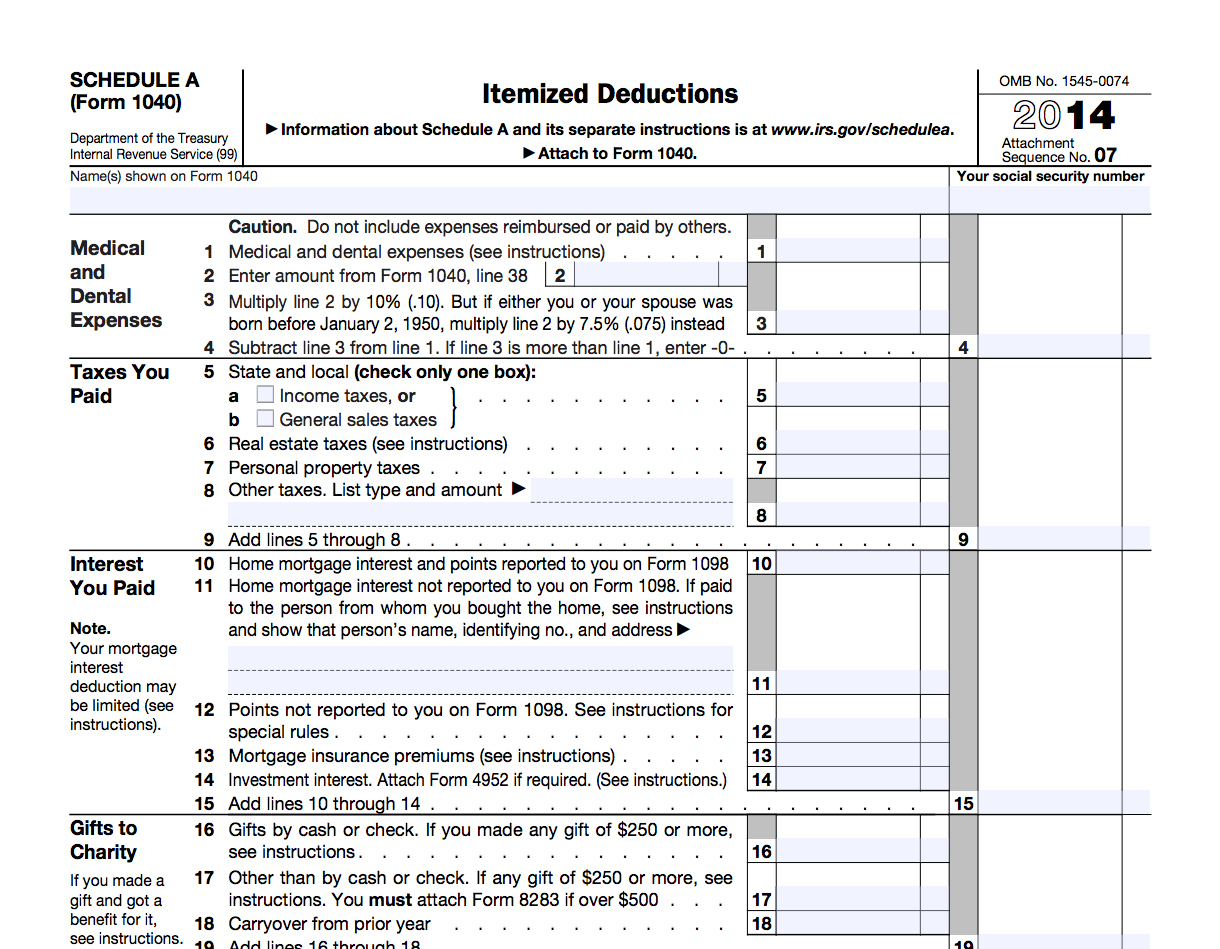

Claiming Medical Deductions

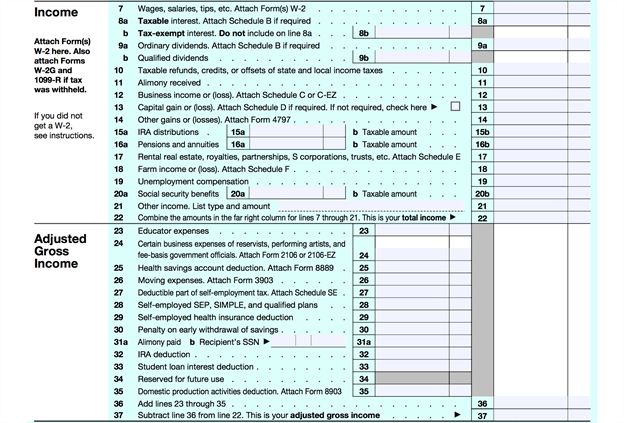

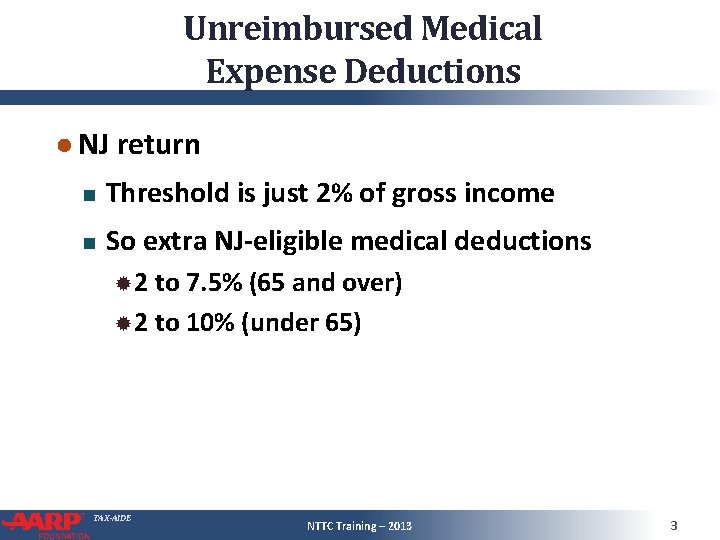

In New Jersey, you claim medical deductions on your state tax return. To do so, you’ll need to itemize your deductions using the appropriate form. The process involves: - Calculating your total medical expenses for the year. - Applying the deduction threshold, which may limit the amount of medical expenses you can deduct. - Subtracting the threshold from your total medical expenses to find the deductible amount. - Reporting this deductible amount on your tax return.

Benefits of Medical Deductions

The primary benefit of claiming medical deductions is the potential to significantly reduce your taxable income. By doing so, you can lower your tax liability, which may result in a larger refund or a reduction in the amount of taxes you owe. This can be especially beneficial for individuals or families with high medical expenses, such as those dealing with chronic illnesses or undergoing extensive medical treatments.

Important Considerations

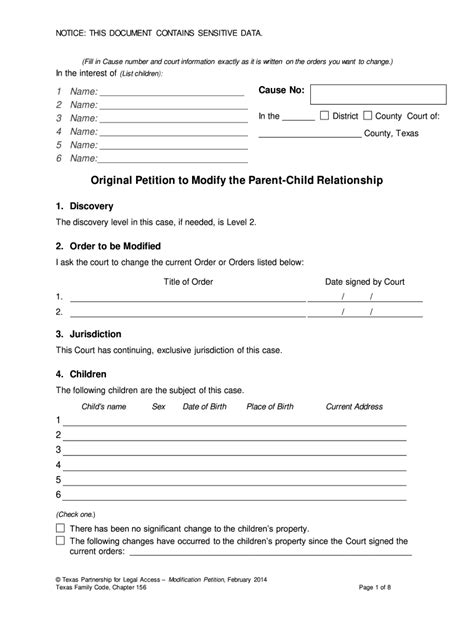

When dealing with medical deductions, there are several important considerations to keep in mind: - Record keeping is crucial. Make sure to save receipts, invoices, and any other documentation related to your medical expenses. - Understand the difference between federal and state deductions. While some expenses may qualify for federal deductions, they might not be eligible under New Jersey state law, and vice versa. - Be aware of any changes in tax laws that could affect medical deductions. Tax regulations can change, so it’s vital to stay informed about any updates or revisions.

📝 Note: Always consult with a tax professional or financial advisor to ensure you're taking advantage of all the medical deductions available to you under New Jersey law.

Conclusion and Next Steps

In summary, medical deductions in New Jersey can provide significant tax savings for individuals and families with substantial medical expenses. By understanding what qualifies as a medical expense, how to claim these deductions, and being mindful of the benefits and considerations involved, you can better navigate the tax landscape and potentially lower your tax bill. Whether you’re dealing with ongoing medical care or one-time expenses, taking advantage of these deductions can make a considerable difference in your financial situation. Remember, tax planning is an ongoing process, and staying informed about medical deductions and other tax-saving strategies can help you make the most of your tax situation.

What qualifies as a medical expense in New Jersey?

+

Medical expenses in New Jersey include costs associated with the diagnosis, cure, mitigation, treatment, or prevention of disease, and treatments affecting any part or function of the body, such as doctor visits, prescription medications, dental care, and vision care.

How do I claim medical deductions on my New Jersey tax return?

+

To claim medical deductions, you need to itemize your deductions on the appropriate form, calculate your total medical expenses, apply the deduction threshold, and report the deductible amount on your tax return.

What are the benefits of claiming medical deductions in New Jersey?

+

The primary benefit is the potential to significantly reduce your taxable income, which can lower your tax liability and result in a larger refund or a reduction in the amount of taxes you owe.