Paperwork

File Lien on Property Paperwork Requirements

Introduction to File Lien on Property

When it comes to securing debts or payments related to a property, one of the legal tools that can be used is a lien. A lien on a property is essentially a claim or a right that one party has over another party’s property, usually due to an unpaid debt or obligation. This can be particularly useful for contractors, suppliers, or other parties who have provided services or materials for the improvement of a property but have not been paid. In this context, understanding how to file a lien on a property is crucial for protecting one’s interests and ensuring payment.

Understanding Liens

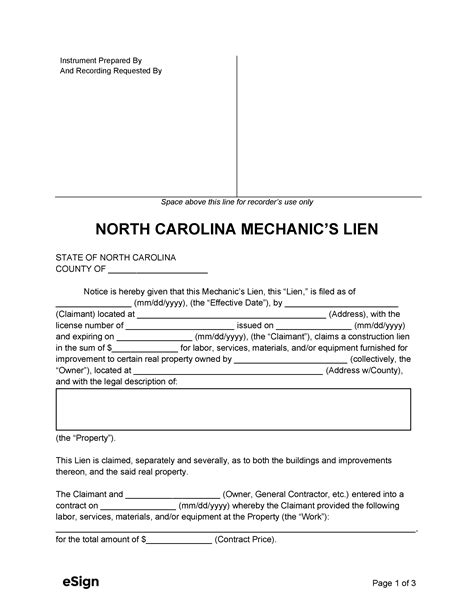

Before diving into the process of filing a lien, it’s essential to understand what a lien is and how it works. A lien provides a security interest in the property, meaning that if the debt is not paid, the party with the lien can potentially force the sale of the property to satisfy the debt. There are different types of liens, including mechanic’s liens, which are used by contractors and suppliers for construction projects, and tax liens, which are used by governments for unpaid taxes.

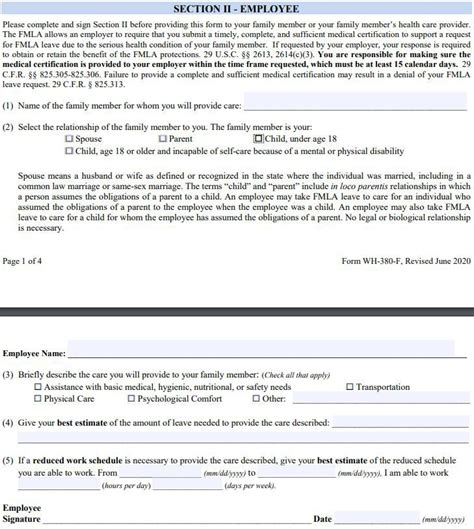

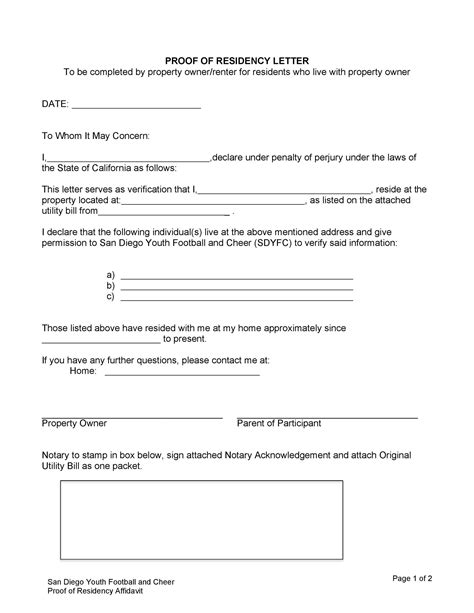

Requirements for Filing a Lien

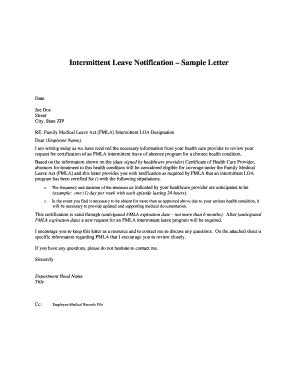

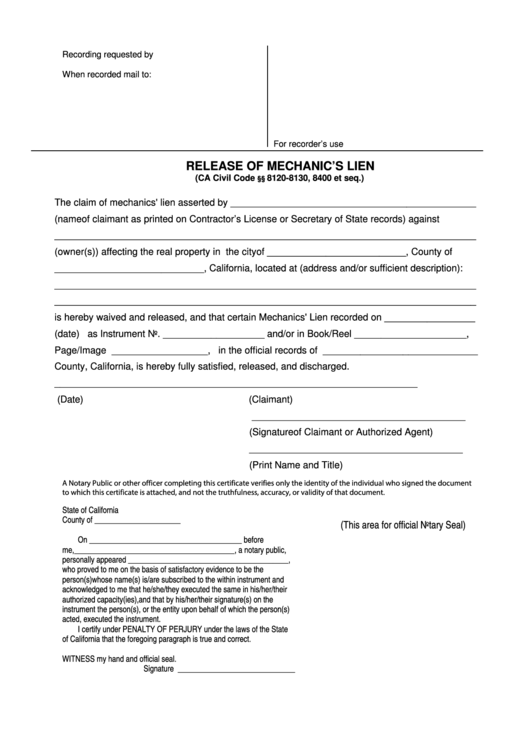

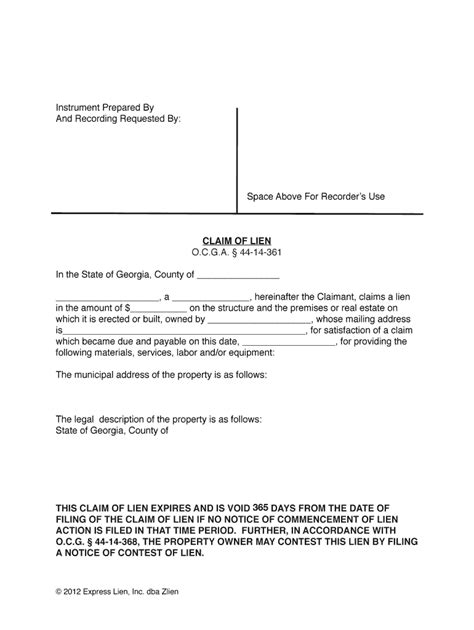

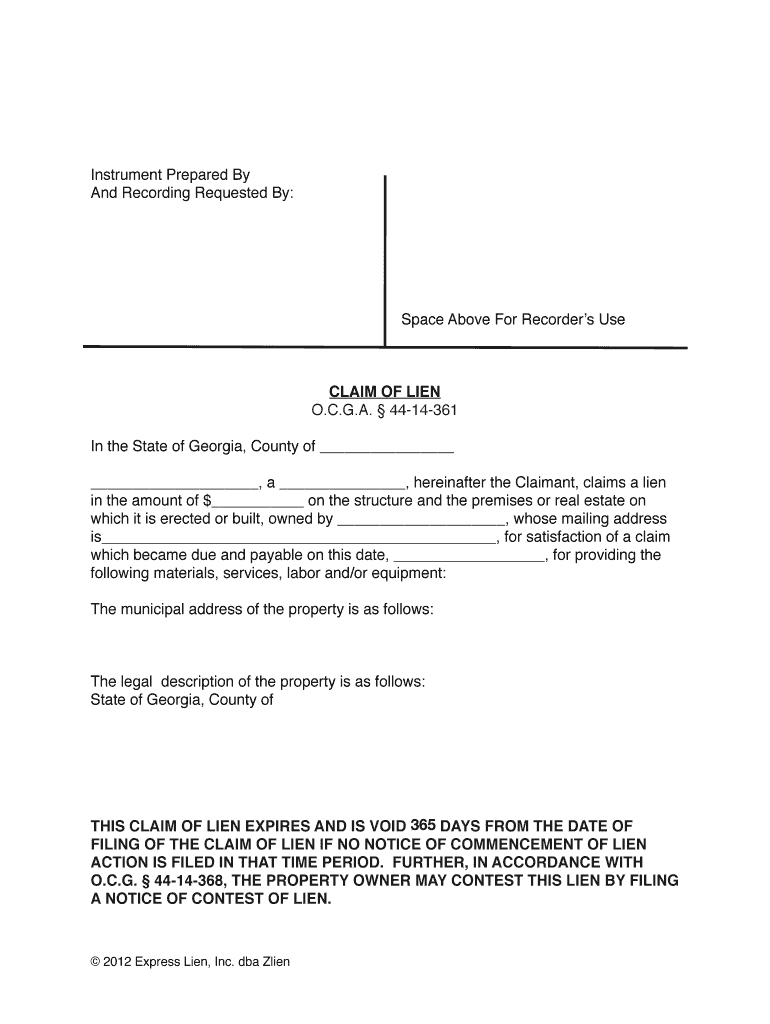

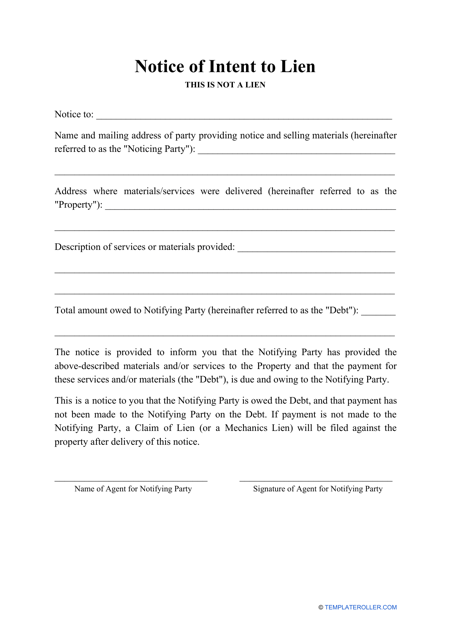

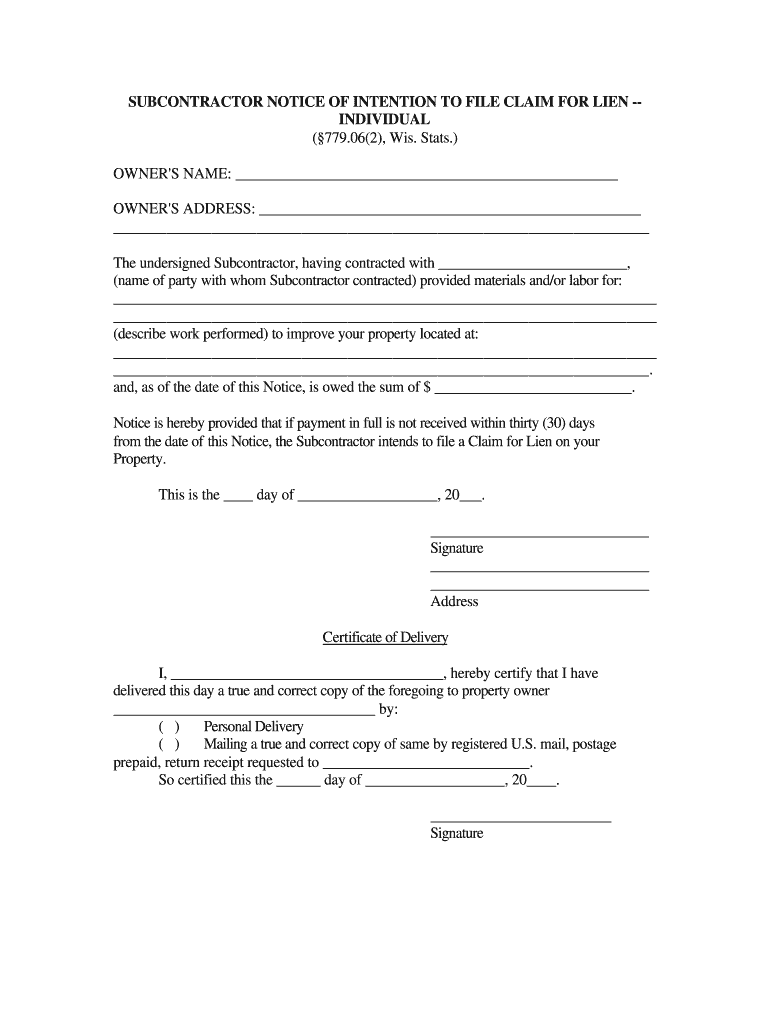

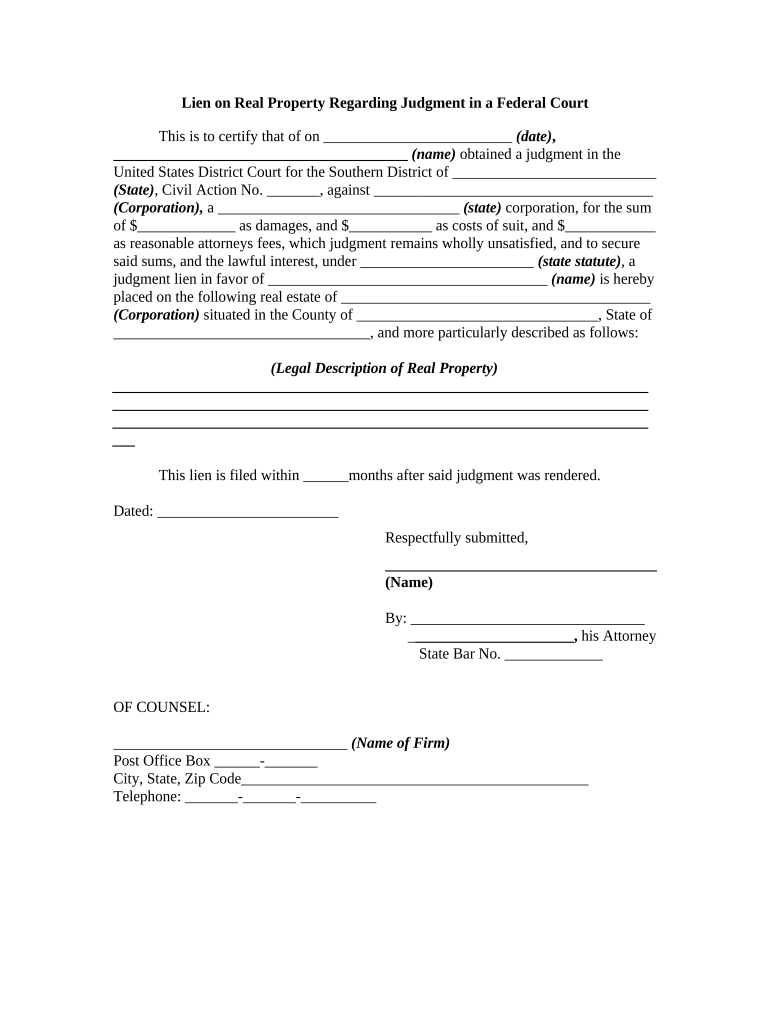

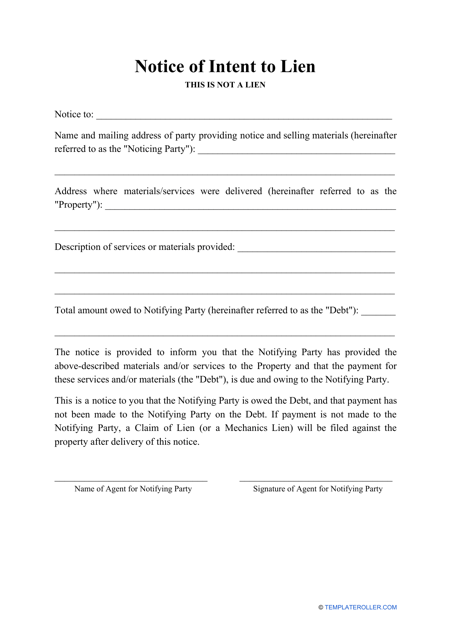

The requirements for filing a lien can vary significantly depending on the jurisdiction. However, there are some general steps and requirements that are commonly found across different regions: - Notice of Intent: In many cases, the party intending to file a lien must first provide a notice of intent to the property owner. This notice serves as a warning that a lien will be filed if the debt is not paid. - Lien Documents: The actual lien document must be prepared and filed with the appropriate government office, usually the county recorder’s office. This document must include specific information, such as the amount of the debt, a description of the property, and the names of the parties involved. - Timing: There are strict deadlines for filing a lien, which can range from a few months to a year after the last work was done or materials were supplied, depending on the jurisdiction. - Fees: Filing a lien typically requires paying a fee, which can vary based on the location and the type of lien being filed.

Process of Filing a Lien

The process of filing a lien involves several steps: 1. Prepare the Lien Document: This involves drafting the lien document according to the specific legal requirements of the jurisdiction. It’s crucial to include all necessary details to ensure the lien is valid. 2. File the Lien: The lien document must be filed with the appropriate office. This is usually done by taking the document to the county recorder’s office and paying the required fee. 3. Serve Notice: After filing the lien, the party who filed it must serve notice to the property owner and possibly other interested parties, such as lenders. 4. Enforce the Lien: If the debt is still not paid, the party with the lien may need to take further legal action to enforce the lien, which could involve foreclosing on the property.

Challenges and Considerations

Filing a lien can be a complex and time-sensitive process. Some of the challenges and considerations include: - Technical Requirements: Meeting all the technical requirements for filing a lien can be daunting. Small mistakes can invalidate the lien. - Time Limits: The deadlines for filing a lien are strict and vary by jurisdiction. Missing these deadlines can mean losing the right to file a lien. - Legal Consequences: Filing a lien can have serious legal consequences, including the potential for lawsuits. It’s essential to understand the legal implications before proceeding.

| Type of Lien | Description | Example |

|---|---|---|

| Mechanic's Lien | Used by contractors and suppliers for construction projects | A contractor files a mechanic's lien against a property for unpaid construction work |

| Tax Lien | Used by governments for unpaid taxes | A local government files a tax lien against a property for unpaid property taxes |

📝 Note: The process and requirements for filing a lien can vary significantly depending on the jurisdiction, so it's crucial to consult local laws and regulations or seek legal advice.

Conclusion and Next Steps

In conclusion, filing a lien on a property can be a powerful tool for securing debts related to property improvements or other obligations. However, the process is complex and requires careful attention to detail and timing. Understanding the types of liens, the requirements for filing, and the potential challenges is essential for anyone considering this legal option. Whether you’re a contractor, supplier, or property owner, being informed about liens can help protect your interests and ensure a smoother resolution to disputes over property-related debts.

What is a lien on a property?

+

A lien on a property is a claim or right that one party has over another party’s property, usually due to an unpaid debt or obligation.

How do I file a lien on a property?

+

Filing a lien involves preparing the lien document, filing it with the appropriate office, serving notice to the property owner, and potentially enforcing the lien through legal action if the debt is not paid.

What are the different types of liens?

+

There are several types of liens, including mechanic’s liens used by contractors and suppliers for construction projects, and tax liens used by governments for unpaid taxes.