Refinance Car Paperwork Requirements

Understanding Refinance Car Paperwork Requirements

When considering refinancing your car loan, it’s essential to understand the paperwork requirements involved in the process. Refinancing a car loan can be a great way to lower your monthly payments, reduce your interest rate, or change the loan term. However, it requires gathering various documents and information to complete the application process. In this article, we will guide you through the necessary paperwork requirements for refinancing a car loan.

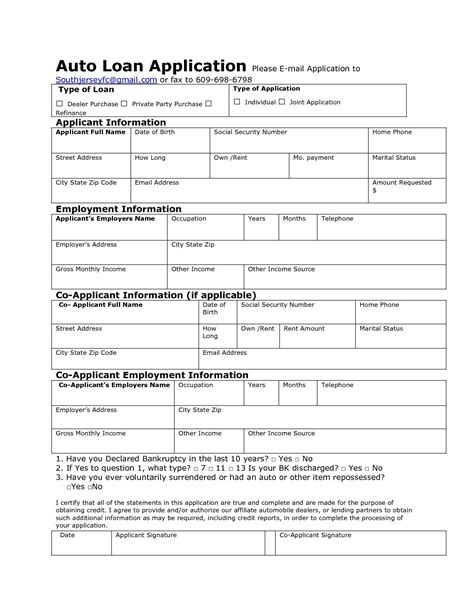

Required Documents for Refinance Car Loan

To refinance your car loan, you will need to provide the following documents: * Vehicle Information: You will need to provide the vehicle’s make, model, year, vehicle identification number (VIN), and mileage. * Current Loan Information: You will need to provide your current loan account number, lender’s name, and current loan balance. * Personal Identification: You will need to provide a valid government-issued ID, such as a driver’s license or passport. * Income Verification: You will need to provide proof of income, such as pay stubs, W-2 forms, or tax returns. * Employment Verification: You will need to provide proof of employment, such as a letter from your employer or business cards. * Insurance Information: You will need to provide proof of insurance, such as an insurance card or policy documents.

Additional Requirements

Depending on your lender and financial situation, you may need to provide additional documents, such as: * Credit Report: Your lender may require a credit report to determine your creditworthiness. * Bank Statements: You may need to provide bank statements to verify your income and assets. * Title and Registration: You may need to provide the vehicle title and registration to verify ownership.

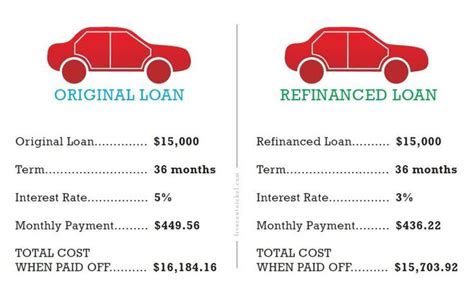

Benefits of Refinancing a Car Loan

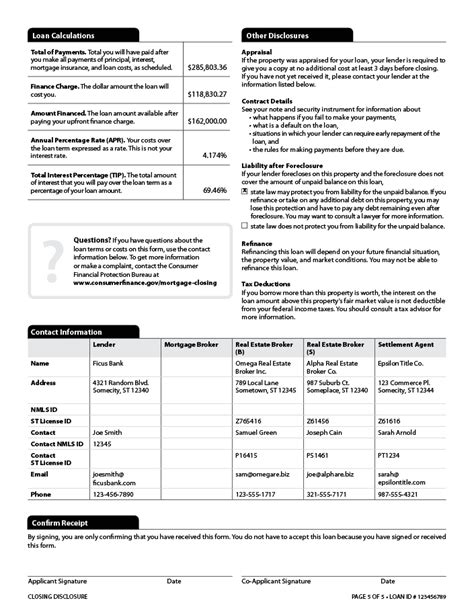

Refinancing a car loan can have several benefits, including: * Lower Monthly Payments: Refinancing can help you lower your monthly payments by extending the loan term or reducing the interest rate. * Reduced Interest Rate: Refinancing can help you reduce your interest rate, which can save you money over the life of the loan. * Changing Loan Term: Refinancing can help you change the loan term, which can help you pay off the loan faster or slower, depending on your needs.

How to Refinance a Car Loan

To refinance a car loan, follow these steps: * Check Your Credit Score: Your credit score will play a significant role in determining the interest rate you qualify for. * Gather Required Documents: Make sure you have all the necessary documents, including vehicle information, current loan information, personal identification, income verification, employment verification, and insurance information. * Shop Around for Lenders: Compare rates and terms from different lenders to find the best deal. * Apply for Refinancing: Submit your application and required documents to the lender. * Review and Sign the Contract: Carefully review the contract and sign it if you agree to the terms.

📝 Note: Make sure to read and understand the contract before signing it, as it will outline the terms of your new loan.

Common Mistakes to Avoid

When refinancing a car loan, avoid the following common mistakes: * Not Checking Your Credit Score: Failing to check your credit score can result in a higher interest rate or loan rejection. * Not Shopping Around: Not comparing rates and terms from different lenders can result in a bad deal. * Not Reading the Contract: Failing to read and understand the contract can result in unexpected fees or terms.

| Document | Description |

|---|---|

| Vehicle Information | Make, model, year, VIN, and mileage |

| Current Loan Information | Account number, lender's name, and current loan balance |

| Personal Identification | Valid government-issued ID, such as a driver's license or passport |

| Income Verification | Proof of income, such as pay stubs, W-2 forms, or tax returns |

| Employment Verification | Proof of employment, such as a letter from your employer or business cards |

| Insurance Information | Proof of insurance, such as an insurance card or policy documents |

In summary, refinancing a car loan requires gathering various documents and information, including vehicle information, current loan information, personal identification, income verification, employment verification, and insurance information. By understanding the paperwork requirements and avoiding common mistakes, you can successfully refinance your car loan and enjoy the benefits of lower monthly payments, reduced interest rates, or changed loan terms.

What is the main purpose of refinancing a car loan?

+

The main purpose of refinancing a car loan is to lower your monthly payments, reduce your interest rate, or change the loan term.

What documents do I need to refinance a car loan?

+

You will need to provide vehicle information, current loan information, personal identification, income verification, employment verification, and insurance information.

How long does the refinancing process take?

+

The refinancing process typically takes a few days to a few weeks, depending on the lender and the complexity of the application.