5 Steps for SAFT ICO

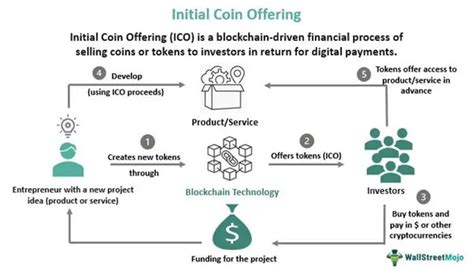

Introduction to SAFT ICO

The Simple Agreement for Future Tokens (SAFT) has emerged as a popular instrument for ICOs (Initial Coin Offerings) aiming to raise funds from accredited investors. This framework is designed to comply with the regulations set forth by the Securities and Exchange Commission (SEC), specifically tailored for projects that are still in their development phase and do not yet have a functional product. The SAFT is particularly appealing because it allows startups to secure funding while ensuring compliance with securities laws, thereby mitigating legal risks. Here, we will delve into the 5 steps for a SAFT ICO, providing a comprehensive overview of the process.

Understanding SAFT

Before diving into the steps, it’s crucial to understand what SAFT entails. SAFT is not a token itself but an investment contract that promises accredited investors future delivery of tokens once the project’s network is developed and functional. This distinction is key because it positions the initial investment as a security, which must comply with federal securities laws, and the eventual token as a utility, which may not be considered a security depending on its use and the network’s functionality.

Step 1: Determine Eligibility and Compliance

The first step in considering a SAFT ICO is to determine if your project is eligible for this funding model and to ensure compliance with all relevant regulations. This involves: - Accredited Investors: Identifying and targeting accredited investors who can participate in the SAFT. - Regulatory Compliance: Ensuring that the SAFT structure complies with SEC regulations, specifically Regulation D (Reg D) of the Securities Act of 1933, which provides exemptions from the registration requirements for certain offerings. - Legal Counsel: Engaging with legal counsel experienced in securities law and cryptocurrency to guide through the process.

Step 2: Drafting the SAFT Agreement

Drafting the SAFT agreement is a critical step that requires careful consideration of various factors, including: - Terms and Conditions: Clearly outlining the terms and conditions of the investment, including the amount of funding sought, the valuation of the project, and the anticipated timeline for the development and launch of the token. - Token Delivery: Specifying the conditions under which the tokens will be delivered to investors, including any milestones that must be achieved. - Investor Rights: Defining the rights of investors, such as any equity or governance rights they may have in the project.

Step 3: Marketing and Investor Outreach

Effective marketing and investor outreach are essential for the success of a SAFT ICO. This involves: - Building a Strong Project Narrative: Developing a compelling narrative about the project’s vision, mission, and potential impact. - Creating a Professional Website: Establishing a professional website that provides detailed information about the project, including its technology, use cases, team, and roadmap. - Networking and Events: Participating in industry events and conferences to network with potential investors and promote the project.

Step 4: Executing the SAFT ICO

The execution phase involves the actual process of selling the SAFTs to accredited investors. Key considerations include: - KYC/AML Compliance: Ensuring that all investors undergo Know Your Customer (KYC) and Anti-Money Laundering (AML) checks to comply with regulatory requirements. - Secure Transaction Process: Implementing a secure process for executing SAFT agreements and transferring funds. - Communication: Maintaining transparent and regular communication with investors regarding the project’s progress and any updates.

Step 5: Post-ICO and Token Distribution

After the SAFT ICO, the focus shifts to developing the project and distributing the tokens as outlined in the SAFT agreement. Important aspects include: - Development Milestones: Achieving the development milestones and launching the network as promised. - Token Generation and Distribution: Generating the tokens and distributing them to investors according to the terms of the SAFT. - Ongoing Compliance: Ensuring ongoing compliance with regulatory requirements, especially as the project evolves and the regulatory landscape changes.

💡 Note: The regulatory environment for cryptocurrencies and ICOs is continuously evolving. Projects must stay informed and adapt to changes in laws and regulations.

In summary, a SAFT ICO offers a compliant and structured approach for startups to raise funds from accredited investors. By understanding the SAFT framework, determining eligibility, drafting a comprehensive agreement, effectively marketing the project, executing the ICO, and ensuring post-ICO compliance and token distribution, projects can navigate the complex landscape of cryptocurrency fundraising with greater confidence.

What is the primary purpose of a SAFT in an ICO?

+

The primary purpose of a SAFT (Simple Agreement for Future Tokens) in an ICO is to allow projects to raise funds from accredited investors by promising future delivery of tokens once the project’s network is developed and functional, thereby complying with securities laws.

Who can participate in a SAFT ICO?

+

SAFT ICOs are typically limited to accredited investors, as defined by the Securities and Exchange Commission (SEC), to comply with securities regulations and exemptions under Regulation D.

What are the key benefits of using a SAFT for ICO fundraising?

+

The key benefits include compliance with securities laws, access to funding from accredited investors, and the ability to secure investments before the project has a functional product or network, reducing the legal and regulatory risks associated with ICOs.