5 Roth IRA Forms

Introduction to Roth IRA Forms

When it comes to managing your retirement savings, Roth Individual Retirement Accounts (IRAs) are a popular choice due to their tax benefits and flexibility. To navigate the process of setting up, contributing to, and managing a Roth IRA, you’ll need to be familiar with various forms and documents. These forms are crucial for ensuring that your account is properly established and maintained, and that you’re making the most of the tax advantages offered by Roth IRAs. In this guide, we’ll explore five key Roth IRA forms that you might encounter, along with their purposes and how to use them effectively.

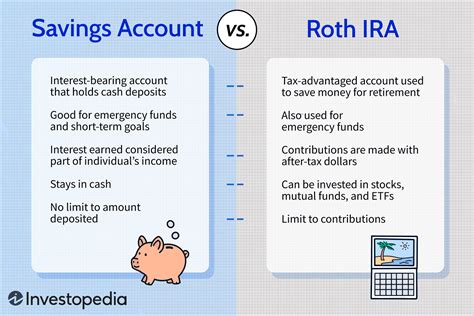

Understanding Roth IRA Contributions

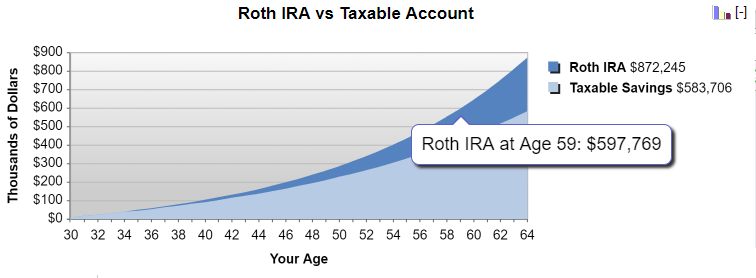

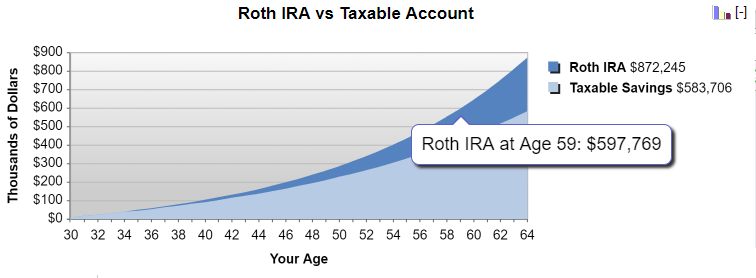

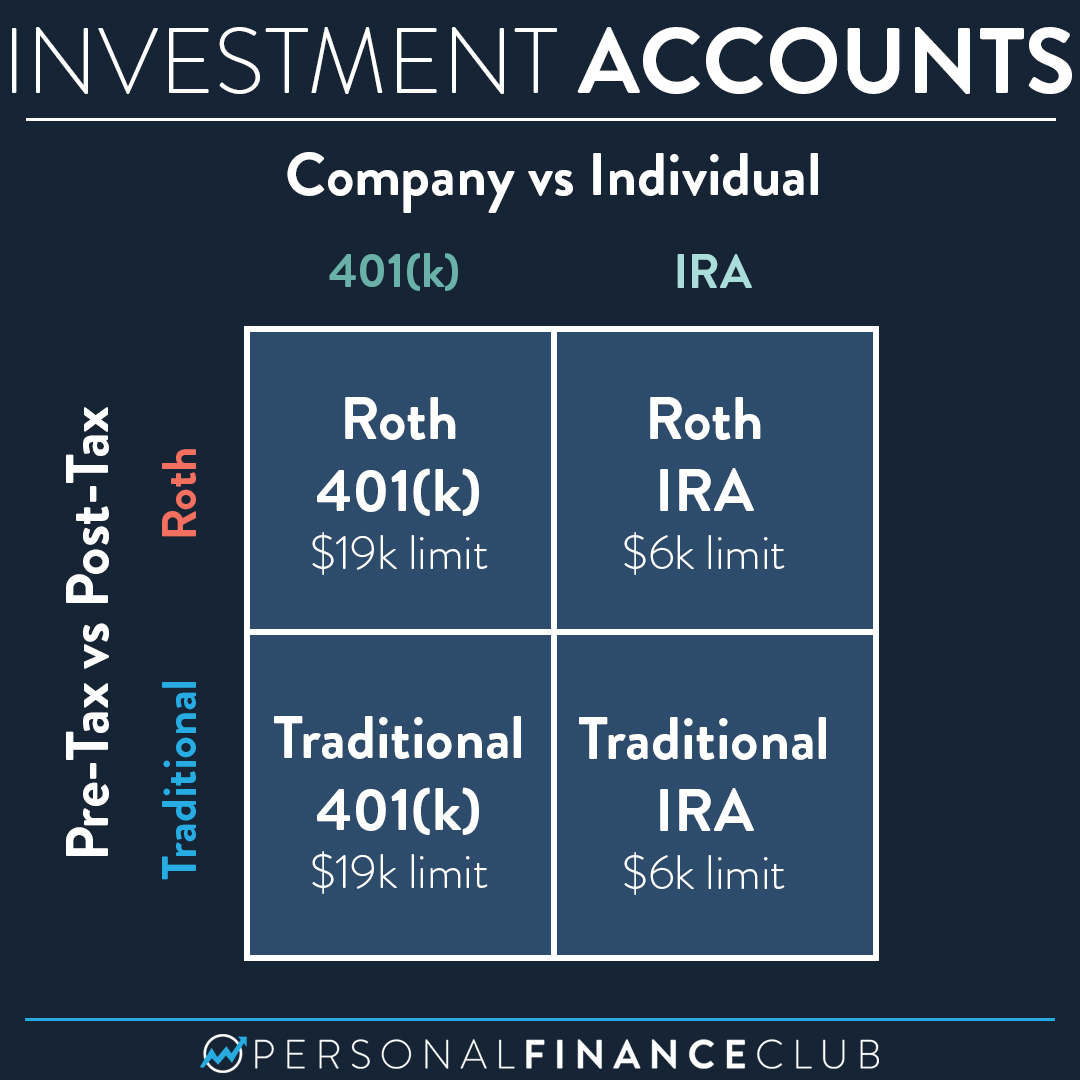

Before diving into the specific forms, it’s essential to understand the basics of contributing to a Roth IRA. Contributions to a Roth IRA are made with after-tax dollars, meaning you’ve already paid income tax on the money. In return, the money grows tax-free, and you won’t have to pay taxes on withdrawals if you meet certain conditions, such as waiting until you’re 59 1⁄2 or older and having had a Roth IRA for at least five years. The amount you can contribute annually is subject to income limits and may change from year to year, so it’s crucial to stay informed about current contribution limits and eligibility rules.

1. Form 8606: Nondeductible IRAs

Form 8606 is used to report nondeductible contributions to a traditional IRA, but it’s also relevant for Roth IRA conversions, as it helps track the basis in your IRAs. When you convert a traditional IRA to a Roth IRA, you’re essentially moving pre-tax money into an after-tax account, which means you’ll owe taxes on the converted amount. Form 8606 is crucial for keeping track of these conversions and ensuring you’re not taxed twice on the same money in the future.

- Purpose: Reporting nondeductible contributions to traditional IRAs and tracking the basis for Roth IRA conversions.

- Importance: Essential for accurate tax reporting and avoiding double taxation on converted funds.

2. Form 5498: IRA Contribution Information

Each year, your IRA custodian will send you Form 5498, which reports contributions, including those made to a Roth IRA, for the previous tax year. This form is informational, meaning you don’t need to file it with your tax return, but it’s useful for verifying that your contributions were reported correctly and for keeping a record of your annual contributions.

- Purpose: Reporting IRA contributions, including Roth IRA contributions, to the IRS and to you.

- Importance: Helps ensure accuracy in contribution reporting and serves as a personal record of contributions.

3. Form 5329: Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

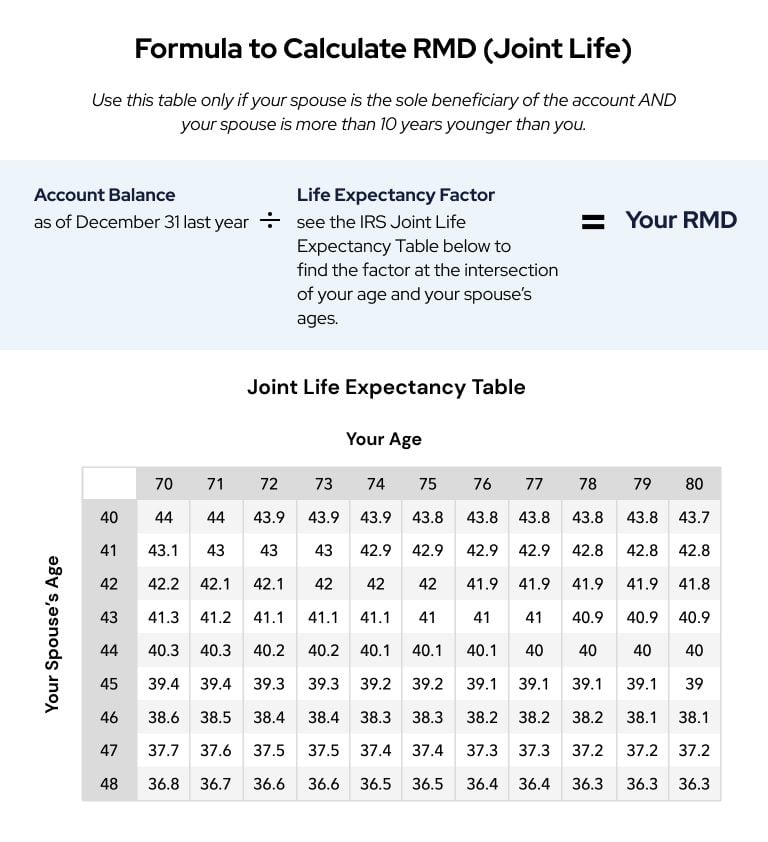

If you fail to follow the rules regarding Roth IRA contributions or distributions, you might end up owing additional taxes or penalties. Form 5329 is used to report and pay these penalties, which can include excess contributions, early distribution penalties, or failed required minimum distributions (RMDs) from traditional IRAs. While Roth IRAs do not have RMDs during your lifetime, understanding this form can help you avoid costly mistakes.

- Purpose: Reporting and paying additional taxes and penalties related to IRAs and other tax-favored accounts.

- Importance: Essential for compliance and avoiding further penalties related to IRA management.

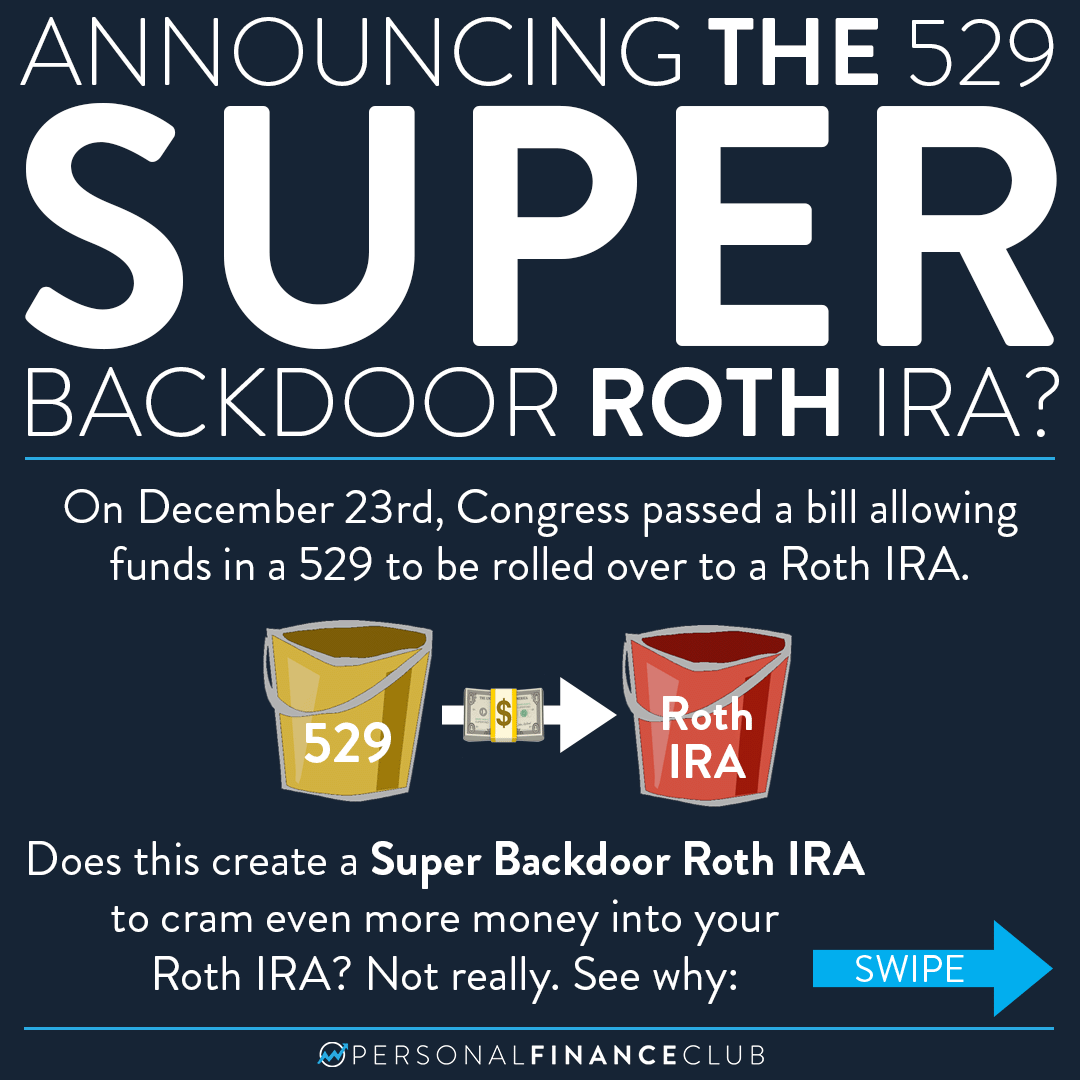

4. IRS Form 8606 and the Backdoor Roth IRA

For individuals whose income exceeds the limits for direct Roth IRA contributions, a “backdoor” Roth IRA strategy can be an attractive workaround. This involves contributing to a traditional IRA (which has no income limits for contributions) and then converting those funds to a Roth IRA. Form 8606 plays a critical role in this strategy, as it helps track the basis in your traditional IRA, ensuring you report the conversion correctly and avoid unnecessary taxes.

- Purpose: Facilitating the backdoor Roth IRA strategy by tracking nondeductible contributions to traditional IRAs.

- Importance: Crucial for high-income individuals seeking to contribute to a Roth IRA through alternative means.

5. Recharacterization Forms

In the past, if you converted a traditional IRA to a Roth IRA and later decided that was not in your best interest, you could recharacterize the conversion, essentially reversing it and moving the funds back to a traditional IRA. While the Tax Cuts and Jobs Act eliminated the ability to recharacterize Roth IRA conversions after October 15th of the year following the conversion, understanding the concept and the forms involved (such as Form 8606 for tracking the basis) remains important for those who made conversions before this change.

| Form Number | Form Purpose |

|---|---|

| 8606 | Nondeductible IRAs and tracking basis for Roth conversions |

| 5498 | IRA Contribution Information |

| 5329 | Additional Taxes on Qualified Plans and Other Tax-Favored Accounts |

📝 Note: Always consult with a tax professional or financial advisor to ensure you're using the correct forms for your specific situation and to comply with all tax laws and regulations.

As you navigate the world of Roth IRAs, it’s clear that understanding and correctly using the appropriate forms is crucial for maximizing the benefits of these accounts while minimizing potential penalties. By being informed and proactive, you can make the most of your retirement savings strategy and look forward to a more secure financial future.

In wrapping up, managing your Roth IRA effectively involves more than just contributing money; it requires an understanding of the various forms and rules that govern these accounts. By familiarizing yourself with key forms like 8606, 5498, and 5329, and staying informed about strategies like the backdoor Roth IRA, you’ll be better equipped to make informed decisions about your retirement savings. Remember, planning and education are key to unlocking the full potential of your Roth IRA and securing your financial future.

What is the main purpose of Form 8606 in relation to Roth IRAs?

+

Form 8606 is primarily used to report nondeductible contributions to traditional IRAs, which is important for tracking the basis in your IRAs, especially in the context of Roth IRA conversions.

Can I still recharacterize a Roth IRA conversion?

+

No, as of the Tax Cuts and Jobs Act, the ability to recharacterize a Roth IRA conversion was eliminated, except in certain situations involving conversions done before the law change.

What is the purpose of Form 5498?

+

Form 5498 is an informational form sent by your IRA custodian to report contributions made to your IRA during the previous tax year. It’s used for your records and to verify that contributions were correctly reported to the IRS.