1099 Contractor Paperwork Requirements

Introduction to 1099 Contractor Paperwork Requirements

As a 1099 contractor, also known as an independent contractor, you are considered self-employed and are responsible for reporting your own income and expenses to the Internal Revenue Service (IRS). One of the key aspects of being a 1099 contractor is understanding the paperwork requirements that come with this status. In this article, we will delve into the details of the paperwork requirements for 1099 contractors, including the forms you need to fill out, the deadlines you need to meet, and the records you need to keep.

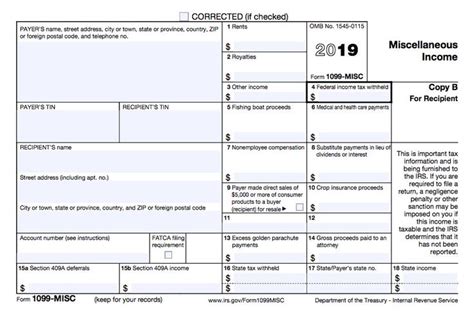

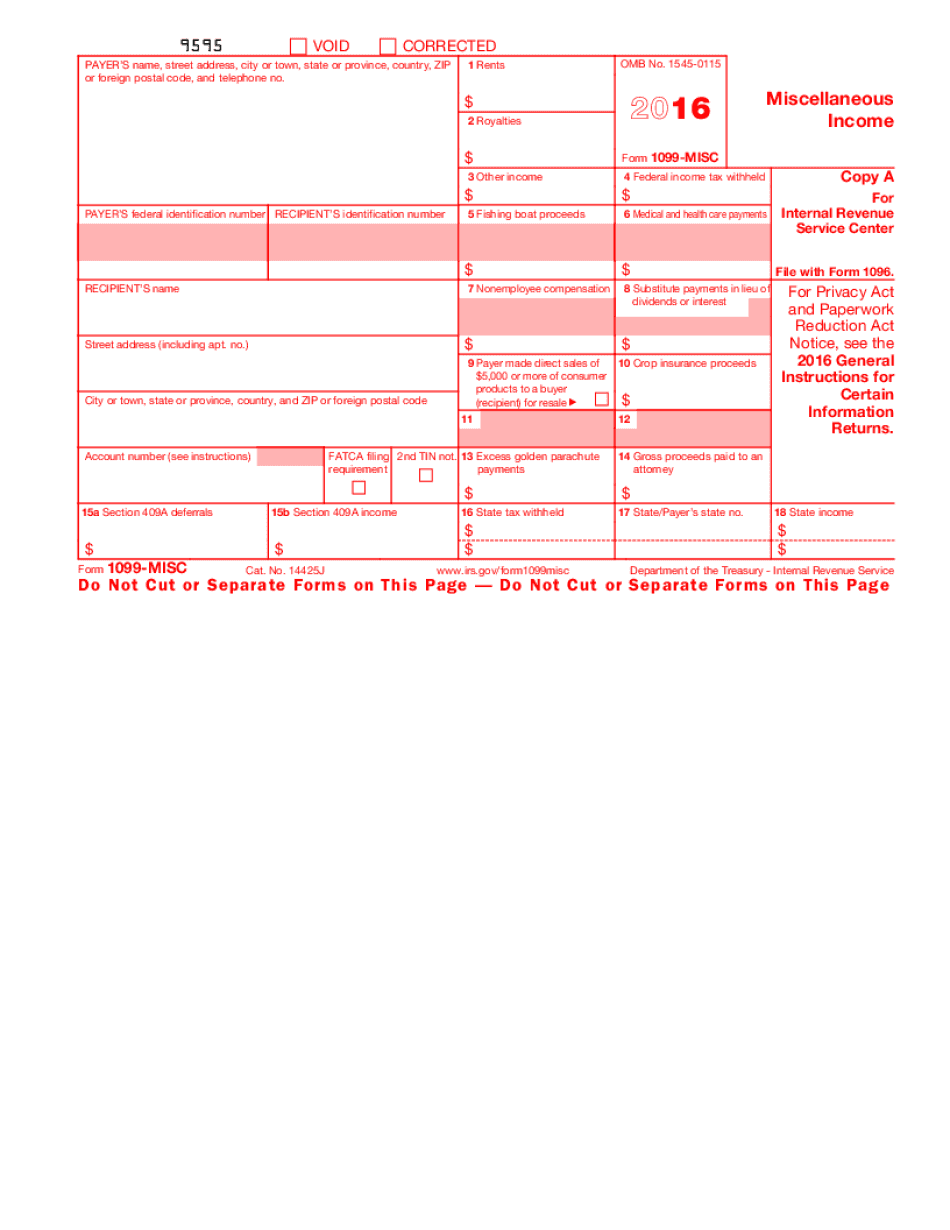

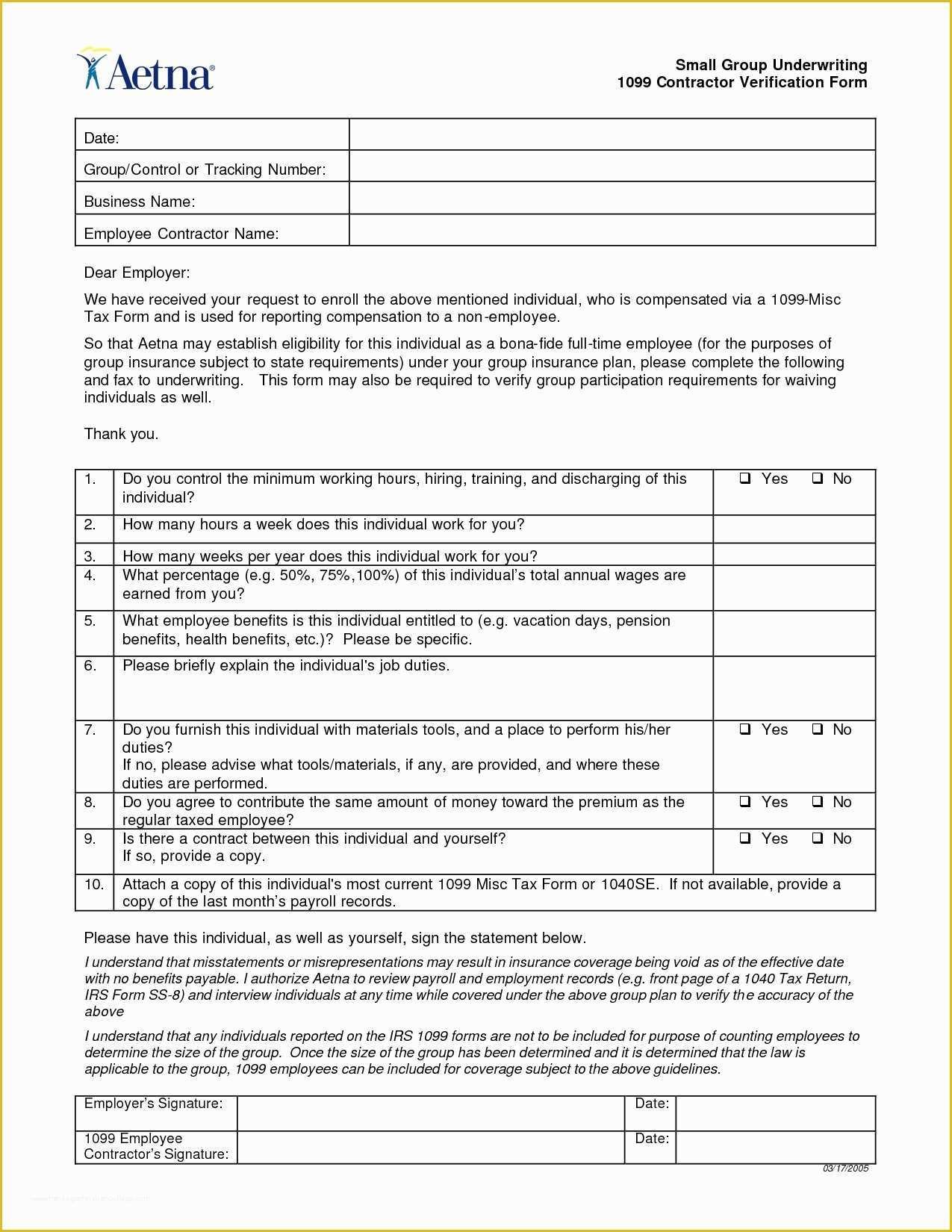

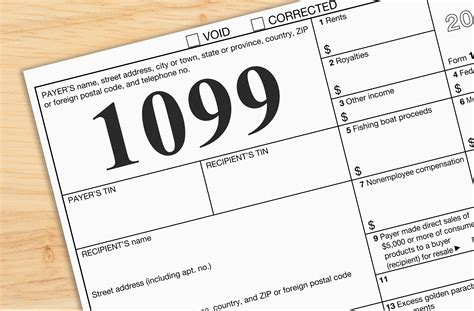

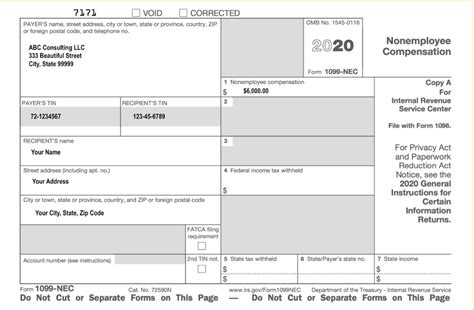

Understanding 1099 Forms

The 1099 form is a series of documents used to report various types of income, such as freelance work, rental income, and interest earned. As a 1099 contractor, you will receive a 1099-MISC form from each client who paid you more than $600 in a calendar year. This form will show the amount of money you earned from that client, and you will use this information to report your income on your tax return. There are several types of 1099 forms, including: * 1099-MISC: Reports miscellaneous income, such as freelance work and rental income * 1099-INT: Reports interest income * 1099-DIV: Reports dividend income * 1099-B: Reports capital gains and losses

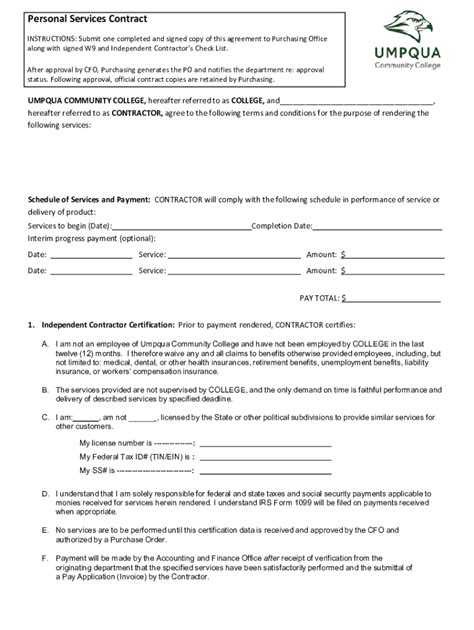

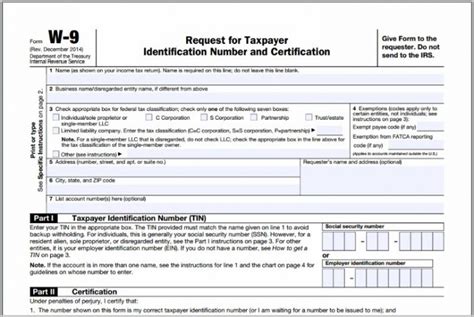

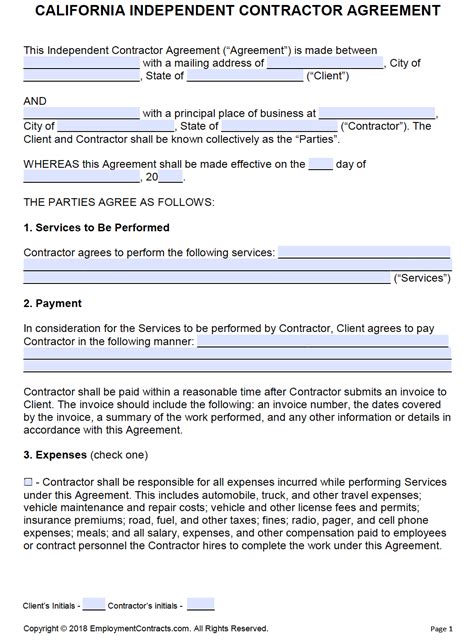

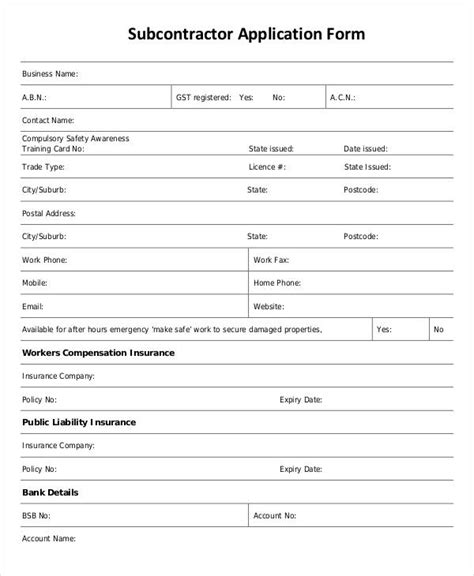

Completing the W-9 Form

Before you start working as a 1099 contractor, you will need to complete a W-9 form for each client. The W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is used to provide your taxpayer identification number (either your Social Security number or your Employer Identification Number) and to certify that you are not subject to backup withholding. You will need to provide your: * Name and address * Taxpayer identification number * Type of business entity (e.g. sole proprietorship, partnership, corporation) * Certification that you are not subject to backup withholding

Record Keeping Requirements

As a 1099 contractor, you are responsible for keeping accurate records of your income and expenses. This includes: * Invoices and receipts: Keep a record of all invoices you send to clients and receipts for expenses related to your business * Business expenses: Keep a record of all business expenses, including mileage logs, receipts for supplies, and invoices for services * Mileage logs: Keep a record of all business miles driven, including the date, location, and purpose of each trip * Bank statements: Keep a record of all bank statements, including deposits and withdrawals

💡 Note: It's a good idea to keep all of your records organized and easily accessible, in case you need to refer to them during tax season or in the event of an audit.

Filing Your Tax Return

As a 1099 contractor, you will need to file a tax return with the IRS, reporting all of your income and expenses. You will use the information from your 1099 forms and your record keeping to complete your tax return. You will need to: * Report all income: Report all income earned from your business, including freelance work, rental income, and interest earned * Claim business expenses: Claim all business expenses, including supplies, equipment, and mileage * Calculate self-employment tax: Calculate your self-employment tax, which is used to fund Social Security and Medicare

Deadlines and Penalties

It’s essential to meet all deadlines and avoid penalties when filing your tax return as a 1099 contractor. The deadlines are: * January 31: Deadline for receiving 1099 forms from clients * February 28: Deadline for filing Form 1096, which is the annual summary and transmittal of U.S. Information Returns * April 15: Deadline for filing your tax return and paying any taxes owed * October 15: Deadline for filing an amended tax return

🕒️ Note: Failure to meet these deadlines can result in penalties and fines, so it's crucial to stay organized and on top of your paperwork requirements.

Table of 1099 Forms and Deadlines

| Form | Deadline | Description |

|---|---|---|

| 1099-MISC | January 31 | Reports miscellaneous income, such as freelance work and rental income |

| 1096 | February 28 | Annual summary and transmittal of U.S. Information Returns |

| 1040 | April 15 | Individual tax return |

In summary, as a 1099 contractor, it’s essential to understand the paperwork requirements that come with this status. You will need to complete a W-9 form, receive 1099 forms from clients, keep accurate records, and file a tax return with the IRS. By staying organized and meeting all deadlines, you can avoid penalties and ensure a smooth tax season.

What is a 1099 form?

+

A 1099 form is a series of documents used to report various types of income, such as freelance work, rental income, and interest earned.

What is the deadline for receiving 1099 forms from clients?

+

The deadline for receiving 1099 forms from clients is January 31.

What is the penalty for failing to file a tax return?

+

The penalty for failing to file a tax return can result in fines and penalties, so it’s crucial to stay organized and on top of your paperwork requirements.