Get Car Insurance Paperwork

Introduction to Car Insurance Paperwork

When it comes to car insurance, there are numerous documents and paperwork that need to be filled out and understood. From the initial application to the final policy documents, it’s essential to be aware of what each document entails and how it affects your coverage. In this article, we will delve into the world of car insurance paperwork, exploring the different types of documents you’ll encounter and what you need to know about each one.

Types of Car Insurance Paperwork

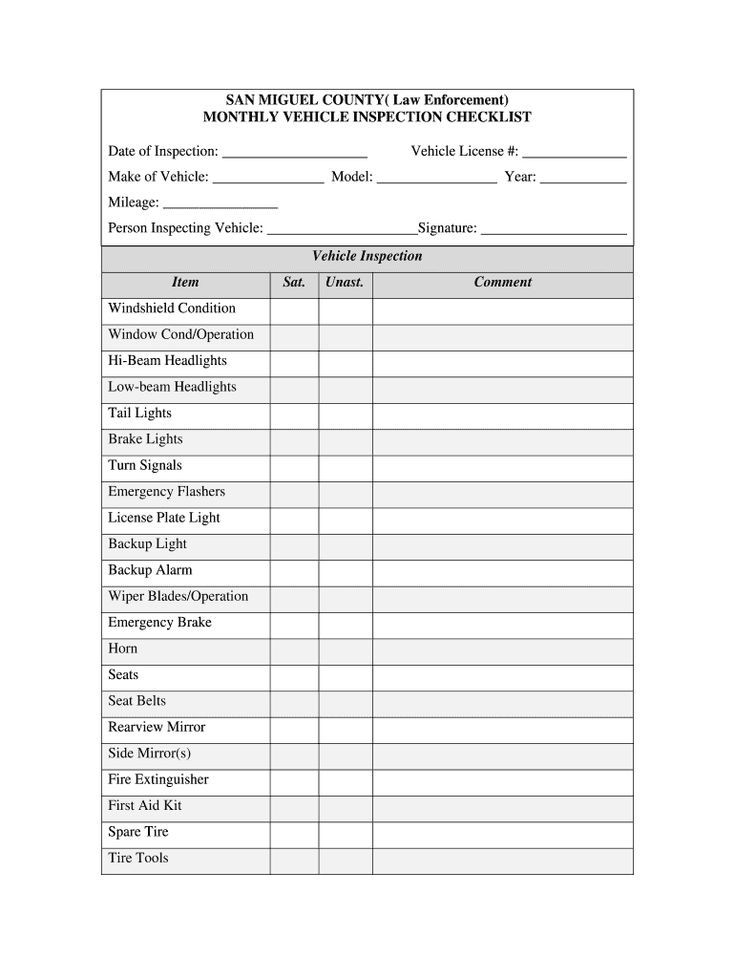

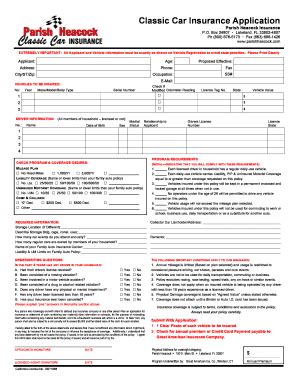

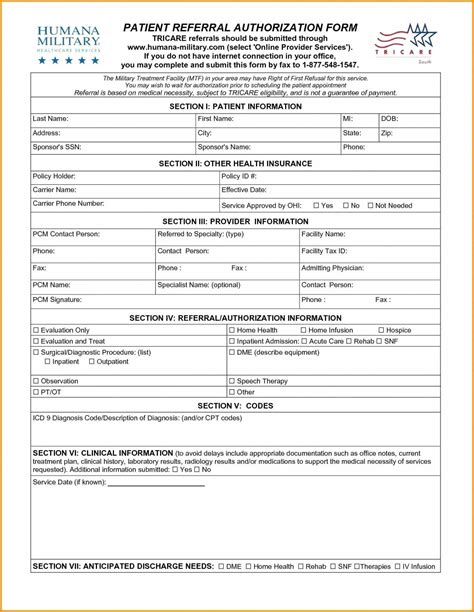

There are several types of car insurance paperwork that you’ll come across when purchasing or managing your policy. These include: * Application forms: These are the initial forms you fill out when applying for car insurance. They typically require personal and vehicle information, as well as details about your driving history. * Policy documents: These are the official documents that outline the terms and conditions of your car insurance policy. They include information about your coverage, deductibles, and premiums. * Claims forms: If you’re involved in an accident or need to make a claim, you’ll need to fill out a claims form. This form will require details about the incident, including the date, time, and location, as well as information about any damages or injuries. * Proof of insurance: This is a document that proves you have valid car insurance. You may need to show this document to law enforcement or other authorities if you’re pulled over or involved in an accident.

Understanding Your Policy Documents

Your policy documents are an essential part of your car insurance paperwork. These documents outline the terms and conditions of your policy, including: * Coverage limits: This refers to the maximum amount your insurance company will pay out in the event of a claim. * Deductibles: This is the amount you need to pay out of pocket before your insurance coverage kicks in. * Premiums: This is the amount you pay for your car insurance policy, usually on a monthly or annual basis. * Exclusions: These are situations or circumstances that are not covered by your insurance policy.

Managing Your Car Insurance Paperwork

To ensure you’re getting the most out of your car insurance policy, it’s essential to manage your paperwork effectively. Here are some tips: * Keep your policy documents in a safe place: Make sure you have a copy of your policy documents in a safe and easily accessible place, such as a filing cabinet or digital storage. * Review your policy regularly: It’s essential to review your policy regularly to ensure you understand the terms and conditions and to make any necessary changes. * Update your information: If your personal or vehicle information changes, make sure to update your insurance company to ensure your policy remains valid.

| Document Type | Description |

|---|---|

| Application Form | Initial form filled out when applying for car insurance |

| Policy Document | Official document outlining the terms and conditions of your car insurance policy |

| Claims Form | Form filled out when making a claim |

| Proof of Insurance | Document proving you have valid car insurance |

📝 Note: It's essential to keep your car insurance paperwork organized and easily accessible to ensure you can access the information you need when you need it.

In summary, car insurance paperwork is a crucial aspect of managing your policy. By understanding the different types of documents and how to manage them effectively, you can ensure you’re getting the most out of your car insurance policy. Remember to keep your policy documents in a safe place, review your policy regularly, and update your information as necessary.

What is the purpose of car insurance paperwork?

+

The purpose of car insurance paperwork is to provide a record of your policy, including the terms and conditions, coverage limits, and deductibles.

How do I manage my car insurance paperwork?

+

To manage your car insurance paperwork, keep your policy documents in a safe place, review your policy regularly, and update your information as necessary.

What happens if I lose my car insurance paperwork?

+

If you lose your car insurance paperwork, contact your insurance company to request a replacement copy. They may also be able to provide you with digital access to your policy documents.