Mortgage Paperwork Needed

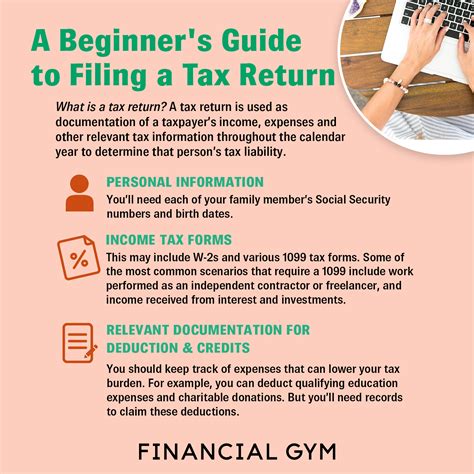

Introduction to Mortgage Paperwork

When applying for a mortgage, it’s essential to understand the various documents and paperwork required to complete the process. The mortgage application process can be complex and time-consuming, but being prepared with the necessary documents can help streamline the procedure. In this article, we will explore the different types of mortgage paperwork needed and provide guidance on how to navigate the application process.

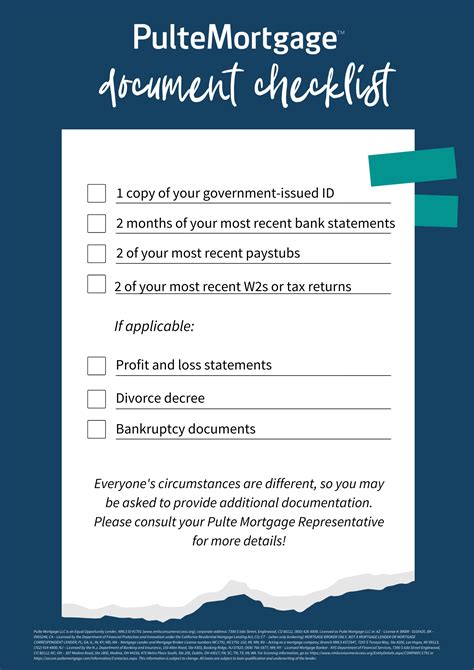

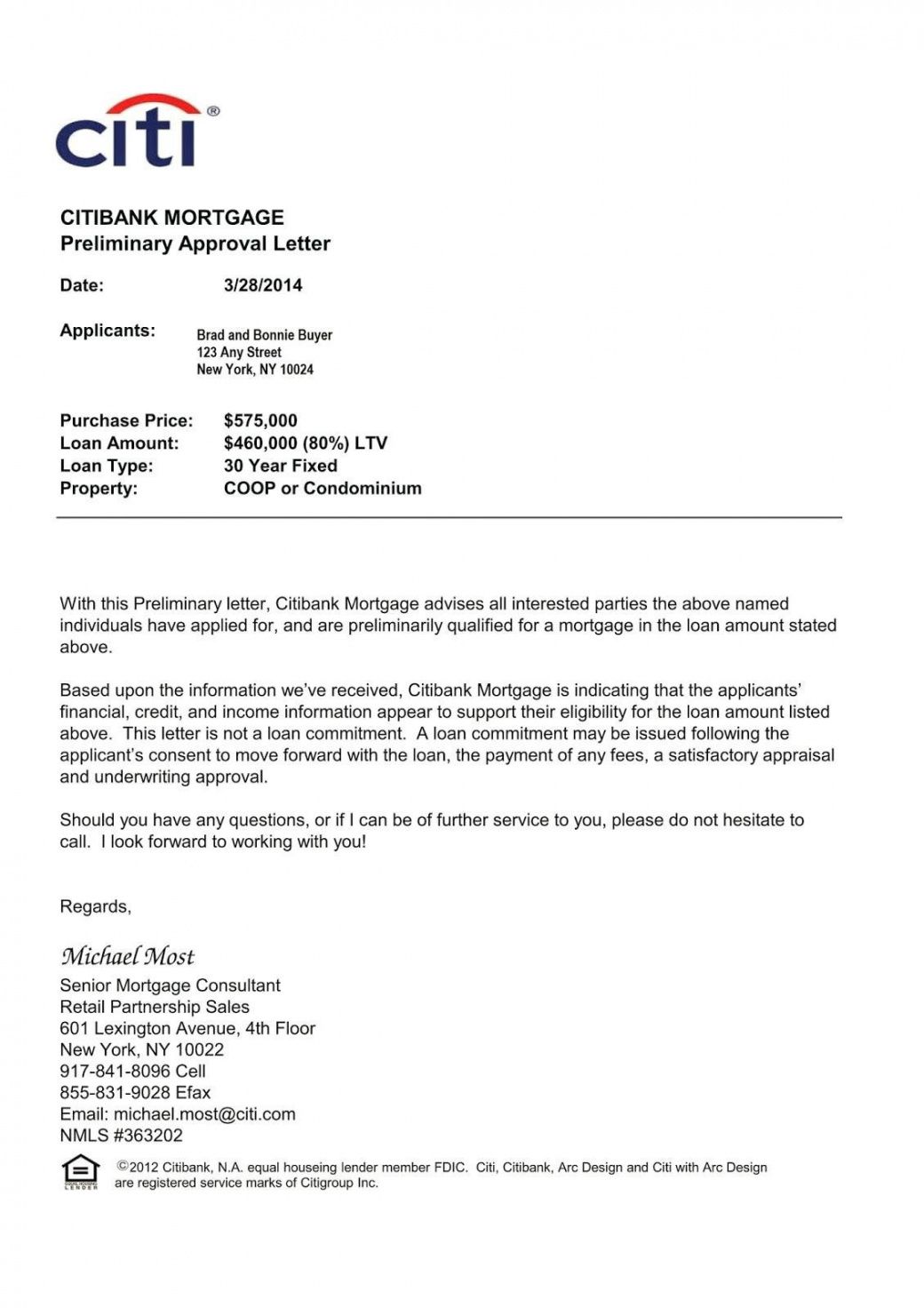

Pre-Approval Documents

Before starting the mortgage application process, it’s recommended to get pre-approved for a mortgage. This involves providing some basic financial information to a lender, who will then provide a pre-approval letter stating the amount they are willing to lend. To get pre-approved, you will typically need to provide the following documents: * Identification: A valid government-issued ID, such as a driver’s license or passport * Income verification: Pay stubs, W-2 forms, or tax returns to verify your income * Credit report: A credit report to check your credit score and history * Asset verification: Bank statements or investment accounts to verify your assets

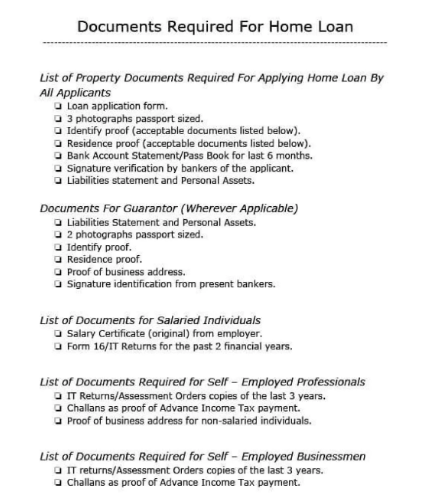

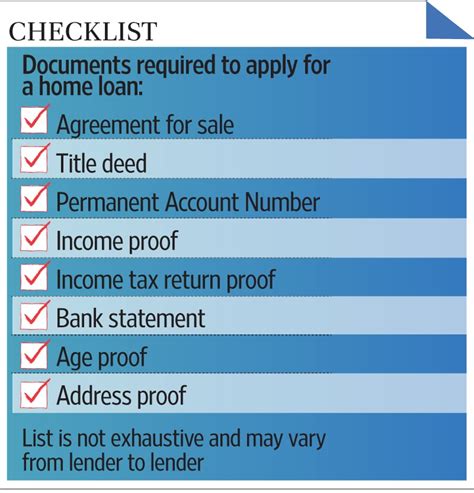

Mortgage Application Documents

Once you have been pre-approved, you can start the mortgage application process. This will require providing more detailed financial information and documentation. Some of the key documents needed for a mortgage application include: * Pay stubs: Recent pay stubs to verify your income * W-2 forms: W-2 forms from the past two years to verify your income * Tax returns: Tax returns from the past two years to verify your income and tax obligations * Bank statements: Bank statements to verify your assets and account activity * Identification: A valid government-issued ID, such as a driver’s license or passport * Credit report: A credit report to check your credit score and history * Appraisal report: An appraisal report to verify the value of the property

Additional Documents

Depending on your individual circumstances, you may need to provide additional documentation to support your mortgage application. Some examples include: * Divorce or separation documents: If you are divorced or separated, you may need to provide documentation related to your divorce or separation agreement * Child support or alimony documents: If you receive child support or alimony, you may need to provide documentation related to these payments * Bankruptcy or foreclosure documents: If you have filed for bankruptcy or experienced a foreclosure, you may need to provide documentation related to these events * Gift letter: If you are receiving a gift from a family member or friend to help with the down payment, you will need to provide a gift letter to verify the source of the funds

Table of Mortgage Paperwork Needed

The following table summarizes the key documents needed for a mortgage application:

| Document | Description |

|---|---|

| Identification | A valid government-issued ID, such as a driver’s license or passport |

| Income verification | Pay stubs, W-2 forms, or tax returns to verify your income |

| Credit report | A credit report to check your credit score and history |

| Asset verification | Bank statements or investment accounts to verify your assets |

| Appraisal report | An appraisal report to verify the value of the property |

📝 Note: The specific documents required may vary depending on your individual circumstances and the lender you are working with. It's essential to check with your lender to confirm the necessary documentation.

Conclusion and Final Thoughts

In conclusion, the mortgage application process requires a significant amount of paperwork and documentation. By understanding the different types of documents needed and being prepared, you can help streamline the process and increase your chances of approval. Remember to check with your lender to confirm the necessary documentation and to ask any questions you may have. With the right preparation and knowledge, you can navigate the mortgage application process with confidence and secure the financing you need to purchase your dream home.

What is the first step in the mortgage application process?

+

The first step in the mortgage application process is to get pre-approved for a mortgage. This involves providing some basic financial information to a lender, who will then provide a pre-approval letter stating the amount they are willing to lend.

What documents are needed for a mortgage application?

+

The documents needed for a mortgage application include identification, income verification, credit report, asset verification, and appraisal report. Additional documents may be required depending on your individual circumstances.

How long does the mortgage application process typically take?

+

The mortgage application process can take anywhere from a few days to several weeks, depending on the complexity of the application and the lender’s processing time. It’s essential to work with a lender who can provide clear guidance and updates throughout the process.