5 Docs to Buy Car

Introduction to Buying a Car

Buying a car can be a daunting task, especially for first-time buyers. With so many options available in the market, it’s essential to be prepared and have all the necessary documents in place. In this article, we will discuss the 5 essential documents you need to buy a car.

Understanding the Documents Required

Before we dive into the list of documents, it’s crucial to understand the importance of each document. These documents will help you complete the car buying process smoothly and ensure that you have a hassle-free ownership experience. The documents required may vary depending on your location, but the following are the most common ones:

- Identification Proof: This document is used to verify your identity and is usually a government-issued ID.

- Income Proof: This document is used to verify your income and is usually a salary slip or a letter from your employer.

- Address Proof: This document is used to verify your address and is usually a utility bill or a rental agreement.

- Insurance Documents: These documents are used to insure your vehicle and provide financial protection in case of an accident or damage.

- Financing Documents: These documents are used to secure financing for your vehicle and may include a loan agreement or a lease contract.

Document 1: Identification Proof

The first document you need to buy a car is a valid identification proof. This can be a:

- Driver’s license

- Passport

- State ID card

- Pan card

Document 2: Income Proof

The second document you need is an income proof. This can be:

- Salary slip

- Letter from employer

- Bank statement

- Tax return documents

Document 3: Address Proof

The third document you need is an address proof. This can be:

- Utility bill

- Rental agreement

- Bank statement

- Voter ID card

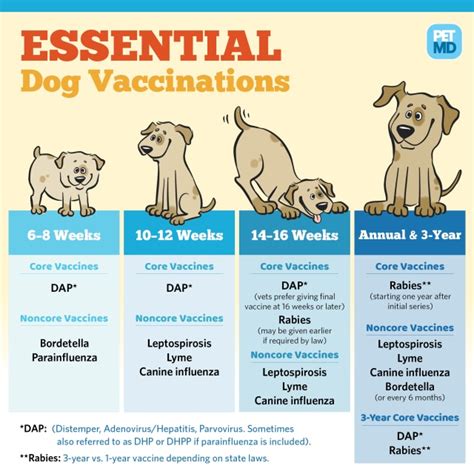

Document 4: Insurance Documents

The fourth document you need is an insurance document. This can be:

- Car insurance policy

- Insurance premium payment receipt

Document 5: Financing Documents

The fifth document you need is a financing document. This can be:

- Loan agreement

- Lease contract

- Financing approval letter

📝 Note: Make sure to keep all the documents in order and have multiple copies of each document. This will help you avoid any delays or complications during the car buying process.

Additional Tips

In addition to the above documents, here are some additional tips to keep in mind:

- Check your credit score before applying for financing

- Research and compare different financing options

- Read and understand the terms and conditions of the loan or lease

- Test drive the car before making a purchase

- Check the car’s history and condition before making a purchase

| Document | Description |

|---|---|

| Identification Proof | Verifies your identity |

| Income Proof | Verifies your income |

| Address Proof | Verifies your address |

| Insurance Documents | Provides financial protection |

| Financing Documents | Secures financing for your vehicle |

In summary, buying a car requires careful planning and preparation. Having the right documents in place can make the process smoother and less stressful. By understanding the importance of each document and following the tips outlined above, you can ensure a hassle-free ownership experience.

What are the most common documents required to buy a car?

+

The most common documents required to buy a car are identification proof, income proof, address proof, insurance documents, and financing documents.

Why is it important to have a good credit score when buying a car?

+

A good credit score can help you qualify for better financing options and lower interest rates, making it easier to buy a car.

What should I do if I don’t have all the required documents?

+

If you don’t have all the required documents, you can contact the dealer or financier to see if there are any alternative options available. You can also take the time to gather the necessary documents before proceeding with the purchase.