File 501c6 Texas Paperwork

Understanding the 501c6 Texas Paperwork: A Comprehensive Guide

When it comes to forming a business association or a chamber of commerce in Texas, one of the most important steps is obtaining a 501c6 tax exemption status. This status is crucial for organizations that aim to promote the common business interests of their members, and it offers numerous benefits, including tax exemptions on income. However, the process of obtaining this status can be complex and involves a significant amount of paperwork. In this guide, we will delve into the details of the 501c6 Texas paperwork, explaining what it entails, the benefits it offers, and a step-by-step guide on how to file for it.

What is a 501c6 Organization?

A 501c6 organization refers to a type of tax-exempt organization under the U.S. Internal Revenue Code. These organizations are typically business leagues, chambers of commerce, real estate boards, or boards of trade, whose purpose is to promote the common business interests of their members. Unlike 501c3 organizations, which are primarily charitable, 501c6 organizations are focused on the betterment of business conditions and can engage in lobbying activities to a certain extent.

Benefits of 501c6 Status

Obtaining a 501c6 status offers several benefits to business associations and chambers of commerce in Texas. Some of the key benefits include: - Tax Exemption: The most significant advantage is that these organizations are exempt from paying federal income taxes on their income, which can significantly reduce their operational costs. - Deductible Contributions: While contributions to 501c6 organizations are not deductible as charitable contributions, they can be deductible as business expenses, which can be beneficial for members. - Increased Credibility: Having a 501c6 status can enhance the credibility of an organization, making it more attractive to potential members and partners. - Lobbying Activities: 501c6 organizations are allowed to engage in lobbying activities, which can be crucial for influencing policies that affect their members’ businesses.

Required Paperwork for 501c6 Status in Texas

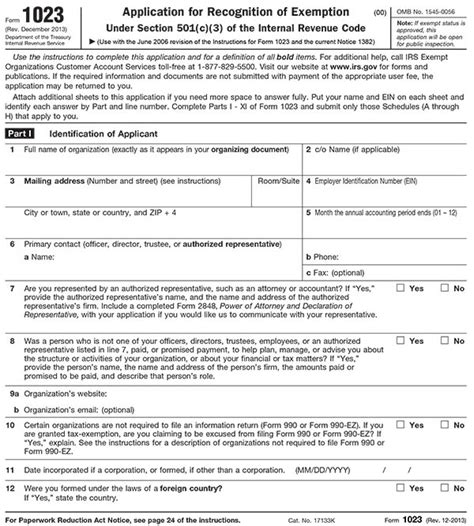

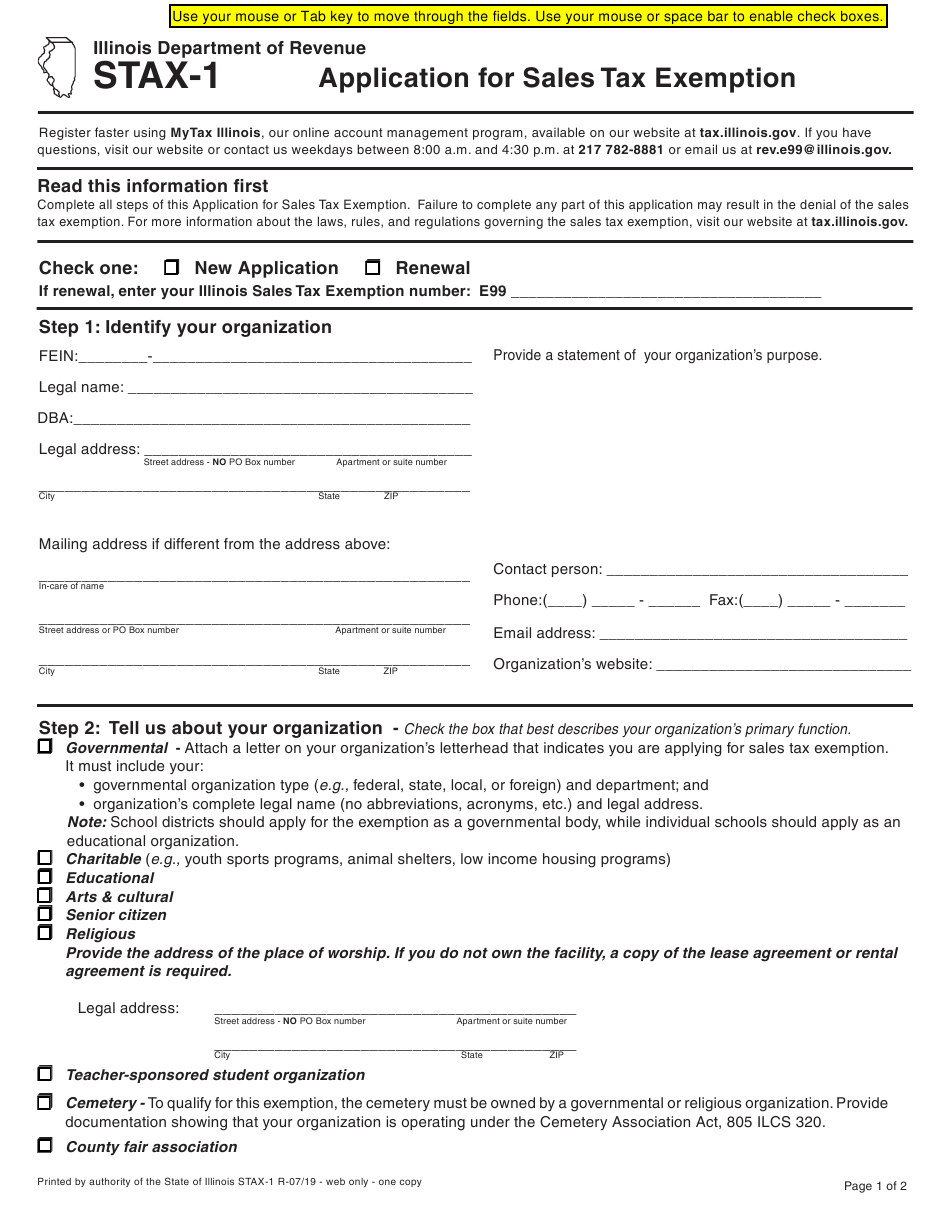

To apply for 501c6 status in Texas, an organization must file the necessary paperwork with both the state of Texas and the Internal Revenue Service (IRS). The primary documents required include: - Articles of Incorporation: The organization must first incorporate in the state of Texas by filing Articles of Incorporation with the Texas Secretary of State. These articles must include specific language regarding the organization’s purpose, which aligns with the requirements for a 501c6 organization. - IRS Form 1024: After incorporation, the organization must apply for tax-exempt status by filing Form 1024 with the IRS. This form requires detailed information about the organization, its purpose, its governance structure, and its financial projections. - Form 1024-A: If the organization expects to have $10,000 or more in annual gross receipts, it must also file Form 1024-A, which provides additional information required for section 501©(6) organizations.

Step-by-Step Guide to Filing for 501c6 Status

Here is a simplified step-by-step guide to help navigate the process: 1. Incorporate Your Organization: File Articles of Incorporation with the Texas Secretary of State. 2. Obtain an EIN: Get an Employer Identification Number (EIN) from the IRS. 3. Prepare and File Form 1024: Submit Form 1024 to the IRS, ensuring all required information and attachments are included. 4. File Form 1024-A if Necessary: If your organization’s annual gross receipts are expected to exceed $10,000, file Form 1024-A. 5. Wait for IRS Determination: The IRS will review your application and may request additional information. Once approved, you will receive a determination letter.

💡 Note: It is highly recommended to consult with an attorney or a tax professional experienced in non-profit law to ensure all paperwork is correctly prepared and filed, as the process can be complex and any mistakes could lead to delays or even rejection of the application.

Post-Approval Compliance

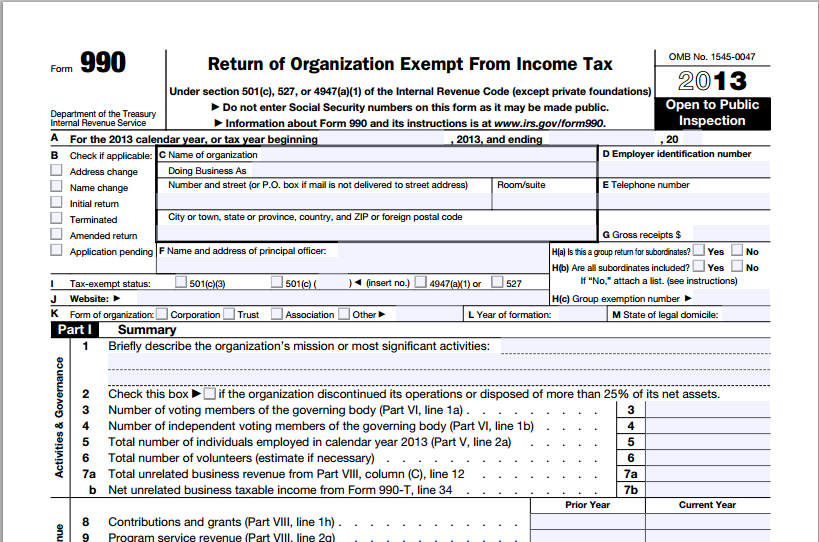

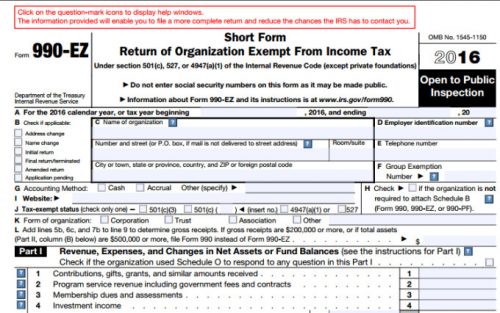

After receiving 501c6 status, the organization must comply with ongoing requirements, including: - Annual Information Returns: Filing Form 990 with the IRS annually to report on the organization’s activities, governance, and financial condition. - Texas State Reporting: Complying with any reporting requirements to the state of Texas. - Maintaining Records: Keeping accurate and detailed records of meetings, financial transactions, and other significant activities.

Embedding Images for Clarity

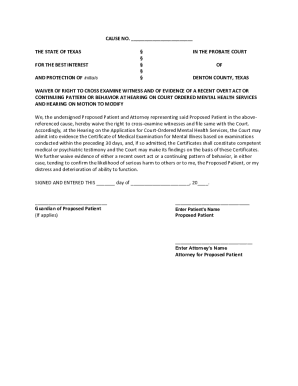

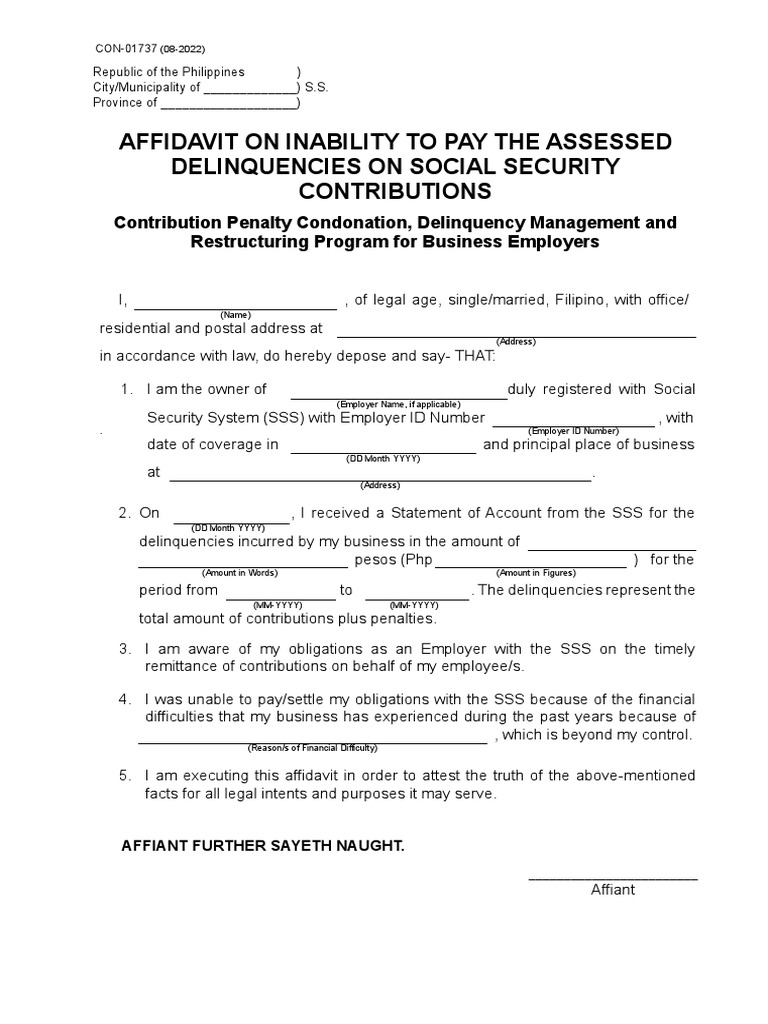

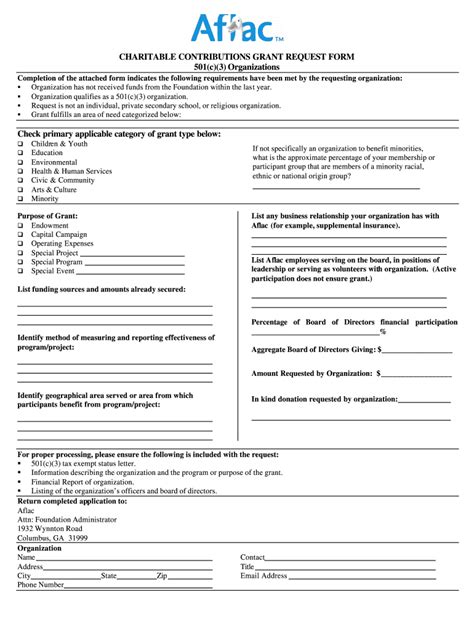

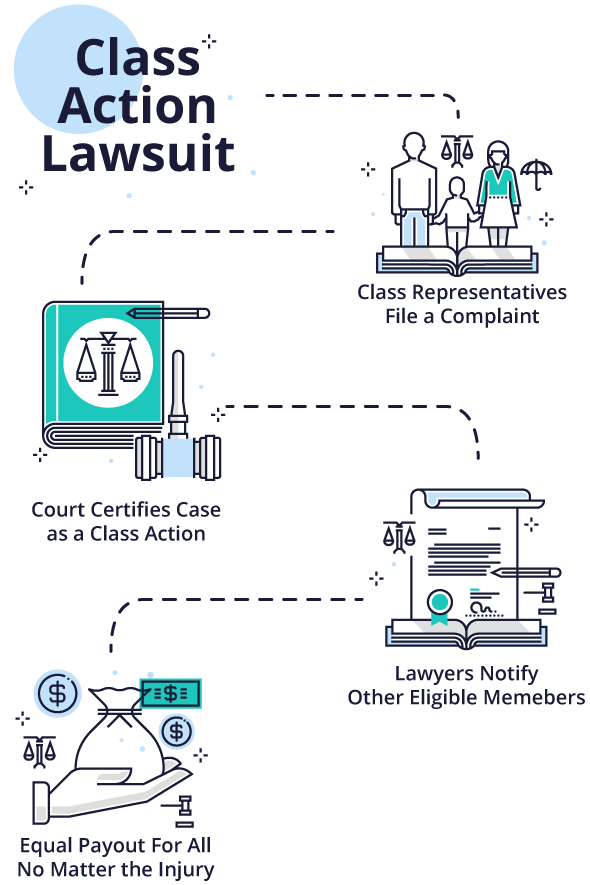

This image represents an example of the paperwork required for 501c6 status, highlighting the complexity and the need for meticulous preparation.

This image represents an example of the paperwork required for 501c6 status, highlighting the complexity and the need for meticulous preparation.

Table for Summary of Benefits

| Benefit | Description |

|---|---|

| Tax Exemption | Exemption from federal income taxes |

| Deductible Contributions | Contributions are deductible as business expenses |

| Increased Credibility | Enhanced credibility for the organization |

| Lobbying Activities | Ability to engage in lobbying activities |

To finalize the process of obtaining a 501c6 status in Texas, it is essential to carefully follow each step, ensuring all necessary paperwork is accurately prepared and filed. The benefits of this status, including tax exemptions and the ability to engage in lobbying activities, make the effort worthwhile for business associations and chambers of commerce. By understanding the requirements and complying with ongoing obligations, these organizations can effectively promote the common business interests of their members, contributing to a healthier and more prosperous business community in Texas.

What is the primary purpose of a 501c6 organization?

+

The primary purpose of a 501c6 organization is to promote the common business interests of its members, often through lobbying and other activities aimed at improving business conditions.

How long does it take to get approved for 501c6 status?

+

The approval time for 501c6 status can vary significantly depending on the complexity of the application and the workload of the IRS. It can take anywhere from a few months to over a year to receive a determination letter.

Can contributions to a 501c6 organization be deducted as charitable donations?

+

No, contributions to a 501c6 organization are not deductible as charitable donations. However, they can be deductible as business expenses, which can provide a similar tax benefit for donors.