Chase Bank Account Paperwork Needed

Introduction to Chase Bank Account Paperwork

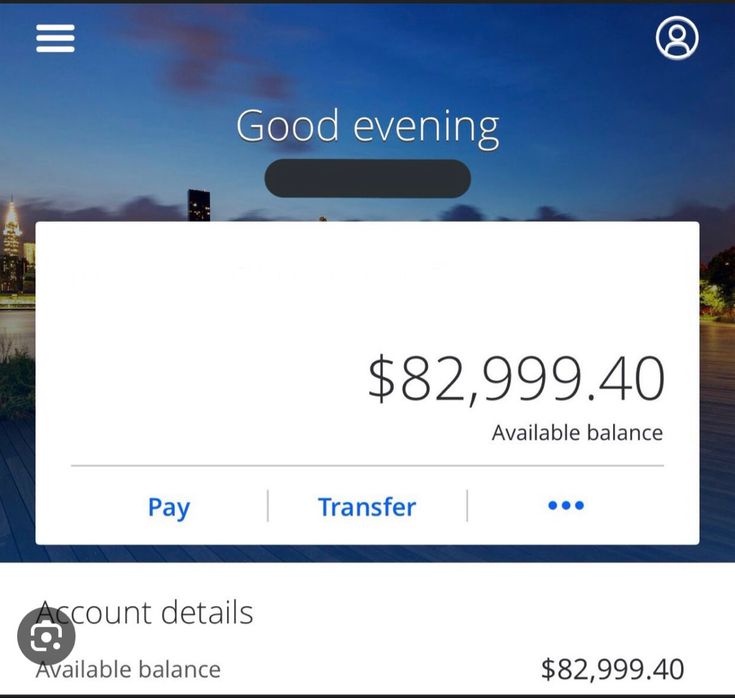

When opening a bank account with Chase Bank, it is essential to have all the necessary paperwork ready to ensure a smooth and efficient process. Chase Bank, being one of the largest banks in the United States, offers a variety of account options, including personal checking and savings accounts, business accounts, and investment accounts. The paperwork needed may vary depending on the type of account you are applying for and your individual circumstances. In this article, we will guide you through the typical paperwork required to open a Chase Bank account.

Personal Identification Documents

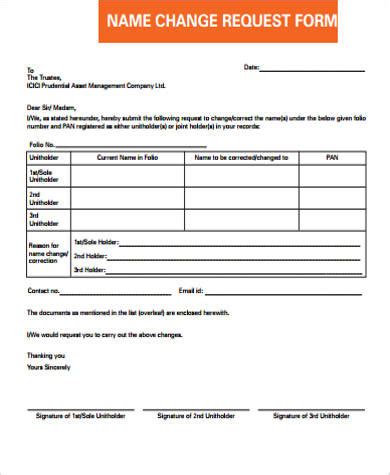

To open a Chase Bank account, you will need to provide personal identification documents. These documents are required to verify your identity and comply with banking regulations. The typical identification documents needed include: * A valid government-issued ID, such as a: + Driver’s license + State ID + Passport + Military ID * A social security number or individual taxpayer identification number (ITIN) * Proof of address, such as a: + Utility bill + Lease agreement + Bank statement

Business Account Paperwork

If you are applying for a business account, you will need to provide additional paperwork, including: * Business license or certificate of incorporation * Articles of incorporation or organization * Business tax ID number (EIN) * Proof of business address * Resolution or minutes authorizing the opening of the account * Identification documents for all business owners or authorized signers

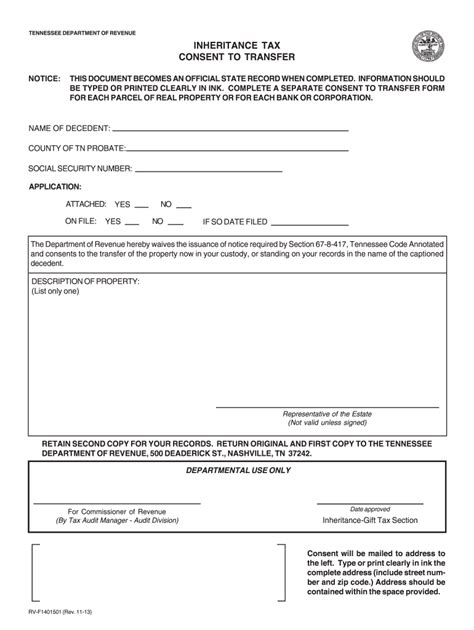

Other Required Documents

Depending on the type of account and your individual circumstances, you may need to provide additional documents, such as: * Proof of income, such as a pay stub or W-2 form * Proof of student status, such as a student ID or transcript * Documentation for any beneficiaries or co-signers

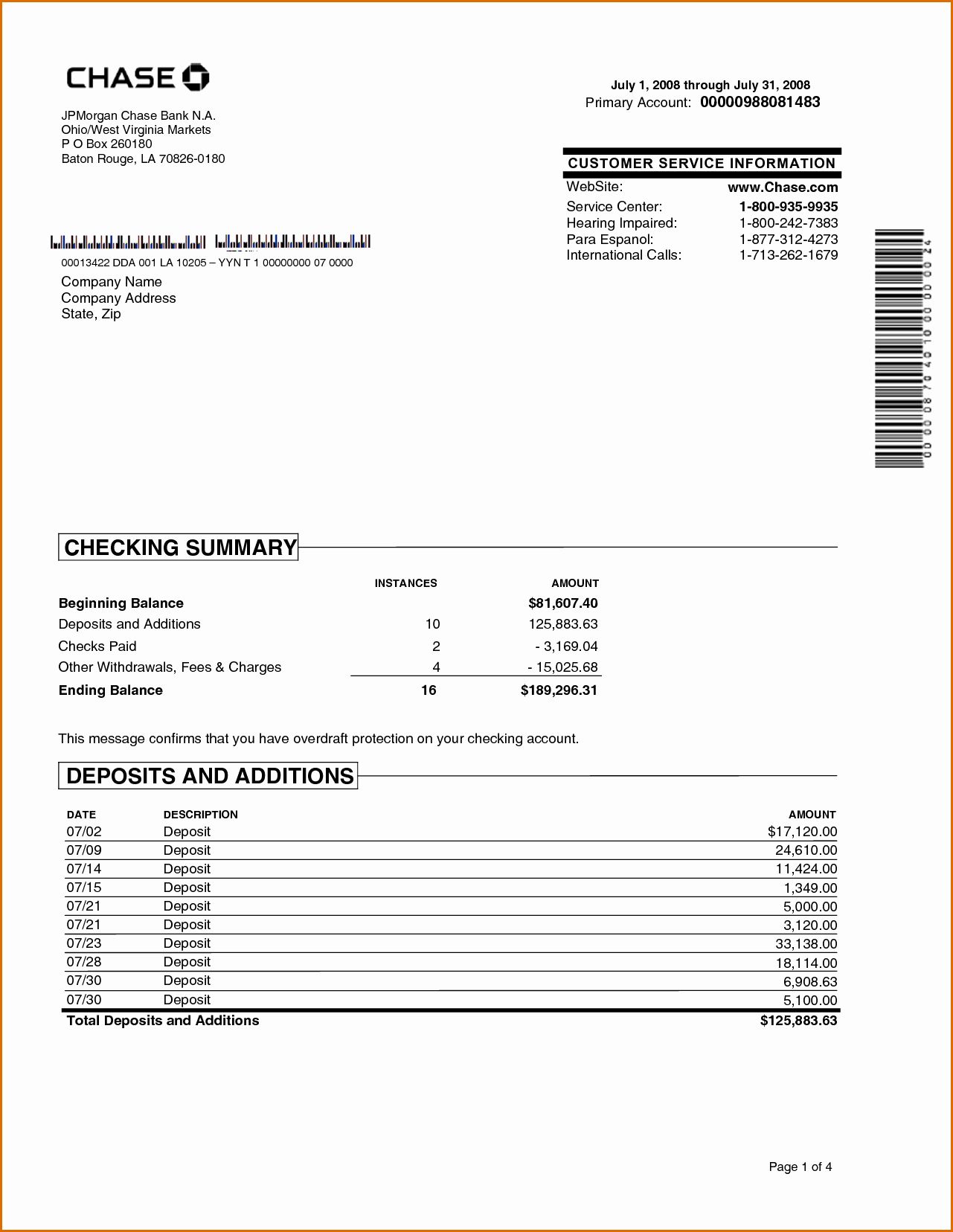

Table of Required Documents

The following table summarizes the typical paperwork needed to open a Chase Bank account:

| Account Type | Required Documents |

|---|---|

| Personal Checking or Savings | ID, social security number, proof of address |

| Business Account | Business license, articles of incorporation, EIN, proof of business address |

| Student Account | Student ID, proof of student status, ID, social security number |

📝 Note: The required documents may vary depending on your individual circumstances and the specific account you are applying for. It is always best to check with Chase Bank directly for the most up-to-date and accurate information.

Application Process

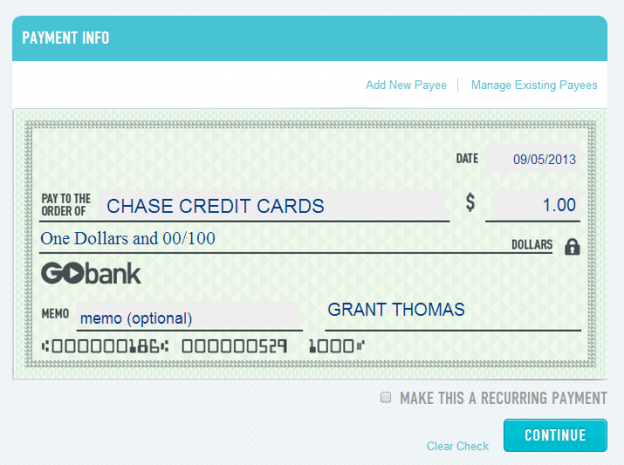

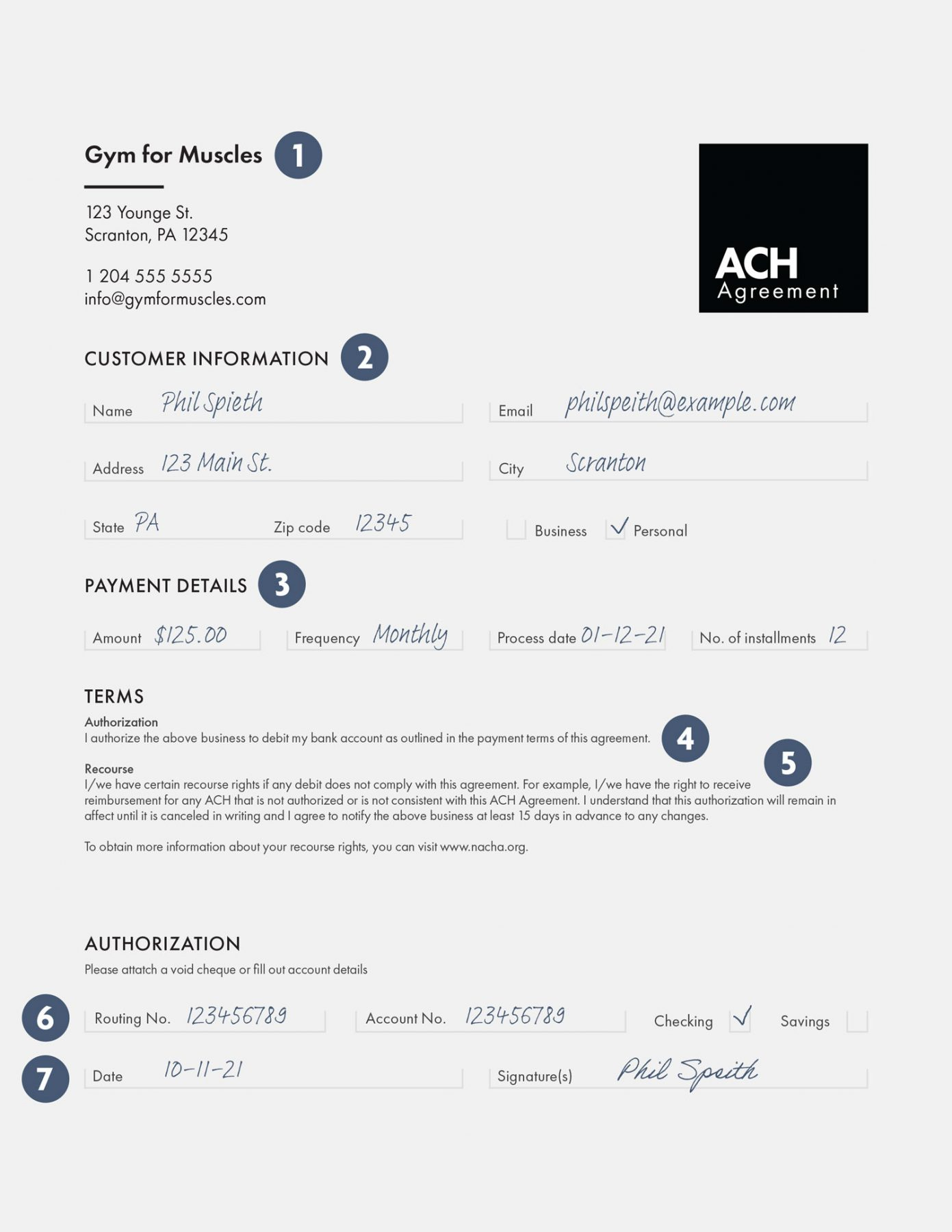

Once you have gathered all the necessary paperwork, you can apply for a Chase Bank account online, by phone, or in person at a local branch. The application process typically involves: * Filling out an application form * Providing the required documents * Funding your account * Reviewing and signing account agreements

Conclusion and Final Thoughts

In summary, opening a Chase Bank account requires various paperwork, including personal identification documents, business documents (if applicable), and other supporting documents. It is essential to have all the necessary documents ready to ensure a smooth application process. By following the guidelines outlined in this article, you can prepare yourself for the application process and get started with your new Chase Bank account. Remember to always check with Chase Bank directly for the most up-to-date and accurate information regarding the required paperwork and application process.

What is the minimum age requirement to open a Chase Bank account?

+

The minimum age requirement to open a Chase Bank account is 18 years old. However, some accounts, such as student accounts, may have different age requirements.

Can I open a Chase Bank account online?

+

Yes, you can open a Chase Bank account online. However, you may need to visit a local branch to complete the application process or provide additional documentation.

What is the required minimum deposit to open a Chase Bank account?

+

The required minimum deposit to open a Chase Bank account varies depending on the account type. Some accounts may have no minimum deposit requirement, while others may require a minimum deposit of 25 or 100.