5 Tax Forms

Understanding Tax Forms: A Comprehensive Guide

When it comes to taxes, one of the most critical aspects is filling out the correct tax forms. The Internal Revenue Service (IRS) provides various tax forms for different purposes, and it’s essential to understand which form to use for your specific situation. In this guide, we’ll delve into the details of five essential tax forms, their purposes, and who should use them.

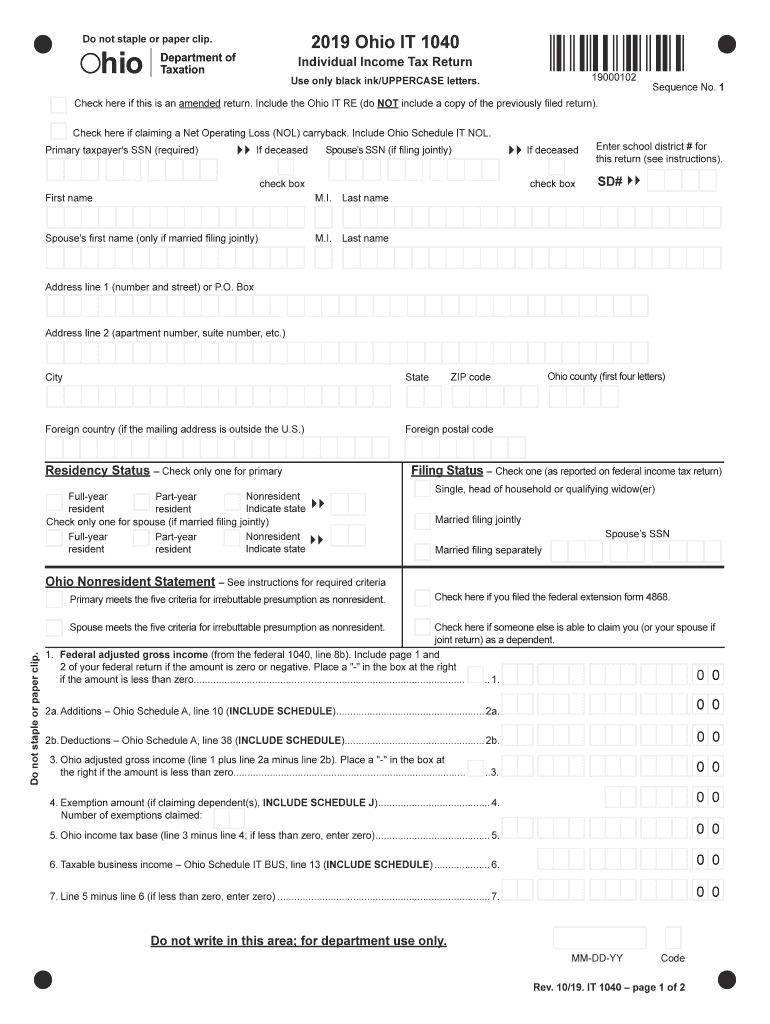

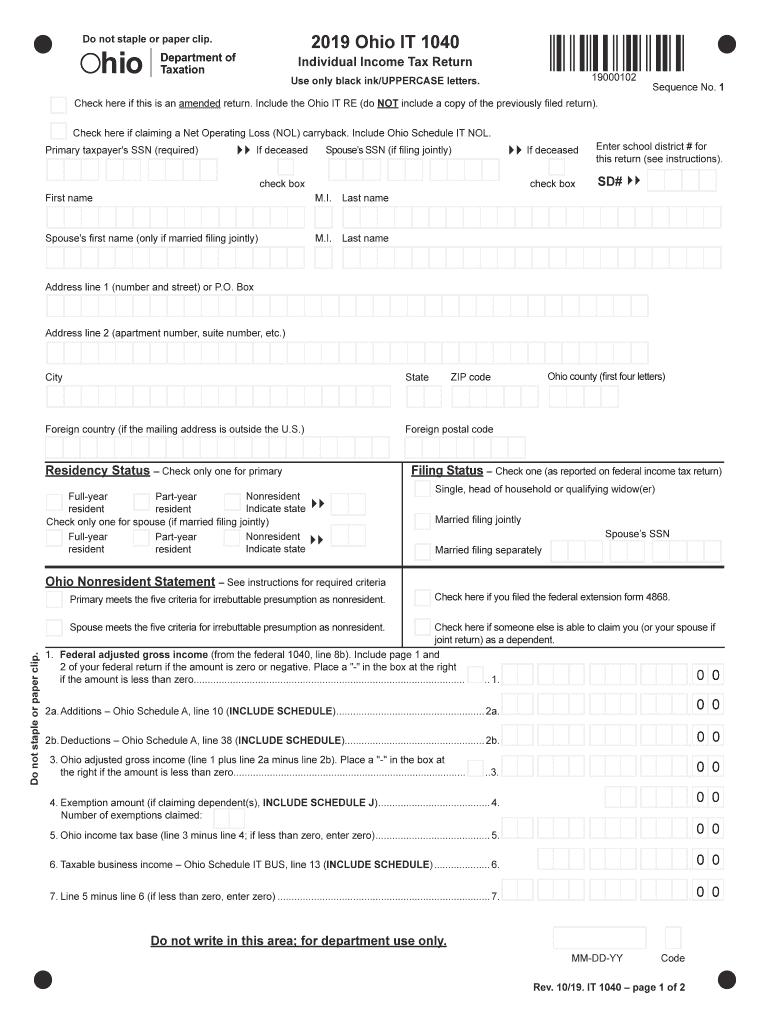

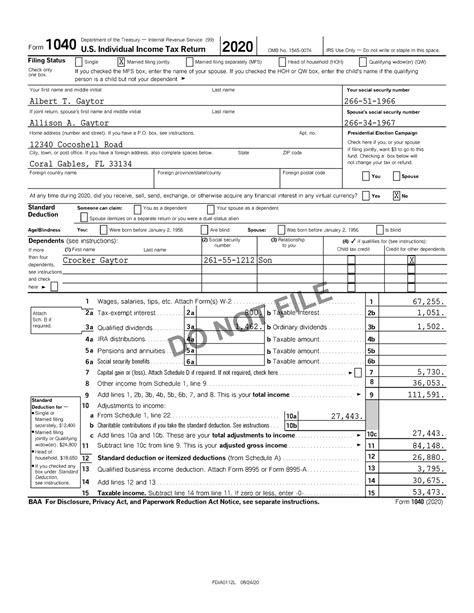

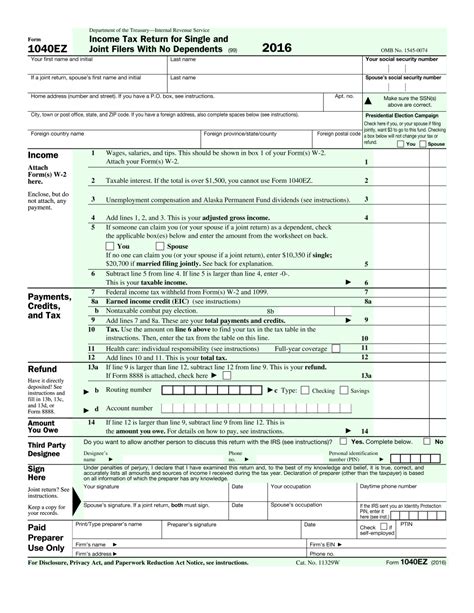

1. Form 1040: The Standard Tax Return Form

The Form 1040 is the standard tax return form used by most individuals to report their income, claim deductions and credits, and calculate their tax liability. This form is used to report income from various sources, such as wages, salaries, tips, and self-employment income. It’s also used to claim deductions for expenses like mortgage interest, charitable donations, and medical expenses. All taxpayers who earn income must file a Form 1040, unless they qualify for a simpler form like the 1040EZ or 1040A.

2. Form W-4: The Employee’s Withholding Certificate

The Form W-4 is used by employees to inform their employers of their tax withholding status. This form helps employers determine how much federal income tax to withhold from an employee’s wages. New employees must complete a Form W-4 when they start a new job, and existing employees may need to update their form if their tax situation changes. The form asks for personal information, such as filing status, number of dependents, and other income sources.

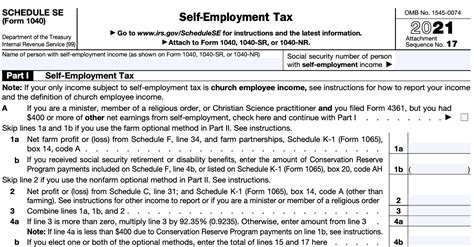

3. Form 1099-MISC: The Miscellaneous Income Form

The Form 1099-MISC is used to report various types of income, such as freelance work, consulting fees, and rent. Self-employed individuals and businesses use this form to report income they’ve earned from non-employee sources. The form is typically used to report income that’s not subject to withholding, such as income from a side hustle or a one-time gig. Recipients of this form must report the income on their tax return and pay any applicable taxes.

4. Form 8829: The Expenses for Business Use of Your Home Form

The Form 8829 is used by self-employed individuals and businesses to calculate the business use percentage of their home. This form is used to claim a home office deduction, which allows taxpayers to deduct a portion of their rent or mortgage interest as a business expense. To qualify, taxpayers must use a dedicated space in their home regularly and exclusively for business. The form requires detailed calculations and documentation to support the deduction.

5. Form 4868: The Automatic Extension of Time to File Form

The Form 4868 is used to request an automatic six-month extension of time to file a tax return. Taxpayers who need more time to gather information or complete their tax return can file this form to avoid late-filing penalties. The form is typically filed by the original tax filing deadline, and it gives taxpayers an additional six months to file their return. However, interest may still accrue on any unpaid tax liability, and taxpayers must estimate their tax liability and make a payment with the extension request.

📝 Note: Taxpayers should carefully review the instructions for each form and seek professional help if they're unsure about which form to use or how to complete it.

In addition to these five tax forms, there are many other forms and schedules that may be required depending on an individual’s or business’s specific situation. Taxpayers should always consult the IRS website or consult with a tax professional to ensure they’re using the correct forms and following the proper procedures.

To summarize, the five tax forms discussed in this guide are: * Form 1040: The standard tax return form * Form W-4: The employee’s withholding certificate * Form 1099-MISC: The miscellaneous income form * Form 8829: The expenses for business use of your home form * Form 4868: The automatic extension of time to file form

These forms are essential for reporting income, claiming deductions and credits, and calculating tax liability. Taxpayers should carefully review the instructions for each form and seek professional help if they’re unsure about which form to use or how to complete it.

In terms of best practices, taxpayers should: * Keep accurate and detailed records of their income and expenses * Consult the IRS website or a tax professional for guidance on which forms to use * File their tax return on time to avoid penalties and interest * Review their tax return carefully before submitting it to ensure accuracy and completeness

By following these best practices and using the correct tax forms, taxpayers can ensure they’re in compliance with tax laws and regulations, and they can minimize their tax liability.

What is the purpose of Form 1040?

+

Form 1040 is the standard tax return form used by most individuals to report their income, claim deductions and credits, and calculate their tax liability.

Who should use Form W-4?

+

New employees must complete a Form W-4 when they start a new job, and existing employees may need to update their form if their tax situation changes.

What is the deadline for filing Form 4868?

+

Form 4868 must be filed by the original tax filing deadline to request an automatic six-month extension of time to file a tax return.