5 Papers to File

Understanding the Importance of Tax-Related Documents

When it comes to managing your finances, especially during tax season, having the right documents in order is crucial. Among these, there are several key papers that you should ensure are filed correctly to avoid any legal or financial issues. In this article, we will delve into five essential papers to file, discussing their significance, how to obtain them, and the implications of not filing them properly.

1. W-2 Forms

The W-2 form, also known as the Wage and Tax Statement, is a crucial document provided by your employer that details your income and the taxes withheld from your paycheck. This form is vital for filing your income tax return. You should receive a W-2 form from your employer by January 31st of each year, reflecting the previous year’s earnings. If you do not receive your W-2 by the end of January, you should contact your employer immediately. The information on your W-2 is used to fill out your tax return (Form 1040), ensuring you report your income accurately and claim the correct amount of taxes withheld.

2. 1099 Forms

For individuals who are self-employed or have income from sources other than employment, such as freelancing, consulting, or investments, the 1099 form is a key document. There are various types of 1099 forms, each designed for different types of income: - 1099-MISC for miscellaneous income, such as freelance work. - 1099-INT for interest income. - 1099-DIV for dividend income. - 1099-B for proceeds from broker and barter exchange transactions. You should receive these forms from the payer by January 31st. Like the W-2, the 1099 forms are essential for accurately reporting your income on your tax return.

3. Receipts for Deductions

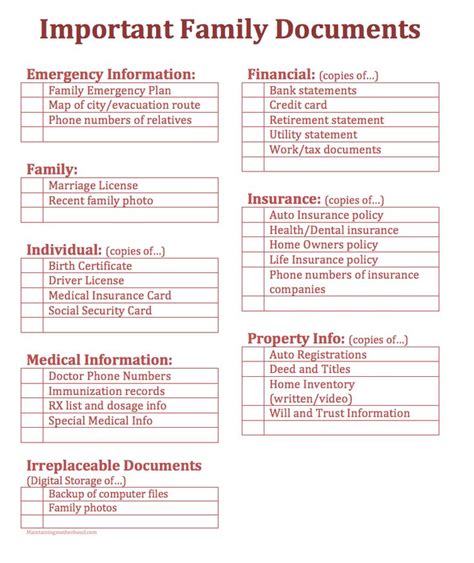

Receipts for deductions are crucial for claiming deductions on your tax return. These can include receipts for: - Charitable donations - Medical expenses - Home office expenses (for self-employed individuals) - Business expenses Keeping accurate and detailed records of these receipts throughout the year can significantly impact your tax liability. It’s advisable to organize them in a secure location, such as a digital cloud storage service or a physical file, to ensure they are easily accessible when filing your taxes.

4. Proof of Health Insurance

Depending on your country’s healthcare system and tax laws, you might need to provide proof of health insurance when filing your taxes. This documentation is typically required to comply with health care mandates or to claim certain tax credits related to health insurance premiums. Forms like 1095-A, 1095-B, or 1095-C are used for this purpose, showing that you and your family members had qualifying health coverage for some or all months of the year.

5. Investment Statements

For individuals with investments, such as stocks, bonds, or mutual funds, investment statements are necessary for reporting capital gains and losses. These statements, usually provided by your brokerage firm, detail the transactions made during the tax year, including sales, purchases, and any dividends or interest earned. You will use this information to complete Form 8949 and Schedule D of your tax return, where you calculate and report your capital gains and losses.

📝 Note: It's essential to review each of these documents carefully for accuracy and completeness before filing your taxes. Any discrepancies or missing information can lead to delays in processing your return or even trigger an audit.

To manage these documents efficiently, consider the following steps: - Organize your documents as soon as you receive them, either physically or digitally. - Review each document for accuracy and completeness. - Seek professional advice if you’re unsure about any aspect of the filing process. - File your taxes electronically to reduce the chance of errors and expedite your refund, if applicable.

In summary, maintaining accurate and complete records of your W-2 forms, 1099 forms, receipts for deductions, proof of health insurance, and investment statements is vital for a smooth tax filing process. Understanding the importance and proper handling of these documents can help you navigate the complexities of tax season with confidence.

What is the deadline for receiving a W-2 form from my employer?

+

You should receive your W-2 form from your employer by January 31st of each year, reflecting the previous year’s earnings.

Why are receipts for deductions important?

+

Receipts for deductions are crucial for claiming deductions on your tax return, which can significantly impact your tax liability.

What happens if I don’t file my taxes correctly?

+

If you don’t file your taxes correctly, you might face delays in processing your return, penalties, or even an audit. It’s essential to ensure all documents are accurate and complete.