5 Post-Repossession Papers

Understanding the Process of Repossession

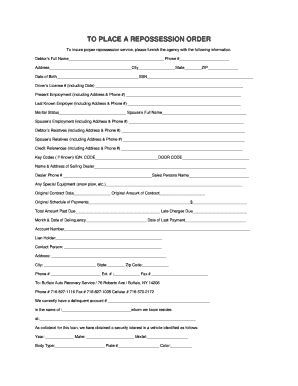

When an individual fails to make payments on a loan, the lender may repossess the asset that was used as collateral for the loan. This process can be stressful and overwhelming, especially if the individual is not prepared for the consequences. One of the most important things to understand is the paperwork involved in the repossession process. In this post, we will explore the 5 post-repossession papers that individuals should be aware of.

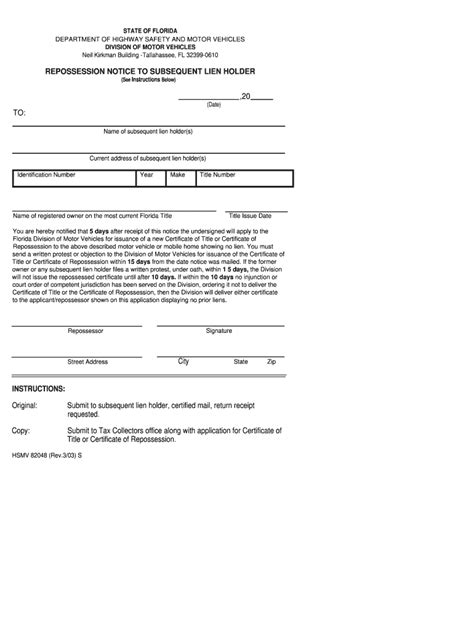

1. Notice of Repossession

The first paper that individuals will receive is the Notice of Repossession. This document informs the individual that the lender has taken possession of the asset and outlines the next steps in the process. The Notice of Repossession will typically include the following information: * The reason for the repossession * The date and time of the repossession * A description of the asset that was repossessed * The amount owed on the loan * The fees associated with the repossession

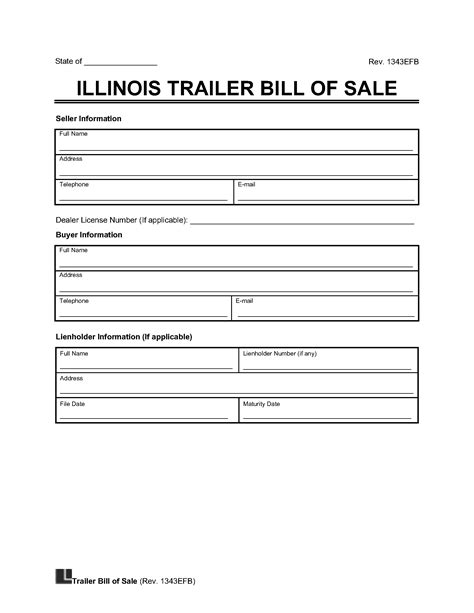

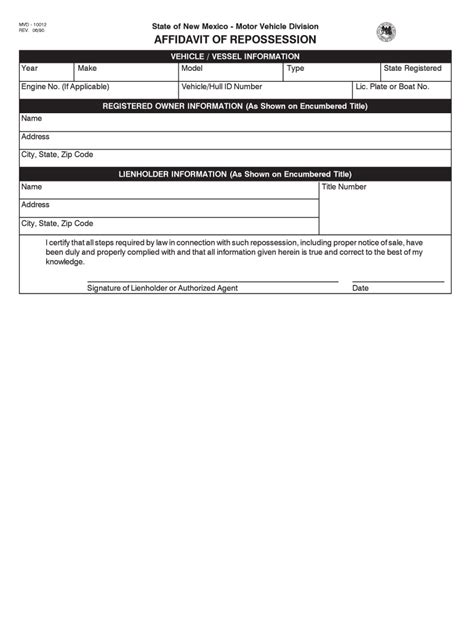

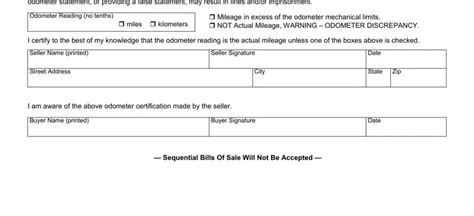

2. Affidavit of Repossession

The Affidavit of Repossession is a sworn statement that the lender must file with the court. This document confirms that the lender has taken possession of the asset and outlines the circumstances surrounding the repossession. The Affidavit of Repossession will typically include the following information: * A description of the asset that was repossessed * The date and time of the repossession * The reason for the repossession * The amount owed on the loan * The fees associated with the repossession

3. Notice of Sale

After the lender has repossessed the asset, they will typically sell it at a public auction to recoup their losses. The Notice of Sale is a document that informs the individual of the upcoming sale and provides them with an opportunity to attend the auction. The Notice of Sale will typically include the following information: * The date, time, and location of the sale * A description of the asset that will be sold * The minimum bid required to purchase the asset * The terms and conditions of the sale

4. Statement of Account

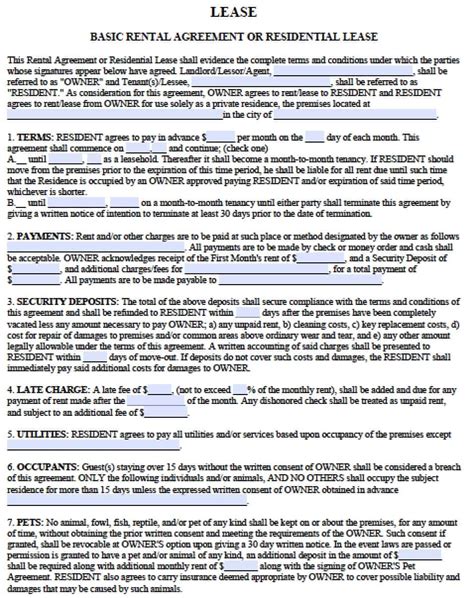

The Statement of Account is a document that outlines the individual’s account activity, including the amount owed on the loan, the fees associated with the repossession, and any payments that have been made. This document will help individuals understand their financial obligations and make informed decisions about how to proceed.

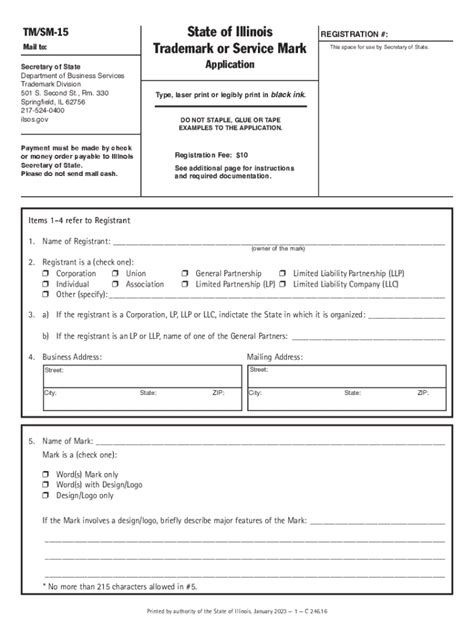

5. Release of Lien

The final paper that individuals will receive is the Release of Lien. This document confirms that the lender has released their claim to the asset and that the individual is no longer responsible for the loan. The Release of Lien will typically include the following information: * A description of the asset that was repossessed * The date and time of the repossession * The amount owed on the loan * The fees associated with the repossession * A statement confirming that the lender has released their claim to the asset

📝 Note: It is essential to carefully review each of these documents to ensure that the information is accurate and that the individual's rights are protected.

In addition to these documents, individuals may also receive other papers, such as a Notice of Deficiency or a Request for Payment. It is crucial to understand the purpose and content of each document to navigate the repossession process effectively.

To better understand the repossession process, let’s take a look at the following table:

| Document | Purpose | Content |

|---|---|---|

| Notice of Repossession | Inform individual of repossession | Reason for repossession, date and time of repossession, description of asset |

| Affidavit of Repossession | Confirm repossession with court | Description of asset, date and time of repossession, reason for repossession |

| Notice of Sale | Inform individual of upcoming sale | Date, time, and location of sale, description of asset, minimum bid |

| Statement of Account | Outline account activity | Amount owed, fees associated with repossession, payments made |

| Release of Lien | Confirm release of lender’s claim | Description of asset, date and time of repossession, amount owed, fees associated with repossession |

In conclusion, understanding the 5 post-repossession papers is crucial for individuals who are navigating the repossession process. By carefully reviewing each document and understanding the purpose and content, individuals can make informed decisions about how to proceed and protect their rights. It is also essential to seek professional advice to ensure that the individual’s financial obligations are managed effectively.

What is the Notice of Repossession?

+

The Notice of Repossession is a document that informs the individual that the lender has taken possession of the asset and outlines the next steps in the process.

What is the purpose of the Affidavit of Repossession?

+

The Affidavit of Repossession is a sworn statement that the lender must file with the court to confirm that they have taken possession of the asset and outline the circumstances surrounding the repossession.

What is the Notice of Sale?

+

The Notice of Sale is a document that informs the individual of the upcoming sale of the repossessed asset and provides them with an opportunity to attend the auction.