7 Papers to Keep

Introduction to Essential Documents

When it comes to organizing our personal and financial lives, it’s easy to get overwhelmed by the sheer amount of paperwork we accumulate. From bills and receipts to contracts and identification documents, it can be difficult to know what to keep and what to discard. However, there are certain documents that are crucial to keep, both for our own protection and for the sake of our loved ones. In this article, we’ll explore 7 essential papers to keep, and why they’re so important.

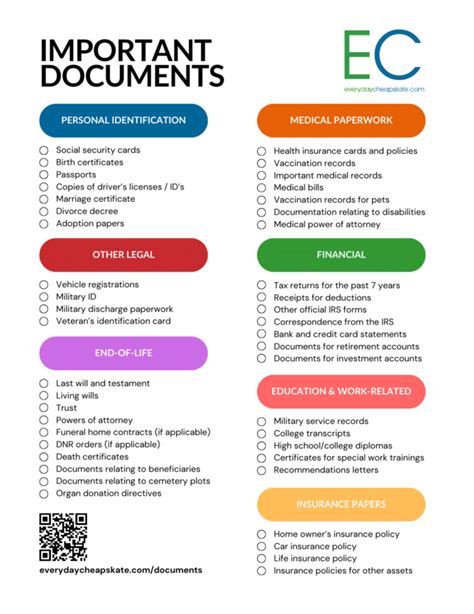

1. Identification Documents

Identification documents, such as passports, driver’s licenses, and birth certificates, are essential for proving who we are and where we come from. These documents are often required for everyday activities, such as opening a bank account, applying for a job, or traveling abroad. It’s a good idea to keep these documents in a safe and secure location, such as a fireproof safe or a locked cabinet.

2. Financial Documents

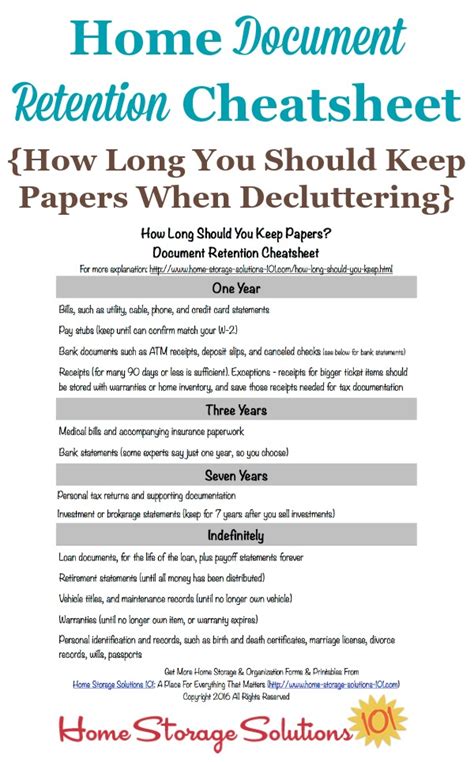

Financial documents, such as bank statements, investment accounts, and tax returns, are crucial for managing our financial lives. These documents provide a record of our income, expenses, and assets, and can be useful for tracking our financial progress over time. It’s a good idea to keep these documents for at least 3-5 years, in case we need to reference them for tax purposes or other financial transactions.

3. Insurance Policies

Insurance policies, such as health insurance, life insurance, and disability insurance, provide financial protection in the event of illness, injury, or death. These policies can be complex and difficult to understand, so it’s a good idea to keep a copy of the policy documents in a safe and secure location. This will help us to quickly reference the terms and conditions of the policy, and to make claims if necessary.

4. Property Deeds and Titles

Property deeds and titles, such as house deeds and car titles, prove ownership of our assets. These documents are essential for buying, selling, and transferring ownership of property, and can be useful for tracking the value of our assets over time. It’s a good idea to keep these documents in a safe and secure location, such as a fireproof safe or a locked cabinet.

5. Wills and Trusts

Wills and trusts, such as last will and testaments and living trusts, provide a way to distribute our assets after we pass away. These documents can be complex and difficult to understand, so it’s a good idea to keep a copy of the documents in a safe and secure location. This will help our loved ones to quickly reference the terms and conditions of the will or trust, and to carry out our wishes after we’re gone.

6. Powers of Attorney

Powers of attorney, such as healthcare powers of attorney and financial powers of attorney, provide a way to appoint someone to make decisions on our behalf if we become incapacitated. These documents can be useful for managing our financial and personal lives if we’re unable to do so ourselves. It’s a good idea to keep a copy of the power of attorney documents in a safe and secure location, such as a fireproof safe or a locked cabinet.

7. Tax Documents

Tax documents, such as W-2 forms and 1099 forms, provide a record of our income and expenses for tax purposes. These documents can be useful for tracking our financial progress over time, and for preparing our tax returns each year. It’s a good idea to keep these documents for at least 3-5 years, in case we need to reference them for tax purposes or other financial transactions.

💡 Note: It's a good idea to keep digital copies of these documents, in addition to physical copies. This will help to ensure that we have access to the documents if the physical copies are lost or destroyed.

Here is a summary of the 7 essential papers to keep:

| Document | Importance |

|---|---|

| Identification documents | Proving identity and citizenship |

| Financial documents | Managing financial lives and tracking progress |

| Insurance policies | Providing financial protection in case of illness or injury |

| Property deeds and titles | Proving ownership of assets |

| Wills and trusts | Distributing assets after death |

| Powers of attorney | Appointing someone to make decisions on our behalf |

| Tax documents | Tracking income and expenses for tax purposes |

In summary, keeping these 7 essential papers can help us to manage our personal and financial lives, and to protect ourselves and our loved ones in case of emergency. By keeping digital and physical copies of these documents, we can ensure that we have access to the information we need, when we need it.

What are the most important documents to keep?

+

The most important documents to keep include identification documents, financial documents, insurance policies, property deeds and titles, wills and trusts, powers of attorney, and tax documents.

How long should I keep financial documents?

+

It’s a good idea to keep financial documents for at least 3-5 years, in case you need to reference them for tax purposes or other financial transactions.

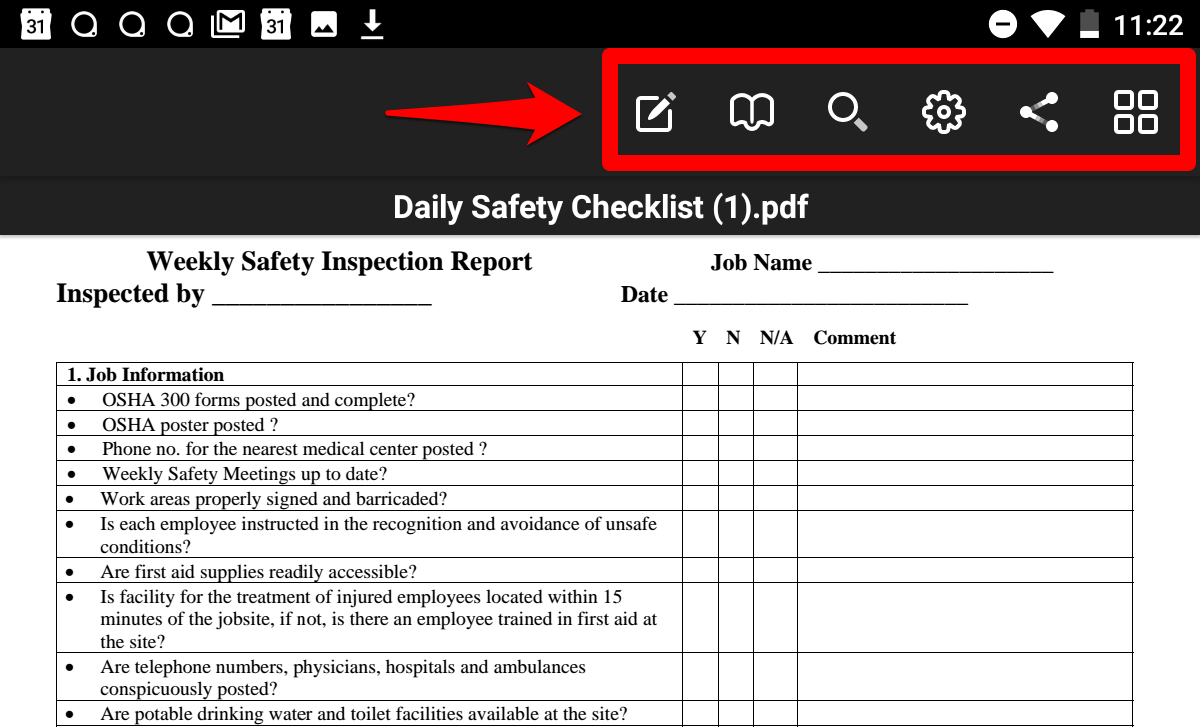

What is the best way to store important documents?

+

The best way to store important documents is in a safe and secure location, such as a fireproof safe or a locked cabinet. You should also keep digital copies of the documents, in case the physical copies are lost or destroyed.