5 IRS Papers

Understanding the Importance of IRS Papers

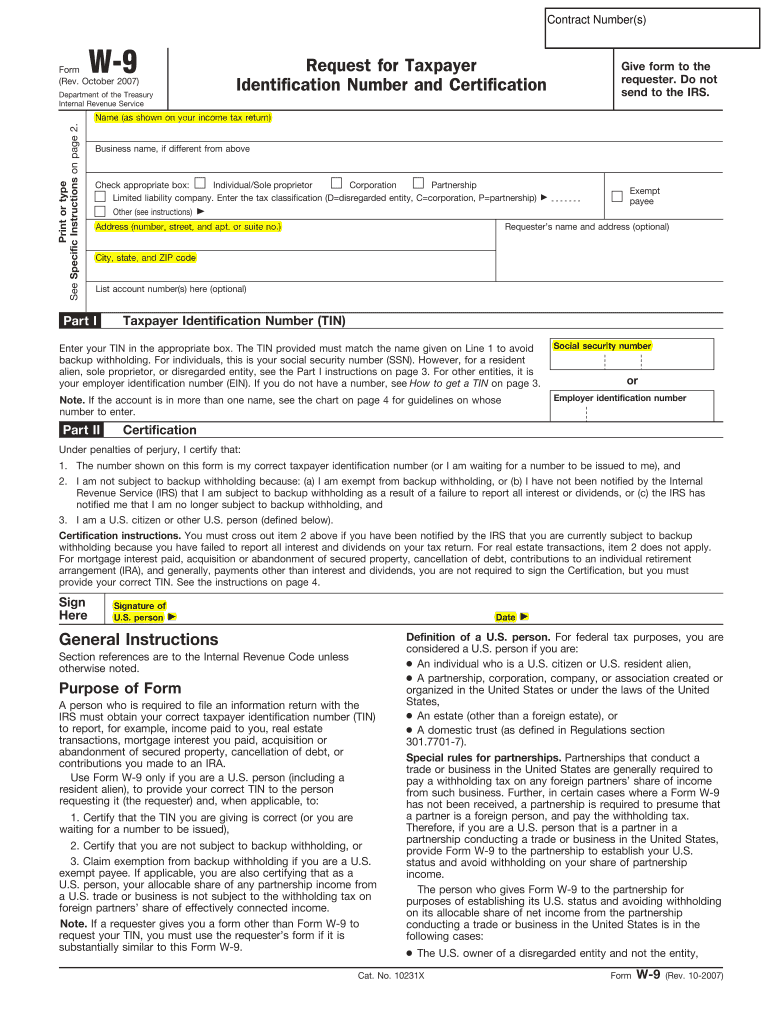

The Internal Revenue Service (IRS) is responsible for collecting taxes and enforcing tax laws in the United States. To achieve this, the IRS requires individuals and businesses to submit various forms and documents, collectively known as IRS papers. These papers play a crucial role in ensuring that taxpayers comply with tax regulations and that the government can effectively manage its revenue. In this article, we will delve into the world of IRS papers, exploring their types, purposes, and significance.

Type 1: W-2 Forms

One of the most common IRS papers is the W-2 form, also known as the Wage and Tax Statement. Employers are required to provide this form to their employees by January 31st of each year, showing the amount of wages paid and taxes withheld during the previous tax year. The W-2 form is essential for employees to file their tax returns, as it serves as proof of income and tax payments. The form includes important information such as: * Employee’s name and address * Employer’s name and address * Employee’s Social Security number * Wages and tips earned * Federal income tax withheld * Social Security tax withheld

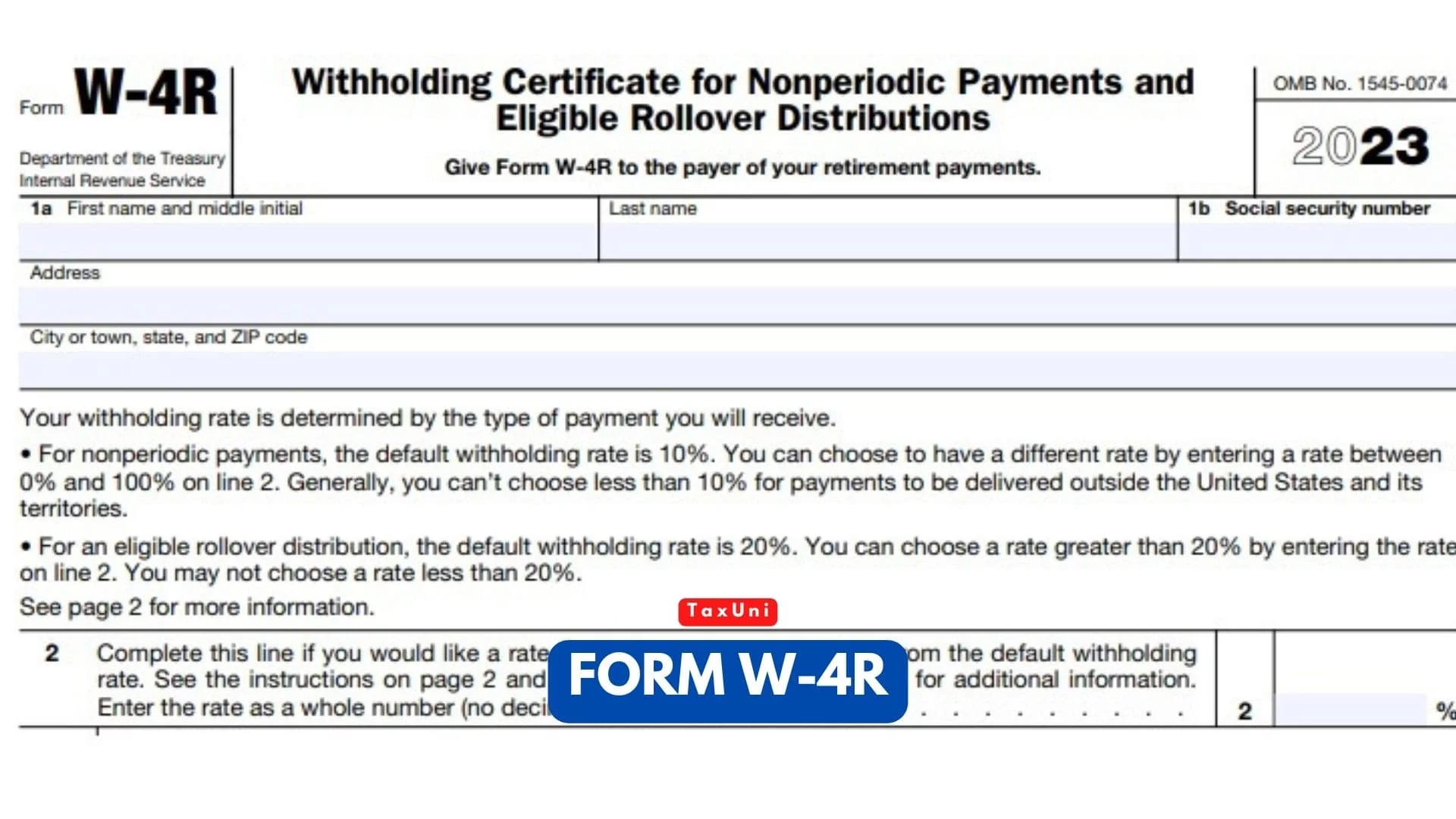

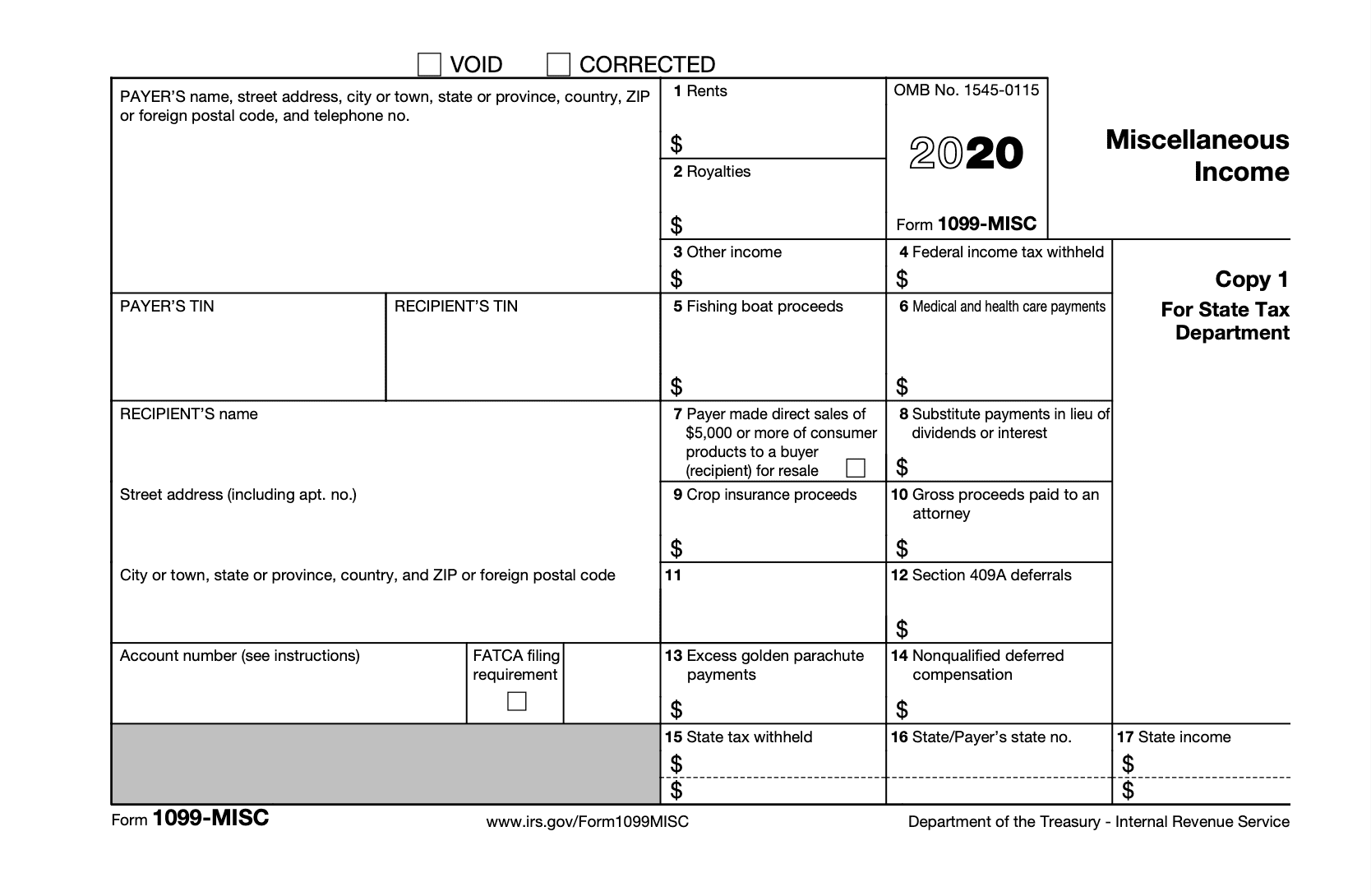

Type 2: 1099 Forms

Another significant IRS paper is the 1099 form, which is used to report various types of income, such as freelance work, dividends, and interest earned. There are several types of 1099 forms, including: * 1099-MISC: Used to report miscellaneous income, such as freelance work or independent contracting. * 1099-INT: Used to report interest income, such as interest earned on savings accounts or investments. * 1099-DIV: Used to report dividend income, such as dividends earned on stock ownership. These forms are essential for taxpayers to report their income accurately and comply with tax regulations.

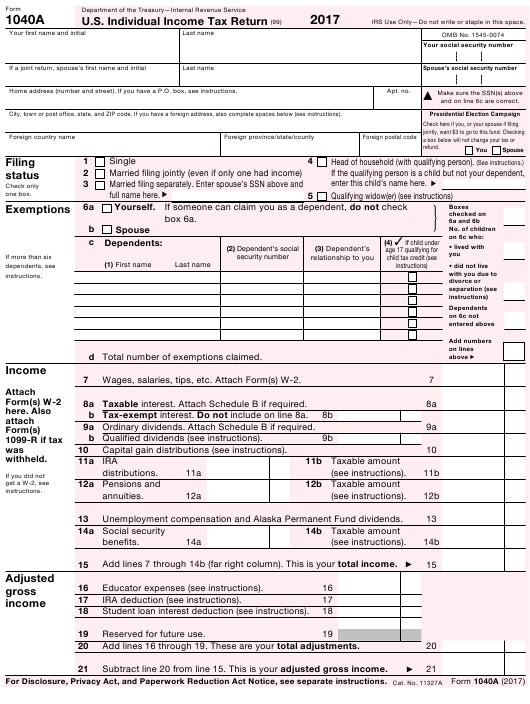

Type 3: 1040 Forms

The 1040 form, also known as the Individual Income Tax Return, is one of the most critical IRS papers. This form is used by individuals to report their income, claim deductions and credits, and calculate their tax liability. The 1040 form includes several sections, such as: * Income: Reports wages, salaries, tips, and other types of income. * Deductions: Claims deductions for expenses, such as mortgage interest, charitable donations, and medical expenses. * Credits: Claims tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit. The 1040 form is typically due on April 15th of each year, and it is essential for taxpayers to submit this form accurately and on time to avoid penalties and interest.

Type 4: Schedule C Forms

The Schedule C form, also known as the Profit or Loss from Business, is an essential IRS paper for self-employed individuals and small business owners. This form is used to report business income and expenses, and to calculate the net profit or loss from the business. The Schedule C form includes sections such as: * Income: Reports business income, such as sales, services, and other revenue. * Cost of Goods Sold: Reports the cost of producing or purchasing the products or services sold. * Expenses: Reports business expenses, such as rent, utilities, and equipment. The Schedule C form is attached to the 1040 form and is used to calculate the self-employment tax.

Type 5: Form 8949

The Form 8949, also known as the Sales and Other Dispositions of Capital Assets, is an IRS paper used to report the sale or exchange of capital assets, such as stocks, bonds, and real estate. This form is essential for taxpayers to report their capital gains and losses, and to calculate their tax liability. The Form 8949 includes sections such as: * Description of property: Reports the type and description of the capital asset sold or exchanged. * Date of acquisition: Reports the date the capital asset was acquired. * Date of sale: Reports the date the capital asset was sold or exchanged. * Sales price: Reports the sales price of the capital asset.

💡 Note: It is essential to keep accurate records of IRS papers, as they may be required for audits or other tax purposes.

In summary, IRS papers play a vital role in ensuring that taxpayers comply with tax regulations and that the government can effectively manage its revenue. Understanding the different types of IRS papers, such as W-2 forms, 1099 forms, 1040 forms, Schedule C forms, and Form 8949, is crucial for taxpayers to navigate the complex tax system. By submitting these forms accurately and on time, taxpayers can avoid penalties and interest, and ensure that they receive the tax credits and deductions they are eligible for.

The significance of IRS papers cannot be overstated, as they provide a transparent and accountable system for taxation. By maintaining accurate records and submitting the required forms, taxpayers can ensure that they are in compliance with tax laws and regulations. Furthermore, IRS papers provide a vital source of information for the government to assess tax revenue, make informed policy decisions, and allocate resources effectively.

What is the purpose of the W-2 form?

+

The W-2 form is used to report an employee’s wages and taxes withheld to the IRS and the employee.

Who needs to file a 1099 form?

+

Businesses and individuals who earn income from freelance work, dividends, interest, and other sources need to file a 1099 form.

What is the deadline for filing the 1040 form?

+

The deadline for filing the 1040 form is typically April 15th of each year.