DC Condo Association Paperwork Requirements

Introduction to DC Condo Association Paperwork Requirements

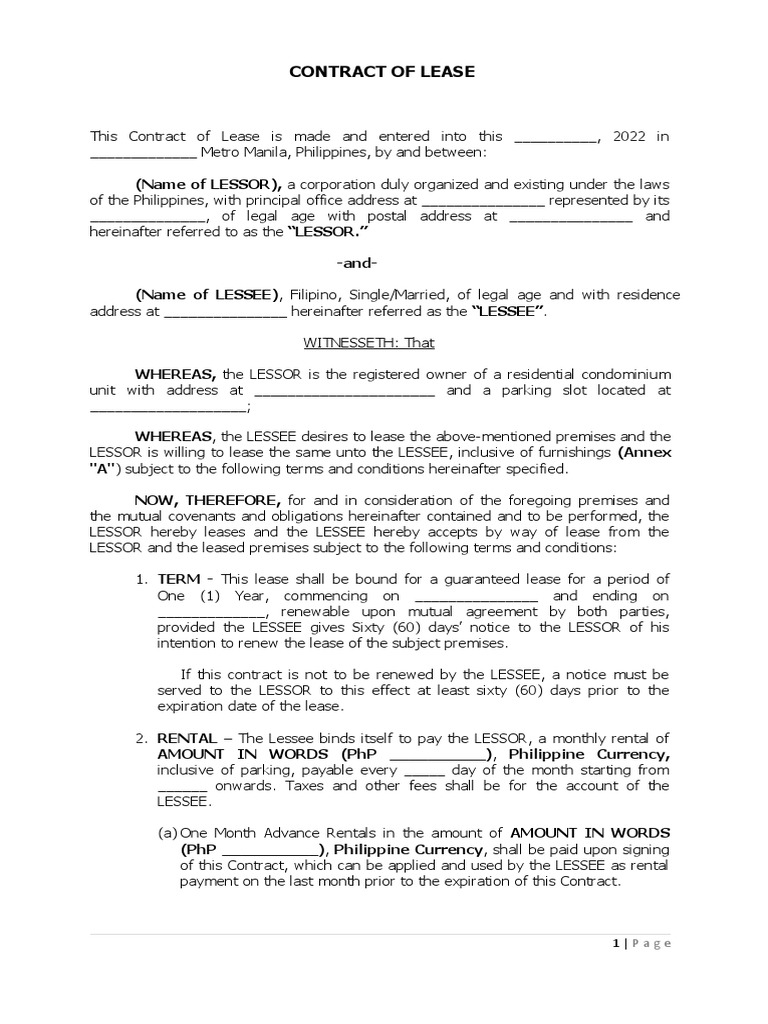

When it comes to managing a condominium association in Washington D.C., there are numerous paperwork requirements that must be adhered to. These requirements are designed to ensure that the association is run in a transparent and accountable manner, and that the rights of all unit owners are protected. In this article, we will provide an overview of the key paperwork requirements that DC condo associations must comply with.

Annual Reports and Meetings

One of the most important paperwork requirements for DC condo associations is the preparation and distribution of annual reports. These reports must include detailed financial information, as well as a summary of the association’s activities over the past year. The report must be distributed to all unit owners at least 30 days prior to the annual meeting. The annual meeting is also a critical event, where unit owners have the opportunity to ask questions, raise concerns, and vote on important issues. Minutes of the meeting must be taken and preserved for future reference.

Financial Statements and Budgets

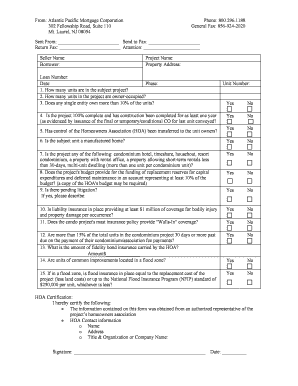

DC condo associations are required to prepare and distribute detailed financial statements, including a balance sheet, income statement, and budget. These statements must be prepared in accordance with generally accepted accounting principles (GAAP) and must be reviewed or audited by an independent accountant. The budget must be approved by the board of directors and must include a detailed breakdown of projected income and expenses.

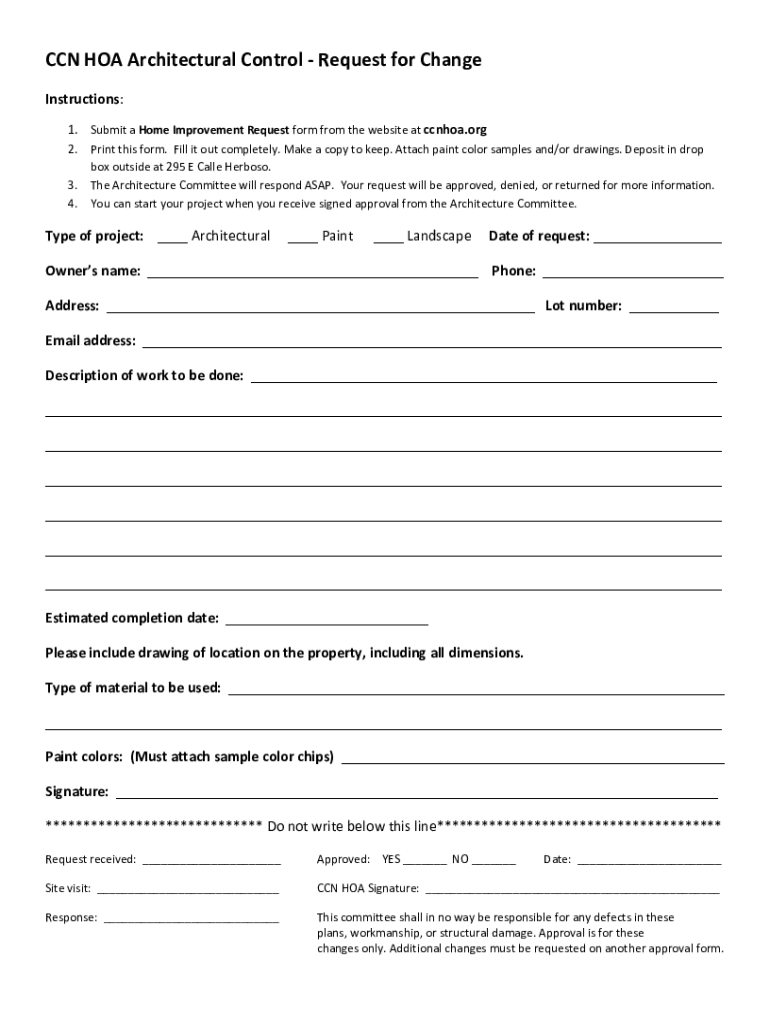

Governing Documents

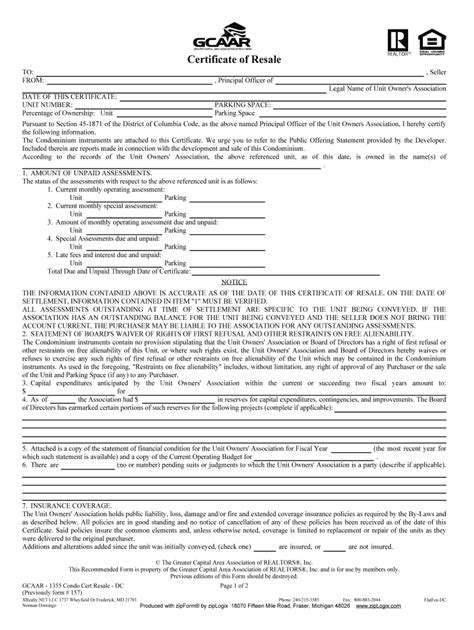

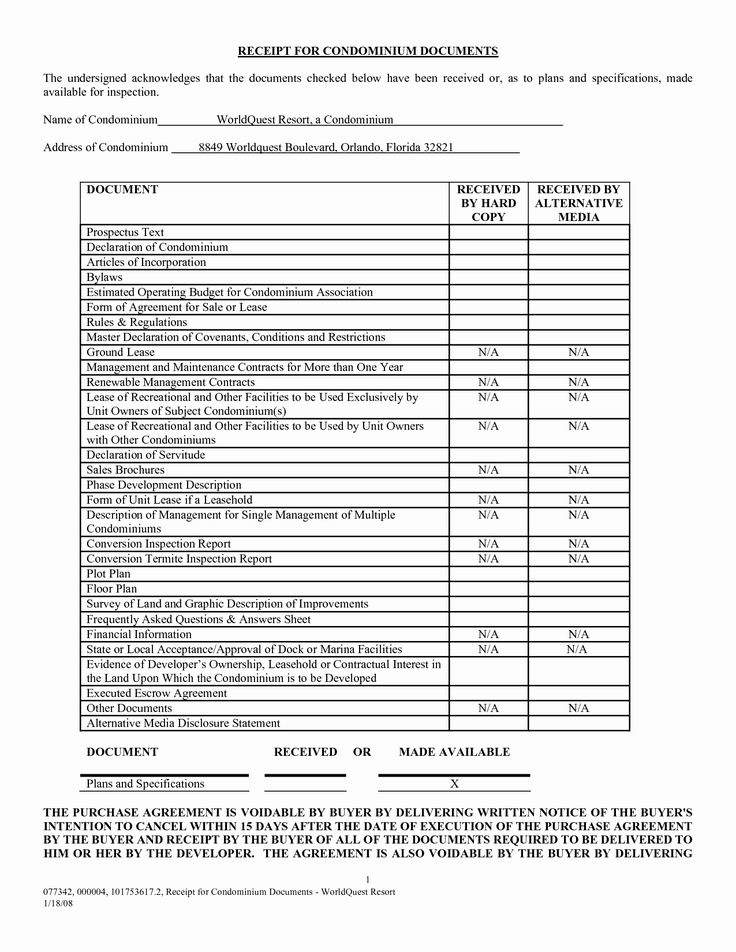

The governing documents of a DC condo association, including the bylaws, articles of incorporation, and condominium instruments, must be maintained and updated as necessary. These documents outline the rules and procedures for the operation of the association and must be made available to all unit owners upon request.

Reserve Studies and Funding

DC condo associations are required to conduct regular reserve studies to determine the adequacy of the association’s reserve funds. The reserve study must be updated at least every 5 years and must include a detailed analysis of the association’s major components, such as the roof, HVAC system, and elevators. The study must also include a funding plan to ensure that the association has sufficient reserves to meet its future needs.

Insurance and Risk Management

DC condo associations are required to maintain adequate insurance coverage to protect against potential risks and liabilities. This includes liability insurance, property insurance, and workers’ compensation insurance. The association must also have a risk management plan in place to identify and mitigate potential risks.

Compliance with DC Law

DC condo associations must comply with all applicable laws and regulations, including the DC Condominium Act and the DC Nonprofit Corporation Act. The association must also comply with all relevant regulations, including those related to disclosure, governance, and financial reporting.

📝 Note: It is essential for DC condo associations to stay up-to-date with all relevant laws and regulations to avoid potential penalties and fines.

Best Practices for Maintaining Accurate Records

To ensure compliance with all paperwork requirements, DC condo associations should maintain accurate and detailed records, including: * Minutes of all meetings * Financial statements and budgets * Governing documents * Reserve studies and funding plans * Insurance policies and risk management plans * Compliance records and reports

The following table summarizes the key paperwork requirements for DC condo associations:

| Document | Description | Frequency |

|---|---|---|

| Annual Report | Detailed report of the association's activities and financial information | Annually |

| Financial Statements | Detailed financial information, including balance sheet, income statement, and budget | Annually |

| Governing Documents | Bylaws, articles of incorporation, and condominium instruments | As necessary |

| Reserve Study | Detailed analysis of the association's major components and funding plan | Every 5 years |

| Insurance Policies | Liability, property, and workers' compensation insurance | Annually |

In summary, DC condo associations must comply with numerous paperwork requirements to ensure transparency, accountability, and compliance with all relevant laws and regulations. By maintaining accurate and detailed records, associations can avoid potential penalties and fines and ensure the smooth operation of the community.

What is the purpose of the annual report?

+

The annual report provides a detailed overview of the association’s activities and financial information, allowing unit owners to stay informed and engaged.

How often must the reserve study be updated?

+

The reserve study must be updated at least every 5 years to ensure that the association has sufficient reserves to meet its future needs.

What types of insurance must the association maintain?

+

The association must maintain liability, property, and workers’ compensation insurance to protect against potential risks and liabilities.