Paperwork to Keep When Someone Dies

Introduction to Handling Estate After a Death

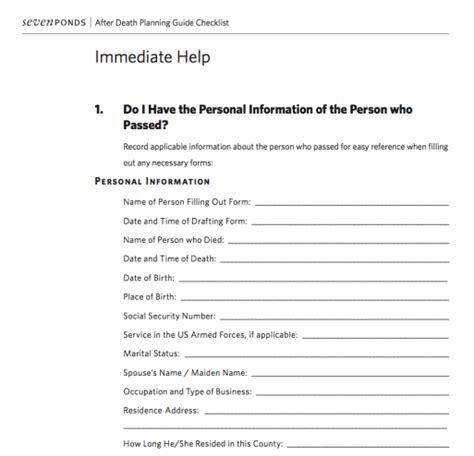

When a loved one passes away, it can be a very difficult and emotional time. Along with grieving, there are numerous tasks that need to be taken care of, including handling the deceased person’s estate. This involves dealing with a significant amount of paperwork and making important decisions. Knowing what paperwork to keep and how to manage the estate can help alleviate some of the stress during this challenging period.

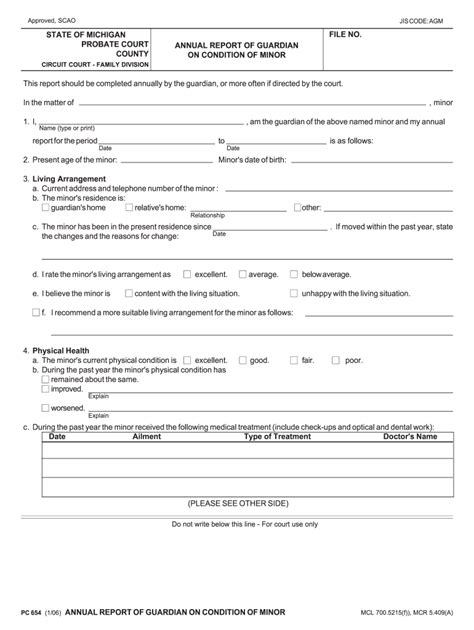

Types of Paperwork to Keep

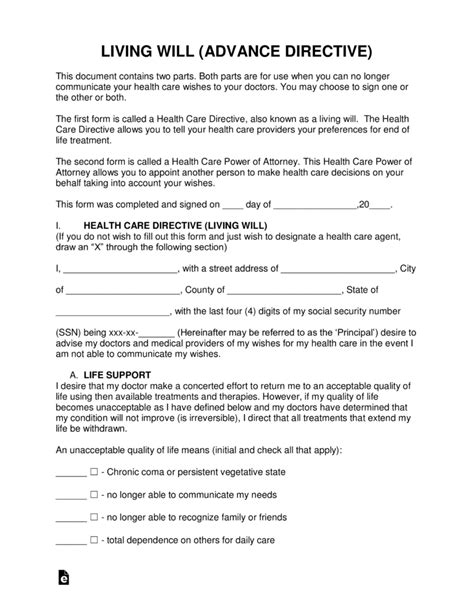

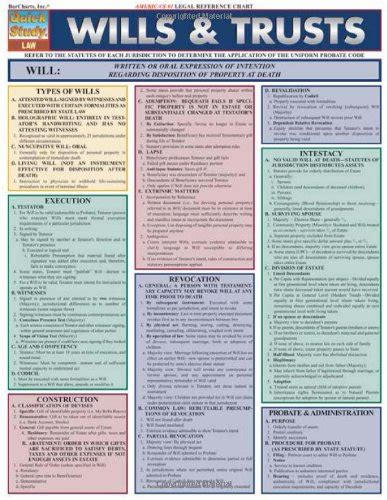

There are several types of paperwork that are essential to keep when someone dies. These include: * Death certificate: This is a crucial document that serves as proof of death. It is needed for a variety of purposes, such as claiming life insurance, settling the estate, and notifying government agencies. * Will and trust documents: If the deceased person had a will or trust, these documents will outline their wishes regarding the distribution of their assets. * Life insurance policies: These policies can provide financial support to the beneficiaries. * Retirement accounts and pensions: These documents will help in managing and distributing the deceased person’s retirement savings. * Property deeds and titles: For any real estate or vehicles owned by the deceased, these documents are necessary for transfer of ownership. * Tax returns: The deceased person’s tax returns for the previous years may be required for estate tax purposes. * Bills and invoices: Keeping track of the deceased person’s outstanding bills and invoices can help in managing their estate effectively.

Organizing the Paperwork

It is essential to organize the paperwork in a systematic manner to ensure that everything is easily accessible when needed. Here are some tips to help with organization: * Create a file system with separate folders for different types of documents, such as financial documents, estate planning documents, and tax documents. * Make digital copies of important documents and store them securely, such as in a password-protected cloud storage service. * Keep the original documents in a safe and secure location, such as a fireproof safe or a safe deposit box at a bank.

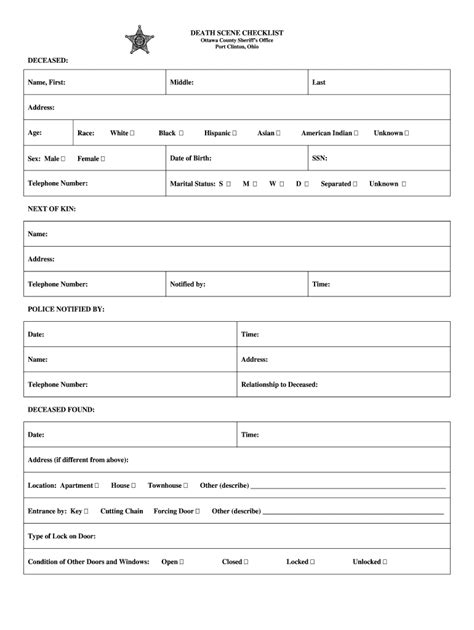

Notifying Relevant Parties

After someone dies, it is crucial to notify the relevant parties, including: * Government agencies: Notify the Social Security Administration, the IRS, and other relevant government agencies. * Financial institutions: Inform banks, credit card companies, and other financial institutions where the deceased person had accounts. * Insurance companies: Notify life insurance companies and other insurance providers. * Credit reporting agencies: Inform the credit reporting agencies to prevent identity theft.

💡 Note: Notifying these parties can help prevent fraud and ensure that the deceased person's assets are protected.

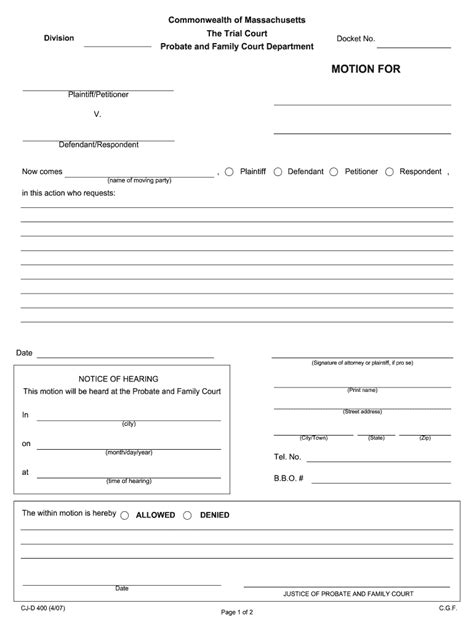

Distributing Assets

The distribution of assets is typically managed by the executor or personal representative of the estate, as outlined in the will or trust documents. If there is no will or trust, the distribution of assets will be determined by the laws of the state where the deceased person lived. The assets may include: * Real estate * Vehicles * Bank accounts * Investments * Personal property

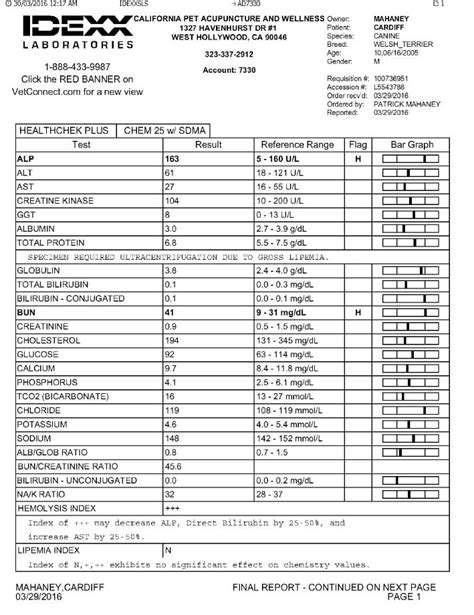

Tax Implications

The death of a loved one can have significant tax implications. The estate tax is a tax on the transfer of assets from the deceased person to their beneficiaries. The tax laws and regulations can be complex, so it is essential to consult with a tax professional to ensure that the estate is managed effectively.

| Type of Asset | Tax Implication |

|---|---|

| Real Estate | Subject to estate tax |

| Vehicles | Subject to estate tax |

| Bank Accounts | Subject to estate tax |

| Investments | Subject to estate tax |

| Personal Property | Subject to estate tax |

In summary, handling the estate after a death requires a significant amount of paperwork and attention to detail. It is essential to keep track of important documents, notify relevant parties, and manage the distribution of assets effectively. By being organized and seeking professional advice when needed, you can ensure that the estate is managed smoothly and efficiently.

What is the first step in handling the estate after a death?

+

The first step in handling the estate after a death is to obtain a death certificate, which serves as proof of death and is required for a variety of purposes, including claiming life insurance and settling the estate.

What types of paperwork should I keep when someone dies?

+

You should keep a variety of paperwork, including the death certificate, will and trust documents, life insurance policies, retirement accounts and pensions, property deeds and titles, tax returns, and bills and invoices.

How do I notify relevant parties after a death?

+

You should notify government agencies, financial institutions, insurance companies, and credit reporting agencies to prevent fraud and ensure that the deceased person’s assets are protected.