5 Mortgage Paperworks

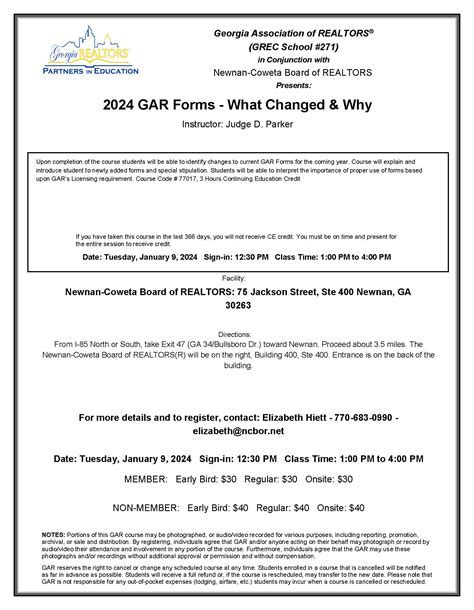

Introduction to Mortgage Paperwork

When it comes to purchasing a home, one of the most critical aspects of the process is understanding and completing the necessary mortgage paperwork. This can be a daunting task, especially for first-time homebuyers who are unfamiliar with the terminology and requirements involved. In this article, we will delve into the world of mortgage paperwork, exploring the different types of documents you will encounter and providing guidance on how to navigate this complex process.

Understanding the Mortgage Application Process

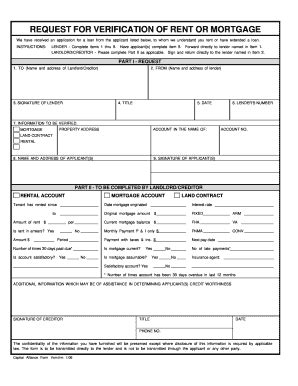

The mortgage application process typically begins with the submission of a loan application to a lender. This application will require personal and financial information, including income, credit score, and debt obligations. The lender will use this information to determine the borrower’s creditworthiness and eligibility for a mortgage. Some of the key documents required during this stage include: * Identification documents (driver’s license, passport, etc.) * Income verification (pay stubs, W-2 forms, etc.) * Credit reports * Bank statements

Pre-Approval and Pre-Qualification

Before starting the home search, it’s essential to get pre-approved or pre-qualified for a mortgage. While these terms are often used interchangeably, they have distinct meanings: * Pre-qualification: This is an estimate of how much you can borrow based on a cursory review of your financial situation. * Pre-approval: This is a more formal commitment from the lender, indicating that you have been approved for a specific loan amount, subject to certain conditions.

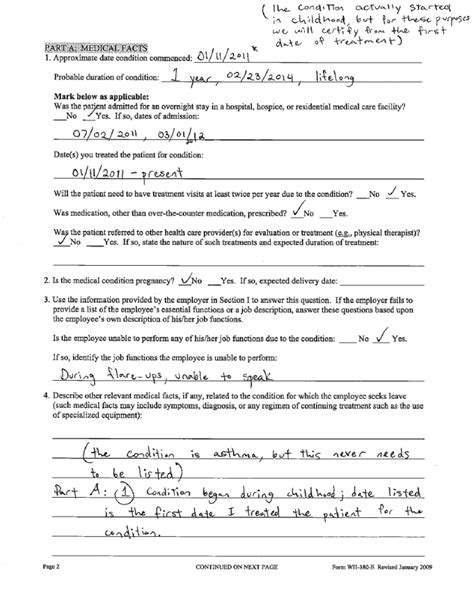

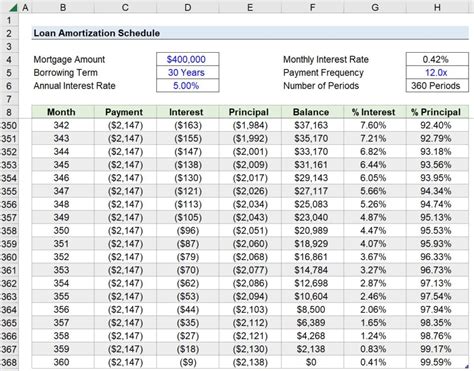

Key Mortgage Paperwork Documents

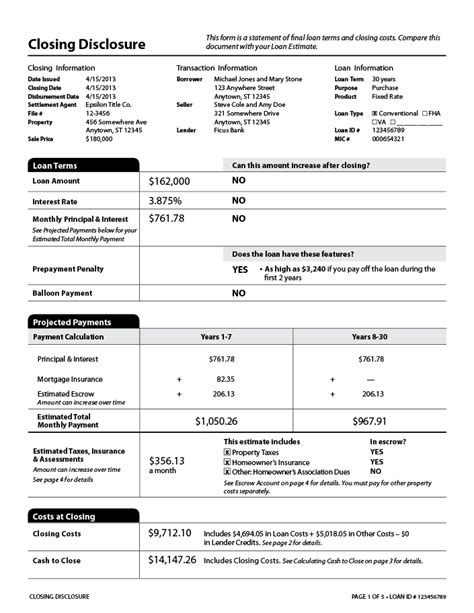

The following are some of the most critical documents you will encounter during the mortgage process: * Good Faith Estimate (GFE): This document outlines the estimated costs associated with the mortgage, including interest rates, fees, and closing costs. * Truth-in-Lending (TIL) Disclosure: This document provides a detailed breakdown of the loan terms, including the annual percentage rate (APR), finance charges, and total payments. * Loan Estimate (LE): This document replaces the GFE and TIL disclosure, providing a comprehensive overview of the loan terms and costs. * Closing Disclosure (CD): This document is provided at least three business days before closing, outlining the final terms and costs of the loan.

Mortgage Paperwork Checklist

To ensure a smooth and efficient mortgage process, it’s essential to have the following documents readily available: * Identification documents * Income verification * Credit reports * Bank statements * Asset documentation (e.g., investment accounts, retirement accounts) * Employment verification

📝 Note: It's crucial to carefully review and understand all mortgage paperwork before signing, as this can help avoid potential issues or disputes down the line.

Conclusion and Final Thoughts

In conclusion, navigating the complex world of mortgage paperwork requires patience, attention to detail, and a solid understanding of the process. By familiarizing yourself with the key documents and requirements involved, you can ensure a smoother and more efficient mortgage experience. Remember to carefully review and understand all paperwork before signing, and don’t hesitate to seek guidance from a qualified professional if needed.

What is the difference between pre-qualification and pre-approval?

+

Pre-qualification is an estimate of how much you can borrow based on a cursory review of your financial situation, while pre-approval is a more formal commitment from the lender, indicating that you have been approved for a specific loan amount, subject to certain conditions.

What is the purpose of the Good Faith Estimate (GFE)?

+

The Good Faith Estimate (GFE) outlines the estimated costs associated with the mortgage, including interest rates, fees, and closing costs.

What is the difference between the Loan Estimate (LE) and the Closing Disclosure (CD)?

+

The Loan Estimate (LE) provides a comprehensive overview of the loan terms and costs, while the Closing Disclosure (CD) outlines the final terms and costs of the loan, provided at least three business days before closing.