Paperwork

Taxes Paperwork Needed

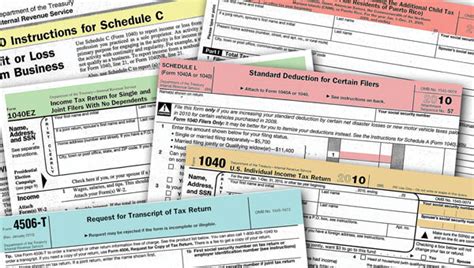

Understanding the Basics of Tax Paperwork

When it comes to handling taxes, one of the most daunting tasks for many individuals and businesses is navigating through the complex world of tax paperwork. The process involves gathering various documents, filling out forms, and ensuring that all information is accurate and submitted on time. Tax compliance is crucial to avoid any legal issues or financial penalties. In this article, we will delve into the essential paperwork needed for tax purposes, providing a comprehensive guide to simplify the process.

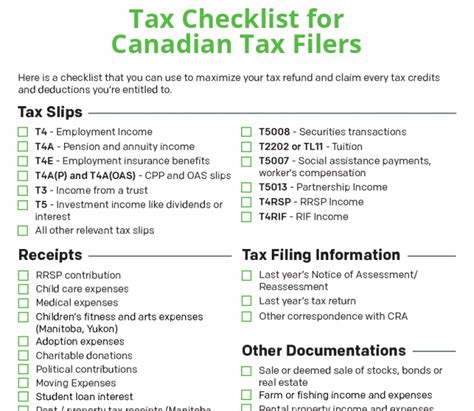

Personal Tax Paperwork

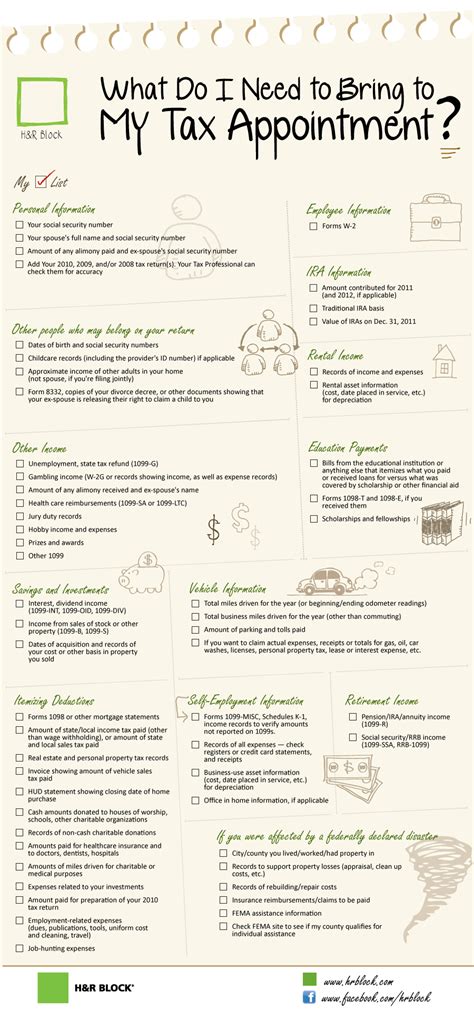

For individuals, the tax paperwork primarily revolves around income, deductions, and credits. Some of the key documents required include: - W-2 Forms: Provided by employers, these forms detail an individual’s income and the taxes withheld. - 1099 Forms: For those with freelance or contract work, these forms report income earned from sources other than employment. - Interest Statements (1099-INT): Banks and other financial institutions issue these for interest earned on accounts. - Dividend Statements (1099-DIV): Received for dividends earned from investments. - Charitable Donation Receipts: Necessary for claiming deductions on charitable contributions. - Medical Expense Records: For deducting medical expenses, keeping detailed records is essential.

Business Tax Paperwork

Businesses face a more complex landscape when it comes to tax paperwork. The necessary documents can vary significantly depending on the business type (sole proprietorship, partnership, corporation) and its operations. Key paperwork includes: - Business Income Statements: Detailing the business’s income and expenses. - Expense Records: Keeping track of all business expenses for deduction purposes. - Employment Tax Records: For businesses with employees, records of employment taxes withheld and paid are crucial. - Sales Tax Records: If applicable, businesses must keep records of sales tax collected and paid to the state.

Tax Deductions and Credits

Understanding what can be deducted or credited on a tax return is vital for minimizing tax liability. Tax deductions reduce taxable income, while tax credits directly reduce the amount of tax owed. Common deductions include: - Mortgage Interest: Homeowners can deduct the interest paid on their mortgage. - Business Use of Home: For those working from home, a portion of rent or mortgage interest and utilities can be deducted. - Education Expenses: Certain education expenses can be deducted or credited. - Child Care Credits: For working individuals, credits are available for child care expenses.

Tax Filing Options

The method of filing taxes can also impact the paperwork process. Options include: - E-filing: Electronic filing, which is faster and often more accurate than traditional paper filing. - Tax Preparation Software: Programs like TurboTax or H&R Block can guide individuals through the filing process and reduce errors. - Professional Tax Services: Hiring a tax professional can be beneficial for complex tax situations or for those who prefer expert handling of their tax affairs.

📝 Note: It's essential to keep all tax-related documents for at least three years in case of an audit.

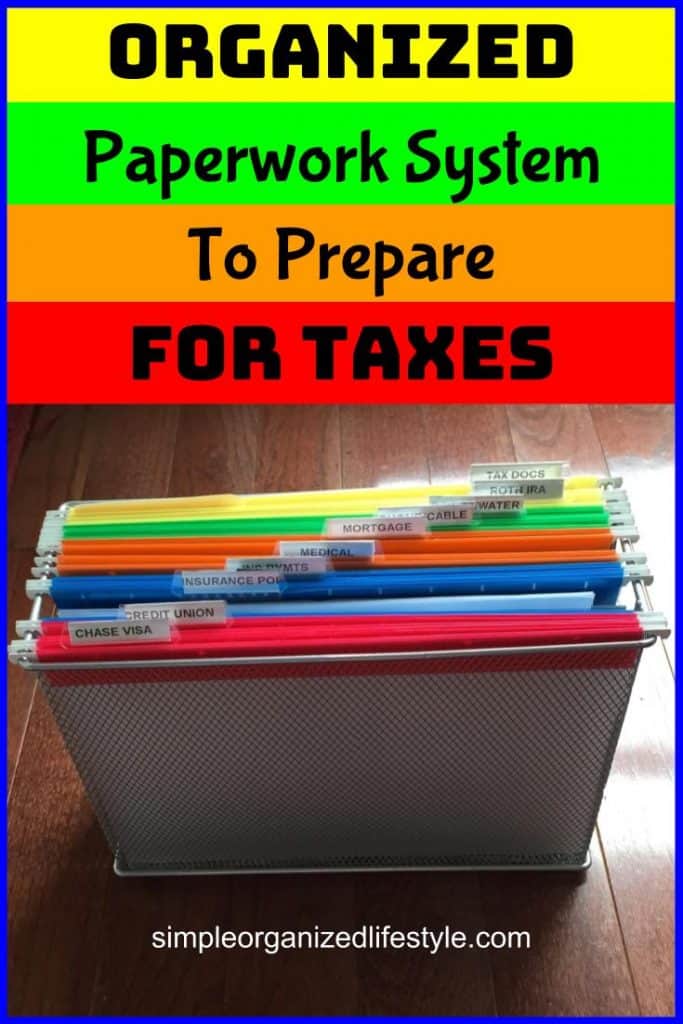

Organizing Tax Paperwork

Given the volume and variety of paperwork involved in tax preparation, organization is key. Using folders, both physical and digital, can help categorize and keep track of necessary documents. Creating a checklist of required paperwork can also ensure that nothing is overlooked.

Conclusion to Tax Paperwork Management

Managing tax paperwork effectively is about understanding what documents are needed, keeping them organized, and ensuring timely submission. By grasping the basics of personal and business tax paperwork, individuals and businesses can navigate the tax season with more ease, minimizing the risk of errors and maximizing their tax savings. Whether through personal management or with the help of a tax professional, the goal is to make the tax process as smooth and stress-free as possible.

What is the deadline for filing personal taxes?

+

The deadline for filing personal taxes typically falls on April 15th of each year, but it can vary if this date falls on a weekend or federal holiday.

Can I file my taxes electronically if I owe money?

+

Yes, you can file your taxes electronically even if you owe money. Electronic filing (e-filing) allows you to submit your tax return online and arrange for payment of any tax due.

How long should I keep my tax records?

+

It’s recommended to keep your tax records for at least three years from the date you filed your tax return. However, if you claim a loss from worthless securities or a bad debt deduction, you should keep records for seven years.