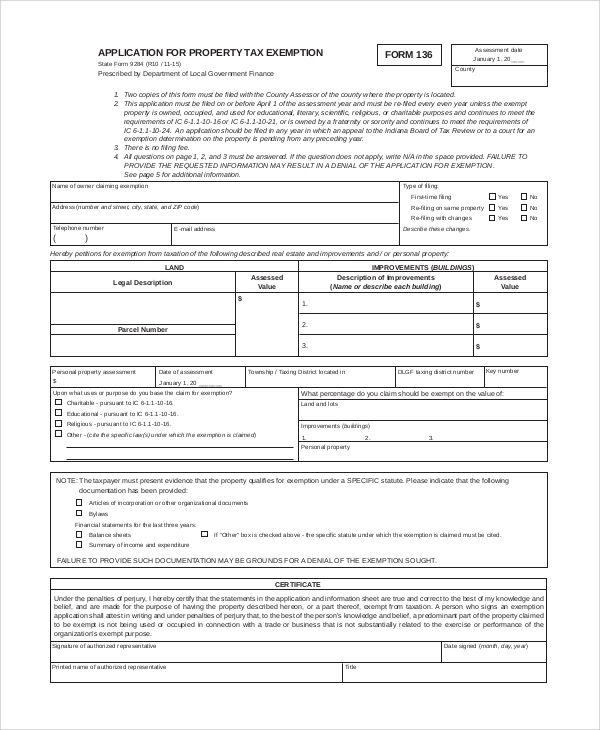

Taxes Paperwork Needed

Introduction to Tax Paperwork

When it comes to filing taxes, one of the most critical aspects is gathering all the necessary paperwork. This process can be overwhelming, especially for those who are new to filing taxes or have complex financial situations. Tax paperwork includes a variety of documents that provide information about your income, deductions, and credits, all of which are essential for accurately filling out your tax return. In this guide, we will walk through the essential documents and steps you need to take to ensure you have all the necessary paperwork for a smooth and stress-free tax filing experience.

Understanding Tax Paperwork Requirements

The type of tax paperwork you need can vary significantly depending on your employment status, income sources, and personal circumstances. For instance, if you are an employee, you will need a W-2 form from your employer, which details your income and the taxes withheld. On the other hand, if you are self-employed or have a side business, you will need to collect 1099 forms for each client that paid you $600 or more during the tax year. It’s also crucial to understand that deadline for tax filing is typically on April 15th, but this can vary if the date falls on a weekend or a federal holiday.

Gathering Essential Documents

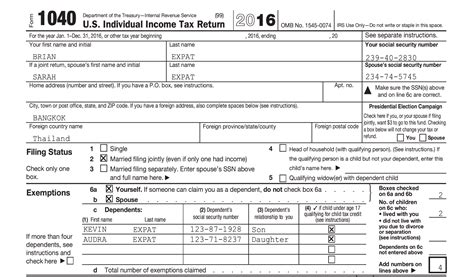

To ensure you have all the necessary paperwork, start by gathering the following essential documents: - Identification documents: This includes your Social Security number or Individual Taxpayer Identification Number (ITIN) for you, your spouse, and your dependents. - W-2 forms: From your employer, detailing your income and taxes withheld. - 1099 forms: For freelance work, contract jobs, or self-employment income. - Interest statements: Such as 1099-INT for interest earned on savings accounts and 1099-DIV for dividend income. - Charitable donation receipts: To claim deductions for your donations. - Medical expense receipts: For any out-of-pocket medical expenses that exceed a certain percentage of your adjusted gross income. - Business expense records: If you are self-employed, you’ll need records of business-related expenses to claim deductions.

Organizing Your Tax Paperwork

Once you have gathered all the necessary documents, the next step is to organize them in a way that makes sense for your tax preparation. You can categorize your documents into income, deductions, and credits. Using folders or digital files labeled with each category can help keep your paperwork tidy and easily accessible. It’s also a good idea to make digital copies of your documents and store them securely, in case the originals are lost or damaged.

📝 Note: Keeping your tax paperwork organized not only simplifies the filing process but also helps in case of an audit, where you may need to provide proof of income or expenses.

Completing Your Tax Return

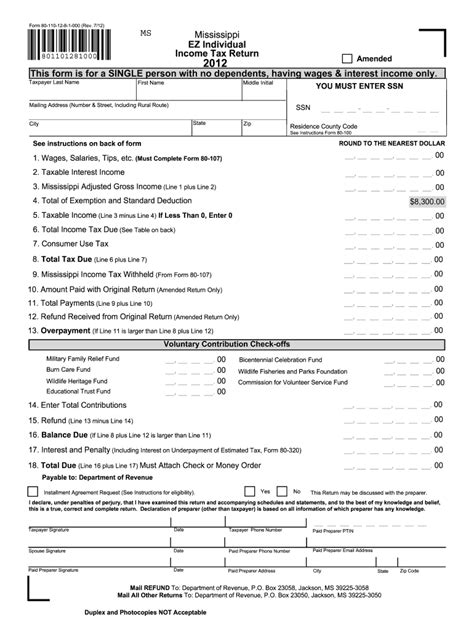

With all your paperwork in order, you can now proceed to fill out your tax return. You can choose to do this manually, using the forms provided by the IRS, or you can use tax preparation software that guides you through the process and checks for errors and potential deductions you might have missed. If your situation is complex or you are unsure about certain aspects, consider consulting a tax professional who can provide personalized advice and ensure your return is accurate and complete.

Submission and Follow-Up

After completing your tax return, the next step is to submit it to the IRS. You can do this electronically or by mail, depending on your preference and the complexity of your return. Electronic filing is generally faster and more secure, and you will typically receive confirmation that your return has been accepted within a day or two. If you are due a refund, you can expect to receive it within a few weeks after the IRS processes your return. It’s a good idea to track the status of your refund using the IRS’s online tool to stay informed about when you can expect to receive your refund.

| Type of Document | Description |

|---|---|

| W-2 | Employment income and taxes withheld |

| 1099 | Freelance, contract, or self-employment income |

| 1099-INT | Interest earned on savings accounts |

| 1099-DIV | Dividend income |

In summary, gathering and organizing the necessary paperwork is a critical step in the tax filing process. By understanding what documents you need, keeping them organized, and ensuring you have all the required information, you can make the process of filing your taxes much smoother and less stressful. Remember, accuracy and completeness are key to avoiding delays or issues with your tax return.

What is the deadline for filing taxes?

+

The deadline for filing taxes is typically on April 15th, but it can vary if this date falls on a weekend or a federal holiday.

Do I need to file taxes if I’m unemployed?

+

Whether you need to file taxes if you’re unemployed depends on your income level and personal circumstances. If you received unemployment benefits, you will need to report this income on your tax return.

How do I check the status of my tax refund?

+

You can check the status of your tax refund using the IRS’s online tool, “Where’s My Refund?” or by contacting the IRS directly.