5 Tax Papers Needed

Understanding the Importance of Tax Papers

When it comes to managing your finances, especially during tax season, having the right documents is crucial. These documents, often referred to as tax papers, are essential for filing your taxes accurately and efficiently. In this article, we will explore five key tax papers that you need to ensure you have a smooth and stress-free tax filing experience.

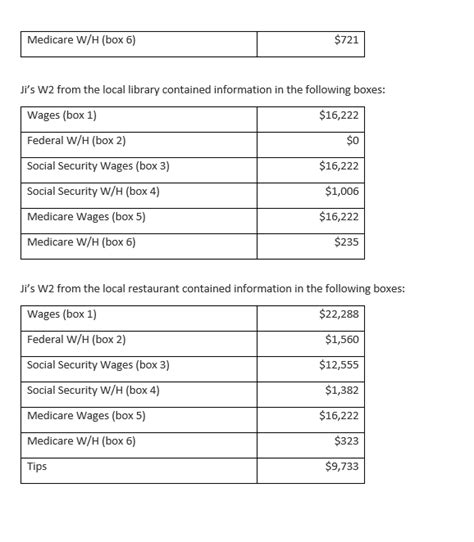

1. W-2 Form: Understanding Your Income

The W-2 form is one of the most critical tax papers you will receive. Issued by your employer, it outlines your annual income and the amount of taxes withheld from your paycheck. This form is vital for reporting your income to the IRS and calculating your tax liability. Ensure you receive a W-2 from each employer you worked for during the tax year, as you will need these to file your taxes.

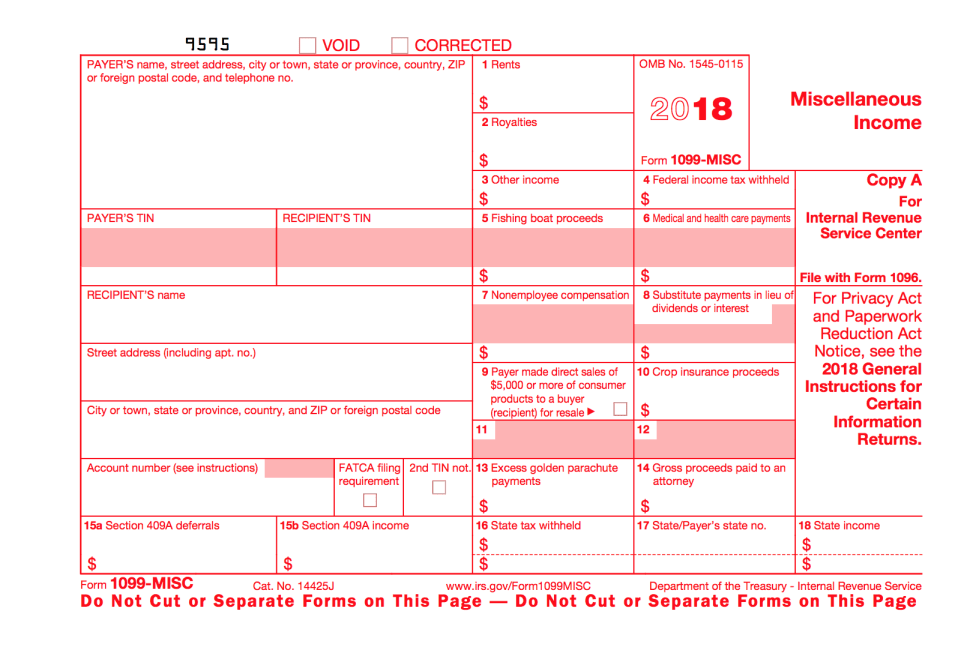

2. 1099 Forms: Reporting Miscellaneous Income

If you have engaged in freelance work, consulting, or any other form of self-employment, you will receive 1099 forms instead of, or in addition to, a W-2. The 1099 form reports the income you earned from these sources to the IRS. There are various types of 1099 forms, including the 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividend income. Accurately reporting this income is essential to avoid any discrepancies or audits.

3. Interest Statements (1099-INT): Tracking Your Investments

For individuals with savings accounts, bonds, or other investments, the 1099-INT form is crucial. This form reports the interest income you earned from these investments. Even if the amount is small, it is still considered taxable income and must be reported on your tax return. Banks and financial institutions are required to send you a 1099-INT by January 31st of each year if you earned more than $10 in interest.

4. Dividend Statements (1099-DIV): Understanding Investment Income

Similar to the 1099-INT, the 1099-DIV form reports the dividends you received from investments in stocks or mutual funds. Dividends are also considered taxable income and must be reported on your tax return. The 1099-DIV will detail the amount of dividends you received and any taxes withheld, making it easier to calculate your total taxable income.

5. Charitable Donation Receipts: Claiming Your Deductions

If you made charitable donations during the tax year, you may be eligible for a tax deduction. To claim this deduction, you need receipts from the charities you donated to. These receipts should include the name of the charity, the date of the donation, and the amount donated. Charitable donations can significantly reduce your taxable income, but without proper documentation, you may not be able to claim these deductions.

📝 Note: It's essential to keep all your tax papers organized and easily accessible. Consider digitizing your documents or using a secure filing system to protect your sensitive financial information.

In the process of gathering and organizing your tax papers, it’s also beneficial to understand how to use them effectively. Here are a few tips: - Accuracy is Key: Double-check all the information on your tax papers for accuracy. Mistakes can lead to delays or even audits. - Keep Them Organized: Use folders or digital tools to keep your tax papers organized. This makes it easier to find the documents you need when filing your taxes. - Understand What Each Form Means: Take some time to understand what each form represents and how it impacts your tax filing.

| Form Type | Description |

|---|---|

| W-2 | Reports income and taxes withheld from employment |

| 1099-MISC | Reports miscellaneous income (freelance, consulting, etc.) |

| 1099-INT | Reports interest income from savings and investments |

| 1099-DIV | Reports dividend income from stocks and mutual funds |

| Charitable Donation Receipts | Documents charitable donations for tax deduction purposes |

As you navigate the world of tax filing, remember that having the right documents is just the first step. Understanding how to use these documents to your advantage can make a significant difference in your tax outcome. By being informed and organized, you can ensure a smoother tax filing process and potentially maximize your refund.

In wrapping up, the key to a successful tax filing experience lies in preparation and understanding. By ensuring you have all the necessary tax papers and knowing how to utilize them, you set yourself up for success. This not only simplifies the tax filing process but also helps in avoiding potential issues with the IRS. With the right approach and knowledge, you can confidently navigate the complexities of tax season.

What is the deadline for receiving tax papers from employers and financial institutions?

+

Employers are required to provide W-2 forms to employees by January 31st of each year. Similarly, financial institutions must send 1099 forms to recipients by January 31st if the payment exceeds the threshold for reporting.

How do I report income from freelance work on my tax return?

+

You will receive a 1099-MISC form for freelance work. Report this income on your tax return using Schedule C (Form 1040), which is used for business income and expenses. You may also need to complete Schedule SE (Form 1040) to report self-employment tax.

Can I file my taxes without all the necessary tax papers?

+

While it’s possible to file for an extension if you’re missing tax papers, it’s not recommended to file your taxes without all the necessary documents. Missing or incorrect information can lead to delays, audits, or even penalties. Wait until you have all your tax papers or file Form 4868 for an automatic extension of time to file.