5 Tax Forms

Understanding Tax Forms: A Comprehensive Guide

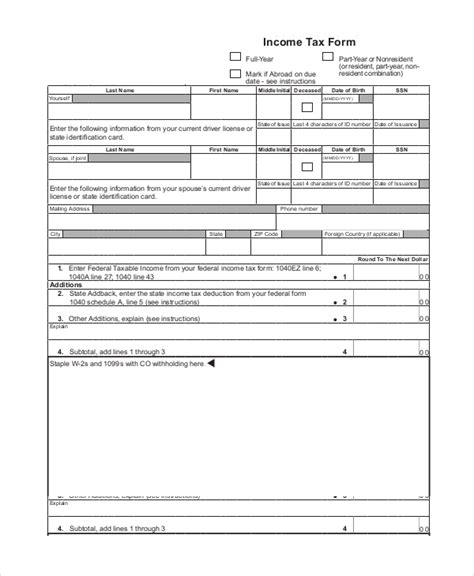

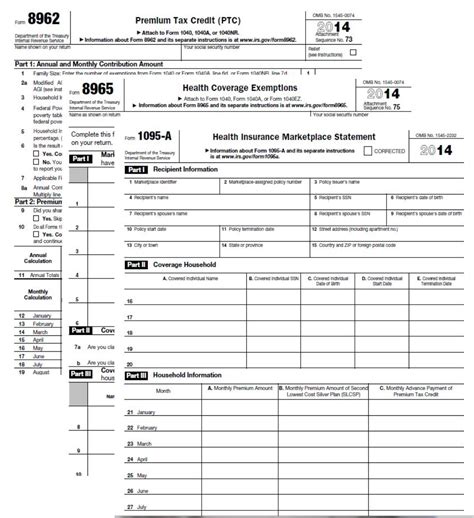

When it comes to filing taxes, individuals and businesses are required to submit various tax forms to the relevant authorities. These forms are used to report income, claim deductions, and pay taxes owed. In this article, we will delve into the world of tax forms, exploring the different types, their purposes, and the information required to complete them.

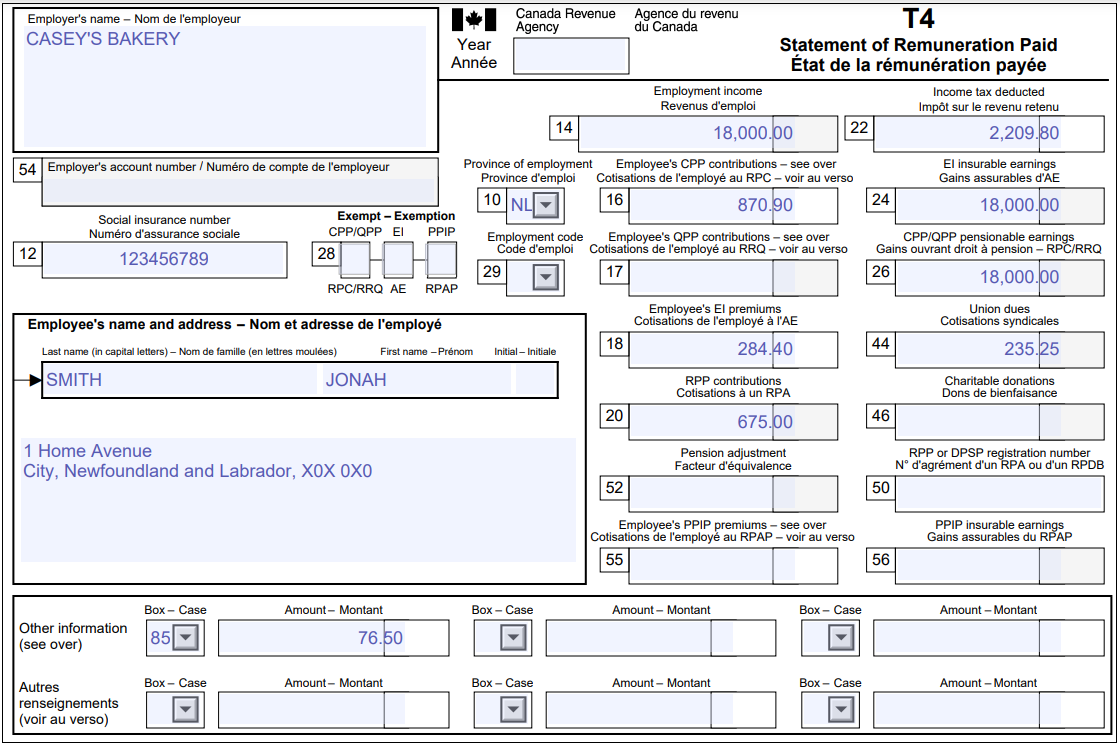

Type 1: W-2 Form

The W-2 form is one of the most common tax forms used by employers to report employee income and taxes withheld. This form is typically provided to employees by January 31st of each year and includes important information such as: * Employee name and address * Employer name and address * Employee Identification Number (EIN) * Wages, tips, and other compensation * Federal income tax withheld * Social Security tax withheld * Medicare tax withheld

Type 2: 1099 Form

The 1099 form is used to report various types of income, such as freelance work, interest, dividends, and capital gains. There are several types of 1099 forms, including: * 1099-MISC: used to report miscellaneous income, such as freelance work and rents * 1099-INT: used to report interest income * 1099-DIV: used to report dividend income * 1099-B: used to report capital gains and losses

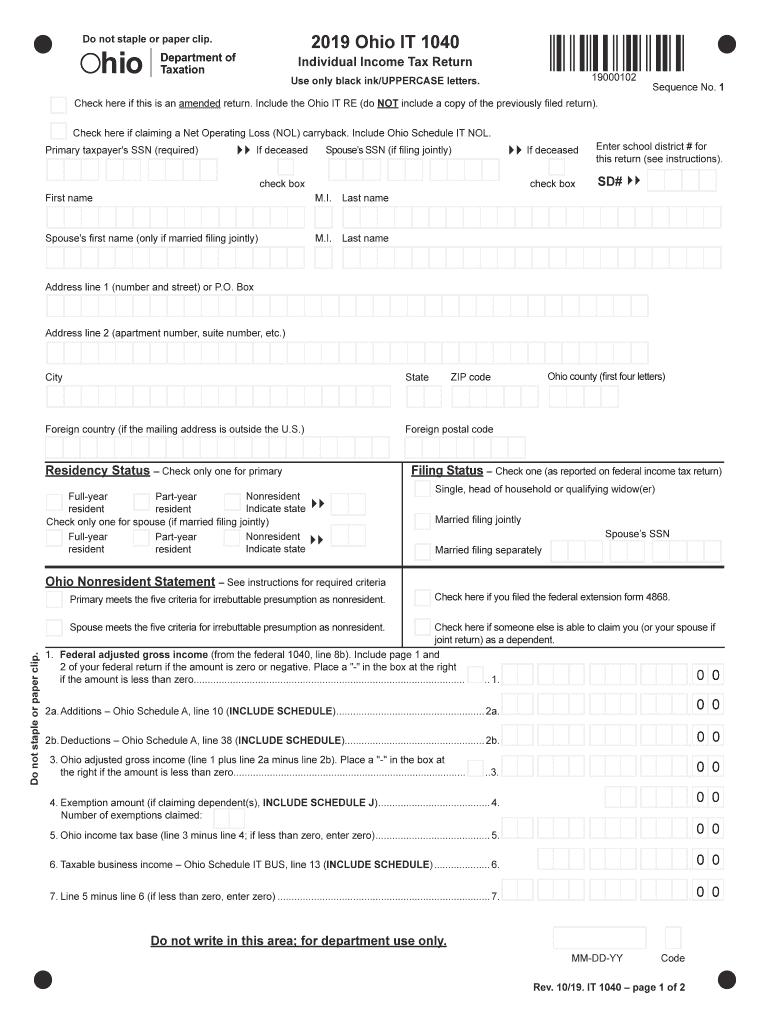

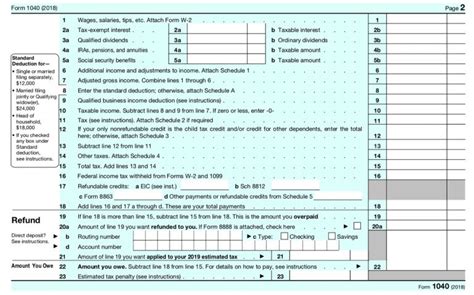

Type 3: 1040 Form

The 1040 form is the standard form used for personal income tax returns. This form is used to report income, claim deductions and credits, and calculate tax owed or refund due. The 1040 form includes several schedules and attachments, such as: * Schedule A: itemized deductions * Schedule B: interest and dividend income * Schedule C: business income and expenses * Schedule D: capital gains and losses

Type 4: Schedule C Form

The Schedule C form is used to report business income and expenses. This form is typically used by self-employed individuals and small business owners to calculate their business profit or loss. The Schedule C form includes sections for: * Business income * Cost of goods sold * Operating expenses * Depreciation and amortization * Business use of home

Type 5: 941 Form

The 941 form is used by employers to report employment taxes, including: * Federal income tax withheld * Social Security tax withheld * Medicare tax withheld * Federal unemployment tax (FUTA) This form is typically filed quarterly and is used to calculate the employer’s tax liability.

📝 Note: It is essential to accurately complete and submit tax forms to avoid penalties and delays in processing.

To illustrate the importance of tax forms, let’s consider an example. Suppose John is a freelance writer who earned $50,000 in income from various clients. He would receive a 1099-MISC form from each client, which he would use to report his income on his 1040 form. John would also need to complete a Schedule C form to calculate his business profit or loss and report his business expenses.

The following table summarizes the key tax forms discussed in this article:

| Form Name | Purpose |

|---|---|

| W-2 | Report employee income and taxes withheld |

| 1099 | Report various types of income |

| 1040 | Report personal income and calculate tax owed or refund due |

| Schedule C | Report business income and expenses |

| 941 | Report employment taxes |

In summary, tax forms are an essential part of the tax filing process. Understanding the different types of tax forms, their purposes, and the information required to complete them can help individuals and businesses navigate the complex world of taxation. By accurately completing and submitting tax forms, individuals and businesses can avoid penalties and delays in processing, ensuring a smooth and efficient tax filing experience.

What is the purpose of the W-2 form?

+

The W-2 form is used to report employee income and taxes withheld.

What types of income are reported on the 1099 form?

+

The 1099 form is used to report various types of income, such as freelance work, interest, dividends, and capital gains.

What is the purpose of the Schedule C form?

+

The Schedule C form is used to report business income and expenses.