Manage Your Property Tax Paperwork

Introduction to Property Tax Paperwork

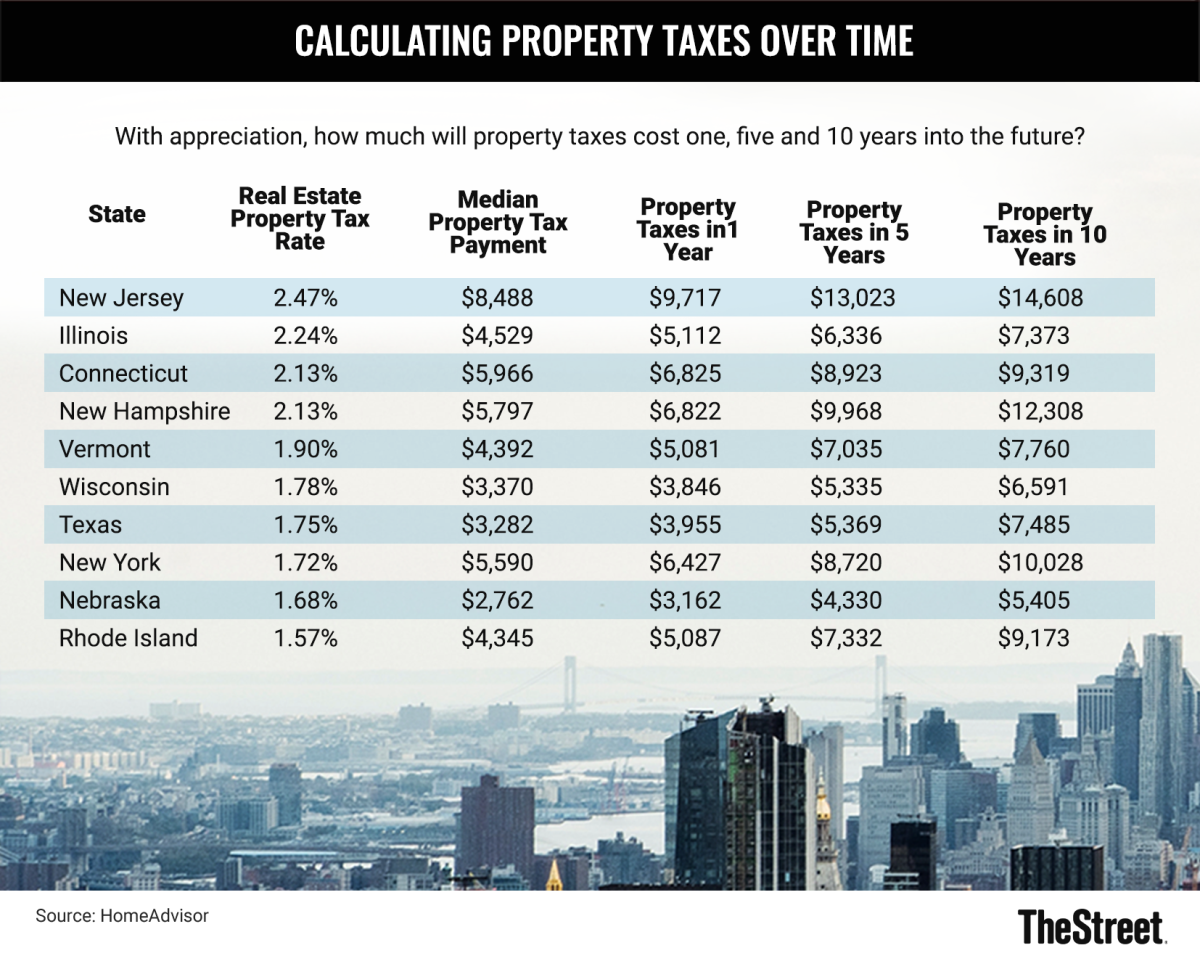

Managing your property tax paperwork can be a daunting task, especially for those who are new to homeownership or have never had to deal with tax-related documents before. Property taxes are a crucial part of owning a home, and it’s essential to stay on top of your paperwork to avoid any potential issues or penalties. In this article, we’ll guide you through the process of managing your property tax paperwork, including what documents you need to keep track of, how to organize them, and what to do if you encounter any problems.

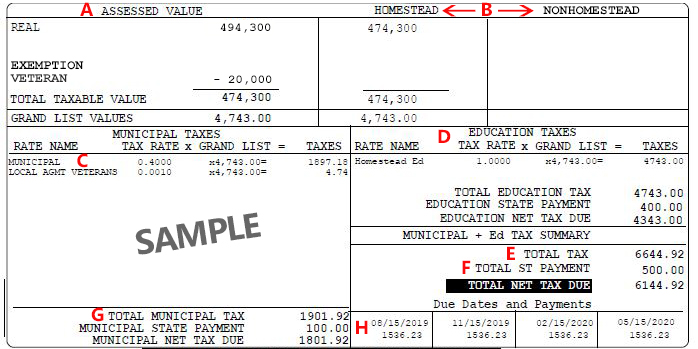

Understanding Your Property Tax Documents

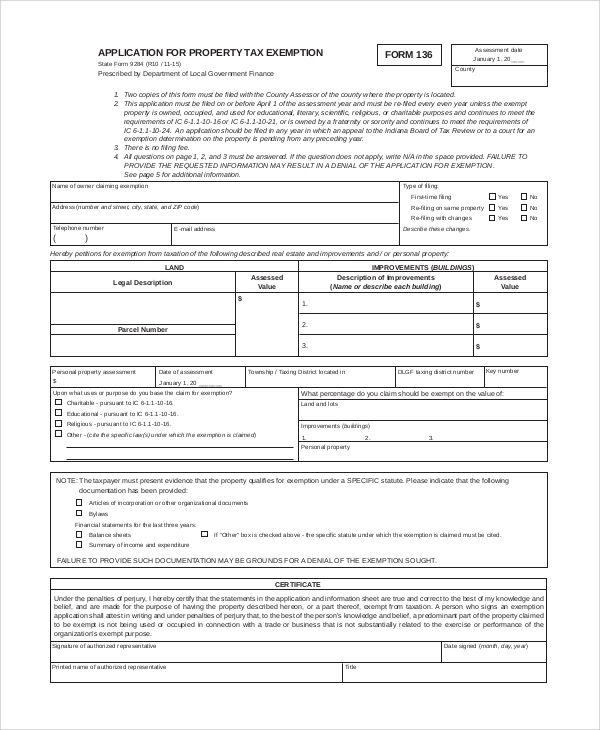

When it comes to property tax paperwork, there are several documents you’ll need to be familiar with. These include: * Property tax bills: These are the annual statements that outline the amount of taxes you owe on your property. * Assessment notices: These notices inform you of the value of your property, which is used to calculate your property taxes. * Exemption applications: If you’re eligible for any tax exemptions, such as a homestead exemption, you’ll need to fill out an application and submit it to your local tax authority. * Payment receipts: Keep track of your payment receipts to ensure you have a record of all payments made.

Organizing Your Property Tax Paperwork

To manage your property tax paperwork effectively, it’s crucial to have a system in place for organizing your documents. Here are some tips to help you get started: * Create a dedicated file folder for your property tax documents, where you can store all relevant paperwork. * Set up a digital filing system, such as a cloud-based storage service, to store electronic copies of your documents. * Consider using a spreadsheet to track your payments, exemptions, and other important details.

| Document Type | Description |

|---|---|

| Property Tax Bill | Annual statement outlining the amount of taxes owed |

| Assessment Notice | Notice informing you of the value of your property |

| Exemption Application | Application for tax exemptions, such as homestead exemption |

| Payment Receipt | Record of payments made |

Common Challenges and Solutions

When managing your property tax paperwork, you may encounter some common challenges. Here are some potential issues and solutions: * Missing documents: If you’re missing a document, such as a property tax bill, contact your local tax authority to request a duplicate copy. * Incorrect assessments: If you disagree with your property assessment, you can appeal the decision by submitting a formal appeal to your local tax authority. * Payment issues: If you’re having trouble making payments, consider setting up a payment plan with your local tax authority.

📝 Note: Keep all correspondence with your local tax authority, including emails, letters, and phone calls, as these can be useful in resolving any disputes or issues that may arise.

Best Practices for Managing Your Property Tax Paperwork

To ensure you’re managing your property tax paperwork effectively, follow these best practices: * Stay organized: Keep all your documents in one place, and consider using a digital filing system to store electronic copies. * Review your documents regularly: Regularly review your property tax documents to ensure you’re aware of any changes or updates. * Seek professional help: If you’re unsure about any aspect of your property tax paperwork, consider seeking the help of a tax professional.

As you can see, managing your property tax paperwork requires attention to detail and a systematic approach. By following the tips and best practices outlined in this article, you’ll be well on your way to staying on top of your property tax paperwork and avoiding any potential issues or penalties. In the end, it’s all about being proactive and taking control of your property tax situation, which will help you save time, money, and stress in the long run.

What is a property tax bill?

+

A property tax bill is an annual statement that outlines the amount of taxes you owe on your property.

How do I appeal a property assessment?

+

If you disagree with your property assessment, you can appeal the decision by submitting a formal appeal to your local tax authority.

What is a homestead exemption?

+

A homestead exemption is a tax exemption that reduces the amount of property taxes you owe on your primary residence.