Corporation Paperwork Requirements

Understanding Corporation Paperwork Requirements

When it comes to establishing and maintaining a corporation, there are numerous paperwork requirements that must be fulfilled. These requirements vary by jurisdiction and are designed to ensure that corporations operate transparently and in compliance with relevant laws and regulations. In this blog post, we will delve into the world of corporation paperwork requirements, exploring the key documents and filings necessary for incorporation, ongoing compliance, and special circumstances.

Initial Incorporation Documents

To form a corporation, several initial documents must be prepared and filed with the relevant state or federal authorities. These documents typically include:

- Articles of Incorporation: This document, also known as a Certificate of Incorporation, provides fundamental information about the corporation, such as its name, purpose, structure, and the number of shares it is authorized to issue.

- Bylaws: While not always required to be filed with the state, bylaws are essential internal documents that outline the rules and procedures for the corporation’s governance, including the roles of directors and officers, meeting procedures, and shareholder rights.

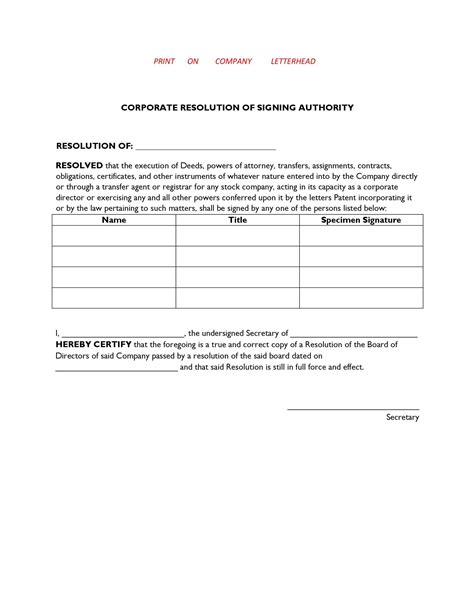

- Organizational Meeting Minutes: After incorporation, the initial directors or incorporators must hold an organizational meeting to adopt bylaws, elect officers, and authorize the issuance of stock. The minutes of this meeting are crucial for documenting these actions.

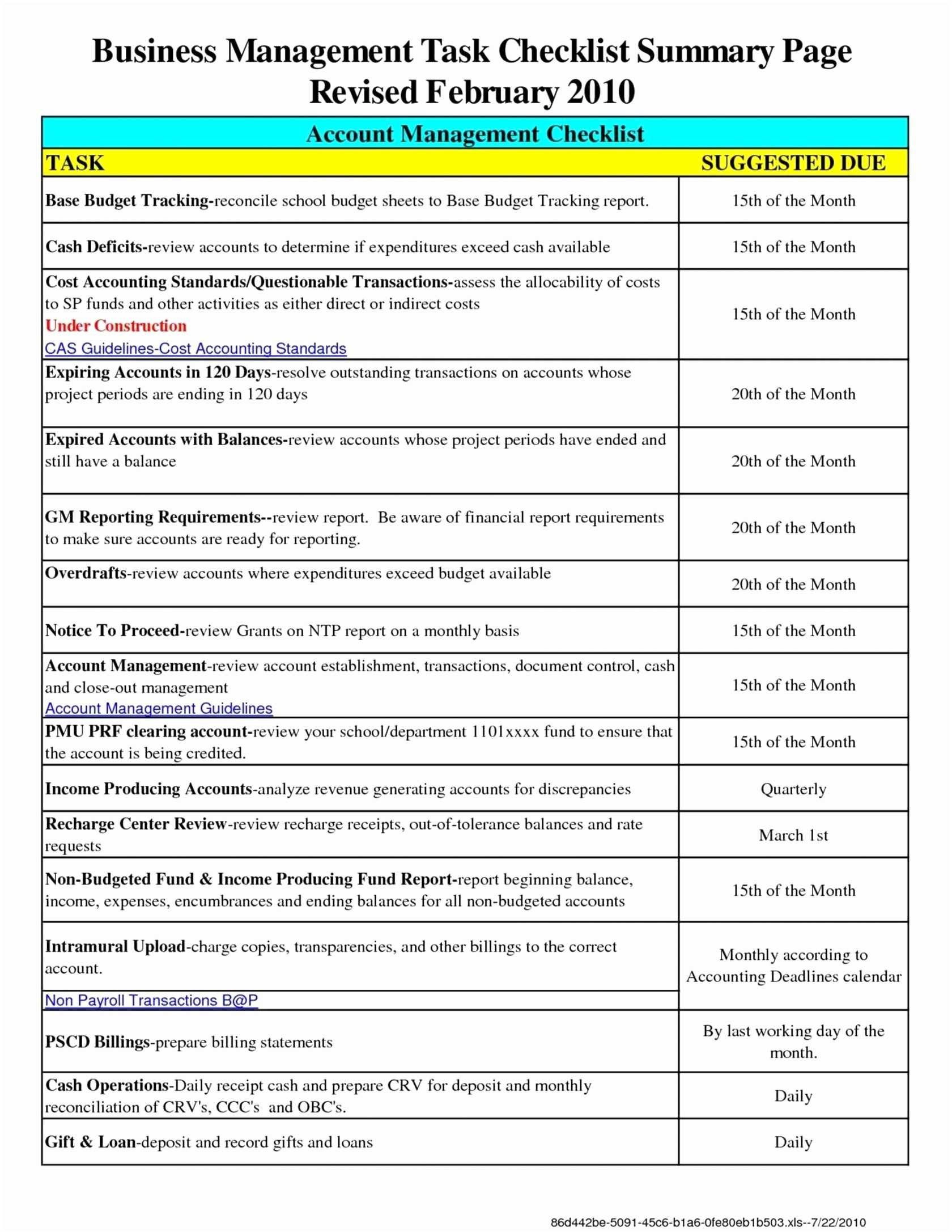

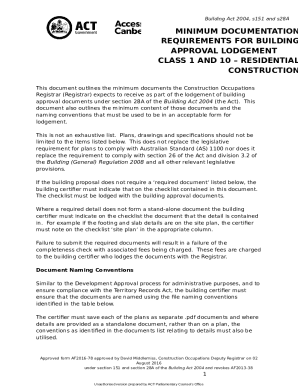

Ongoing Compliance Filings

Beyond the initial incorporation phase, corporations must comply with ongoing filing requirements to maintain their good standing and avoid penalties or dissolution. These filings may include:

- Annual Reports: Most states require corporations to file annual reports, which provide updated information on the corporation’s address, officers, directors, and other key details.

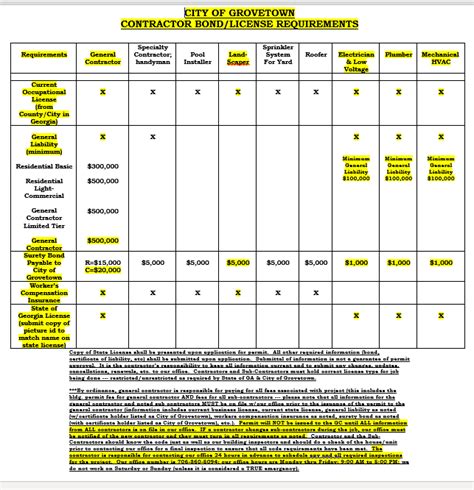

- Business Licenses and Permits: Depending on the nature of the business and its location, corporations may need to obtain and renew various licenses and permits to operate legally.

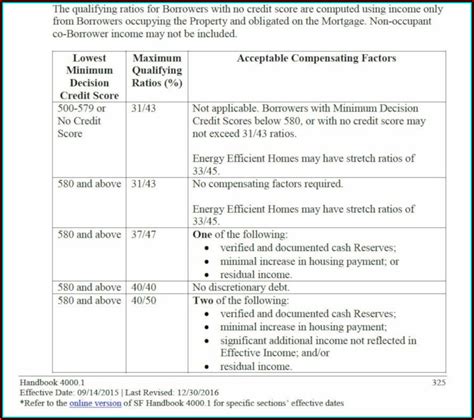

- Tax Filings: Corporations must file tax returns with federal, state, and local tax authorities, reporting their income, deductions, and tax liabilities.

Special Circumstances and Filings

In addition to routine filings, corporations may encounter special circumstances that require additional paperwork and compliance measures. These situations include:

- Mergers and Acquisitions: When corporations merge with or acquire other businesses, they must file specific documents with the state and may need to obtain shareholder approval.

- Amendments to Articles of Incorporation: If a corporation wishes to change its name, purpose, or other fundamental aspects, it must file amendments to its articles of incorporation with the state.

- Dissolution: When a corporation decides to dissolve, it must file articles of dissolution and follow a specific process to wind down its operations, pay off creditors, and distribute assets to shareholders.

📝 Note: The specific paperwork requirements for corporations can vary significantly depending on the jurisdiction, so it's essential to consult with legal and financial advisors to ensure compliance with all applicable laws and regulations.

Table of Key Corporation Paperwork Requirements

| Document/Filing | Description | Frequency |

|---|---|---|

| Articles of Incorporation | Initial incorporation document | One-time |

| Bylaws | Internal governance document | One-time (unless amended) |

| Annual Reports | Ongoing compliance filing | Annually |

| Tax Filings | Tax returns and reports | Annually (or as required by tax authorities) |

To summarize the key points, corporations face a range of paperwork requirements, from initial incorporation documents like articles of incorporation and bylaws, to ongoing compliance filings such as annual reports and tax filings. Special circumstances, including mergers, amendments, and dissolution, also necessitate specific paperwork and procedures. Understanding and adhering to these requirements is crucial for maintaining good standing, avoiding penalties, and ensuring the long-term success of the corporation.

What are the primary documents required for incorporating a business?

+

The primary documents required for incorporating a business typically include Articles of Incorporation, Bylaws, and Organizational Meeting Minutes. These documents provide the foundation for the corporation’s structure, governance, and operations.

How often must corporations file annual reports?

+

Most states require corporations to file annual reports on an annual basis. The specific due date for these reports varies by jurisdiction, so it’s essential for corporations to check with their state’s business registration office for exact requirements.

What happens if a corporation fails to comply with paperwork requirements?

+

If a corporation fails to comply with paperwork requirements, it may face penalties, fines, or even dissolution. Non-compliance can also lead to loss of good standing, which can impact the corporation’s ability to conduct business and access credit.