LLC Paperwork Requirements

Introduction to LLC Paperwork Requirements

Forming a Limited Liability Company (LLC) is a significant step for any entrepreneur or business owner, as it provides personal liability protection and tax benefits. However, the process involves various legal and regulatory requirements, particularly when it comes to paperwork. Understanding these LLC paperwork requirements is crucial for a smooth and compliant setup of your business. In this comprehensive guide, we will delve into the details of the necessary paperwork, the process of filing, and other essential considerations for establishing an LLC.

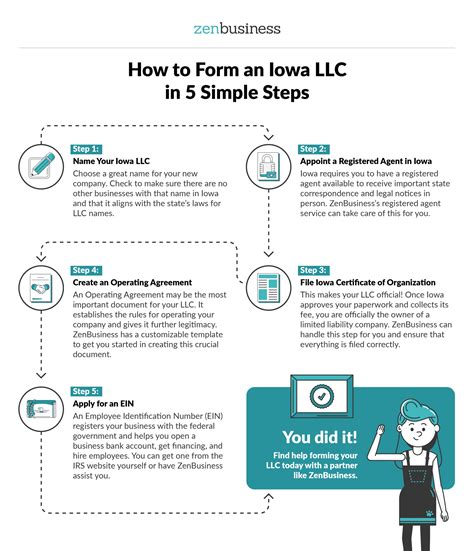

Choosing the Business Name

Before diving into the paperwork, one of the initial steps is choosing a unique and compliant business name for your LLC. The name must include the phrase “Limited Liability Company” or an abbreviation like “LLC” or “L.L.C.” It’s also important to ensure that the name is not already in use by another business in your state. You can check the availability of your desired business name through your state’s business database. Reserving a business name can be done in many states, which holds the name for a certain period, usually 30 to 120 days, giving you time to prepare your other paperwork.

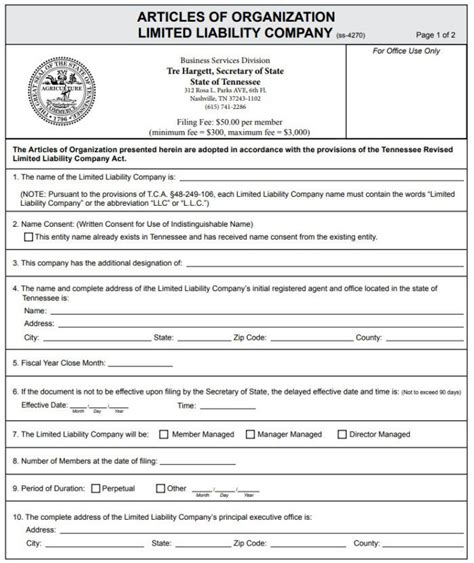

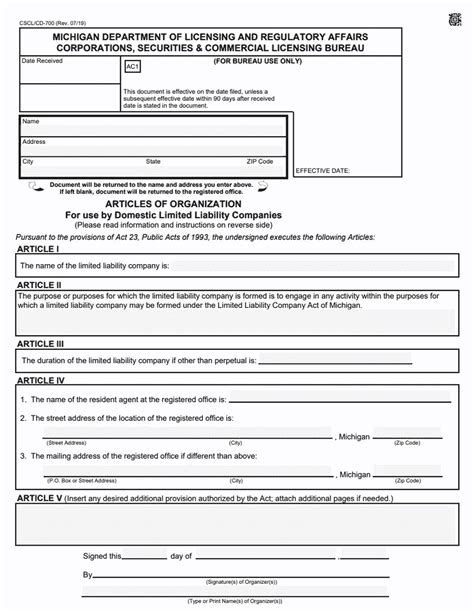

Articles of Organization

The primary document for forming an LLC is the Articles of Organization, which must be filed with the state’s business registration office, often the Secretary of State. This document typically includes: - The LLC’s name and address - The purpose of the LLC (which can be broad to allow for flexibility) - The name and address of the registered agent - The management structure (member-managed or manager-managed) - The duration of the LLC (if not perpetual)

Filing the Articles of Organization is a critical step, as it officially creates the LLC. The filing fee varies by state, ranging from 50 to 500 or more.

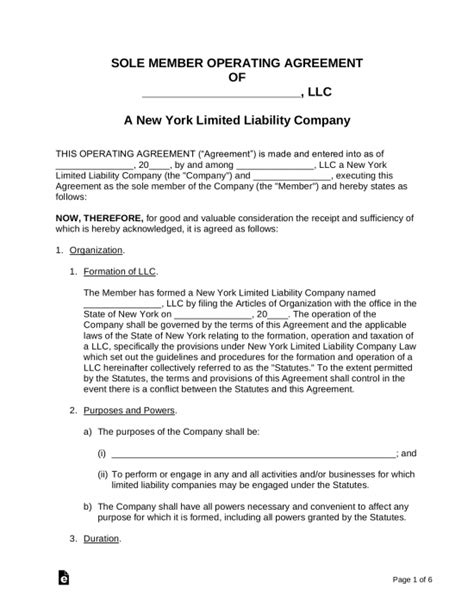

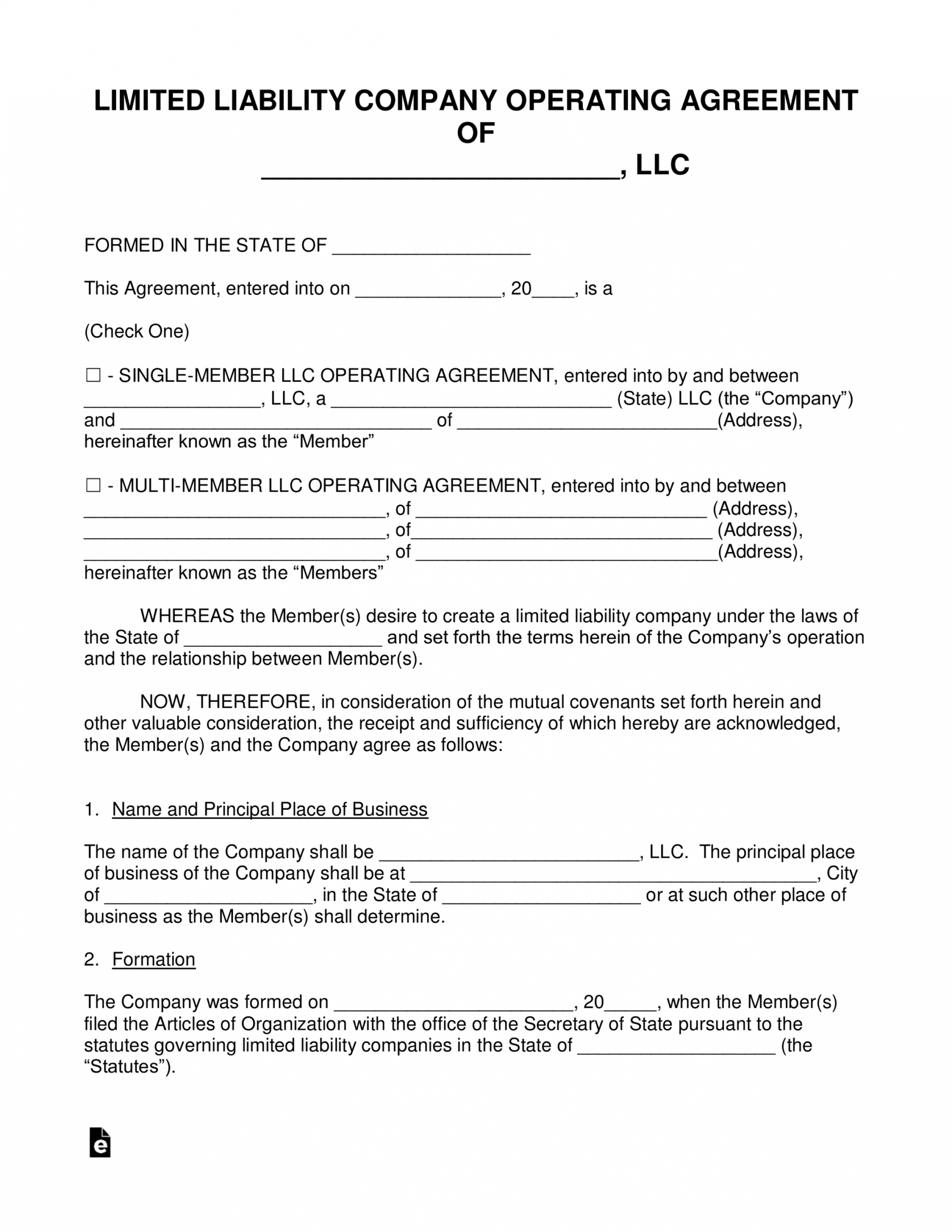

Operating Agreement

Although not always required by the state, an Operating Agreement is a vital internal document that outlines the ownership and operating structure of the LLC. It should include: - Ownership percentages - Roles and responsibilities of members and managers - How profits and losses are distributed - The process for making decisions - Buyout and dissolution procedures

Having a comprehensive Operating Agreement helps prevent disputes and ensures that all members are on the same page regarding the management and operation of the LLC.

Obtaining an EIN

An Employer Identification Number (EIN) is necessary for tax purposes and to open a business bank account. You can apply for an EIN through the IRS website, and it’s usually processed immediately. The EIN is used to: - File taxes - Open business bank accounts - Hire employees

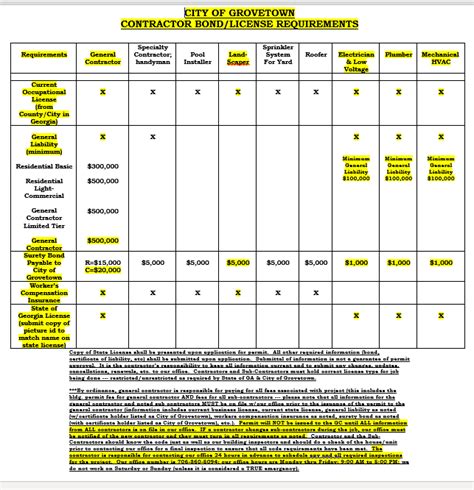

Business Licenses and Permits

Depending on the type of business and its location, you may need to obtain business licenses and permits. These can be federal, state, or local and are required for various activities, such as selling products, practicing a profession, or operating in specific industries.

Annual Reports

Most states require LLCs to file annual reports, which help the state keep up-to-date information about the company. These reports typically include: - The LLC’s name and business address - The name and address of the registered agent - The names and addresses of the members or managers

Filing annual reports is crucial for maintaining the LLC’s good standing and avoiding dissolution.

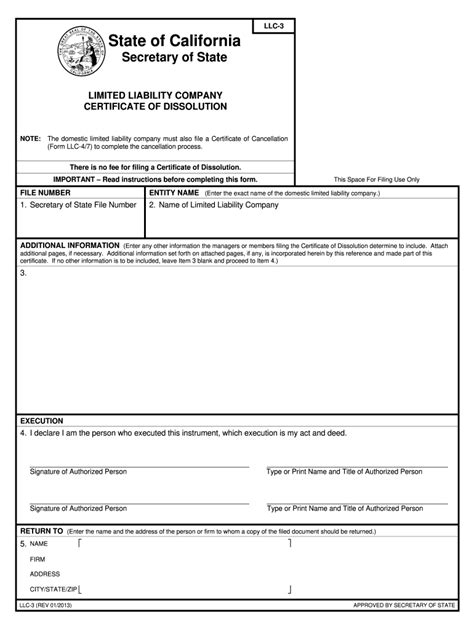

Other Paperwork Considerations

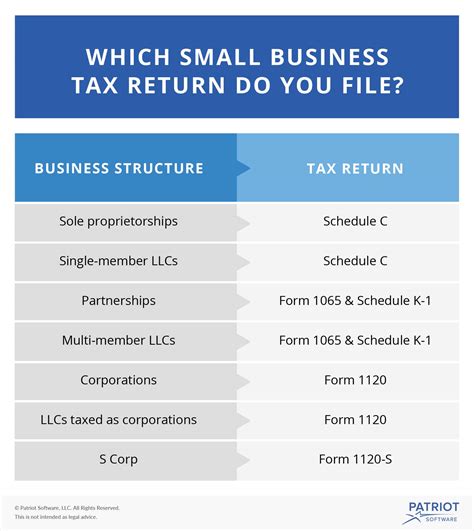

In addition to the aforementioned paperwork, there are other considerations, such as: - Compliance with tax laws: Understanding your tax obligations, including annual tax returns and potential quarterly estimated tax payments. - Maintaining a business bank account: Separating personal and business finances for clarity and protection. - Securing insurance: Considering liability insurance and other types of business insurance to protect against risks.

💡 Note: It's essential to stay organized and keep detailed records of all your LLC's paperwork and filings to ensure compliance and ease of access when needed.

Conclusion and Final Thoughts

In conclusion, forming an LLC involves a range of paperwork and legal requirements that must be carefully navigated. From choosing a compliant business name and filing the Articles of Organization to maintaining annual reports and securing necessary licenses, each step is crucial for establishing and running a successful LLC. By understanding and fulfilling these LLC paperwork requirements, you can ensure your business is set up for success and protected from potential legal and financial risks.

What is the main purpose of filing Articles of Organization?

+

The main purpose of filing Articles of Organization is to officially create the LLC with the state, providing the necessary information about the company’s name, purpose, management structure, and other critical details.

Why is an Operating Agreement important even if it’s not required by the state?

+

An Operating Agreement is important because it outlines the internal workings of the LLC, including ownership, management, and decision-making processes, which helps prevent disputes among members and ensures smooth operation.

What are the consequences of not filing annual reports as required?

+

Failing to file annual reports can lead to the LLC being dissolved or losing its good standing with the state, which can result in additional fees, penalties, and potential legal issues.