5 Times Drop Retirement Paperwork

Understanding the Importance of Retirement Paperwork

When it comes to planning for retirement, there are numerous factors to consider, and one of the most critical aspects is handling the necessary paperwork. Retirement paperwork can be overwhelming, with various documents and forms that need to be filled out and submitted on time. Failure to do so can result in delays, penalties, or even loss of benefits. In this article, we will discuss the top 5 times when dropping retirement paperwork can have significant consequences and provide guidance on how to navigate these situations.

1. Missing the Deadline for Retirement Account Contributions

One of the most common mistakes people make when it comes to retirement paperwork is missing the deadline for contributing to their retirement accounts. The Internal Revenue Service (IRS) sets specific deadlines for contributing to 401(k), IRA, and other retirement accounts. If you fail to contribute to your account by the deadline, you may miss out on the opportunity to reduce your taxable income for the year, which can result in a higher tax bill. Additionally, you may also forfeit any employer matching contributions, which can significantly impact your retirement savings over time.

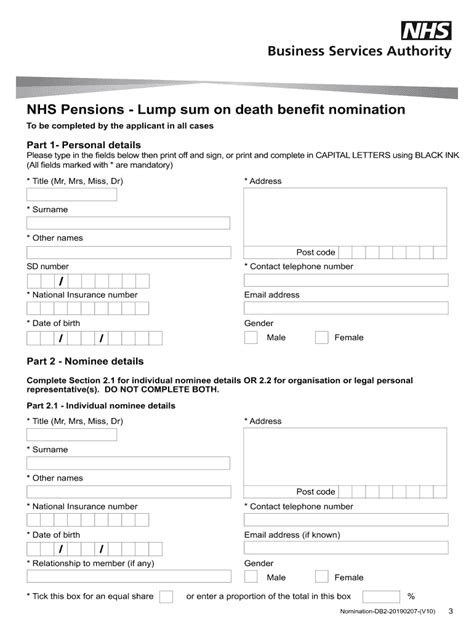

2. Failing to Update Beneficiary Designations

Another critical aspect of retirement paperwork is updating beneficiary designations. When you open a retirement account, you are typically required to designate a beneficiary who will receive the funds in the event of your passing. However, it is essential to review and update your beneficiary designations periodically, especially after major life events such as marriage, divorce, or the birth of a child. If you fail to update your beneficiary designations, your retirement funds may not be distributed according to your wishes, which can lead to disputes and legal issues.

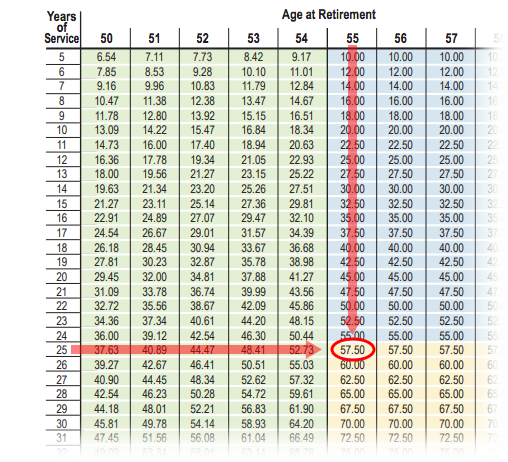

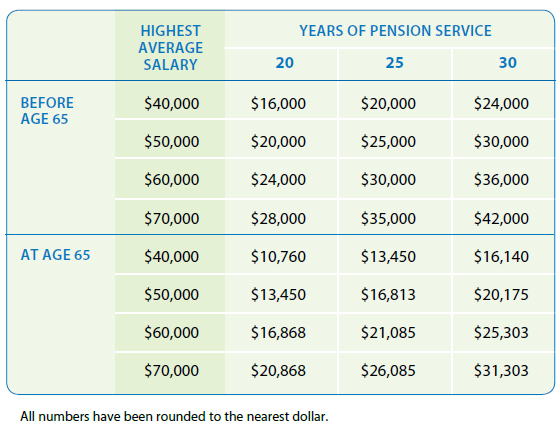

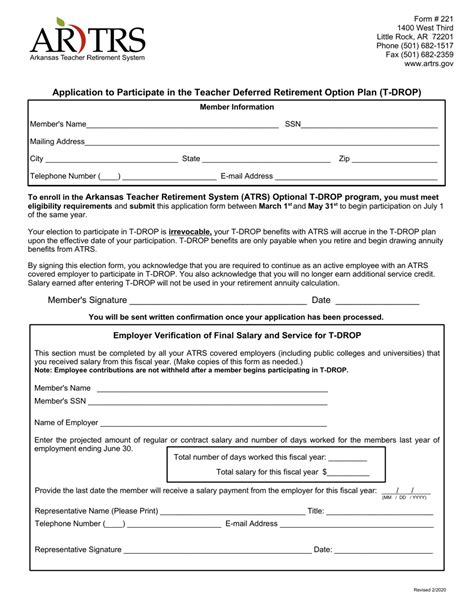

3. Not Submitting Required Minimum Distribution (RMD) Forms

Once you reach age 72, you are required to take Required Minimum Distributions (RMDs) from your traditional IRA or 401(k) accounts. To do this, you must submit the necessary forms to your account administrator by the deadline, which is typically December 31st of each year. If you fail to submit the RMD forms or take the required distribution, you may be subject to a 50% penalty on the amount that should have been withdrawn, as well as potential taxes on the distribution.

4. Missing the Deadline for Rolling Over a Retirement Account

When you leave a job or retire, you may need to roll over your retirement account to a new employer or an IRA. The IRS sets a 60-day deadline for rolling over a retirement account, and if you miss this deadline, you may be subject to taxes and penalties on the distribution. Additionally, you may also be required to pay a 10% early withdrawal penalty if you are under age 59 1⁄2.

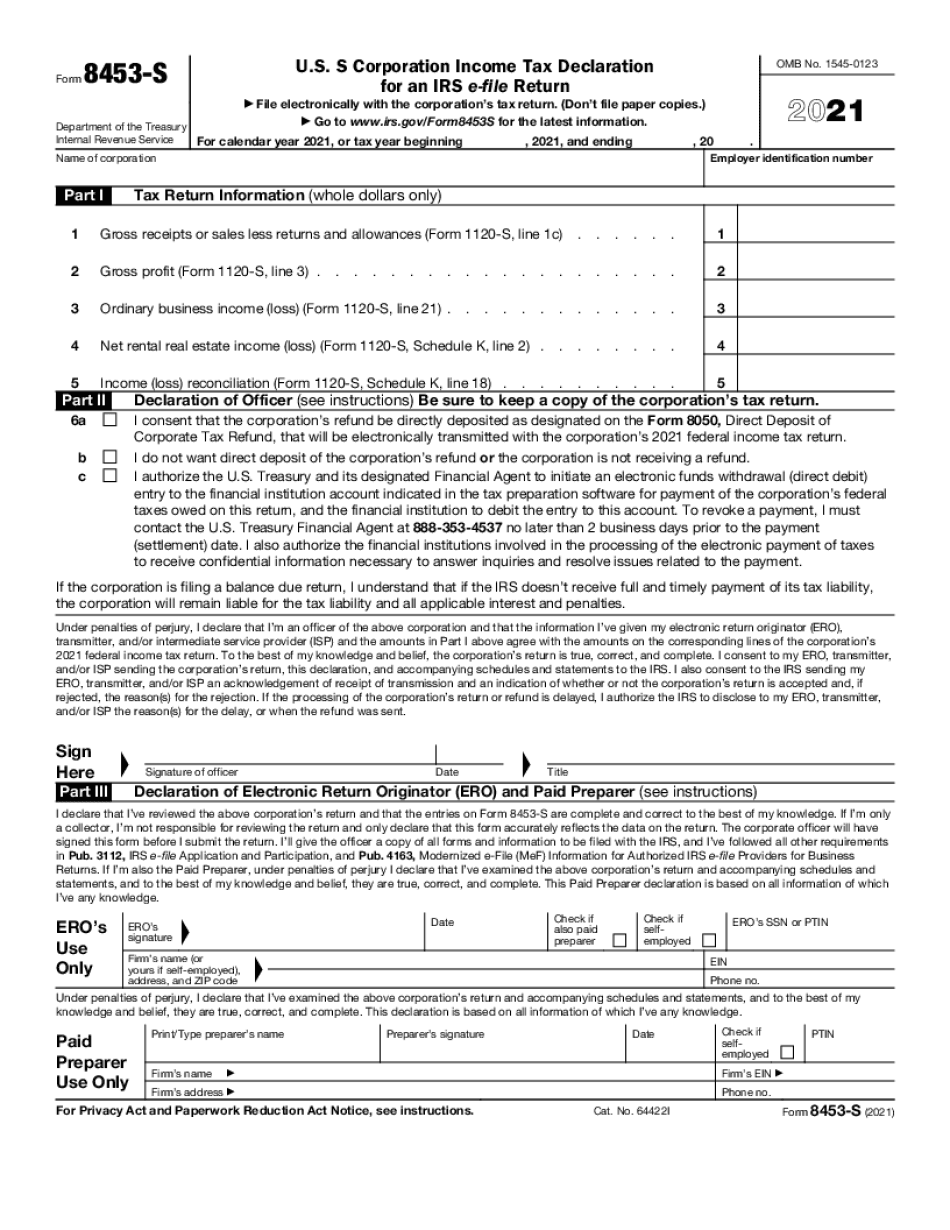

5. Failing to Keep Accurate Records of Retirement Income

Finally, it is essential to keep accurate records of your retirement income, including forms and statements from your account administrator. The IRS requires you to report your retirement income on your tax return, and if you fail to keep accurate records, you may be subject to audits or penalties. Additionally, you may also need to provide documentation to support your retirement income when applying for loans or other benefits.

📝 Note: It is crucial to keep accurate records of your retirement paperwork, including deadlines, forms, and statements, to avoid any potential consequences or penalties.

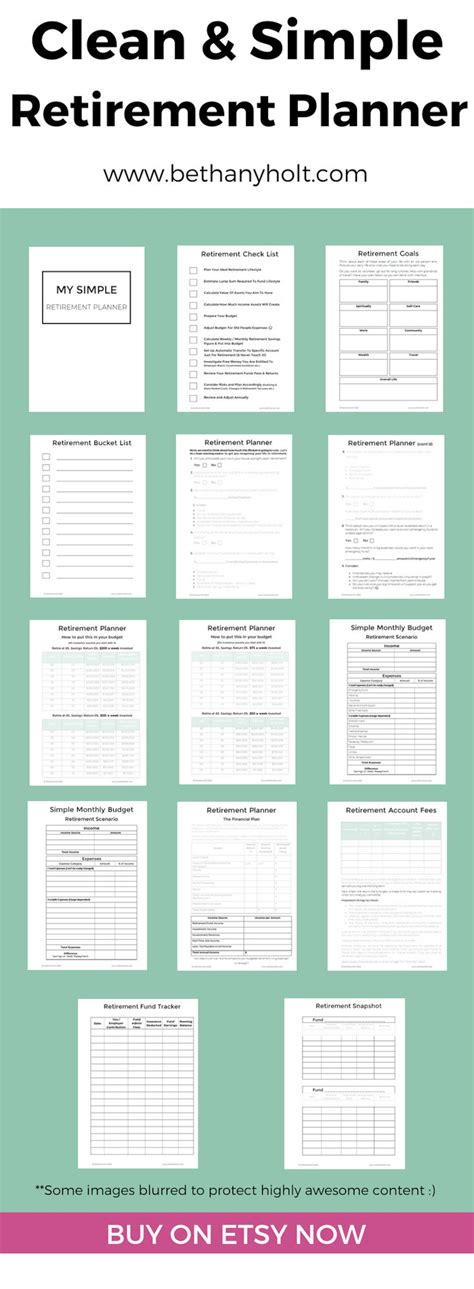

To avoid these common mistakes, it is essential to stay organized and keep track of your retirement paperwork. Here are some tips to help you navigate the process: * Create a calendar or spreadsheet to track deadlines and important dates * Keep accurate records of your retirement income and expenses * Review and update your beneficiary designations periodically * Consult with a financial advisor or tax professional if you have questions or concerns * Take advantage of online resources and tools to help you manage your retirement accounts

| Retirement Account | Deadline | Penalty for Missing Deadline |

|---|---|---|

| 401(k) Contributions | December 31st | Loss of employer matching contributions |

| IRA Contributions | April 15th | Loss of tax deduction |

| RMD Forms | December 31st | 50% penalty on RMD amount |

| Rolling Over a Retirement Account | 60 days | Taxes and penalties on distribution |

In summary, dropping retirement paperwork can have significant consequences, including missing deadlines, penalties, and loss of benefits. By staying organized, keeping accurate records, and seeking professional advice when needed, you can avoid these common mistakes and ensure a smooth transition into retirement. Ultimately, taking control of your retirement paperwork will give you peace of mind and help you achieve your long-term financial goals.

What is the deadline for contributing to a 401(k) account?

+

The deadline for contributing to a 401(k) account is December 31st of each year.

What happens if I miss the deadline for taking a Required Minimum Distribution (RMD)?

+

If you miss the deadline for taking an RMD, you may be subject to a 50% penalty on the amount that should have been withdrawn, as well as potential taxes on the distribution.

How often should I review and update my beneficiary designations?

+

You should review and update your beneficiary designations periodically, especially after major life events such as marriage, divorce, or the birth of a child.