5 Ways to Void Due Dates

Introduction to Voiding Due Dates

Voiding due dates can be a complex and sensitive topic, especially when it comes to legal, financial, or personal obligations. Understanding the implications and procedures for voiding due dates is crucial to avoid any potential penalties or consequences. In this article, we will explore five ways to void due dates, highlighting the importance of careful consideration and adherence to specific guidelines.

Understanding Due Dates

Before diving into the methods of voiding due dates, it’s essential to comprehend what due dates represent. A due date is a specified deadline by which an action, payment, or task must be completed. Due dates can be found in various aspects of life, including bill payments, contract agreements, and project deadlines. Missing a due date can lead to severe repercussions, such as late fees, penalties, or even legal actions.

5 Ways to Void Due Dates

Here are five possible ways to void due dates, depending on the context and circumstances:

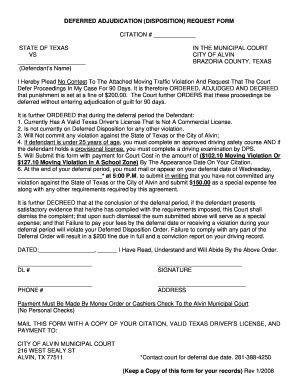

- Negotiation: In some cases, it’s possible to negotiate a new due date or an extension with the relevant party. This approach requires effective communication and a valid reason for the request. For instance, if you’re facing unexpected financial difficulties, you may be able to negotiate a temporary waiver or deferral of the due date.

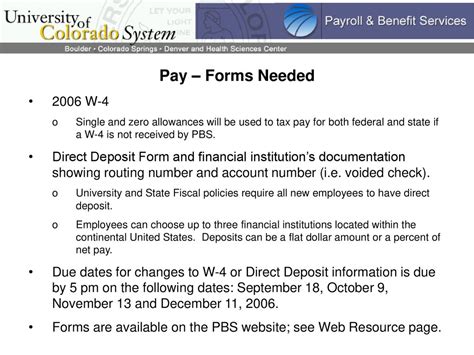

- Contract Revision: If the due date is specified in a contract, it may be possible to revise the agreement to void the original due date. This typically involves mutual consent and a formal amendment to the contract. However, this approach can be complex and may require professional assistance.

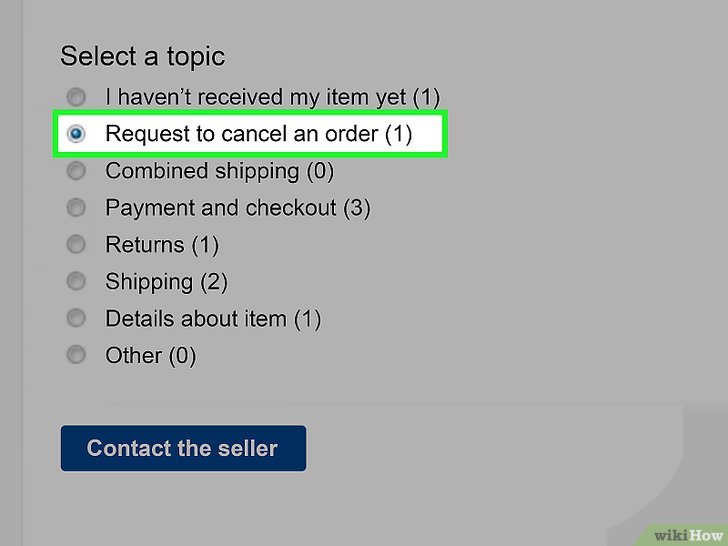

- Payment Plans: In situations where a due date is associated with a payment, setting up a payment plan can help void the original due date. This involves breaking down the payment into smaller, manageable installments and agreeing on a new schedule with the creditor or relevant party.

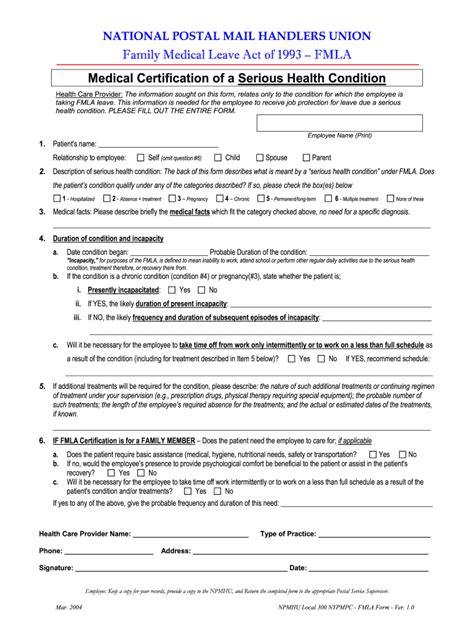

- Due Date Waivers: Some institutions or organizations may offer due date waivers under specific circumstances, such as financial hardship or unexpected events. These waivers can temporarily suspend or void the due date, providing relief to the individual or entity.

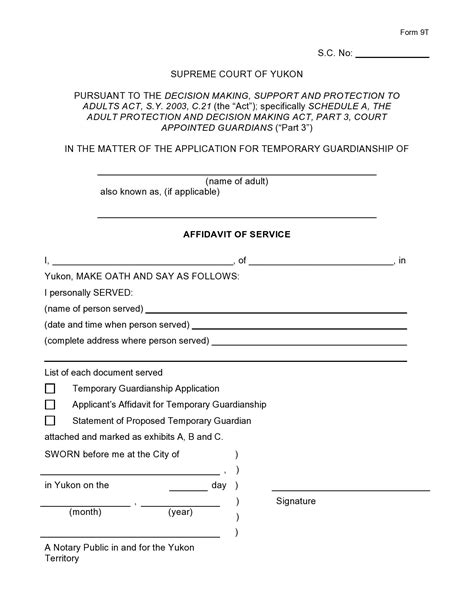

- Legal Interventions: In extreme cases, legal interventions may be necessary to void a due date. This can involve seeking a court order or filing a lawsuit to challenge the validity of the due date or the underlying agreement. However, this approach should be considered a last resort, as it can be costly and time-consuming.

Considerations and Implications

When attempting to void a due date, it’s crucial to consider the potential implications and consequences. Failure to comply with the original due date can result in penalties, fines, or damage to one’s credit score. Additionally, voiding a due date may not always be possible or may require significant effort and resources.

📝 Note: Before attempting to void a due date, it's essential to carefully review the underlying agreement or contract to understand the terms and conditions. Seeking professional advice, such as from a lawyer or financial advisor, can also be beneficial in navigating the process.

Best Practices for Managing Due Dates

To avoid the need to void due dates, it’s essential to adopt best practices for managing due dates. This includes:

- Setting reminders and notifications to ensure timely completion of tasks or payments

- Creating a schedule or calendar to track upcoming due dates

- Communicating with relevant parties to confirm due dates and negotiate extensions when necessary

- Reviewing and understanding the terms and conditions of agreements or contracts

- Seeking professional assistance when needed to navigate complex situations

By following these best practices and understanding the methods for voiding due dates, individuals and entities can better manage their obligations and avoid potential penalties or consequences.

Summary of Key Points

In summary, voiding due dates can be a complex process that requires careful consideration and adherence to specific guidelines. The five methods outlined in this article – negotiation, contract revision, payment plans, due date waivers, and legal interventions – can be used to void due dates, depending on the context and circumstances. By adopting best practices for managing due dates and seeking professional assistance when needed, individuals and entities can minimize the risk of missing due dates and avoid potential repercussions.

As we move forward, it’s essential to recognize the importance of due dates and the potential consequences of missing them. By being proactive and taking a strategic approach to managing due dates, we can reduce stress, avoid penalties, and maintain a positive reputation. In the end, it’s all about finding a balance between meeting our obligations and navigating the complexities of due dates.

What are the consequences of missing a due date?

+

Missing a due date can result in penalties, fines, or damage to one’s credit score. It’s essential to understand the specific consequences associated with the due date and take proactive steps to avoid missing it.

Can I negotiate a new due date with the relevant party?

+

Yes, in some cases, it’s possible to negotiate a new due date or an extension with the relevant party. This approach requires effective communication and a valid reason for the request.

What are the best practices for managing due dates?

+

Best practices for managing due dates include setting reminders and notifications, creating a schedule or calendar, communicating with relevant parties, reviewing and understanding the terms and conditions of agreements or contracts, and seeking professional assistance when needed.