5 Tips Drop Retirement

Introduction to Drop Retirement

The concept of drop retirement, also known as early retirement or financial independence, has gained significant attention in recent years. It involves creating a financial plan that allows individuals to retire early and pursue their passions without the burden of a traditional 9-to-5 job. Achieving drop retirement requires careful planning, discipline, and a deep understanding of personal finance. In this article, we will explore five tips to help individuals achieve their drop retirement goals.

Tip 1: Create a Comprehensive Financial Plan

Developing a comprehensive financial plan is the first step towards achieving drop retirement. This plan should include short-term and long-term goals, income projections, expense management, and investment strategies. It is essential to assess your current financial situation, including your income, expenses, debts, and assets. You can use online tools or consult with a financial advisor to create a personalized plan that suits your needs.

Some key considerations when creating a financial plan include: * Emergency fund: Save 3-6 months’ worth of living expenses in an easily accessible savings account. * Debt management: Pay off high-interest debts, such as credit card balances, as soon as possible. * Investment strategy: Invest in a diversified portfolio of stocks, bonds, and other assets to grow your wealth over time.

Tip 2: Live Below Your Means

Living below your means is crucial to achieving drop retirement. This involves reducing unnecessary expenses and allocating excess funds towards your retirement goals. You can start by tracking your expenses and identifying areas where you can cut back. Consider adopting a frugal lifestyle, which may include: * Cooking at home instead of eating out * Cancelling subscription services you don’t use * Buying second-hand items instead of new ones

By living below your means, you can free up more money in your budget to invest in your retirement.

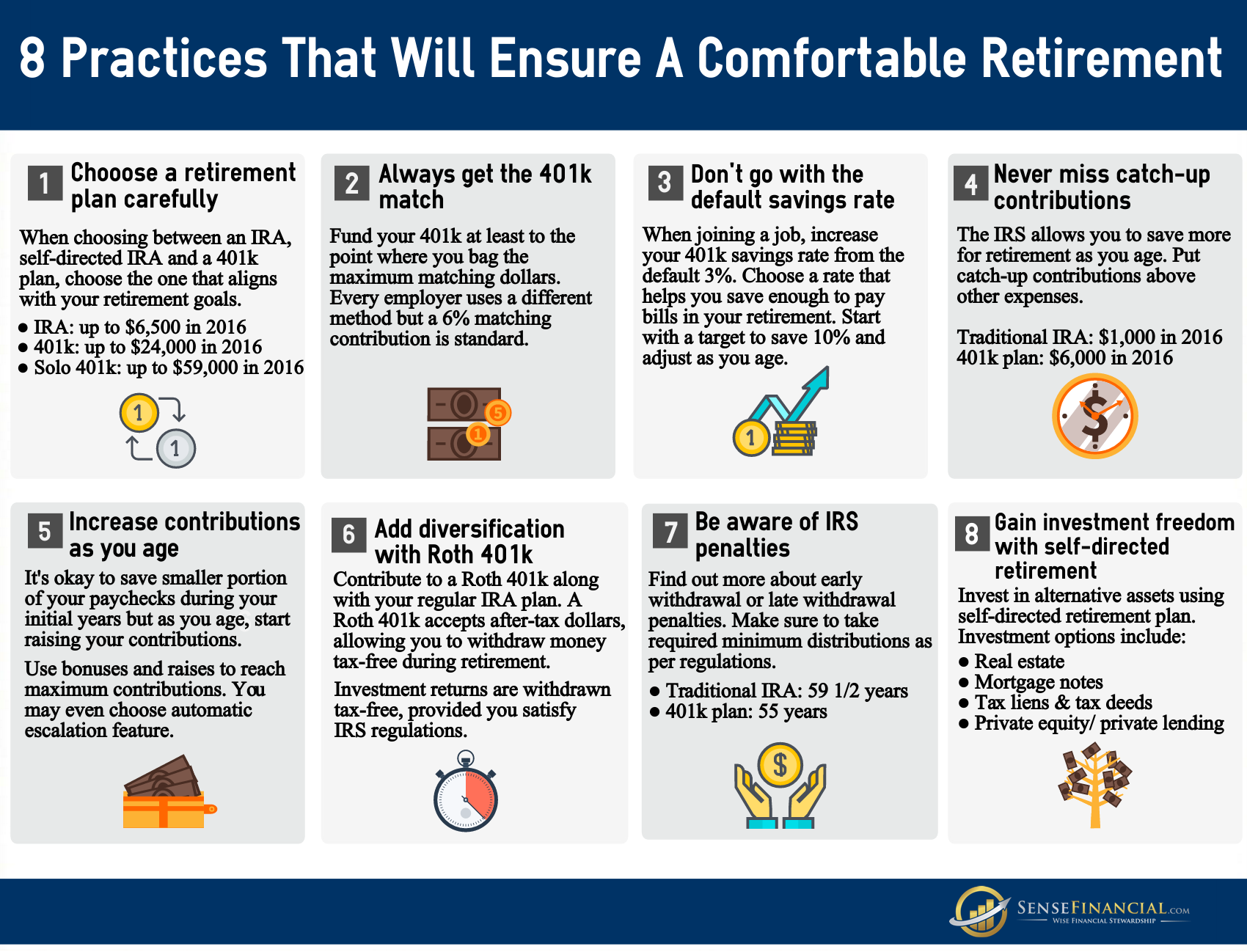

Tip 3: Invest in a Tax-Advantaged Retirement Account

Investing in a tax-advantaged retirement account can help you grow your wealth more efficiently. These accounts, such as 401(k) or IRA, offer tax benefits that can reduce your taxable income and lower your tax liability. You can contribute a portion of your income to these accounts, and the funds will grow tax-deferred until you withdraw them in retirement.

Some popular tax-advantaged retirement accounts include: * 401(k): A employer-sponsored retirement plan that allows you to contribute pre-tax dollars. * IRA: An individual retirement account that offers tax-deductible contributions and tax-deferred growth. * Roth IRA: A type of IRA that offers tax-free growth and withdrawals in retirement.

Tip 4: Diversify Your Income Streams

Diversifying your income streams can help you reduce your reliance on a single source of income. This can include: * Starting a side business or freelancing * Investing in dividend-paying stocks * Renting out a spare room on Airbnb

By creating multiple income streams, you can increase your financial stability and reduce your risk of financial shocks.

Tip 5: Stay Disciplined and Patient

Achieving drop retirement requires discipline and patience. It’s essential to stay focused on your long-term goals and avoid getting distracted by short-term market fluctuations. You should also be willing to learn and adapt to changing market conditions.

Some key strategies to stay disciplined and patient include: * Setting clear goals and tracking your progress * Avoiding emotional decisions based on market volatility * Staying informed about personal finance and investing

📝 Note: It's essential to remember that drop retirement is a long-term goal that requires careful planning, discipline, and patience. By following these tips and staying committed to your goals, you can increase your chances of achieving financial independence and enjoying a fulfilling retirement.

As you work towards achieving your drop retirement goals, it’s essential to stay flexible and adapt to changing circumstances. By being open to new opportunities and challenges, you can stay on track and achieve your vision of a fulfilling retirement.

To further illustrate the importance of diversification, consider the following table:

| Income Stream | Risk Level | Potential Return |

|---|---|---|

| Dividend-paying stocks | Moderate | 4-6% |

| Renting out a spare room | Low | 5-7% |

| Starting a side business | High | 10-20% |

In conclusion, achieving drop retirement requires a combination of careful planning, discipline, and patience. By following these five tips and staying committed to your goals, you can increase your chances of achieving financial independence and enjoying a fulfilling retirement. Remember to stay flexible and adapt to changing circumstances, and always keep your long-term goals in mind.

What is drop retirement, and how does it work?

+

Drop retirement, also known as early retirement or financial independence, involves creating a financial plan that allows individuals to retire early and pursue their passions without the burden of a traditional 9-to-5 job. It requires careful planning, discipline, and a deep understanding of personal finance.

How can I create a comprehensive financial plan for drop retirement?

+

To create a comprehensive financial plan for drop retirement, you should assess your current financial situation, including your income, expenses, debts, and assets. You can use online tools or consult with a financial advisor to create a personalized plan that suits your needs. Consider factors such as emergency funds, debt management, and investment strategies.

What are some common mistakes to avoid when pursuing drop retirement?

+

Common mistakes to avoid when pursuing drop retirement include failing to create a comprehensive financial plan, not living below your means, and not diversifying your income streams. It’s also essential to avoid getting distracted by short-term market fluctuations and to stay disciplined and patient in your pursuit of financial independence.