Paperwork

Employee Tax Paperwork Deadline

Understanding the Importance of Employee Tax Paperwork Deadline

As an employer, managing employee tax paperwork is a critical task that requires attention to detail and adherence to deadlines. The deadline for submitting employee tax paperwork can vary depending on the location and type of business, but it is essential to stay on top of these deadlines to avoid penalties and fines. In this article, we will delve into the world of employee tax paperwork, exploring the key deadlines, requirements, and best practices for employers.

Key Deadlines for Employee Tax Paperwork

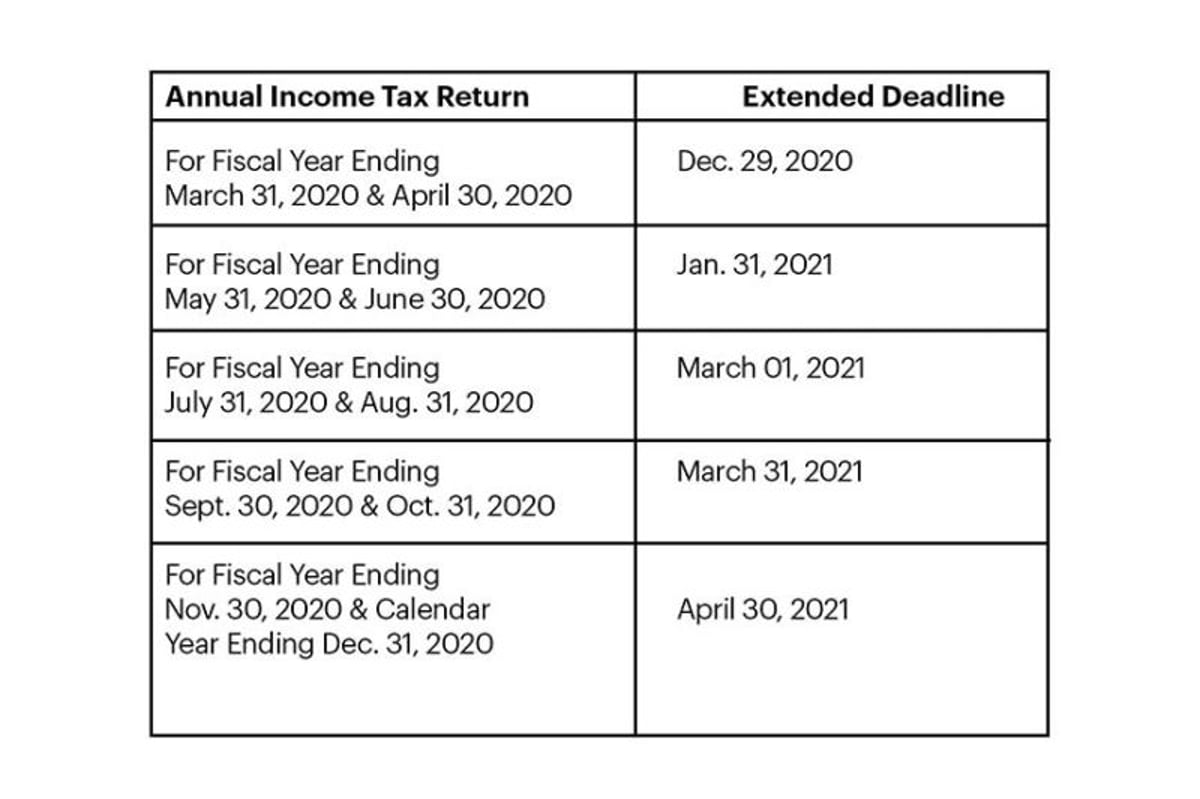

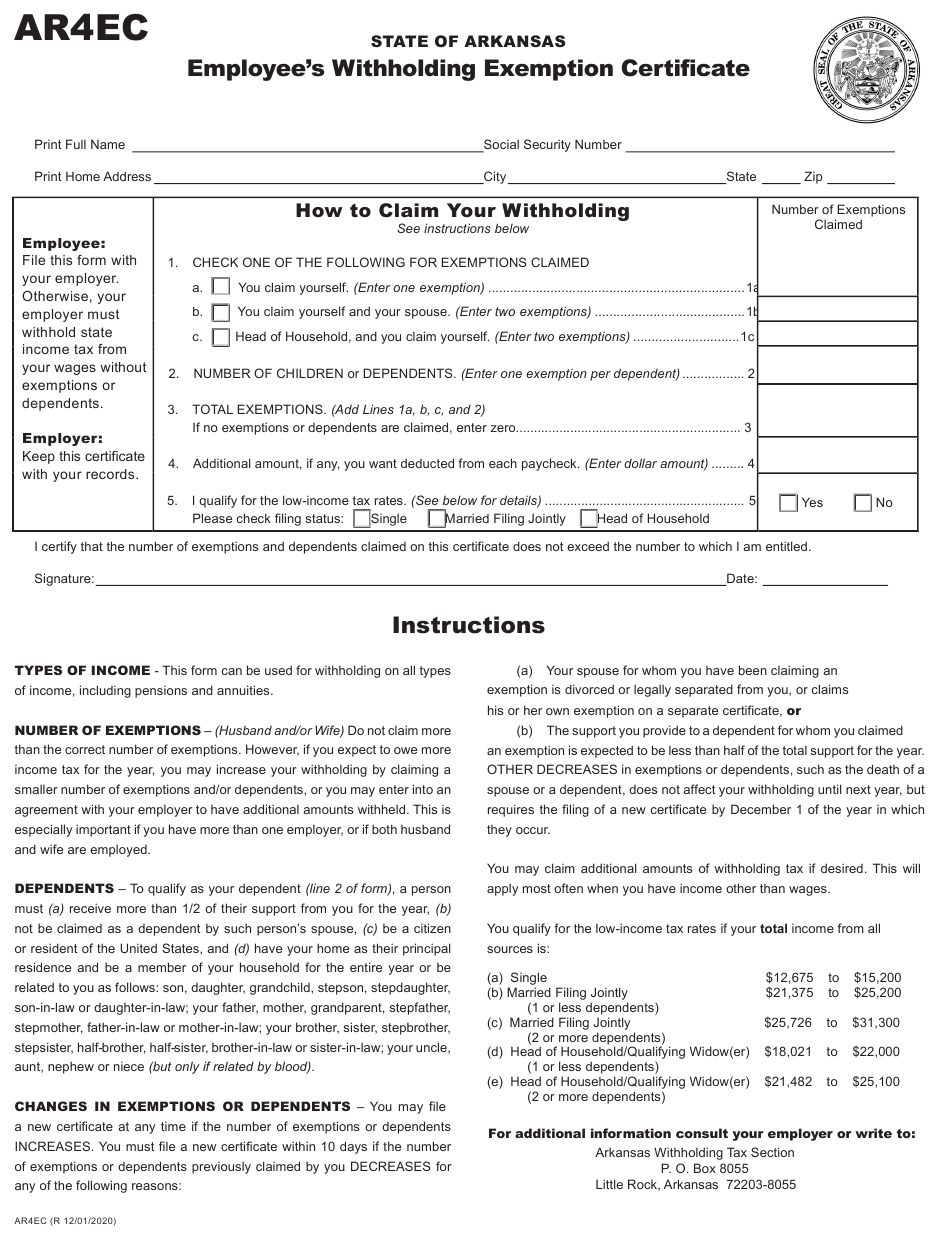

Employers must be aware of the following key deadlines for employee tax paperwork: * W-2 Forms: The deadline for submitting W-2 forms to the Social Security Administration (SSA) is January 31st of each year. Employers must also provide copies of the W-2 forms to their employees by January 31st. * W-4 Forms: Employers must keep W-4 forms on file for each employee, but there is no specific deadline for submitting these forms to the government. However, employers must update W-4 forms annually or when an employee’s tax situation changes. * 941 Forms: Employers must file 941 forms with the IRS on a quarterly basis, with deadlines falling on April 30th, July 31st, October 31st, and January 31st. * 1099-MISC Forms: The deadline for submitting 1099-MISC forms to the IRS is January 31st of each year. Employers must also provide copies of the 1099-MISC forms to their independent contractors by January 31st.

Requirements for Employee Tax Paperwork

Employers must meet specific requirements when preparing and submitting employee tax paperwork: * Accurate and Complete Information: Employers must ensure that all employee tax paperwork is accurate and complete, including employee names, addresses, and tax identification numbers. * Timely Filing: Employers must submit employee tax paperwork on time to avoid penalties and fines. * Record Keeping: Employers must maintain accurate and detailed records of employee tax paperwork, including W-2 forms, W-4 forms, and 941 forms.

Best Practices for Managing Employee Tax Paperwork

To ensure compliance with employee tax paperwork deadlines and requirements, employers should follow these best practices: * Use Tax Preparation Software: Utilize tax preparation software to streamline the process of preparing and submitting employee tax paperwork. * Designate a Tax Preparation Team: Assign a team or individual to manage employee tax paperwork, ensuring that deadlines are met and requirements are fulfilled. * Conduct Regular Audits: Perform regular audits to ensure accuracy and completeness of employee tax paperwork. * Stay Up-to-Date with Tax Law Changes: Stay informed about changes to tax laws and regulations, ensuring that employee tax paperwork is compliant with current requirements.

Penalties for Missing Employee Tax Paperwork Deadlines

Employers who miss employee tax paperwork deadlines may face penalties and fines, including: * Late Filing Penalties: The IRS may impose late filing penalties for employers who fail to submit employee tax paperwork on time. * Accuracy-Related Penalties: The IRS may impose accuracy-related penalties for employers who submit incomplete or inaccurate employee tax paperwork. * Interest on Unpaid Taxes: Employers may be required to pay interest on unpaid taxes, in addition to penalties and fines.

📝 Note: Employers should consult with a tax professional or accountant to ensure compliance with employee tax paperwork deadlines and requirements.

Conclusion and Final Thoughts

In conclusion, managing employee tax paperwork is a critical task that requires attention to detail and adherence to deadlines. By understanding the key deadlines, requirements, and best practices for employee tax paperwork, employers can ensure compliance with tax laws and regulations, avoiding penalties and fines. It is essential for employers to stay informed about changes to tax laws and regulations, utilizing tax preparation software and designating a tax preparation team to manage employee tax paperwork. By following these guidelines and best practices, employers can ensure a smooth and efficient tax preparation process, minimizing the risk of errors and penalties.

What is the deadline for submitting W-2 forms to the Social Security Administration?

+

The deadline for submitting W-2 forms to the Social Security Administration is January 31st of each year.

What are the penalties for missing employee tax paperwork deadlines?

+

Employers who miss employee tax paperwork deadlines may face late filing penalties, accuracy-related penalties, and interest on unpaid taxes.

How can employers ensure compliance with employee tax paperwork deadlines and requirements?

+

Employers can ensure compliance by utilizing tax preparation software, designating a tax preparation team, conducting regular audits, and staying up-to-date with tax law changes.