Dissolution Filing Deadline

Understanding the Dissolution Filing Deadline

When a business decides to cease its operations, it is essential to follow the proper procedures for dissolution. One crucial step in this process is meeting the dissolution filing deadline. Missing this deadline can lead to severe consequences, including penalties and even the loss of business assets. In this article, we will delve into the world of business dissolution, exploring the key aspects of the dissolution filing deadline and its implications for businesses.

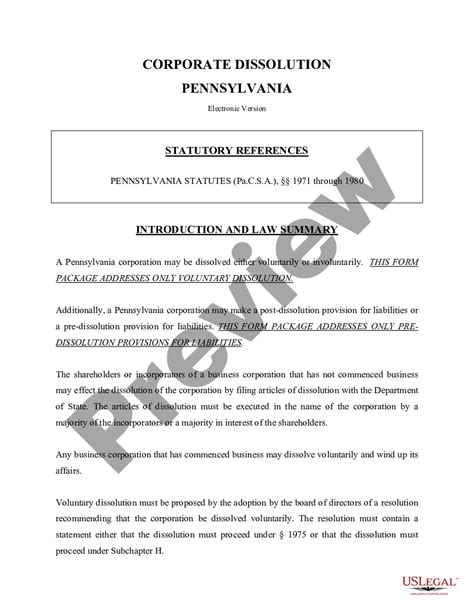

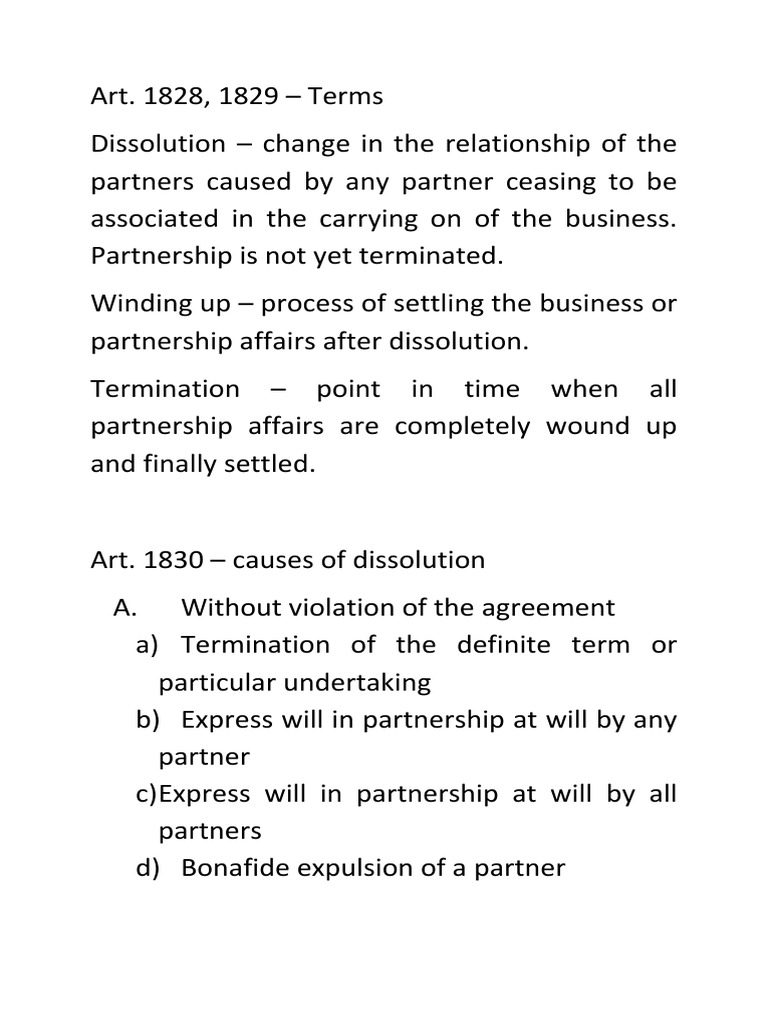

What is the Dissolution Filing Deadline?

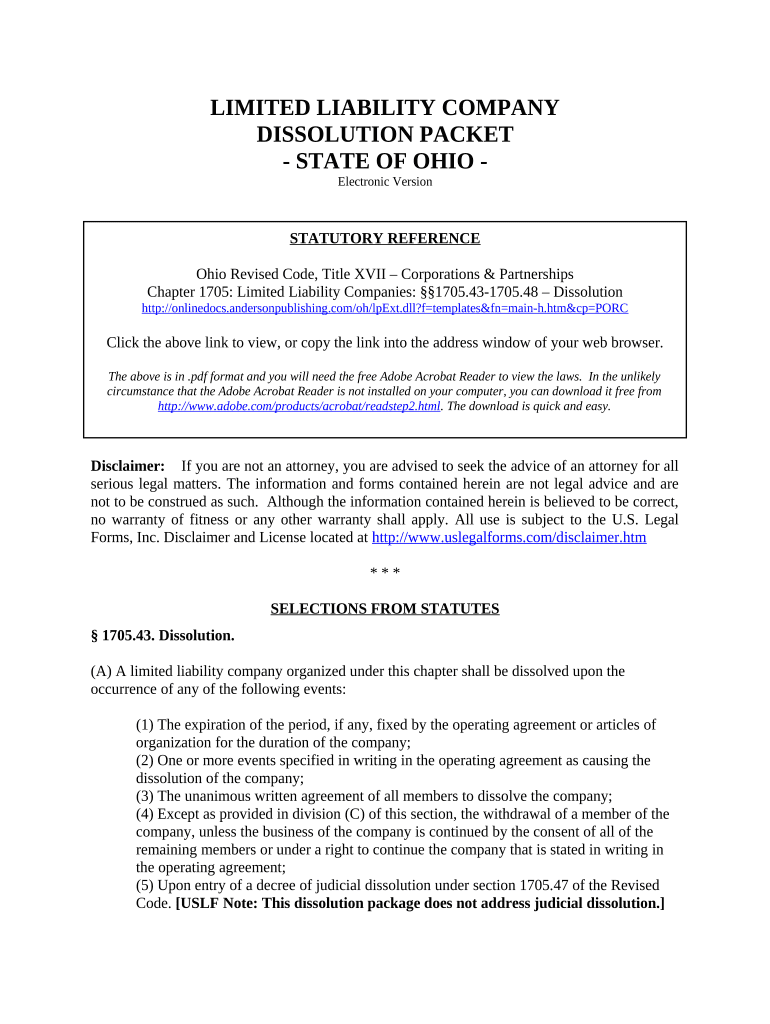

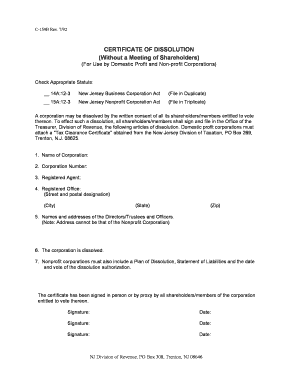

The dissolution filing deadline refers to the timeframe within which a business must submit its dissolution paperwork to the relevant state authorities. This deadline varies by state and is typically 30 to 90 days after the business has ceased its operations or after the shareholders have voted to dissolve the company. It is crucial for businesses to be aware of their state’s specific deadline to avoid any complications during the dissolution process.

Why is the Dissolution Filing Deadline Important?

The dissolution filing deadline is critical because it marks the official end of a business’s existence. Failure to meet this deadline can result in the business being considered still active, leading to ongoing tax liabilities, potential lawsuits, and other unforeseen issues. Furthermore, missing the deadline can also lead to the loss of limited liability protection, exposing the business owners’ personal assets to creditors.

Steps to Meet the Dissolution Filing Deadline

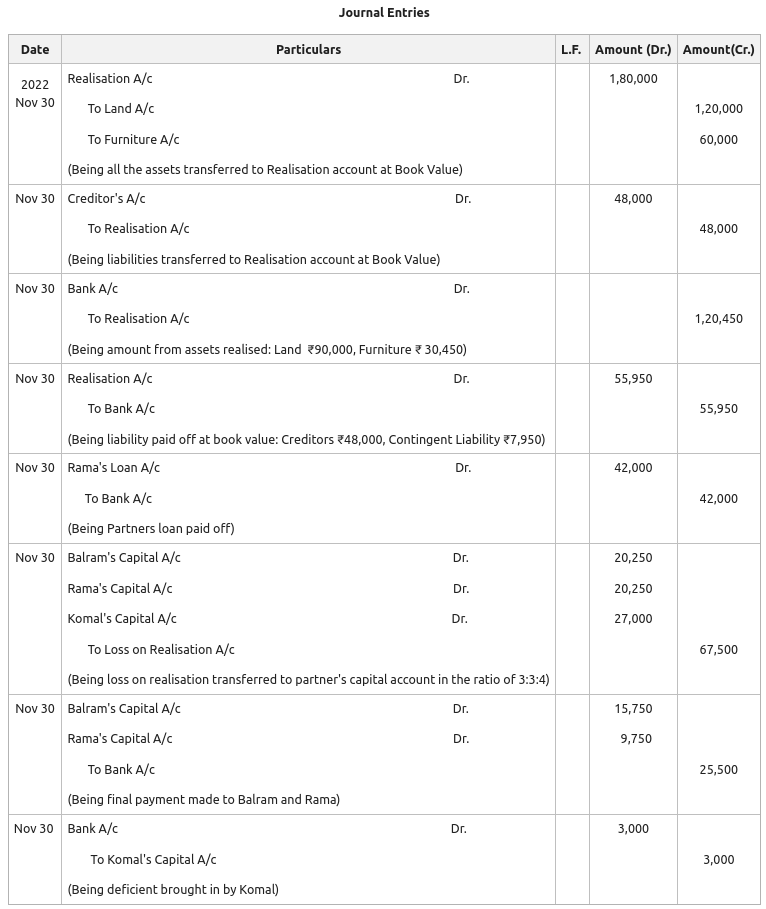

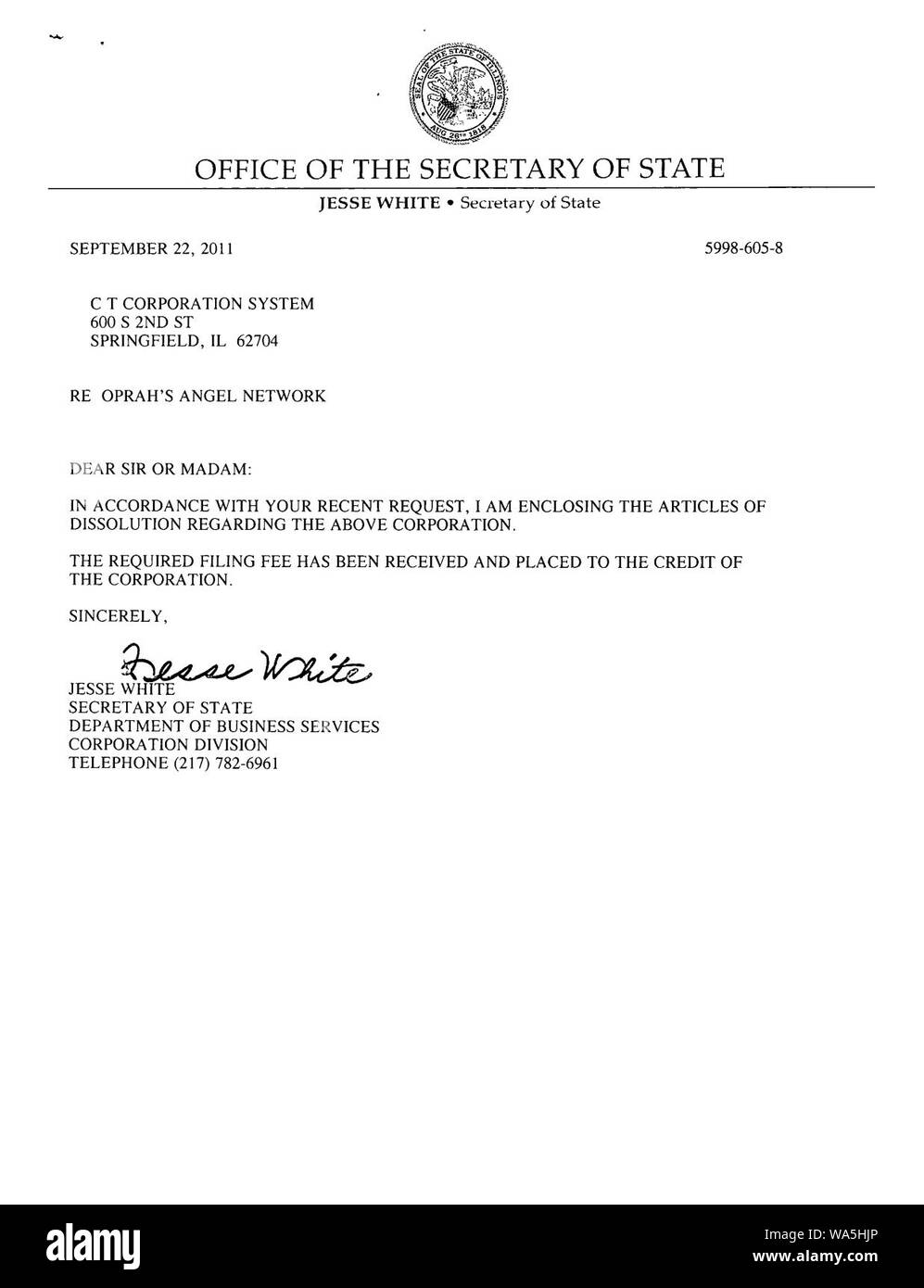

To ensure a smooth dissolution process, businesses should follow these steps: * File articles of dissolution: Submit the necessary paperwork to the state, indicating the business’s intention to dissolve. * Pay all outstanding taxes: Ensure that all tax liabilities are settled to avoid any future complications. * Notify creditors: Inform all creditors of the business’s intention to dissolve, allowing them to file claims against the company. * Distribute assets: Divide the business’s assets among the shareholders, in accordance with the company’s bylaws or operating agreement.

📝 Note: It is essential to consult with an attorney or tax professional to ensure that all steps are taken correctly and that the business is in compliance with state regulations.

Consequences of Missing the Dissolution Filing Deadline

Missing the dissolution filing deadline can have severe consequences, including: * Penalties and fines: The business may be subject to penalties and fines for failing to meet the deadline. * Loss of limited liability protection: The business owners’ personal assets may be at risk if the deadline is missed. * Ongoing tax liabilities: The business may be required to continue paying taxes, even after it has ceased operations. * Potential lawsuits: The business may be vulnerable to lawsuits from creditors or other parties.

Best Practices for Meeting the Dissolution Filing Deadline

To avoid any issues, businesses should: * Keep accurate records: Maintain detailed records of all business activities, including financial transactions and correspondence with creditors. * Stay informed: Stay up-to-date with state regulations and deadlines to ensure compliance. * Seek professional advice: Consult with an attorney or tax professional to ensure that all steps are taken correctly.

| State | Dissolution Filing Deadline |

|---|---|

| California | 90 days |

| New York | 60 days |

| Florida | 30 days |

In the end, meeting the dissolution filing deadline is crucial for businesses to avoid potential complications and ensure a smooth transition. By understanding the importance of this deadline and following the necessary steps, businesses can protect their assets and avoid any unforeseen issues. The key to a successful dissolution is being informed, staying organized, and seeking professional advice when needed.

What happens if I miss the dissolution filing deadline?

+

If you miss the dissolution filing deadline, your business may be subject to penalties and fines, and you may lose limited liability protection. Additionally, you may be required to continue paying taxes and may be vulnerable to lawsuits from creditors or other parties.

How do I file for dissolution?

+

To file for dissolution, you will need to submit the necessary paperwork to your state’s business registration office. This typically includes filing articles of dissolution and paying any required fees. You may also need to notify creditors and settle any outstanding tax liabilities.

What is the difference between dissolution and bankruptcy?

+

Dissolution and bankruptcy are two separate legal processes. Dissolution refers to the process of ending a business’s existence, while bankruptcy refers to the process of seeking protection from creditors due to insolvency. While dissolution can be a voluntary process, bankruptcy is typically involuntary and requires court involvement.