COBRA Paperwork Deadline for Employers in CA

Introduction to COBRA Paperwork Deadline for Employers in CA

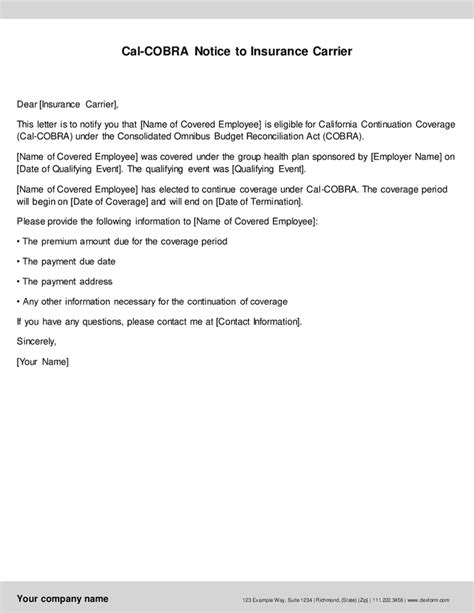

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that requires employers with 20 or more employees to provide continuation of health coverage to employees and their families when they experience a qualifying event, such as job loss, divorce, or death. In California, employers must comply with both federal COBRA regulations and state-specific laws, including Cal-COBRA. Understanding the COBRA paperwork deadline is crucial for employers in CA to avoid penalties and ensure compliance with the law.

Understanding COBRA and Cal-COBRA

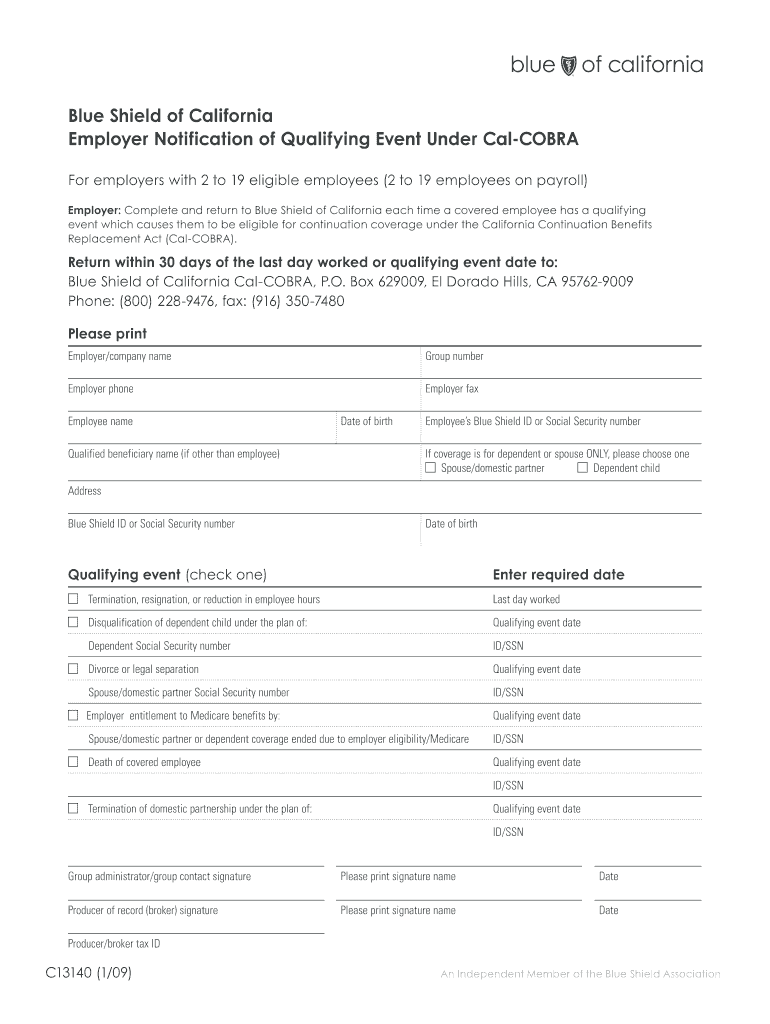

COBRA applies to employers with 20 or more employees, offering group health plans. It mandates that these employers provide continuation coverage to employees and their dependents for a specified period after a qualifying event. Cal-COBRA, on the other hand, is California’s version of COBRA and applies to smaller employers with 2-19 employees, offering similar continuation coverage requirements. Both laws aim to ensure that individuals and families do not lose health coverage due to circumstances beyond their control.

COBRA Paperwork Deadline for Employers in CA

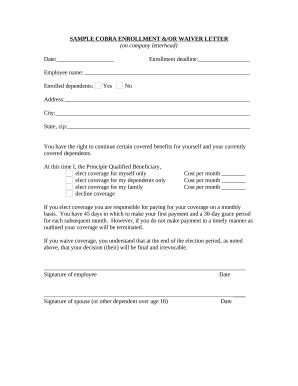

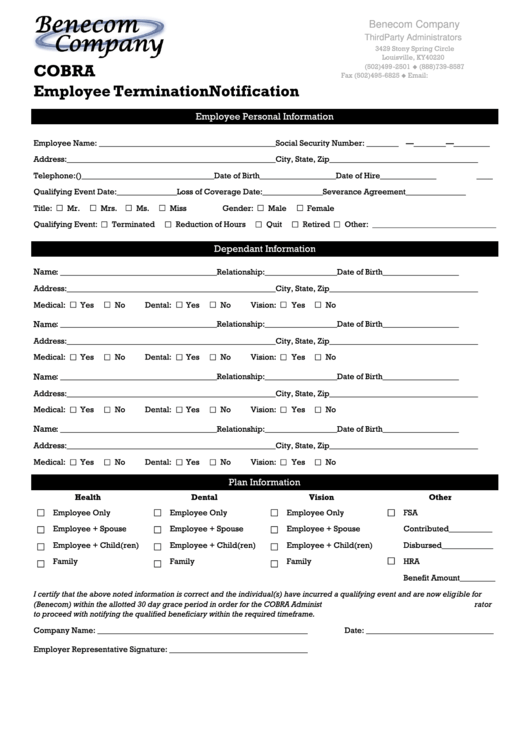

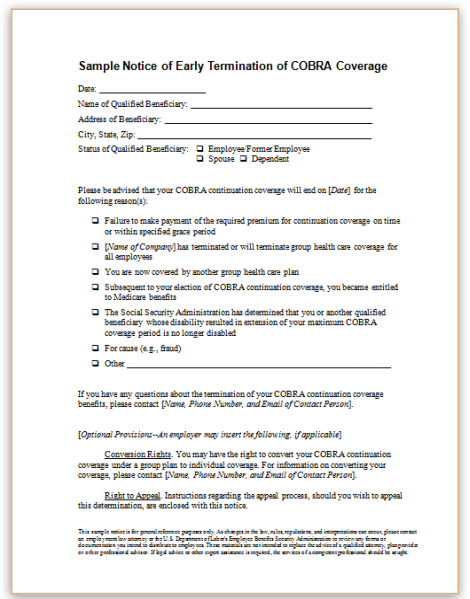

Employers in California must adhere to specific deadlines when handling COBRA paperwork. Upon a qualifying event, the employer has 14 days to notify the plan administrator. The plan administrator then has 44 days from the date the employer notifies them or the date the qualifying event occurs (whichever is later) to send a COBRA election notice to the qualified beneficiary. This notice must include information about the COBRA coverage, costs, and how to elect continuation coverage.

Steps for Employers to Comply with COBRA

To comply with COBRA and avoid potential penalties, employers in CA should follow these steps: - Identify Qualifying Events: Recognize events that trigger COBRA eligibility, such as termination of employment, reduction in work hours, divorce, or death of the covered employee. - Notify the Plan Administrator: Inform the plan administrator within 14 days of a qualifying event. - Provide COBRA Election Notice: Ensure the plan administrator sends the COBRA election notice to the qualified beneficiaries within 44 days. - Maintain Records: Keep detailed records of COBRA notifications, elections, and payments for auditing purposes. - Offer Continuation Coverage: Provide the continuation coverage as elected by the qualified beneficiaries.

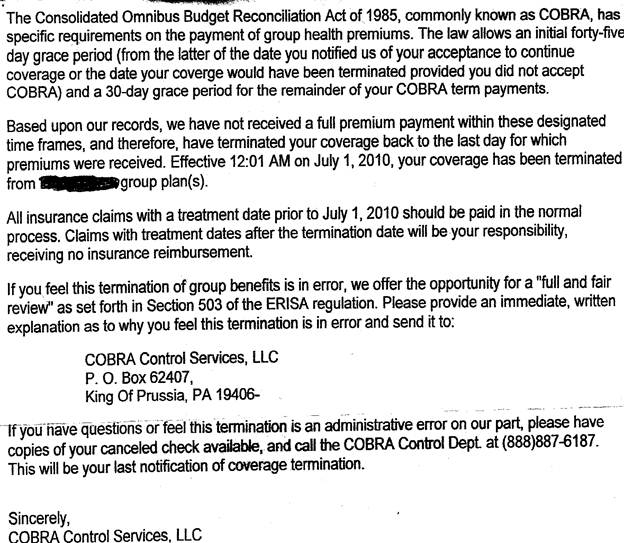

Penalties for Non-Compliance

Failure to comply with COBRA regulations can result in significant penalties for employers. These include: - Excise Tax: Up to $100 per day for each qualified beneficiary not offered COBRA coverage. - Lawsuits: Qualified beneficiaries can sue for damages, including medical expenses incurred due to lack of coverage. - Fines: Additional fines can be imposed by regulatory agencies.

📝 Note: Employers should consult with legal counsel or a benefits administrator to ensure compliance with all aspects of COBRA and Cal-COBRA, as regulations can change and specific circumstances may require special handling.

Best Practices for COBRA Administration

To efficiently manage COBRA administration and avoid potential issues, employers should: - Outsource to a Third-Party Administrator (TPA): If possible, hire a TPA experienced in COBRA administration to handle notifications, elections, and premium collections. - Develop a COBRA Policy: Create a clear, written policy outlining the COBRA process, including timelines, responsibilities, and contact information. - Train HR Personnel: Ensure that HR staff understands COBRA and Cal-COBRA requirements and can handle related inquiries and tasks. - Regularly Review and Update COBRA Procedures: Stay informed about regulatory changes and update internal procedures accordingly.

| Event | Notification Deadline | Next Steps |

|---|---|---|

| Qualifying Event Occurs | Employer: 14 days to notify Plan Administrator | Plan Administrator sends COBRA election notice to qualified beneficiaries within 44 days. |

| COBRA Election Notice Sent | Within 44 days of qualifying event or employer notification | Qualified beneficiaries have 60 days to elect COBRA coverage. |

As the laws and regulations surrounding COBRA and Cal-COBRA are complex and subject to change, it’s essential for employers in California to stay informed and adapt their policies accordingly. By understanding the COBRA paperwork deadline and following best practices for COBRA administration, employers can ensure compliance, avoid penalties, and provide necessary support to their employees during significant life changes.

In summary, compliance with COBRA regulations is critical for employers in California. By recognizing the importance of the COBRA paperwork deadline, understanding the steps to comply, and being aware of the penalties for non-compliance, employers can navigate the complexities of COBRA administration effectively. Staying updated on regulatory requirements and maintaining open communication with employees and plan administrators are key to successful COBRA compliance.

What is the main purpose of COBRA for employers in CA?

+

The main purpose of COBRA for employers in CA is to provide continuation of health coverage to employees and their families when they experience a qualifying event, ensuring they do not lose health coverage due to circumstances beyond their control.

How does Cal-COBRA differ from federal COBRA regulations?

+

Cal-COBRA applies to smaller employers with 2-19 employees, offering continuation coverage similar to federal COBRA, which applies to employers with 20 or more employees. Cal-COBRA extends the period of continuation coverage and applies to certain types of health plans not covered under federal COBRA.

What are the consequences of not complying with COBRA regulations for employers in CA?

+

Failure to comply with COBRA regulations can result in significant penalties, including excise taxes, lawsuits from qualified beneficiaries, and additional fines from regulatory agencies. Employers must adhere to notification deadlines and ensure proper administration of COBRA to avoid these consequences.