5 Quicken Mortgage Tips

Introduction to Quicken Mortgage

Quicken Mortgage, also known as Quicken Loans, is one of the largest mortgage lenders in the United States. The company offers a wide range of mortgage products, including fixed-rate and adjustable-rate loans, FHA loans, VA loans, and jumbo loans. With its user-friendly online platform and dedicated customer service team, Quicken Mortgage has become a popular choice among homebuyers and refinancers. In this article, we will provide you with 5 quicken mortgage tips to help you navigate the mortgage process and make informed decisions.

Tip 1: Check Your Credit Score

Before applying for a mortgage, it’s essential to check your credit score. Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for a mortgage. A good credit score can help you qualify for a lower interest rate, which can save you thousands of dollars over the life of the loan. You can check your credit score for free on various websites, such as Credit Karma, Credit Sesame, or Experian. It’s recommended to have a credit score of 700 or higher to qualify for the best mortgage rates.

Tip 2: Get Pre-Approved

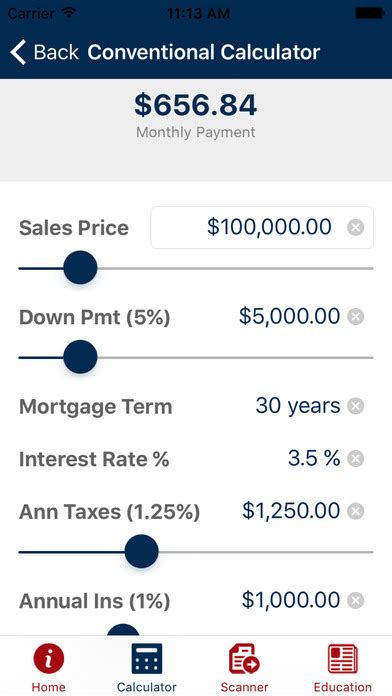

Getting pre-approved for a mortgage is a crucial step in the homebuying process. Pre-approval gives you an idea of how much you can borrow and what your monthly payments will be. It also shows sellers that you’re a serious buyer, which can give you an edge in competitive markets. To get pre-approved, you’ll need to provide financial documents, such as pay stubs, bank statements, and tax returns. Quicken Mortgage offers a pre-approval process that can be completed online in just a few minutes.

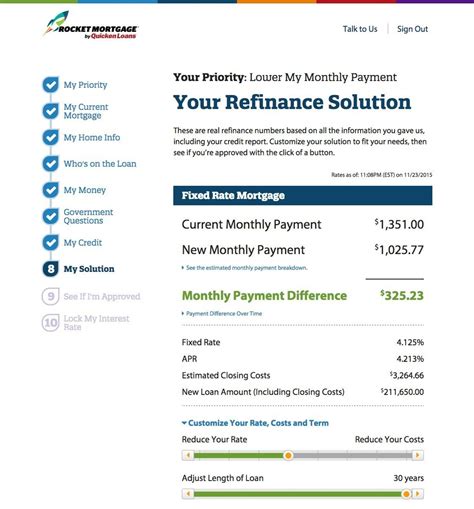

Tip 3: Choose the Right Mortgage Product

Quicken Mortgage offers a variety of mortgage products, each with its own benefits and drawbacks. It’s essential to choose the right mortgage product for your needs and financial situation. For example, if you’re a first-time homebuyer, you may want to consider an FHA loan, which requires a lower down payment. On the other hand, if you’re a veteran, you may want to consider a VA loan, which offers more lenient credit score requirements. Here are some factors to consider when choosing a mortgage product: * Interest rate * Loan term * Down payment * Credit score requirements * Monthly payments

Tip 4: Consider Working with a Mortgage Broker

A mortgage broker can help you navigate the mortgage process and find the best mortgage product for your needs. Mortgage brokers have access to multiple lenders and can help you compare rates and terms. They can also help you with the application process and ensure that you’re getting the best deal possible. Quicken Mortgage has a team of experienced mortgage brokers who can help you find the right mortgage product. Here are some benefits of working with a mortgage broker: * Access to multiple lenders * Expert knowledge of the mortgage market * Personalized service * Time-saving

Tip 5: Read Reviews and Check Ratings

Before choosing a mortgage lender, it’s essential to read reviews and check ratings. This can give you an idea of the lender’s reputation and level of customer service. You can check reviews on websites such as Zillow, LendingTree, or Bankrate. Quicken Mortgage has a 4.5-star rating on Zillow and a 4.5-star rating on LendingTree. Here are some factors to consider when reading reviews: * Customer service * Interest rates * Fees * Application process * Overall satisfaction

📝 Note: When reading reviews, it's essential to consider the source and look for reviews from multiple websites to get a well-rounded view of the lender's reputation.

In summary, Quicken Mortgage is a popular choice among homebuyers and refinancers, offering a wide range of mortgage products and a user-friendly online platform. By following these 5 quicken mortgage tips, you can navigate the mortgage process with confidence and make informed decisions. Remember to check your credit score, get pre-approved, choose the right mortgage product, consider working with a mortgage broker, and read reviews and check ratings. With the right knowledge and preparation, you can find the perfect mortgage for your needs and achieve your dream of homeownership.

What is the minimum credit score required for a Quicken Mortgage?

+

The minimum credit score required for a Quicken Mortgage varies depending on the loan product and other factors. However, a credit score of 620 or higher is typically required for most mortgage products.

How long does the mortgage application process take with Quicken Mortgage?

+

The mortgage application process with Quicken Mortgage can take anywhere from a few days to several weeks, depending on the complexity of the application and the speed of the borrower in providing required documents.

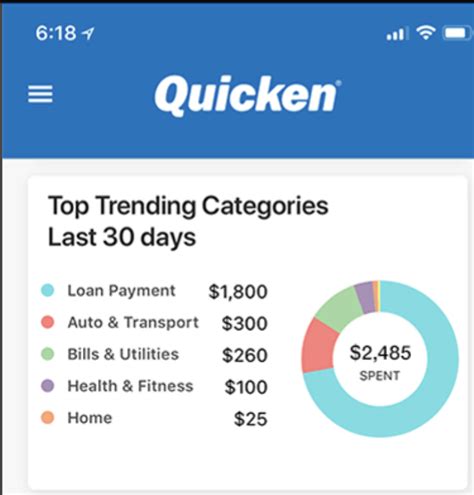

Can I apply for a Quicken Mortgage online?

+

Yes, you can apply for a Quicken Mortgage online through their website or mobile app. The online application process is quick and easy, and you can upload required documents and track the status of your application online.