PPP Paperwork Due Date

Understanding the PPP Paperwork Due Date: A Comprehensive Guide

The Paycheck Protection Program (PPP) has been a vital source of financial relief for numerous businesses affected by the COVID-19 pandemic. To ensure that businesses can take full advantage of this program, it’s essential to understand the importance of meeting the PPP paperwork due date. In this article, we will delve into the world of PPP, exploring its benefits, the application process, and most importantly, the deadlines associated with the necessary paperwork.

Introduction to the Paycheck Protection Program

The PPP is a loan program administered by the Small Business Administration (SBA) that provides businesses with funds to pay up to 8 weeks of payroll costs, including benefits. It also covers interest on mortgages, rent, and utilities. The program’s primary goal is to help businesses keep their workforce employed during the pandemic. The PPP allows businesses to apply for forgiveness of the loan if certain conditions are met, making it an attractive option for those struggling to stay afloat.

Benefits of the Paycheck Protection Program

The benefits of the PPP are multifaceted: - Job Retention: The primary benefit is the ability to retain employees during a time when businesses might otherwise be forced to reduce staff or shut down completely. - Loan Forgiveness: If used correctly, the loan can be forgiven, meaning businesses won’t have to repay the amount they borrowed, provided they meet the forgiveness criteria. - Low-Interest Rates: For any portion of the loan that is not forgiven, the interest rate is capped at a low percentage, making repayment manageable.

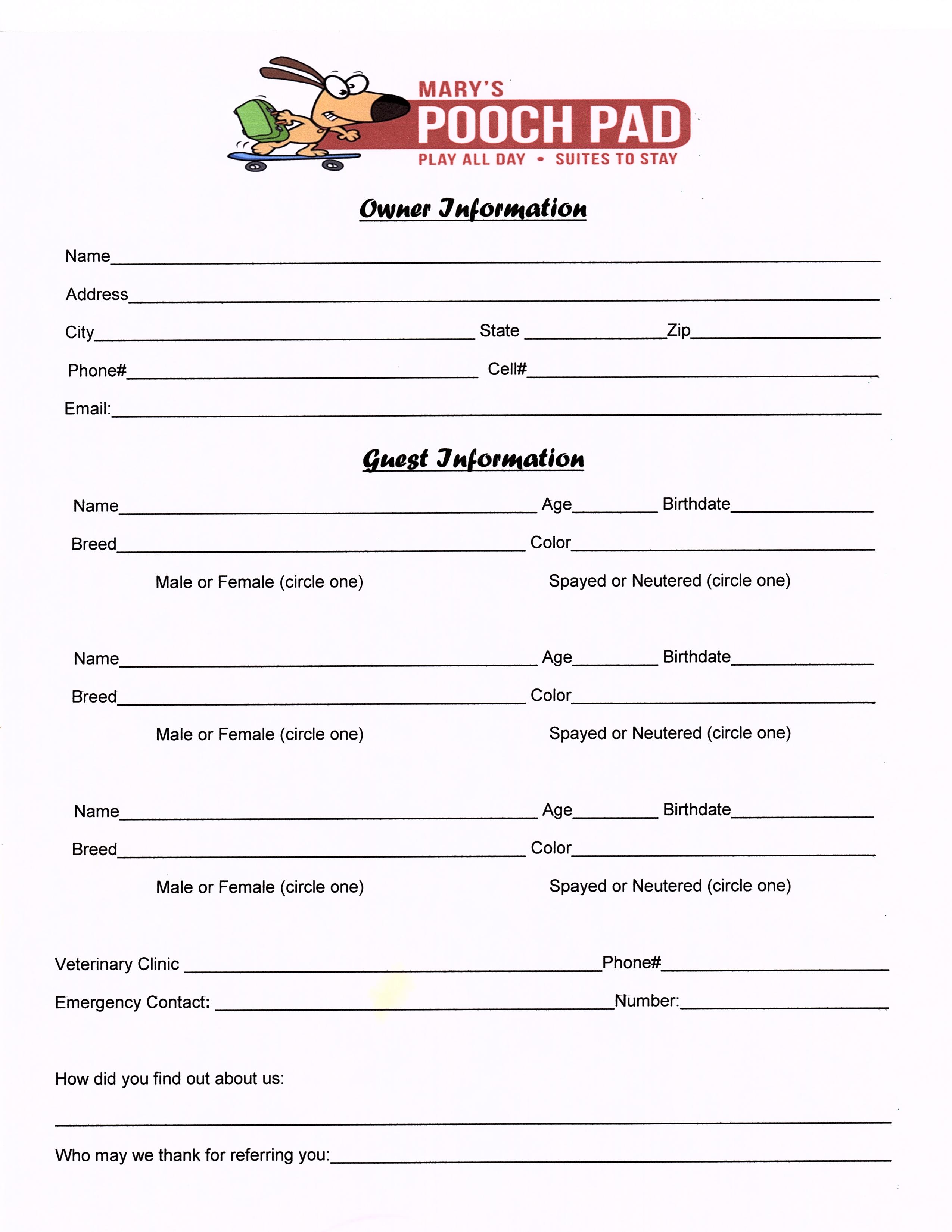

Applying for a PPP Loan

To apply for a PPP loan, businesses must gather specific documents and information. This includes: - Business and Owner Information: Basic business information, such as business name, address, and owner details. - Payroll Documentation: Payroll records to calculate the average monthly payroll costs. - Tax Forms: Business tax returns and possibly personal tax returns for owners. - Identification Documents: For the business and its owners.

The application process typically involves submitting these documents to a participating lender, who then forwards the application to the SBA for approval.

PPP Paperwork Due Date: What You Need to Know

The due date for PPP paperwork can vary depending on the specific loan and the lender. Generally, lenders have a set timeframe within which they must receive all necessary documents to process the loan application. For loan forgiveness applications, the SBA has set specific deadlines based on when the loan was disbursed. It’s crucial for businesses to stay informed about these deadlines to ensure they can apply for forgiveness or make loan payments on time.

📝 Note: Always check with your lender for specific deadlines related to your PPP loan, as these can vary.

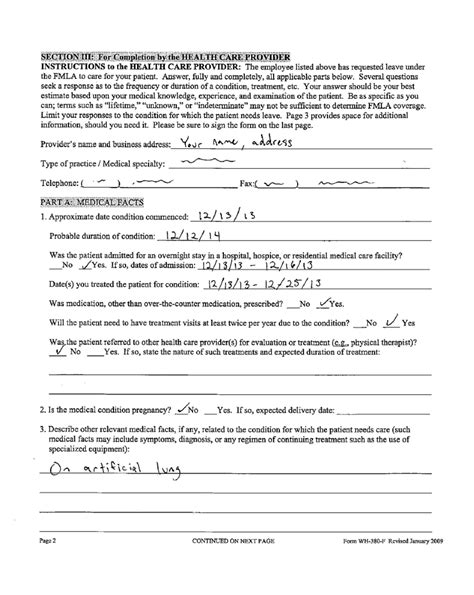

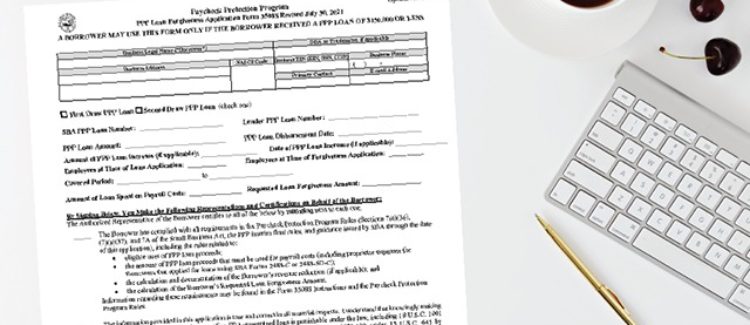

Loan Forgiveness Application Process

To apply for loan forgiveness, businesses will need to complete and submit the Loan Forgiveness Application (SBA Form 3508 or 3508EZ) to their lender. This application requires detailed information about how the PPP funds were used, including: - Payroll Costs: Documentation showing payroll costs, including salaries, wages, and benefits. - Non-Payroll Costs: Receipts for mortgage interest, rent, and utility payments. - Full-Time Equivalent (FTE) Employee Information: Details about the number of employees and their working hours.

The lender will review the application and then submit it to the SBA for approval.

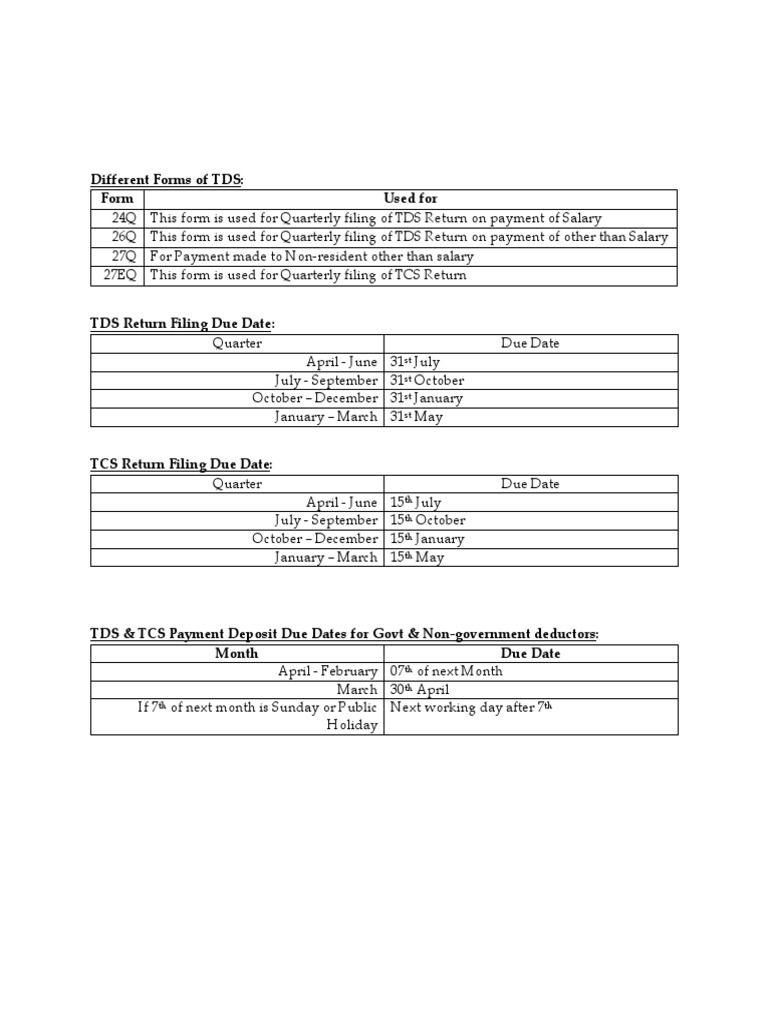

Tables for Tracking PPP Expenses

To keep track of expenses related to the PPP loan, businesses can use a simple table like the one below:

| Category | Amount | Documentation Needed |

|---|---|---|

| Payroll Costs | X</td> <td>Payroll records, benefits documentation</td> </tr> <tr> <td>Mortgage Interest</td> <td>Y | Mortgage statements, payment receipts |

| Rent | Z</td> <td>Rent agreements, payment receipts</td> </tr> <tr> <td>Utilities</td> <td>W | Utility bills, payment receipts |

Importance of Meeting the PPP Paperwork Due Date

Meeting the due date for PPP paperwork is critical for several reasons: - Loan Forgiveness Eligibility: Missing the deadline could result in a business being ineligible for loan forgiveness. - Avoiding Late Fees: Submitting paperwork on time helps avoid late fees associated with loan payments. - Maintaining Good Standing: Timely submission of paperwork keeps the business in good standing with the lender and the SBA.

In summary, understanding and adhering to the PPP paperwork due date is a crucial step in navigating the Paycheck Protection Program successfully. By being aware of the deadlines and preparing all necessary documents in advance, businesses can ensure they make the most of this financial relief opportunity.

As we finalize our discussion on the PPP paperwork due date, it’s essential to remember that the specifics of the program, including deadlines, can change. Always consult the latest information from the SBA and your lender to ensure compliance and to maximize the benefits of the PPP.

What is the primary purpose of the Paycheck Protection Program?

+

The primary purpose of the PPP is to provide loans to businesses to cover payroll costs and certain other expenses, aiming to keep workers employed during the COVID-19 pandemic.

How do I apply for a PPP loan?

+

To apply for a PPP loan, gather required documents such as business and owner information, payroll documentation, tax forms, and identification documents, and submit them to a participating lender.

What happens if I miss the PPP paperwork due date?

+

Missing the due date could result in ineligibility for loan forgiveness, late fees, and negatively impact your standing with the lender and the SBA.