5 Tips for 1031 Paperwork

Understanding the Basics of 1031 Exchange

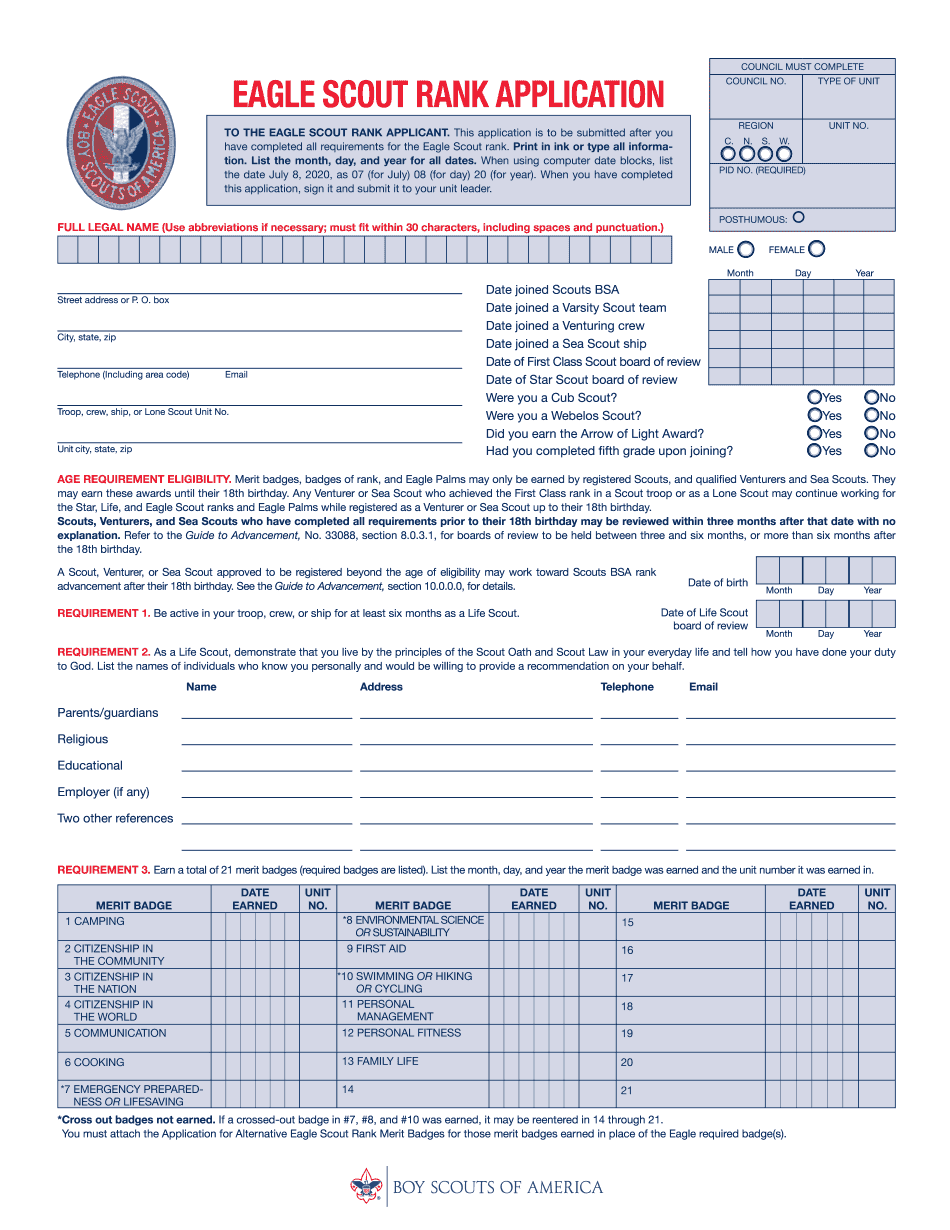

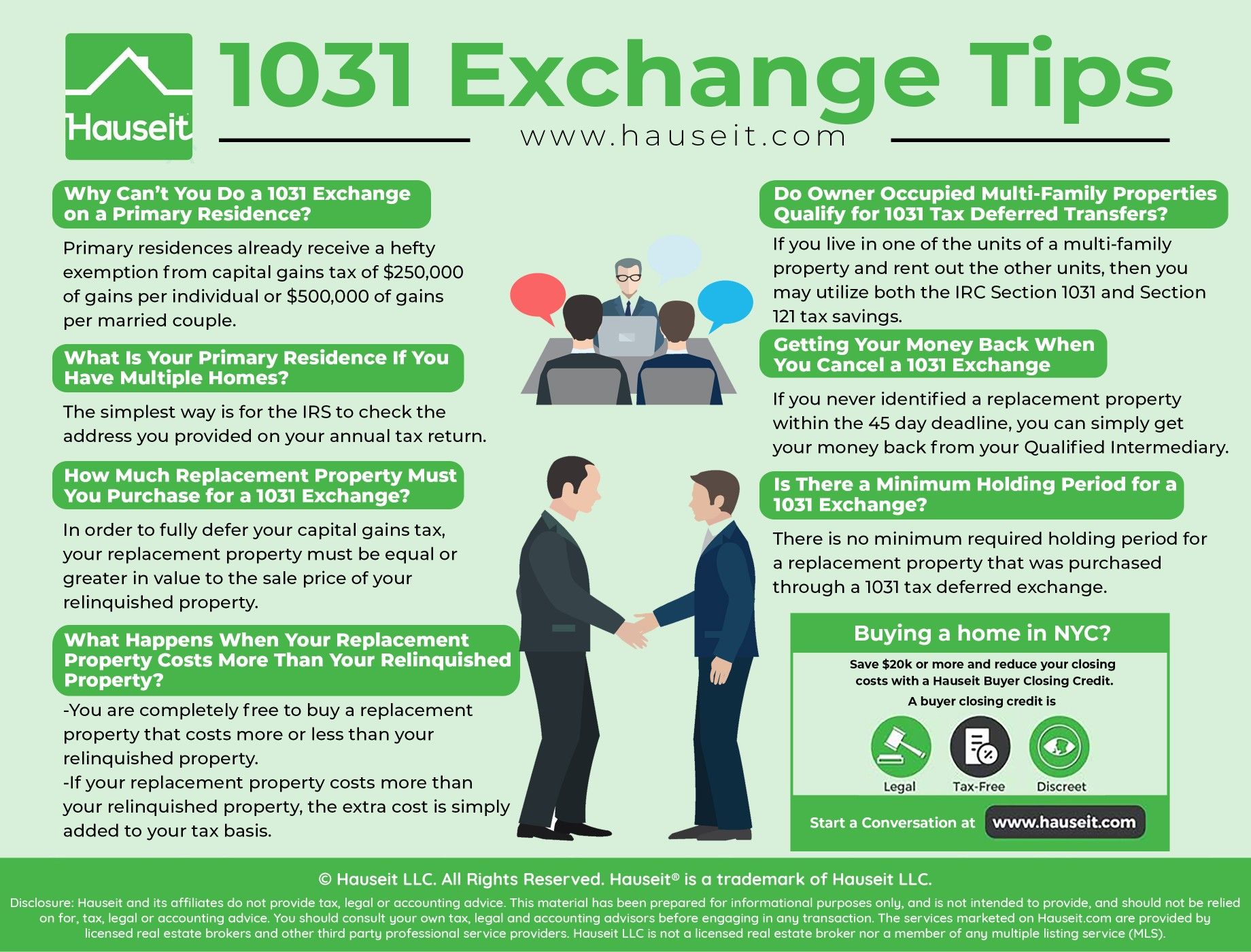

When it comes to real estate investments, one of the most beneficial tax strategies is the 1031 exchange. This process allows investors to defer capital gains taxes by exchanging one investment property for another. However, the success of this transaction heavily relies on the accuracy and timeliness of the 1031 paperwork. In this article, we will delve into the world of 1031 exchanges, focusing on the crucial aspect of paperwork and providing valuable tips to ensure a smooth and compliant process.

The Importance of Accurate 1031 Paperwork

The 1031 exchange is governed by strict rules and timelines. One of the critical components of this process is the paperwork involved. From the initial identification of replacement properties to the final closing, every document must be precise and filed on time. The primary goal is to ensure that the exchange is recognized as tax-deferred by the IRS, avoiding any unintended tax liabilities. Accurate and timely paperwork is key to achieving this goal.

Tips for Efficient 1031 Paperwork Processing

Given the complexity and the importance of 1031 paperwork, it’s essential to approach this aspect of the exchange with a well-planned strategy. Here are five tips to help investors navigate the paperwork efficiently:

- Understand the Timeline: The 1031 exchange process comes with strict deadlines. Investors have 45 days from the closing of the relinquished property to identify potential replacement properties and 180 days to close on one of these properties. Understanding these timelines is crucial for planning the paperwork and ensuring compliance.

- Choose the Right Identification Method: There are different ways to identify replacement properties, including the 3-Property Rule, the 200% Rule, and the 95% Rule. Choosing the right method depends on the investor’s strategy and the properties involved. The paperwork must reflect the chosen method accurately.

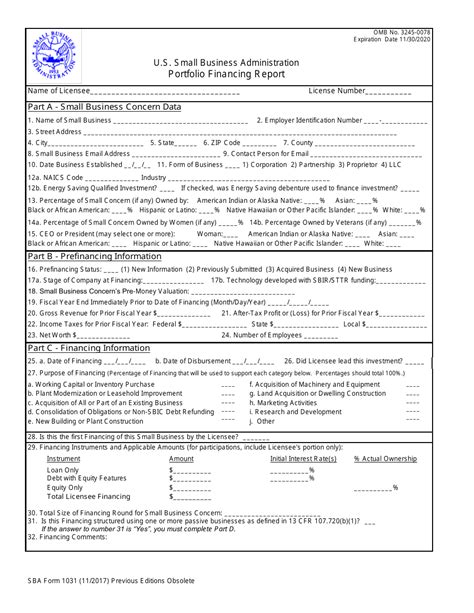

- Use a Qualified Intermediary (QI): A QI is essential for holding the funds from the sale of the relinquished property until they are used to purchase the replacement property. This intermediary ensures that the investor never has actual or constructive receipt of the funds, which is critical for maintaining the tax-deferred status of the exchange. The QI will handle much of the paperwork related to the funds.

- Maintain Detailed Records: Keeping detailed records of all transactions, communications, and timelines is vital. This includes documents related to the sale of the relinquished property, the identification of replacement properties, and the purchase of the replacement property. These records will be indispensable in case of an audit.

- Seek Professional Advice: Given the complexity of the 1031 exchange process, it’s highly recommended to seek advice from professionals experienced in this area. This includes real estate agents, tax advisors, and attorneys who can guide investors through the paperwork and ensure compliance with all regulations.

Benefits of Efficient 1031 Paperwork Processing

Efficient processing of 1031 paperwork offers several benefits, including:

- Tax Deferral: The primary benefit is the deferral of capital gains taxes, allowing investors to reinvest more funds into the replacement property.

- Increased Investment Potential: By deferring taxes, investors can potentially invest in more valuable properties or diversify their investment portfolio.

- Reduced Complexity: Efficient paperwork processing reduces the complexity associated with the 1031 exchange, making the process less daunting for investors.

- Compliance and Risk Reduction: Accurate and timely paperwork minimizes the risk of non-compliance with IRS regulations, reducing the likelihood of audits and potential penalties.

📝 Note: It's crucial to stay updated with the latest regulations and changes in tax laws that could affect the 1031 exchange process.

Conclusion and Future Outlook

The 1031 exchange remains a powerful tool for real estate investors looking to defer capital gains taxes and maximize their investment potential. By focusing on efficient 1031 paperwork processing and following the tips outlined above, investors can navigate this complex process with confidence. As the real estate market and tax laws continue to evolve, staying informed and seeking professional advice will be key to successfully leveraging the 1031 exchange for long-term investment strategies.

What is the primary purpose of a 1031 exchange?

+

The primary purpose of a 1031 exchange is to allow real estate investors to defer paying capital gains taxes on the sale of an investment property by exchanging it for another investment property of equal or greater value.

What are the key deadlines in a 1031 exchange?

+

There are two main deadlines: the 45-day identification period, during which the investor must identify potential replacement properties, and the 180-day exchange period, by which the investor must close on one of the identified properties.

Why is it important to use a Qualified Intermediary in a 1031 exchange?

+

A Qualified Intermediary (QI) holds the funds from the sale of the relinquished property, ensuring the investor does not have actual or constructive receipt of the funds, which is necessary to maintain the tax-deferred status of the exchange.