Personal Allowance Sheet Tax Paperwork

Understanding Personal Allowance and Tax Paperwork

When it comes to managing personal finances, understanding how taxation works is crucial. One key concept that individuals need to grasp is the idea of personal allowance and how it impacts their tax paperwork. Personal allowance refers to the amount of money that an individual can earn before they start paying income tax. This allowance is a fundamental part of the tax system, aiming to ensure that people have a certain level of income that is tax-free, thereby helping to reduce poverty and support low-income earners.

How Personal Allowance Works

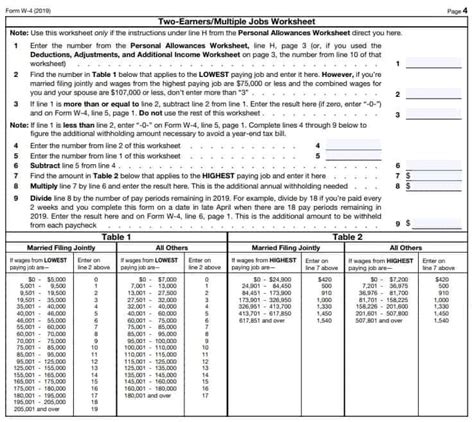

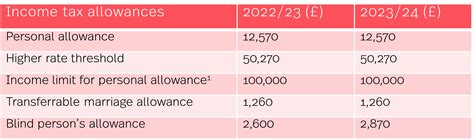

The personal allowance works by setting a threshold below which income is not subject to income tax. For instance, if the personal allowance is set at £12,000, then the first £12,000 of an individual’s income is tax-free. Any income earned above this threshold is then subject to income tax, according to the tax brackets that apply. Tax brackets are the ranges of income that are subject to different rates of taxation. Understanding these brackets and how they apply to one’s income is essential for accurate tax planning and minimizing tax liability.

Factors Affecting Personal Allowance

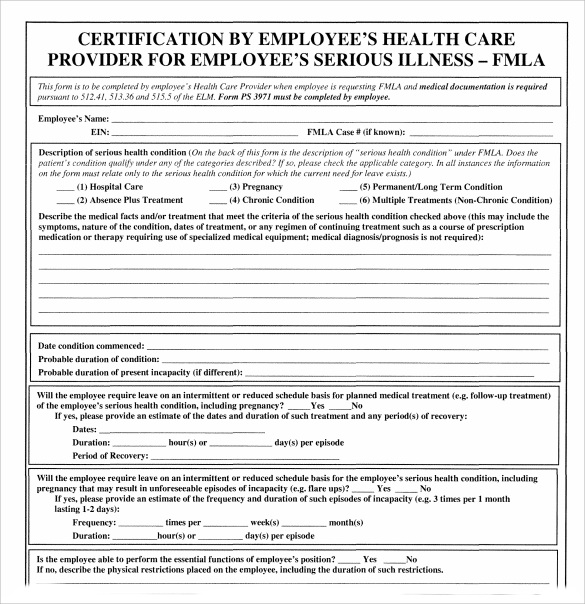

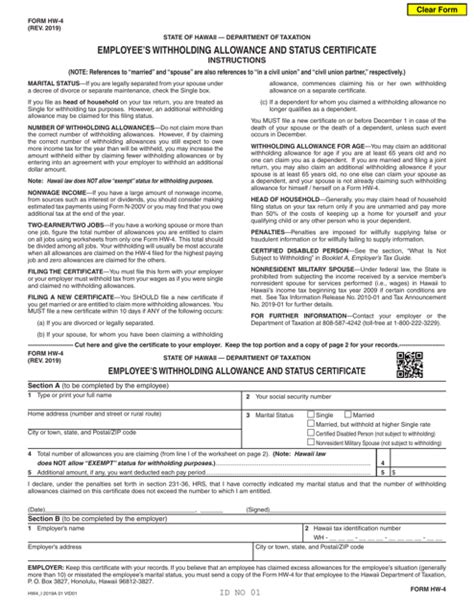

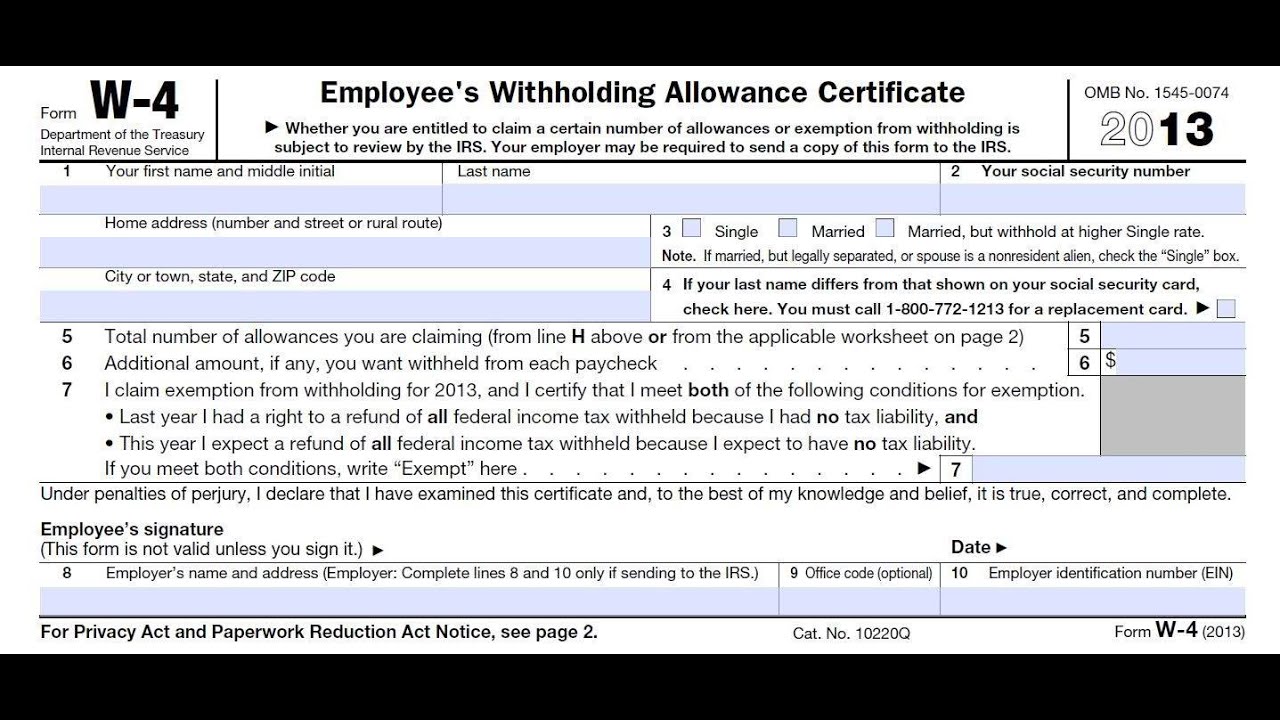

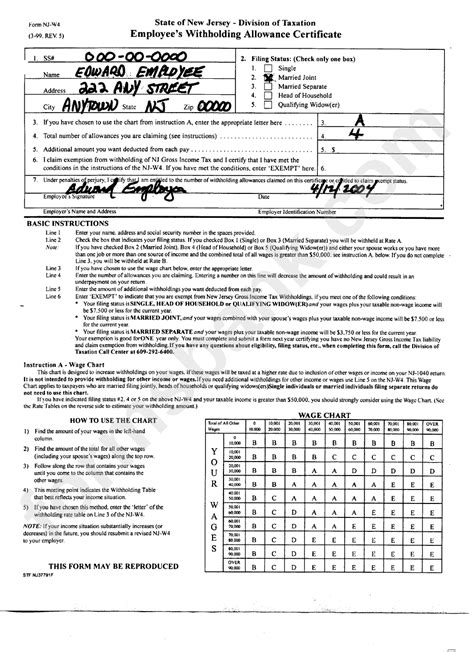

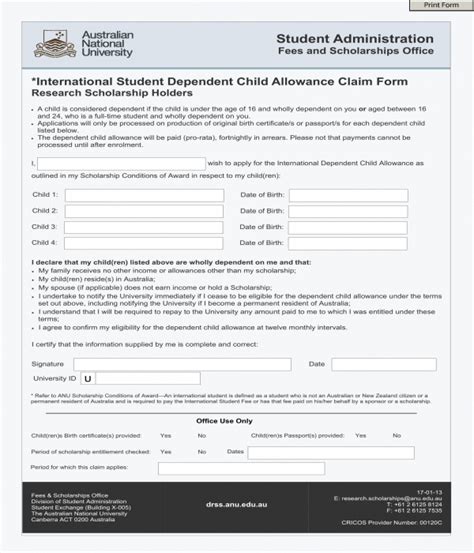

Several factors can affect an individual’s personal allowance. These include: - Age: Different age groups may have different personal allowances. For example, older adults might have a higher personal allowance. - Disability: Individuals with disabilities might be eligible for a higher personal allowance or additional tax credits. - Marital Status: In some cases, marital status can influence the personal allowance, especially if there are specific allowances for married couples or civil partners. - Income Level: While the personal allowance itself sets a tax-free threshold, the level of income can affect which tax bracket one falls into and thus the overall tax rate.

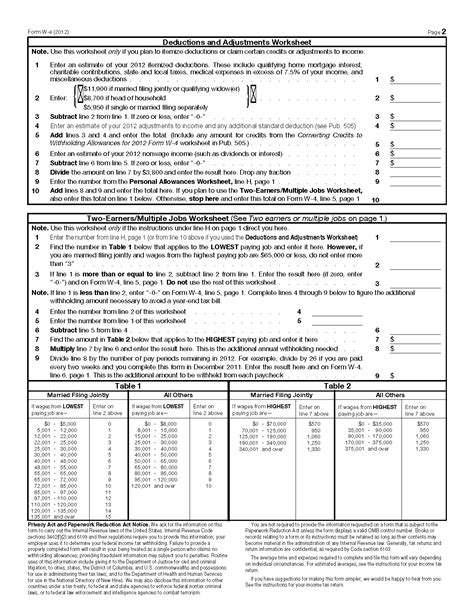

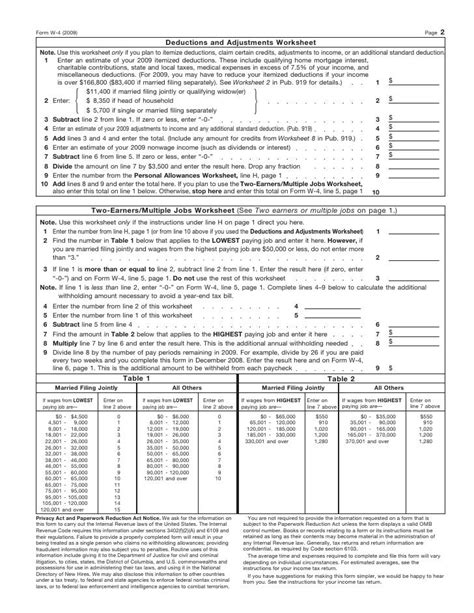

Calculating Personal Allowance and Tax Liability

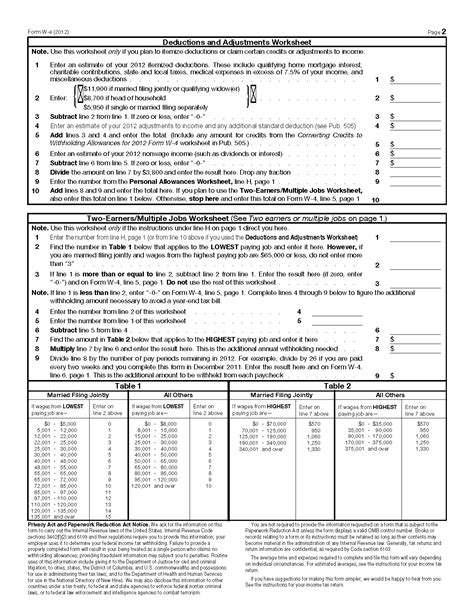

Calculating one’s personal allowance and subsequent tax liability involves understanding the current tax rates and bands. This can be complex, especially considering the various factors that might influence an individual’s tax situation. Here are the steps to follow: - Determine the total income from all sources. - Subtract any deductions or allowances that apply, such as pension contributions or charitable donations. - Apply the personal allowance to find the taxable income. - Calculate the tax liability based on the applicable tax brackets.

📝 Note: It's essential to keep accurate records of income and expenses to ensure that tax returns are completed correctly and to take advantage of all eligible deductions and allowances.

Importance of Accurate Tax Paperwork

Accurate tax paperwork is vital for avoiding penalties and ensuring that individuals receive the correct tax refund or pay the correct amount of tax. Tax refunds occur when an individual has overpaid their taxes throughout the year, and they are due to receive this excess back. Conversely, if an individual underpays their taxes, they may face penalties and interest on the amount owed. Therefore, understanding and correctly applying personal allowance is a critical component of managing one’s tax obligations effectively.

Tools and Resources for Managing Tax Paperwork

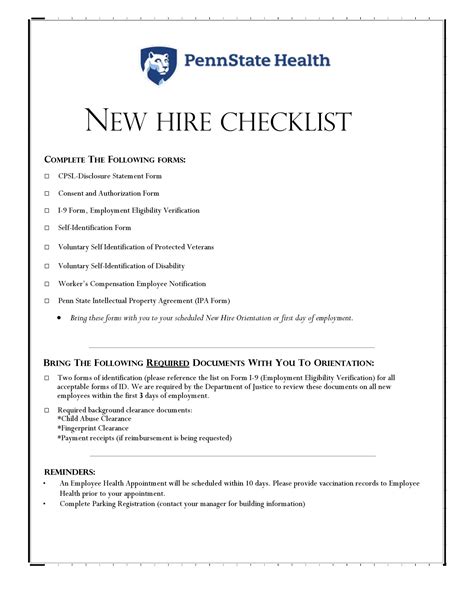

Several tools and resources are available to help individuals manage their tax paperwork and understand their personal allowance better. These include: - Tax Software: Programs that guide individuals through the tax return process, ensuring that all necessary information is included and calculations are accurate. - Government Websites: Official government resources provide detailed information on tax laws, allowances, and deadlines. - Tax Professionals: For those with complex tax situations or who prefer professional assistance, tax advisors or accountants can offer expert guidance and preparation of tax returns.

Staying Informed About Tax Changes

Tax laws and regulations, including personal allowances, can change annually. It’s crucial for individuals to stay informed about these changes to ensure they are taking full advantage of their personal allowance and other tax benefits. Budget announcements and financial news are key sources of information on upcoming tax changes.

| Year | Personal Allowance | Tax Rate |

|---|---|---|

| 2022-2023 | £12,570 | 20% (Basic Rate) |

| 2023-2024 | £12,570 (anticipated) | 20% (Basic Rate) |

Managing Tax Obligations Effectively

To manage tax obligations effectively, individuals should: - Keep detailed records of income and expenses. - Be aware of tax deadlines and submit tax returns on time. - Claim all eligible allowances and deductions. - Consider seeking professional advice for complex tax situations.

In summary, understanding personal allowance and its implications for tax paperwork is vital for effective financial management. By staying informed, utilizing available tools and resources, and ensuring accuracy in tax calculations, individuals can navigate the tax system with confidence and minimize their tax liability.

What is the purpose of personal allowance in taxation?

+

The purpose of personal allowance is to ensure that individuals have a certain level of income that is tax-free, helping to reduce poverty and support low-income earners.

How does marital status affect personal allowance?

+

In some cases, marital status can influence the personal allowance, especially if there are specific allowances for married couples or civil partners. However, the impact of marital status can vary depending on the tax laws of the country or region.

What are the consequences of inaccurate tax paperwork?

+

Inaccurate tax paperwork can lead to penalties, fines, and interest on underpaid taxes. It’s essential to ensure that tax returns are completed correctly to avoid these consequences.